This month’s edition marks the silver jubilee of Inc42’s ‘30 Startups To Watch‘ list. It has been a long but exciting journey as every month, after a gruelling exercise of shortlisting 120-150 startups from all over the country, the Inc42 team curates them to select the top 30 startups with a unique value proposition and the potential to disrupt the sectors where they operate.

Understandably, our previous 24 lists have been a massive success. As we celebrate the silver jubilee edition of this series, we decided to sit back and do a status check of the startups that we have unearthed in the last 24 months.

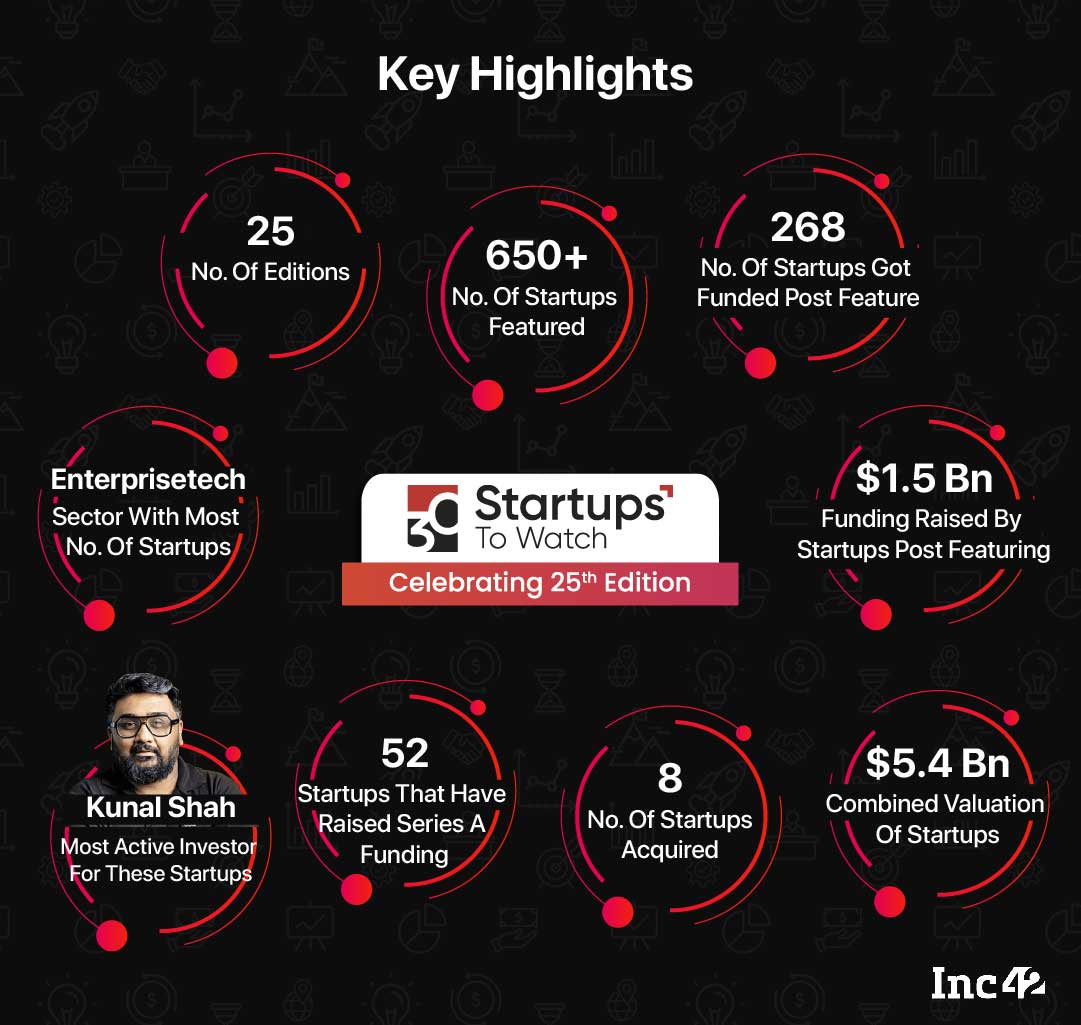

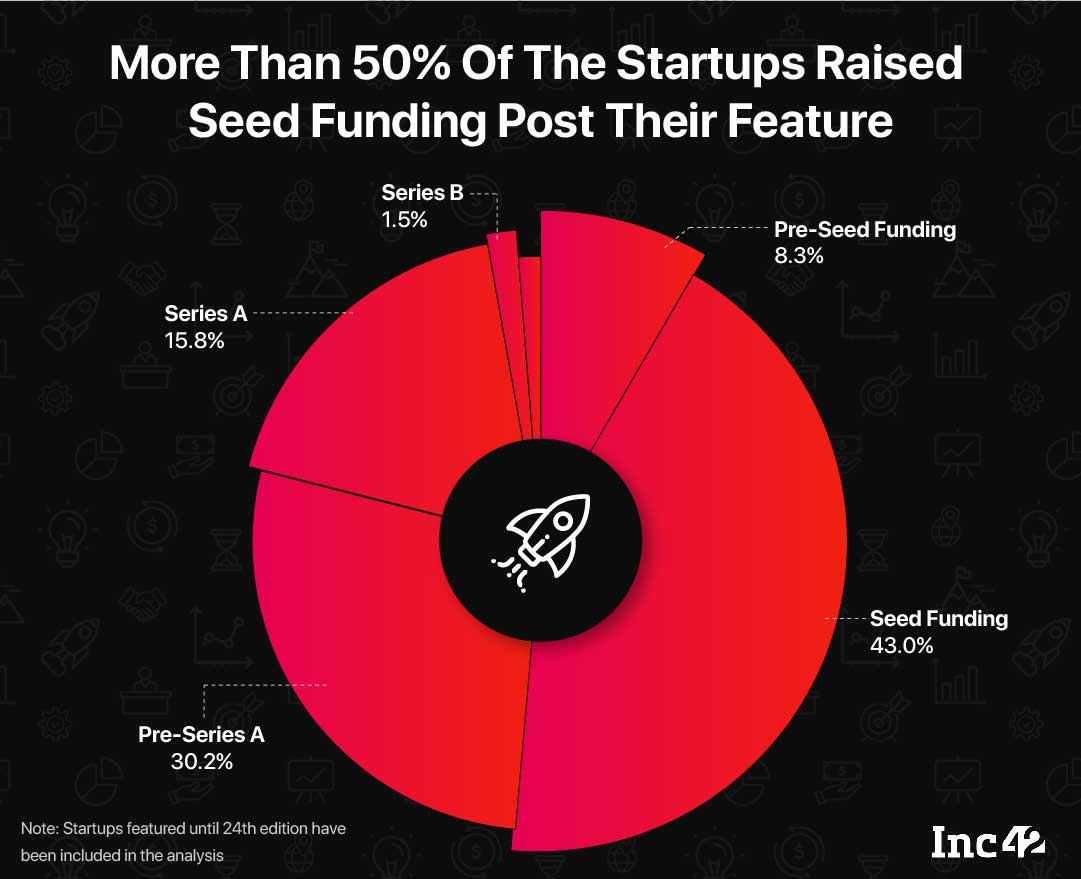

As part of this series, we have featured over 650+ startups spread across different segments such as consumer services, enterprisetech, ecommerce et. al. Analysis of these startups’ current status showed that over $1.5 Bn has been poured into them (combined) after they were featured in this series. The combined valuation of these startups currently stands at $5.4 Bn, reflecting the success they have achieved.

