The Indian startup ecosystem has come a long way, with many tech startups going public and nearly 42 companies becoming unicorns in 2021. According to Inc42’s Indian Tech Startup Funding Report 2021, Indian startups raised $42 Bn in funding across 1,583 deals in 2021, and 2,487 unique investors participated in startup funding. A large chunk of funding went into, software-as-a-service (SaaS), ecommerce, fintech and consumer services segment.

Overall, between 2014 and 31st January 2022, Indian startups have raised close to $116 Bn in funding.

It all starts with bootstrapping. As the business grows, you need funds for operations, expansion, marketing, production. Depending on which stage your business is in and its ability to generate returns, you seek seed funding from angel investors, then move to venture capitalists, and later launch an initial public offering (IPO).

There are three types of startup funding: equity funding, debt funding, and government grants. Each funding option has its pros and cons. For instance, equity funding has no repayment pressure, but you have to let go of a stake in your company, making it the most expensive form of funding.

The startup funding ecosystem has evolved beyond angel investors and venture capitalists. Startups can raise funds from different kind of investors and platforms based on their needs and stage. In this article, we will discuss 12 funding options for startups.

12 Funding Options For Indian Startups

Angel Investors

Angel investors are individual investors or a network of individuals with family connections or rich experience. Most of them are experienced entrepreneurs who have been through the process of starting a business. They understand the pain points and opportunities.

These investors have surplus cash that they are willing to risk in your venture at the seed stage. Before investing, they screen the startup, research, and see how much the founder has invested. Once they are convinced, they give you funding in exchange for convertible debt or equity ownership in your startup.

Angel investors act as mentors to young entrepreneurs. But they invest a lesser amount than venture capitalists and expect higher returns. Some popular individual investors Kunal Shah, Rajan Anandan, Ritesh Malik.

