Image credits: i5invest

The European Tech Ecosystem is developing at a rapid pace, faster than it ever did. In fact, Europe’s growth rate in 2021 outpaced the rate of its peers overseas by a staggering 100 per cent.

Recently, tech M&A advisor i5invest and venture builder i5growth published a report on technology unicorns and expected unicorns (‘soonicorns’) in Europe.

These are the women in science of the Amsterdam startup ecosystem.

The report also covers insights into the Benelux region, as well as in-depth information about individual countries, their trends and how they compare.

Here are eight key takeaways from the report.

85 new tech unicorns

According to the report, 85 new tech unicorns (valued at $1B+) were created in Europe in 2021, growing 2.7x faster than in the US. Europe, currently, counts 132 tech companies that have achieved unicorn status.

Compared to the development of unicorns in the US, Europe’s total account is almost at the level of US unicorns in 2020 (152), adds the report.

Top 5 European unicorn

At present, Europe’s top 5 highest valued unicorns are Klarna (€37.5B), Checkout.com (€35.4B), Revolut (€27.8B), Northvolt (€9.7B), and Global Switch (€9.6B).

The report also reveals that fintechs have the highest average valuation with €3.89B, followed by their peers from edtech, marketing and HR, on average valued at €2.70B.

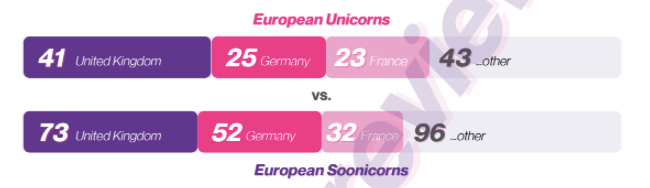

Top 5 countries of European unicorn

As per the report, the top 5 home countries of European unicorns are the UK (41), Germany (25), France (23), Sweden (6), and Austria (6).

On average, a European unicorn has a valuation of €3.1B, funding of €562.7M, created 1,027 jobs, and is ten years and four months old, shares the report.

However, the exception here is German grocery delivery platform Gorillas, which went from 0 to $1B in valuation in just ten months. The Berlin-based company stands out as the fastest unicorn ever created in Europe.

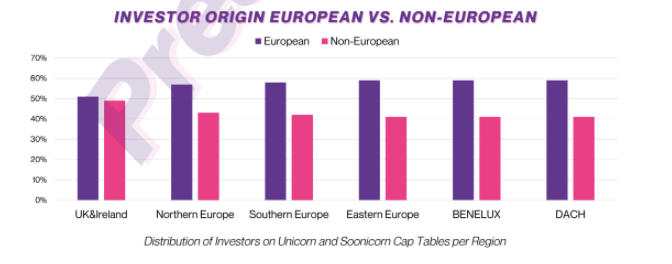

48% of investors from North America

The report also reveals that 48 per cent of the investors on unicorn captables (capitalisation table) originate from outside of Europe, predominantly from North America.

US funds with the most European unicorns in their portfolio are Accel (19 unicorns), Index Ventures (12), Tiger Global (10), TCV (9), and General Atlantic (9).

European Soonicorns

According to the publishers, European investors have given a list of 253 names with potential to achieve a valuation of $1B within the next 24 months.

On average, a European soonicorn has a valuation of €285.8M, funding of €121.5M, created 311 jobs, and is eight years and seven months old.

Soonicorns industry-wise

According to the study, the predominant industry focus among soonicorns is fintech, followed by AI & Big Data and Life Science & HealthTech.

In terms of countries, the UK dominates the list of homes to the most soonicorns (73) followed by Germany (52), France (32), Switzerland (19), the Netherlands (13), and Austria (12).

The reports also find that, on average, unicorns are 21 months older than soonicorns in Europe, hinting at how quickly we might expect a sharp increase in the number of unicorns.

9% of investors are outside Europe

9% of the investors on soonicorn captables originate from outside of Europe, shares the report.

The US VCs include Index Ventures (15), Accel (12), FJ Labs (10), Tiger Global (7), and Salesforce Ventures (7) leading the ranking of most soon-to-be unicorns in their portfolio.

The UK and Ireland

With 27 new unicorns created in 2021, the total number of unicorns has risen to 44 in the region, says the report.

The region’s most valuable unicorn is Checkout.com (€35.4B), followed by Revolut (€27.8B), Global Switch (€9.6B), Hopin (€6.6B), and Howden Group (€4.3B).

On average, a unicorn in the region has a valuation of €3.5B, has raised €534M in funding, created 941 jobs, and is ten years and five months old.

The region is also home to 77 companies with the potential to enter the unicorn club in the next 24 months.

On average, a soonicorn in the region currently has a valuation of €316.3M, funding of €122.9M, has created 279 jobs, and is nine years old.

“In total, uni- and soonicorns in the UK and Ireland have created an incredible 63,000 jobs to date. Given the very promising soon-to-be unicorns in the pipeline, we will see a stronger than ever economic impact of tech startups in the region in the next 24 months”, predicts Herwig Springer, CEO of i5invest.

Benelux

With three new companies reaching $1B valuations in 2021, the total number of unicorns in the region rises to eight – Mollie, Mambu, MessageBird, Bunq, and Bitfury from the Netherlands Collibra and Odoo from Belgium; and OCSiAI from Luxembourg.

On average, a unicorn in the region has €3.1B in valuation, raised €437.3M in funding, created 689 jobs, and is thirteen years and two months old.

The report also says that the region is also home to 20 promising companies with the potential to enter the unicorn club in the next 24 months.

In the Netherlands, startups include Bux, Catawiki, dott, Fairphone, Lumicks, Mosa Meat, SendCloud, Shypple, Studocu, Tiquets, Trengo, VanMoof, and WeTransfer. In Belgium, startups include Cowboy, Deliverect, Drylock Technologies, eTheRNA Immunotherapies, Promethera, Showpad, and Univercells.

On average, they have a valuation of €248.4M, raised €103.21M in funding, created 354 jobs, and are nine years and three months old.

The investors with the most regional unicorns in their portfolio are US funds Tiger Global and TCV, with two investments each. Dutch funds Peak and HPE Growth lead the soonicorn ranking with three investments each.

“In total, uni- and soonicorns in BENELUX have created an incredible 13,000 jobs to date. Given the very promising soon-to-be unicorns in the pipeline, we will see a stronger than ever economic impact of tech startups in the region in the next 24 months”, says Herwig Springer, CEO of i5invest.

How partnering up with Salesforce helped him succeed!