Despite being a terrible human tragedy, Covid-19 has fast-tracked digital adoption across consumer and business ecosystems

An unprecedented shift towards digitalisation turned out to be a windfall for much of the tech industry

Here are the 12 charts that map the rise and fall of the tech ecosystem in India in 2020, the year of shutdowns

Last March, none of us knew that a virus would turn our lives upside down and bring the world to a standstill. The Covid-19 pandemic has triggered a terrible human tragedy ever since, but there is a silver lining. In a matter of a few months, the new normal has speeded up digital adoption across the business ecosystem and pushed for sustainable tech innovations and a cultural transformation that would ideally have taken five years or more.

Employees started working from home. Banks transitioned to remote sales and services, while enabling flexible, digital payments for loans and mortgages. Grocery stores shifted to online ordering and doorstep delivery as their primary business. Most schools across the country pivoted to digital classrooms and online learning. Doctors opted for teleconsultations, aided by more flexible regulations. Manufacturers actively developed plans for lights-out factories and sustainable supply chains. The list goes on.

However, several vaccines have been rolled out in 2021, putting a possible end point to pandemic shutdowns. Businesses and organisations are reopening, especially retail businesses, restaurants and even schools.

The new normal has also opened up a new set of predictions about what the year after the pandemic holds in store. A year ago, it was difficult to imagine the financial bounty remote living and working would have for the tech industry and its backers.