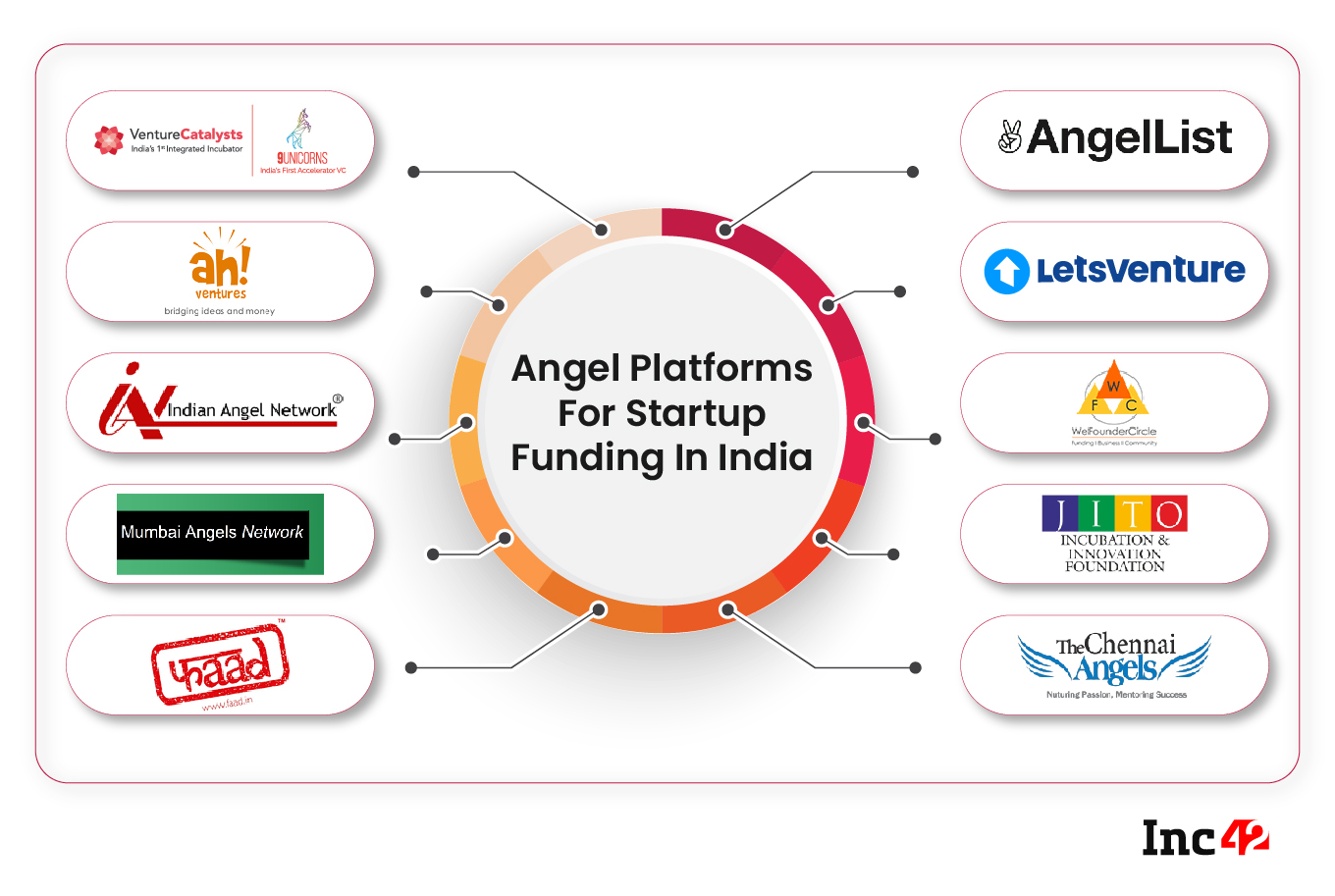

Angel Networks & Platforms

Angel networks & platforms is where angel investors pool their funds to invest in startups. As they operate as a group, these investors can provide larger funds and hedge risks. The platform gets equity ownership of the startup, and they benefit if the startup prospers.

Some popular platforms are AngelList, Venture Catalysts, LetsVenture.

Venture Capital Funds

Venture Capital Funds are an institution whose business is to provide capital to promising startups. This point is where the startup funding goes to the next level. As venture capital funds are an institution, they provide large amounts of capital to a company for growth and expansion and monitor its progress to ensure their investment delivers sustainable development

Venture capital funds get equity or equity-linked instruments from startups in return for the funding. They leave the company when it releases an IPO or is acquired.