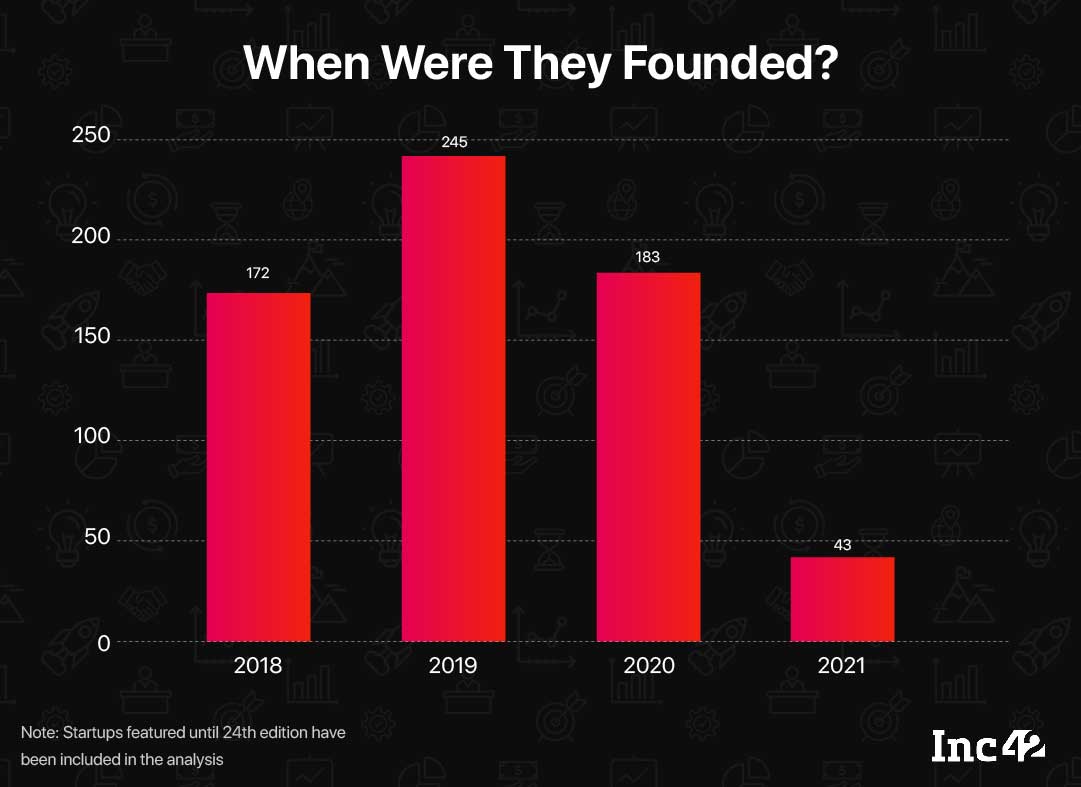

In the past 24 editions, we have featured 650+ startups aged three or less at the time of their listing. As many as 172 startups started their operations in 2018. A total of 245 belonged to the 2019 batch. One hundred and eighty-three companies were launched in 2020, and 43 were set up in 2021. A couple of companies were also minted in 2022.