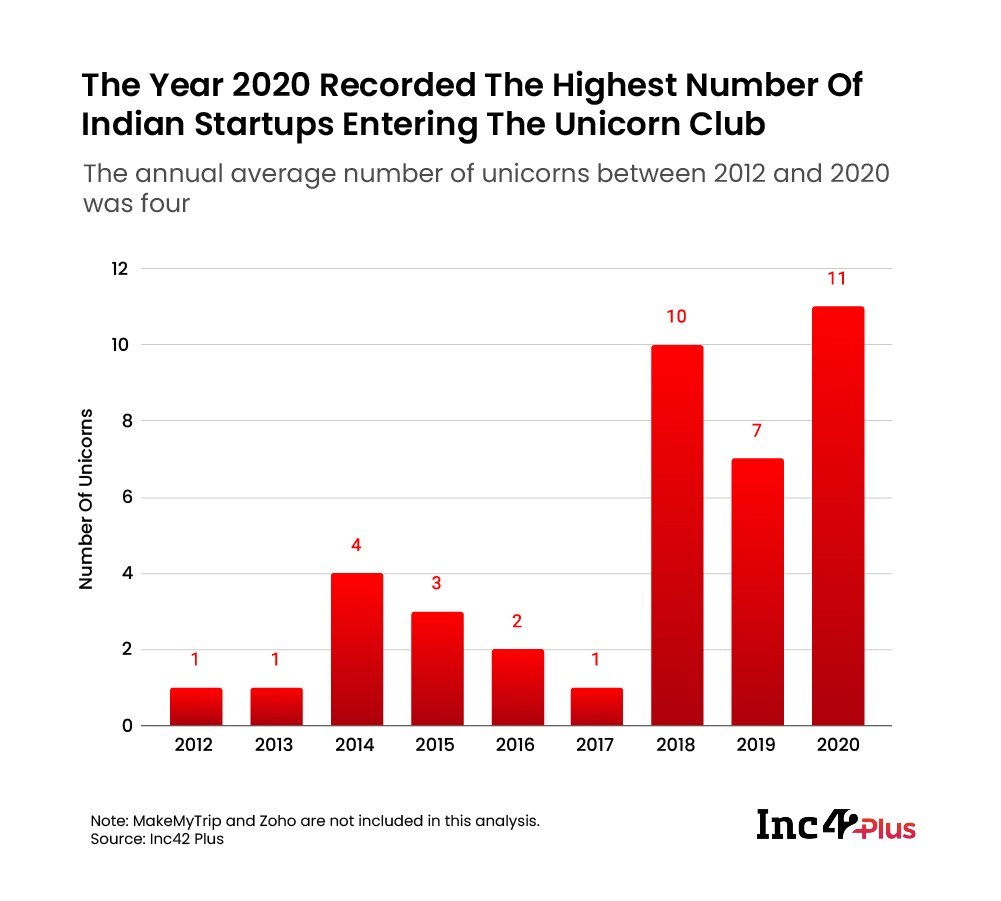

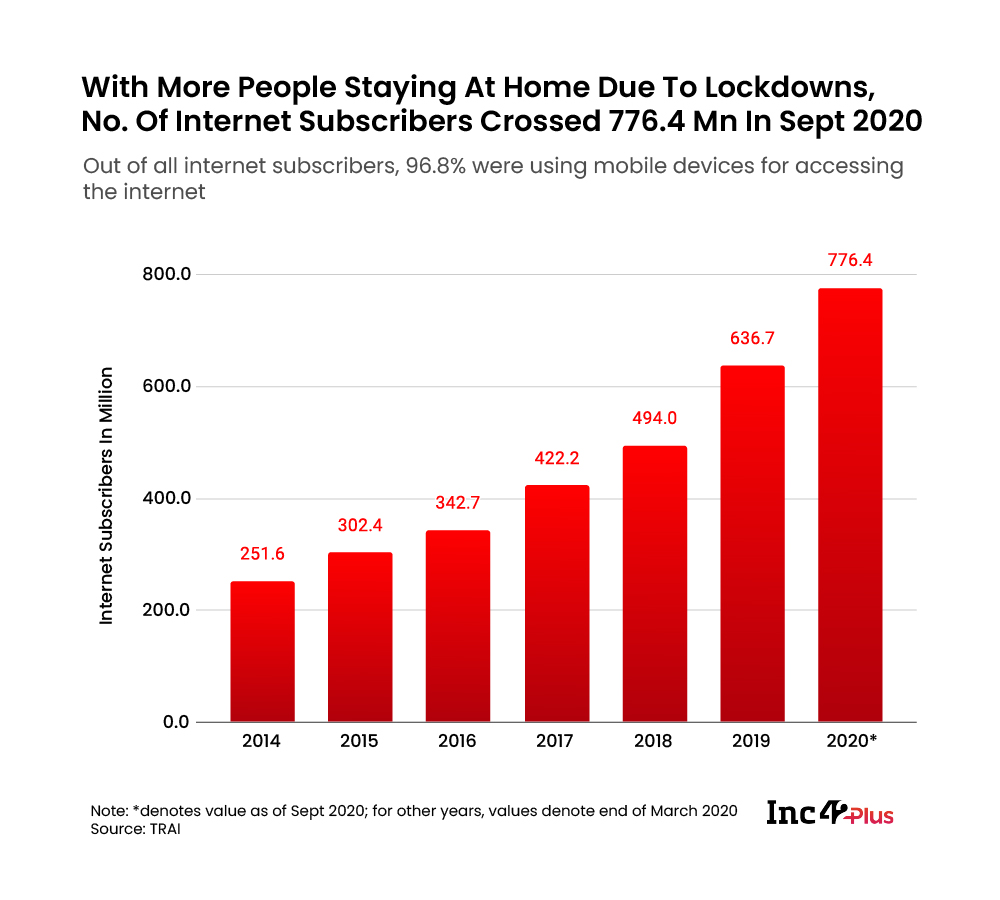

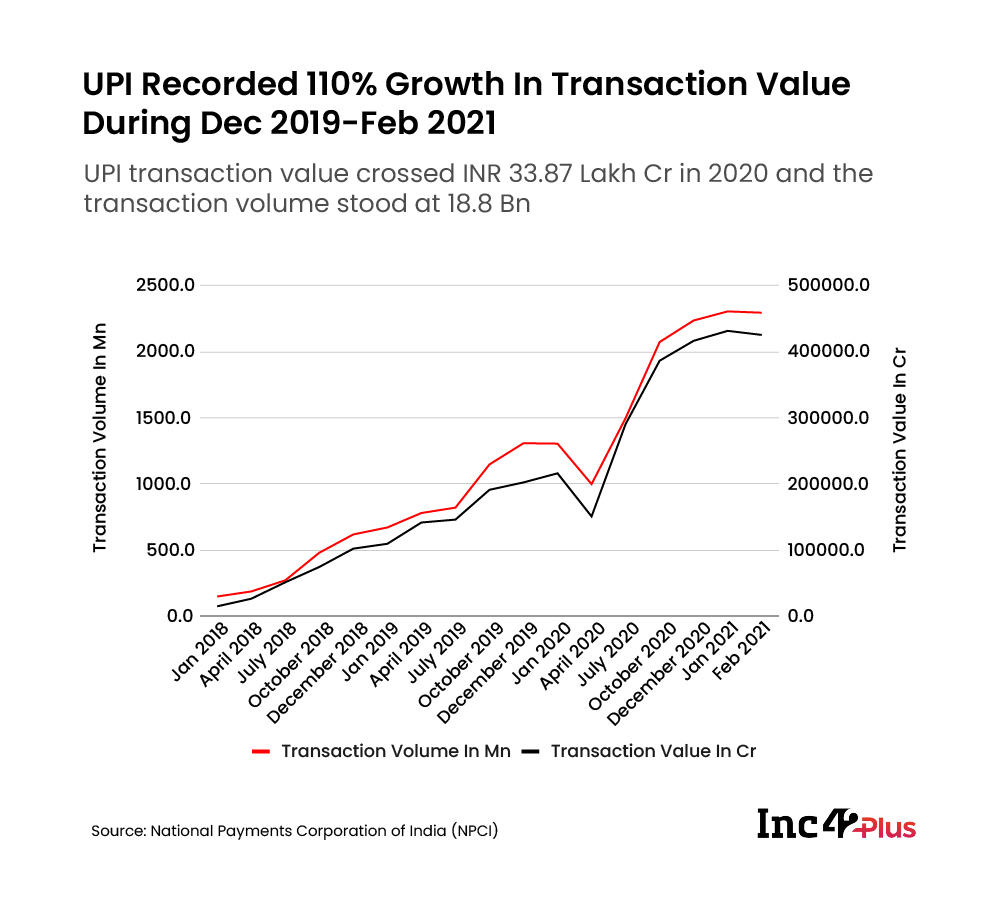

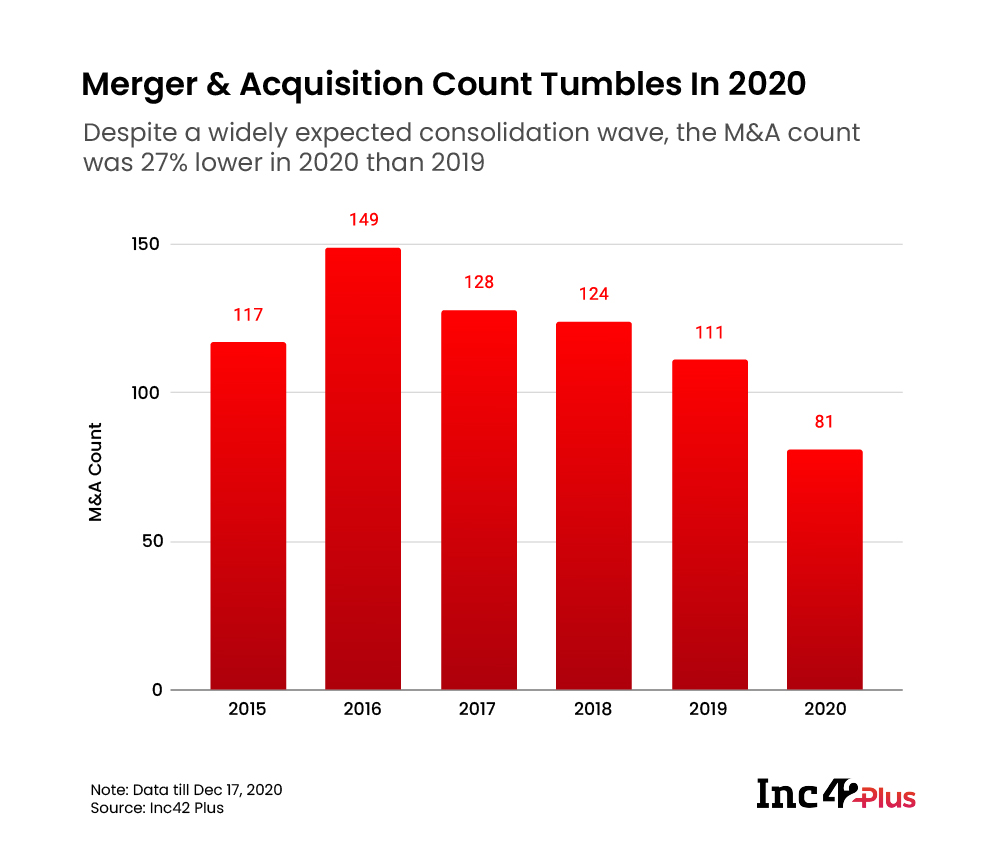

As the following charts show, the extreme circumstances led to business growth in many cases — a spike in VC funding, a rise in the number of internet subscribers, massive growth in internet usage, a humungous rise in UPI transactions, a surge in smartphone shipments later in the year and the highest number of Indian startups entering the coveted unicorn club. Then there were slowdowns — a decline in mega deals (greater than or equal to $100 Mn), a dip in the number of new startup launches and low M&A deals.

But the biggest disruption of the Covid times is that most companies have turned into tech companies of sorts by embracing digital technologies, mandated by nationwide lockdowns and social distancing norms. People, too, have become tech-savvy as they have switched to a digital lifestyle — be it work, education, entertainment or art collection. So, it is not surprising that the internet has ruled our lives and times of late. Interestingly, Reliance Jio Infocomm dominated the market, capturing around 52.2% of the total internet subscribers.