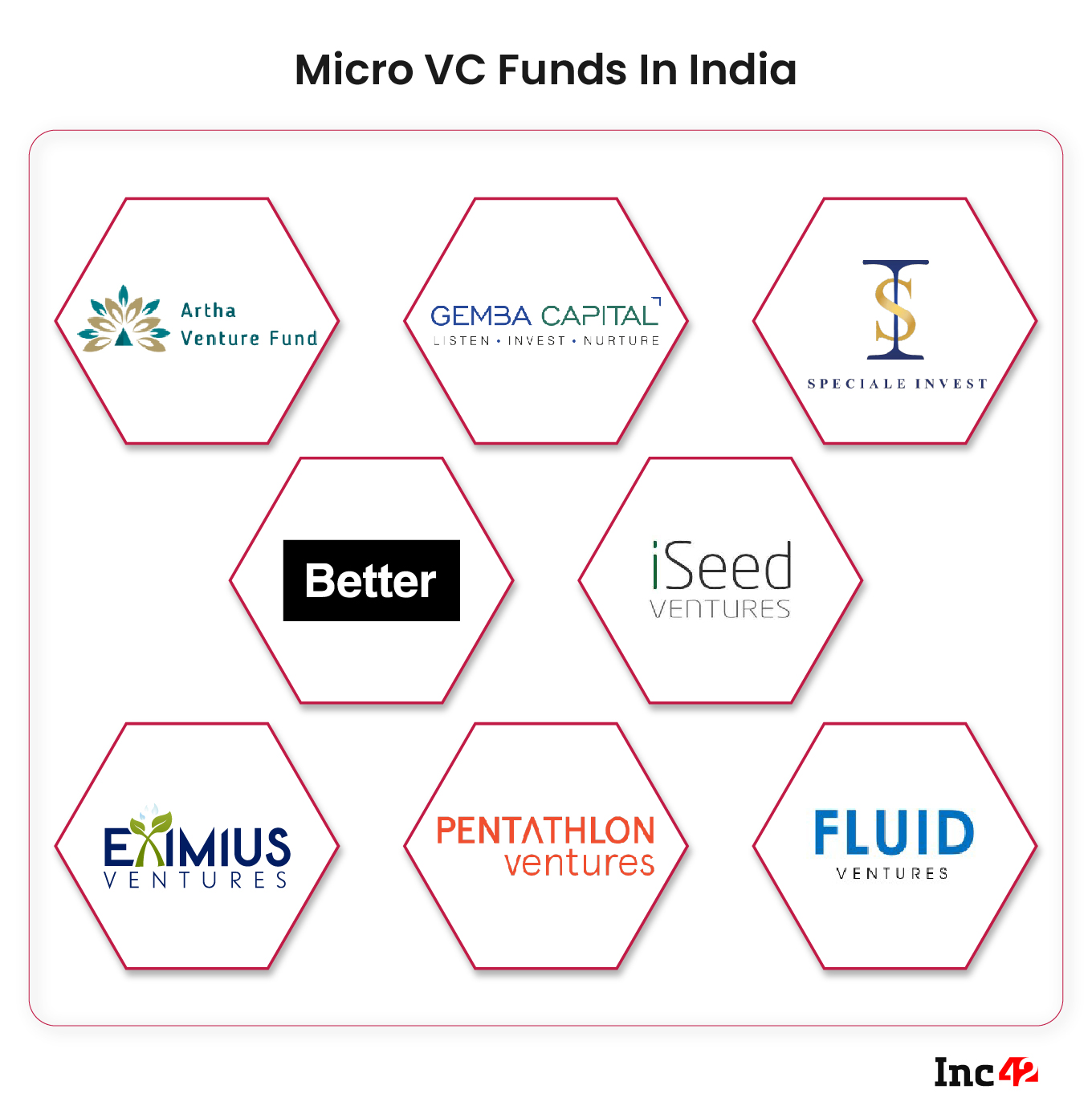

Micro VCs

One branch of venture capital is micro VCs, with a lesser fund size of around $60 Mn – $70 Mn. Micro VCs invest in idea-stage startups and get an equity stake in return.

Corporate Venture Capital

Another branch of VC is Corporate Venture Capital (CVC). CVCs are large multinationals that invest corporate funds into small, innovative startups either for technology, talent pool, or to acquire a target market.

CVCs provide startups with resources like marketing expertise, strategic direction, or a line of credit. Being associated with big names gives startups a boost.

CVC provides funding in exchange for an equity stake in the startup. Among Indian CVCs are Mahindra Partners, Reliance Ventures, and Times Group’s Brand Capital.