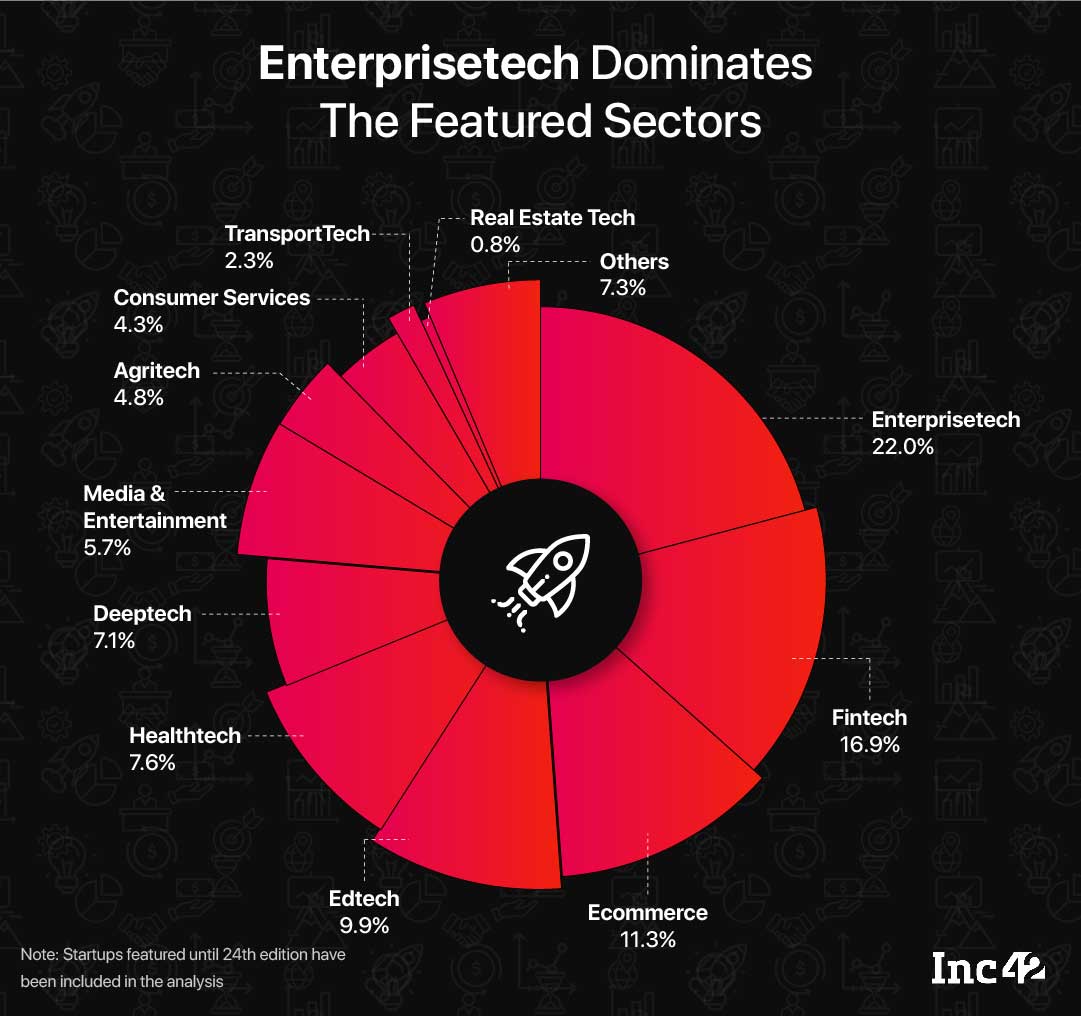

Enterprisetech and fintech were the top two sectors that recorded the maximum number of startups. In the 24 editions, we listed more than 142 enterprisetech startups across many sub-sectors such as HR tech, marketing, and sales. Other sectors with a large swathe of startups included fintech (109 startups), ecommerce (73), edtech (64), healthtech (49) and deeptech (46).

More than 60 of the featured startups raised Series A funding and beyond in the past two years. Eight of the 650+ startups also got acquired after their listing. All this is a testament to the list’s success as the unique business concepts rightfully claimed the limelight.

CRED founder Kunal Shah and Vaibhav Domkundwar’s Better Capital-backed 28 and 24 startups, respectively, out of the 650+ startups featured here. Y Combinator also backed 18 of the startups listed by Inc42.

We started the series when the pandemic was putting the startups and their ideas through a litmus test. But sailing and scaling for a few years, with robust, long-term plans in place, they have proved that there will be an opportunity for innovation in every crisis!

With this, let’s take a look at the startups that are part of this i.e. the Silver Jubilee edition of the series.

30 Startups To Watch: February 2022

This month’s list includes 30 unique startups involved in unique use cases across healthcare blockchain, enterprisetech and fintech. Better still, they seem to have found the right product-market fit, essential for business growth. In the 25th edition of the series, we have featured companies that reassessed their product playbooks after the pandemic and came up with innovative business models within the existing sectors.

This time, as many as 15 enterprisetech startups took centre stage, followed by fintech and blockchain startups. We have also found two exciting healthtech startups. One provides an intriguing combination of wellness solutions and wearable hardware to cope with brain conditions. The other digitises hospital operations for a seamless experience.