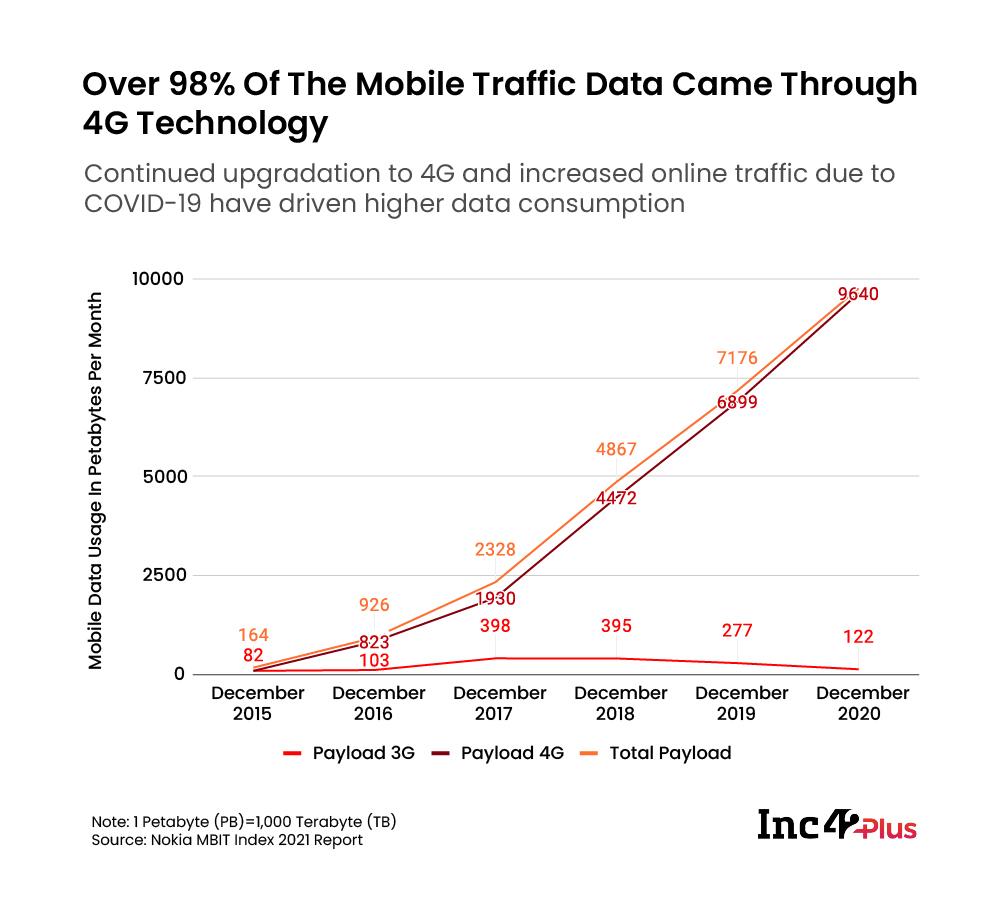

With the rise in the number of internet subscribers, mobile data consumption also took off during Covid-19. According to Nokia India Mobile Broadband Index 2021, overall data traffic increased by 36% in 2020 due to continued 4G consumption, while 3G data traffic showed its highest ever decline of 56%. The average data usage per month registered a CAGR of 76% during 2015-2020, touching 13.5 GB in December 2020.