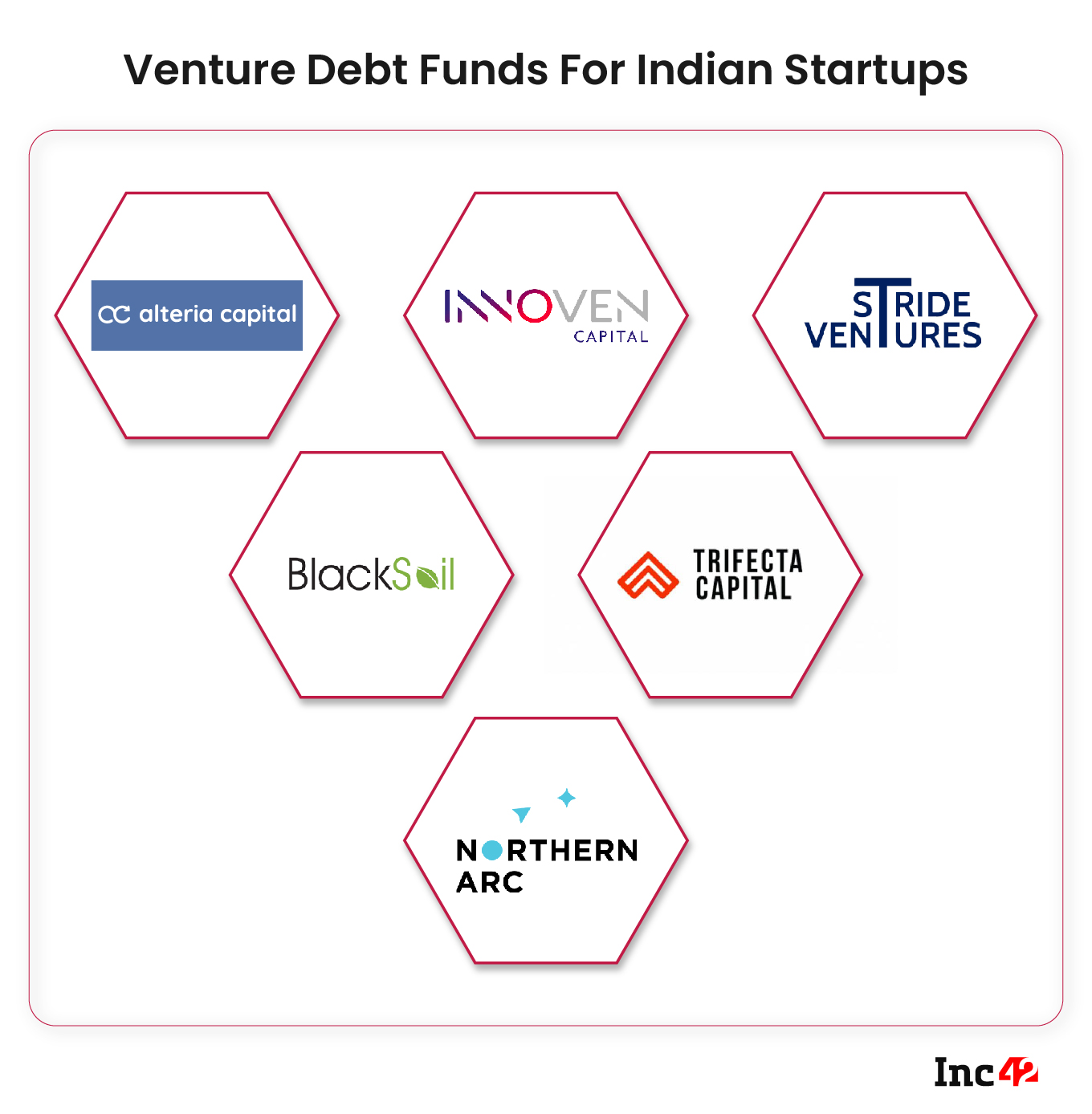

Venture Debt Funds

Equity is an expensive source of funding for startups. Hence, non-banking financial corporations (NBFCs) offer a hybrid scheme called venture debt funds that provide debt financing to VC-backed startups. Bank loans or equity are not a viable funding option when a startup is expanding and needs working capital.

Venture debt funds lend you money in return for non-convertible debentures (NCDs) and equity warrants. Alteria Capital and Trifecta Capital are some players that provide venture debt financing to Indian startups.

Government Grants & Funds

Funding for Indian startups went beyond angel investors and VCs in 2016 when the government of India launched the ‘Startup India’ program. The program offers grants, like an 80% rebate on patent costs and income tax exemption for the first three years, to startups registered under the scheme.

The government disburses the funds as loans through the Small Industries Development Bank of India (SIDBI) Fund of Funds Scheme. The scheme invests in venture capital and alternative investment funds (AIF) that invest in startups. Last year, the government also launched the Startup India Seed Fund scheme which provides funding support to early stage startups.

For the current year, the government has allocated INR 1,000 Cr for the Fund of Funds for Startups and INR 283.5 Cr for the Startup India Seed Fund Scheme (SISFS).

Accelerators & Incubators

While all the above funding options are for startups already doing business, incubators and accelerators are like prep schools for startups. These programs run for four to eight months, where they provide business owners with funding and a platform to connect with investors, mentors, and other startups.

Accelerators and incubators are generally found in major cities and take an equity stake in return for the program. These programmes are either run by individual entities or are part of large corporations or big tech companies.

Some of the popular accelerator programmes for Indian startups include Y Combinator, GSF Accelerator, Microsoft Accelerator, Google Launchpad Accelerator, JioGenNext amongst others.

Family Offices

Another emerging funding for Indian startups is family offices. India has a history of family businesses that pass on their wealth to the next generation. Examples include Azim Premji of Wipro, Anirudh Damani of K. Damani Group, and Gaurav Burman of Burman Family Office (investor in Dabur India). This next-generation seeks to break the stereotype and invest in different avenues.

Family offices are more patient than angel investors and give startups more time, money, and resources to grow their businesses. But the trick is to approach the right family office. India has over 140+ family offices that have heavily invested in the Indian startup space. They have been pro-actively involved in 50+ such deals every year since 2015, a report by Praxis Global Alliance and 256 Network. The report further predicts that Indian Family Offices are expected to contribute 30% of the estimated $100 Bn to be raised by Indian startups by 2025.

Banks

Amid all the new funding options for Indian startups, the conventional funding option of bank loans still exists. Banks offer different types of loans for different business needs like equipment loans, startup business loans, and working capital loans, each with different terms. There is a loan for all stages of business.

For an idea-stage startup, banks require higher collateral, typically with other sources of income. Fullerton India and Omozing.com are popular banks and NBFCs that offer loans to Indian startups.

Crowdfunding

Another less popular funding option for startups is crowdfunding. Several retail investors looking for alternative investment options assemble on a platform, skim through the business model, and invest in the startup of their choice. Every investor invests a fixed amount (peer-to-peer lending) in a business idea with hopes of getting a higher interest.

There is also equity crowdfunding, but its legality in India is questionable. Crowdfunding is prone to controversies and scams. SEBI warns against unregistered digital crowdfunding platforms.

Some of the notable crowdfunding platforms for startups include Indiegogo, SeedInvest Technology, Mightycause, StartEngine, GoFundMe, Patreon, GripInvest, ImpactGuru.

Revenue Based Financing

The revenue-based financing allows a startup to get its future revenues upfront so that it can be easily deployed for inventory, advertising and marketing spending. The payment part is flexible, amounting to a pre-decided percentage of the revenue a company generates month after month. In the recent times, India has seen the rise of several revenue-based financing companies which are addressing the revenue needs of the companies.

Some of the revenue-based financing companies for Indian startups include Velocity, Klub, GetVantage among others.

Conclusion

India has emerged as the third-largest startup ecosystem globally, thanks to the various funding options that encourage business owners. These funding and fundraising options aim to fuel business growth.

The post 12 Options For Startup Funding In India appeared first on Inc42 Media.