Check out the 25th edition of Inc42 Plus’ 30 Startups To Watch list.

Editor’s Note: The list below is not meant to be a ranking of any kind. We have listed the startups in alphabetical order.

1SilverBullet

Share On:

Why 1SilverBullet Made It To The List

Serial entrepreneur Milan Ganatra has worked with the fintech industry for about two decades. And throughout these years, he has noticed an alarming level of information asymmetry between businesses providing financial products and services and people keen to invest through them. That is why his latest venture, 1SilverBullet, is building a layered gateway for businesses across investment, insurance and lending segments.

Launched in 2021, the Mumbai-based startup provides a blockchain-based API that can be integrated with any tech-enabled platform for selling investments, insurances or lending products. But there are other benefits. For instance, a tech platform in the investment space can become a point of contact for investors and financial institutions, linking them at one place via the secure API customer acquisition and sales through investment channels such as AIFs, MFs, PMS and more. Apart from the ready-to-use backend, the company provides maintenance services for its B2B clients and claims that its API reduces a business’s time to market by 50%.

The fintech enabler charges a commission on every transaction done through its platform. Since its revenue generation started in January 2022, the ARR for FY22 stands at $120K and is estimated to reach $5.4 Mn in the next financial year.

1SilverBullet says it has already onboarded 40+ portfolio management services. Going ahead, it plans to introduce life insurance, health insurance and fixed deposit schemes by partnering with 25+ insurers and corporate FD providers. This will take its total number of portfolio management services to 80+ by March 2022.

Algomox

Share On:

Why Algomox Made It To The List

The concept of algorithmic IT operations, or AIOps, is just five years old. Companies in this space enable IT transformation through ML-powered data processing that automatically reduces noise and identifies the probable root cause of incidents. The key focus is about detecting any abnormal behaviour from users, devices or applications.

Shortly after the concept became popular, Bengaluru-based Algomox kickstarted its journey in 2018 and automated IT operations by leveraging AI. It also offers a bouquet of solutions, including omnichannel engagement, anomaly detection in ops, incident recognition and predicting capacity management.

It processes data silos to find anomalies, error patterns, events and incidents; automates end-user support activities to resolve IT tickets and grievances and governs tracking and compliance of IT operations. The platform provides four services — AI consulting, app development, managed AIOps and managed MLOps. Algomox’s team of data scientists also offers a CMS to help companies build models and synthesise data.

Capitall Club

Share On:

Why Capitall Club Made It To The List

More than 70 Mn Indians have put their money in the capital market, while 100 Mn+ people have reportedly invested in digital assets like cryptocurrencies. But retail investors’ interest in startups as a new asset class has piqued only recently. To cater to this upcoming market and ensure a win-win strategy for all stakeholders, serial investors Sanskar Jayaswal and Pranav Nair set up Capitall Club in January 2022.

The Bengaluru-based fintech firm allows retail investors to lend to high-growth startups for fixed returns in the form of passive income, while young companies can raise non-dilutive capital from this marketplace. Retail investors (lenders) can also trade their investments through a secondary market for early exits. Prior to investing, people can review a company’s financials and use financial tools to analyse investment opportunities. Retail investors can use Capitall’s services for free, but startups need to pay a processing fee on the debt raised. The company is run on blockchain to ensure foolproof security for all.

Currently, it claims a 100+ investor base backing four startups, with a revenue run rate of INR 50 Lakh for FY22. It also aims to disburse INR 45 Cr worth of loans to 100+ Indian startups through 10,000+ retail investors by the end of this year. By 2025, it plans to bring 50K+ startups and 6.35 Cr+ MSMEs within its ambit.

Cardbyte

Share On:

Well-designed business cards are essential marketing tools. But in India, most of them are made offline and stored/managed haphazardly, resulting in lost or out-of-date contacts.