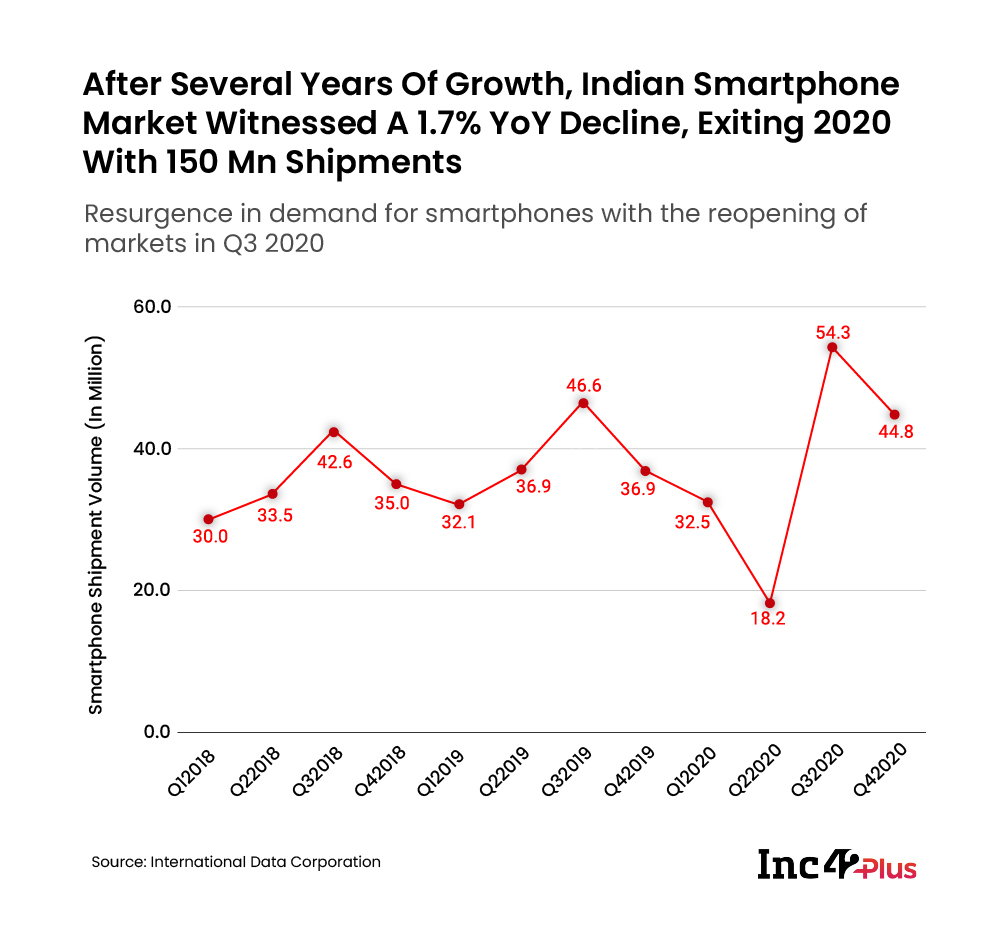

Although mobile devices were the primary means for internet access, the smartphone market was temporarily affected last year. According to International Data Corporation (IDC), the Indian smartphone market saw a decline of 1.7% YoY, crossing 150 Mn shipments in 2020.

Stay-at-home restrictions, work from home, online education, travel restrictions and manufacturing shutdowns led to a sluggish H1 2020 (-26% YoY decline), particularly affecting Q2 2020. But there was a recovery during H2 2020, with a 19% YoY growth, as markets reopened gradually.

Lockdowns and restrictions rendered an urgent need for devices supporting key activities such as remote working, remote learning and digital entertainment, resulting in more devices per household. All these led to a resurgence in demand for consumer devices, including smartphones, notebooks and tablets in 2020.

The online channel outpaced the overall market, growing by 12% annually with a 48% market share in 2020. Multiple sales events, promotions, trade-in/upgrade programmes and affordability initiatives helped it clock a record 51% share in Q4 2020.

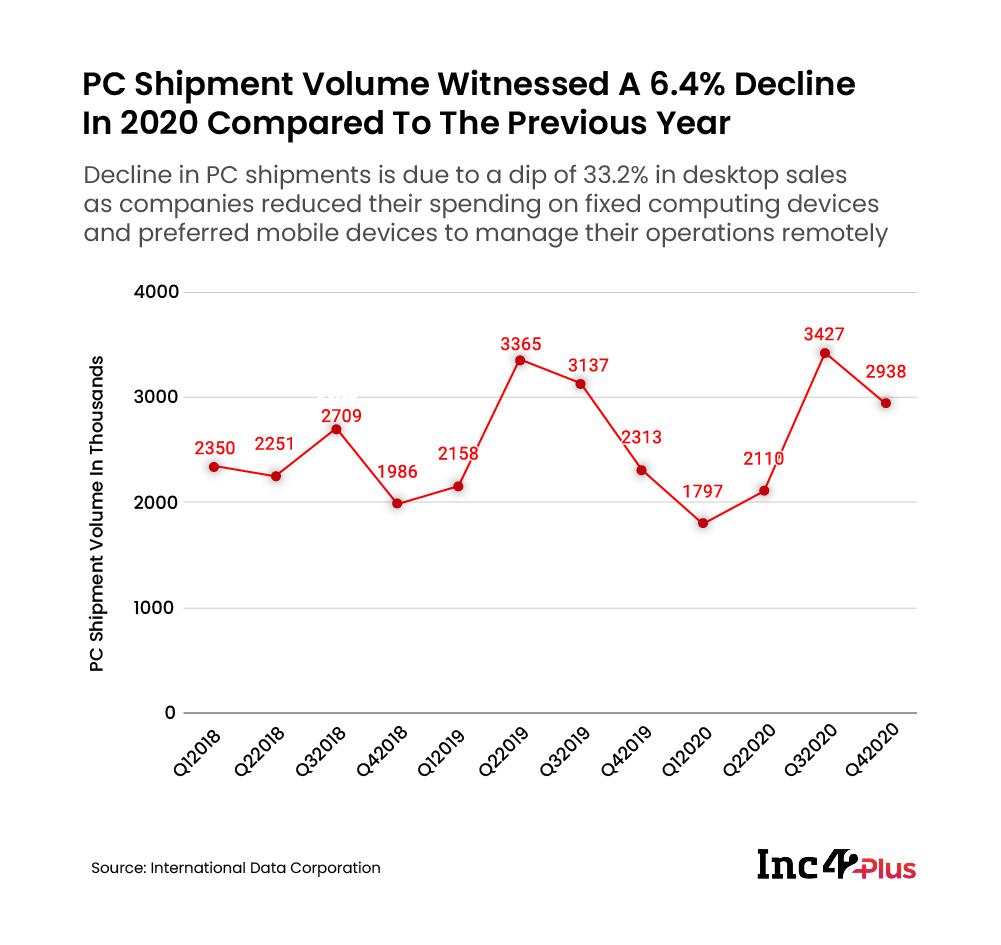

Although the PC market witnessed an overall decline in 2020, it saw growth in Q3 2020, driven by e-learning and remote working, leading to a 74.1% and a 14.1% annual growth in the consumer and the enterprise segments, respectively.