Aiming to digitalise the contact management industry for greater convenience, New Delhi-based CardByte launched Android and iOS apps in January 2022. These apps help users create professional business cards and share these on their networks via QR codes or through third-party apps like WhatsApp. Plus, there are in-app features to enable data tagging, grouping and contact search. CardByte also scans paper cards to digitise the information and tracks and reports card updates within its network. Overall, the new tool makes it easier for users to access, organise and share business cards and professional contacts without the least hassle.

Currently, the startup has a freemium B2C business model, allowing users to store up to 50 cards for free. The company will launch its enterprise service suite by late 2022 and add a host of advanced features such as CRM integration, collaboration tools, augmented reality and voice assistance, advanced analytics and more.

Colexion

Share On:

Why Colexion Made It To The List

The NFT mania has hit India hard and caught the attention of anyone remotely interested in (blockchain-powered) Web 3.0 and the digital assets, especially digital art, that can be bought and sold in this space. Celebrities from India and abroad are also drawn towards this all-new revenue channel and selling artworks on various NFT platforms.

Launched in 2021, New Delhi- and Dubai-based Colexion is a marketplace on the Polygon network where fans can purchase collectable/trading cards, autographed cards, video moments, and other tokens from their favourite celebrities hailing from the world of cricket and entertainment. The platform hosts 1,200+ NFTs from 100+ celebrities across 10 or more countries. Among them are cricketer Yuvraj Singh, actors Suniel Shetty and Krissann Barretto, daily soap actor Rameet Sandhu and music composer siblings Salim and Sulaiman Merchant.

Colexion earns commissions and gas fees on NFT transactions, similar to its peers. It has also introduced an in-house crypto token called $CLXN that can be traded privately and used for NFT transactions.

However, the startup aims to go beyond celebrity NFTs and foray into the metaverse. It plans to build its metaverse infrastructure to launch a state-of-the-art digital museum. Here, artists and collectors will connect not only to deal in collectables but also to engage over the life journeys of celebs, play immersive virtual games and shop for NFTs across art, lifestyle, sports and celebrity categories.

Deefy

Share On:

Why Deefy Made It To The List

Currently, NFT marketplaces are considered a buzzing revenue channel for artists and celebrities, thanks to their enormous collections of digital assets. But New Delhi-based Deefy aims to disrupt this trend by helping collectors earn passive incomes via NFTs. In an all-new approach, Deefy is developing a fintech layer to add a personalised credit scoring system to fund NFT transactions. Better still, it will be a simple procedure, doing away with the cumbersome due diligence of Web 2.0 when it comes to lending.

As of now, a person must pay the total amount and the gas fee to buy an NFT as opposed to various loan options and the ease of repayment for other assets. However, Deefy users can buy NFTs from different blockchains on EMIs for a specific duration. Deefy also considers NFTs as collateral and offers loans against these digital assets. Apart from raising loans, users can mortgage or rent their NFTs to meet emergencies or generate extra earnings.

The startup determines a score for each NFT collection based on the floor price, 24-hour sales data, total sales, price change (drop or gain), popularity, the number of holders and the social score, among other factors. The interest rate in each case depends on the product score and the service fee charged by the company.

Deefy is still in alpha, but it is already in talks with major NFT marketplaces in a bid to tie up with them and provide this critical utility service. It plans to test its products on the Polygon network by March this year and roll out a beta version and a mobile app in the second quarter of CY22. The company also claims that it has loan requests worth $500K.

Falcon

Share On:

Why Falcon Made It To The List

With digital commerce growing exponentially, embedded finance, or the seamless integration of financial components into non-financial platforms, has emerged as a significant trend. Today, companies want to overcome the challenges of bundling multiple banks/legacy financial systems with their offerings and aim to provide personalised solutions to increase customer lifetime value.

Set up in 2021, New Delhi-based Falcon provides a host of customisation tools through APIs so that fintech, ecommerce startups and BFSI companies can launch their financial products in a couple of days. The company helps develop payment and lending tools such as cards, UPI enablers and money transfer platforms using no-code/low-code SDKs. Its B2B clients can onboard customers and manage and deliver financial products while Falcon handles the backend, card processing, reconciliation and compliance, among other tasks.