E-learning and remote working needs helped the Indian PC market log its biggest quarter in Q3 2020, with the shipment rising 9.2% YoY to 3.4 Mn units.

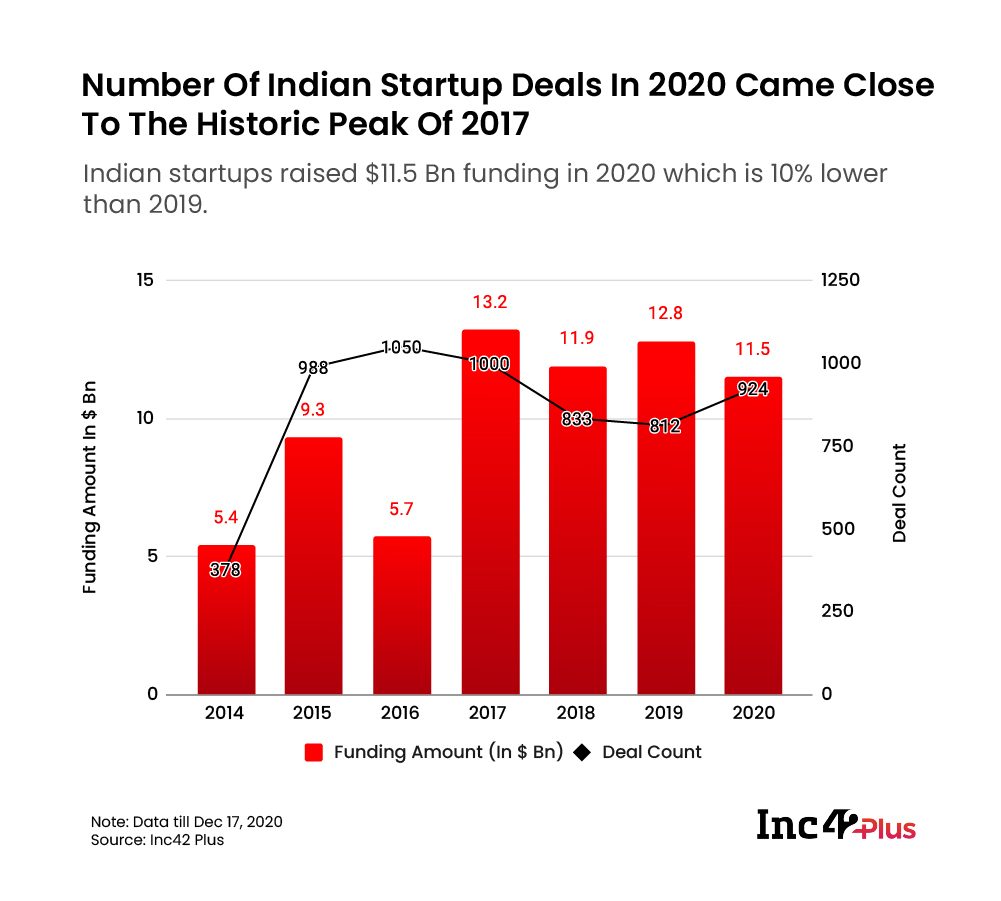

The Indian startup ecosystem recorded a total funding of $70 Bn across 5,985 funding deals between 2014 and 2020. Indian startups recorded more than $11.5 Bn in funding in 2020, which was 10% lower than 2019. But in terms of deal count, the year 2020 easily surpassed the previous one. With 924 deals, the deal count was 14% higher than in 2019.

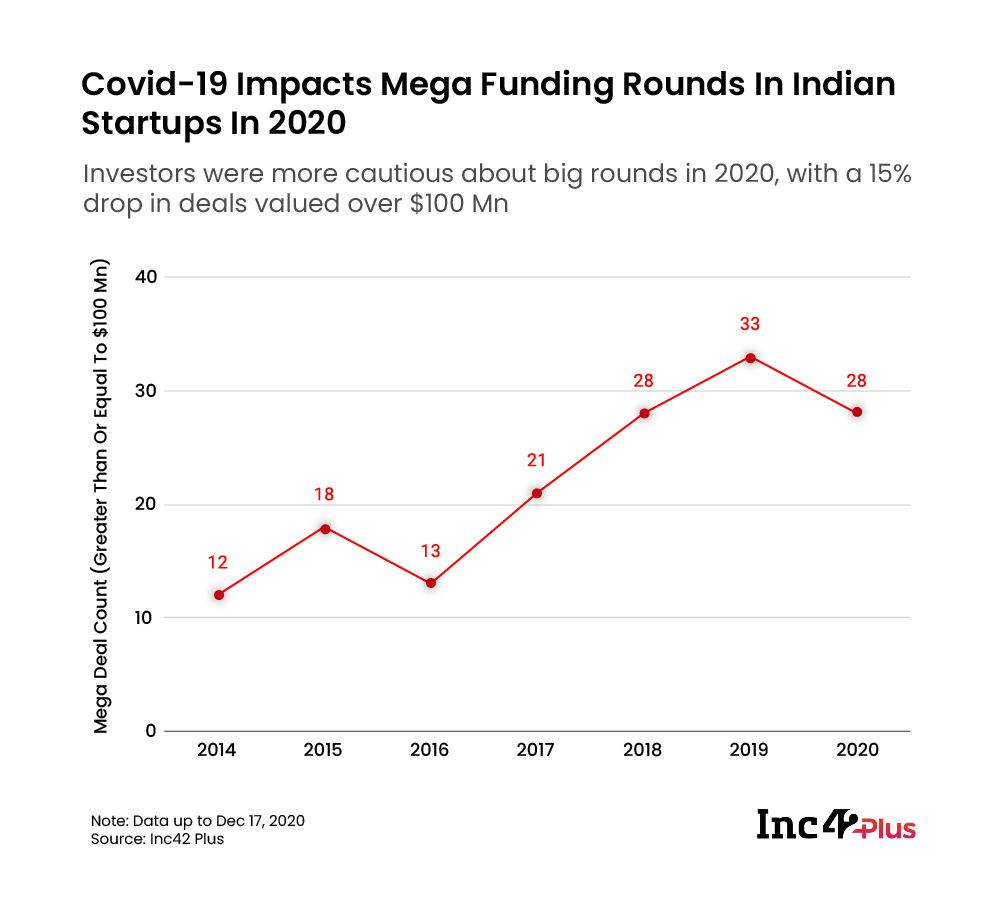

In 2020, the average ticket size of investments in Indian startups stood at $17 Mn, which was 15% lower than the $20.0 Mn clocked in the previous year. The drop in the average ticket size of investments and the count of mega-rounds (greater than $100 Mn) indicates that investor confidence was relatively low in 2020 than in 2019.

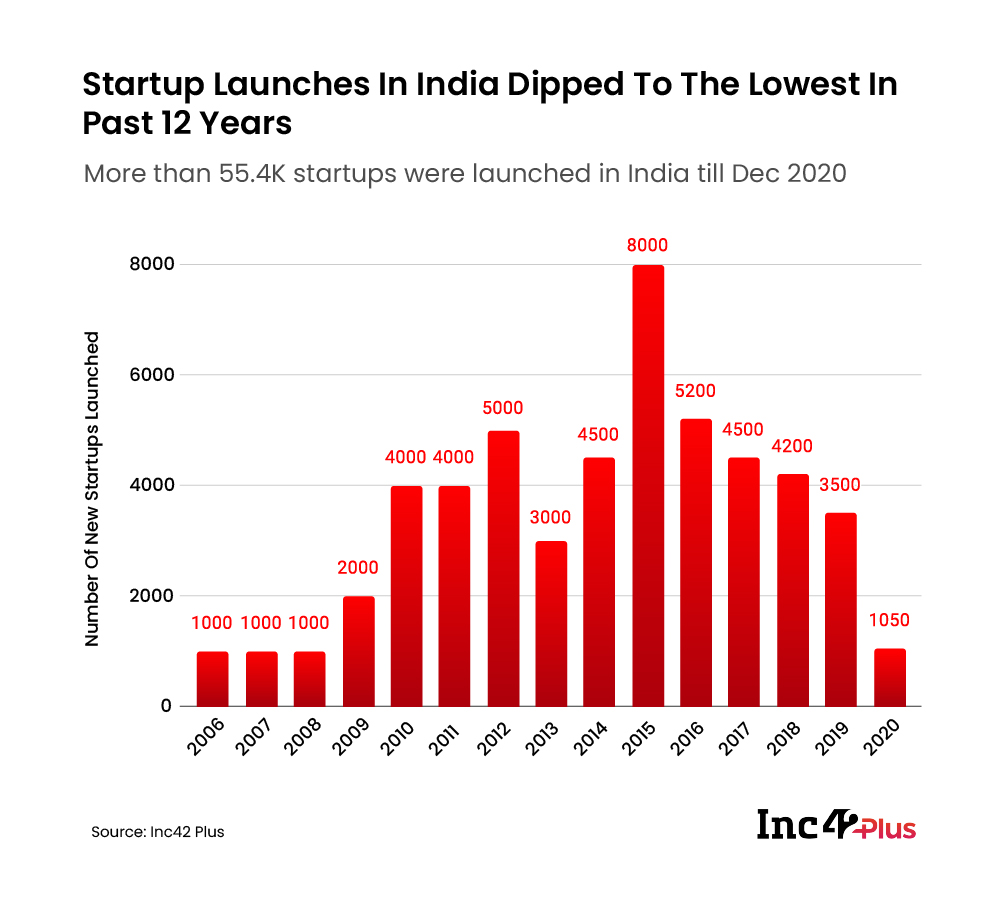

There were 1,050 new startups launched in 2020, the lowest number in the past 12 years.

According to NPCI, the UPI transaction volume during October 2020 crossed the 2 Bn mark, the highest ever in history. This was around 270 Mn higher than the corresponding figure in September 2020. Understandably, the Covid-19 pandemic gave a major thrust to digital payments as consumers are avoiding physical contact with vendors and delivery agents.

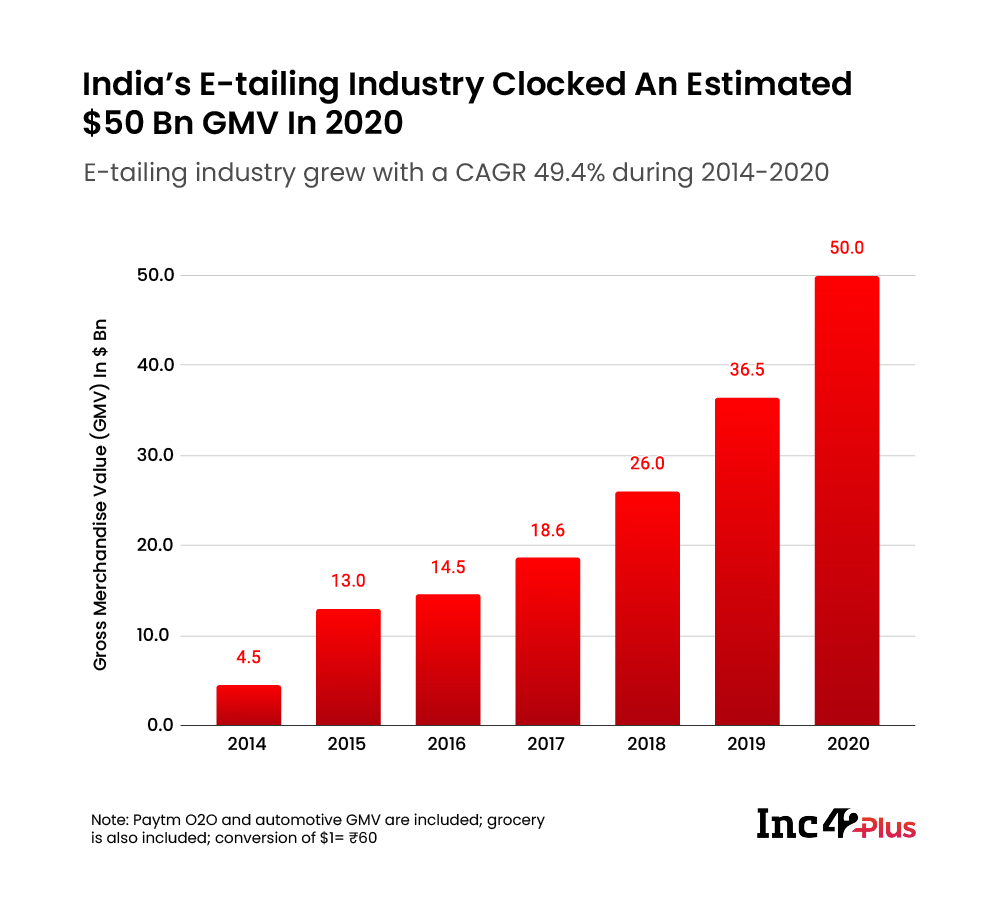

The rise in the E-tailing industry is driven by the rise in the number of online shoppers which is estimated to cross the 120 Mn mark by 2020. While many expected consolidations to be the flavor of 2020, given the pandemic’s impact on businesses, the merger and acquisition count in 2020 was the lowest in the past six years.

While many expected consolidations to be the flavor of 2020, given the pandemic’s impact on businesses, the merger and acquisition count in 2020 was the lowest in the past six years.

The year 2020 witnessed a golden moment for startups entering the unicorn club. There were around 11 startups — Unacademy, Postman, Zenoti, Firstcry, Zerodha, Cars24, Razorpay, Nykaa and PineLabs — which entered the unicorn club. The year 2021 is no different, and has seen 3 Indian startups entering unicorn club i.e. Innovacer, Infra.market, and Digit Insurance.

As of March 2021, India is home to 45 unicorns and 53 soonicorns.