The startup’s cofounder Prabhtej Singh launched a B2B payment embedding product called Kite in 2016, which has been merged with Falcon. The company came out of stealth mode in February 2022 after announcing its partnerships with Visa, NPCI, many global processors and several Indian banks. Through these partnerships, Falcon offers white-label services such as vendor payment, payroll, tax payment, crypto payment, loans on cards, corporate gifting, BNPL and virtual currency transactions for online gaming platforms. The fintech-as-a-service platform also eyes $30 Mn in revenue by FY23.

Goldsetu

Share On:

Why Goldsetu Made It To The List

In India, jewellery is considered a highly coveted asset class and one of the most-favoured consumer goods. Although it is a traditional industry, retailers in this space required a digital makeover in the wake of the Covid-19 pandemic for business continuity and growth. Set up in 2021, New Delhi-based Goldsetu has developed a mobile-first SaaS platform to help jewellers set up digital storefronts, automate workflow and offer online payment, along with digital passbooks for their customers. Additionally, the startup provides access to smart dashboards, product and customer analytics and CRM tools required for seamless customer onboarding, order tracking, collection and management.

Goldsetu is still in the pre-revenue stage but claims to have acquired 300+ jewellers just three weeks into the beta launch. It is also working on a suite of value-added services such as gold savings plans, jewellery insurance, digital gold and gold loans to empower jewellery retailers. The platform has adopted a freemium model where all commerce-related features, including storefront and marketing tools, are free. However, it will charge a usage-based transaction fee for its value-add features to be launched this year.

Goodmeetings.AI

Share On:

Why Goodmeetings.AI Made It To The List

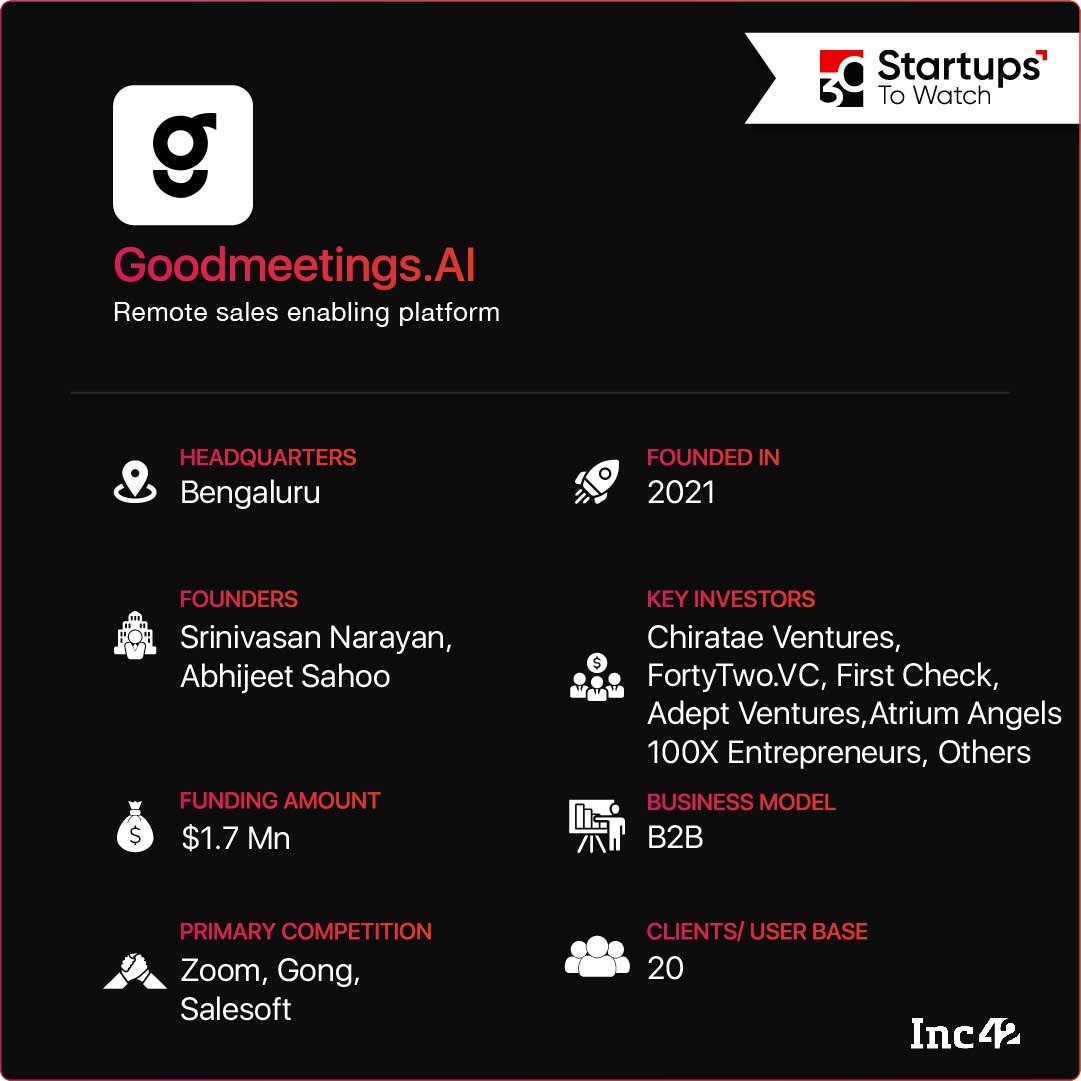

According to the Pareto Principle or the 80/20 rule, 80% of your sales come from 20% of the salespeople, while 80% of the salespeople bring only 20% of the sales. Although companies today are gaining in operational efficiency and moving towards an era of remote sales, powered by online demos, analytics platforms and virtual meetings for deal-clinching, the outcome of the sales remains chaotic for many businesses. So, Bengaluru-based Goodmeetings was set up in 2021 to help professionals sell better via remote channels. The company has developed an AI-powered video platform that automates the workflow and provides nudges and checklists to enhance sales performance. It also offers post-video call analytics to enable sales managers and coaches to gather valuable insights and make data-driven decisions.

Goodmeetings currently offers a video sales platform with five major functionalities. To begin with, a meeting can be started on any browser with an ID, and the video can be integrated with analytical CRM. There is an option to flip the camera for a live feed and pre-load standardised presentations and demo environments. It further offers multi-app and widget support to automate sales workflows, take notes, schedule follow-up meetings and fill in questionnaires within the meeting console. Then there are AI-powered dynamic nudges to identify when a customer is losing interest or a sales associate is straying from the ideal sales pitch. Finally, one can access video meeting recordings in a YouTube-like format that provides transcripts to analyse critical points and assess sales call quality.

The platform charges a monthly subscription based on the number of sales agents and tiered pricing depending on the features used by a company. It plans to onboard at least 1K paying customers in 2022, up from 20 clients worldwide, and eyes an ARR of $2 Mn. It aims to grow the number of customers to 4K by 2025 and hit $54 Mn in revenue.

IndiaP2P

Share On:

Why IndiaP2P Made It To The List

Indians mostly favour equity investments due to higher returns than the earnings from debt investments like bonds, debentures and mortgages. However, a good understanding of the debt market can help one earn good returns minus the heightened risks of the stock market. Therefore, Mumbai-based IndiaP2P was launched in 2021 as a peer-to-peer lending platform that would benefit both borrowers and lenders.

The tech-driven marketplace enables lenders to earn higher returns than conventional savings, around 16-18% against the industry average of 7-9%. On the other hand, borrowers on this platform, primarily small-town women entrepreneurs, can raise loans at lower interest rates. People can invest INR 5K- 50 Lakh, while borrowers can raise loans up to INR 50K from a single lender and a total of INR 10 Lakh.

The company offers an ‘income plan’ where the interest income is credited to the bank every month and a ‘growth plan’ where the payment is re-invested every month to compound. IndiaP2P charges an annual fee of INR 250 and an interest commission from investors/lenders.

The startup has not disclosed total loan disbursals or the asset under management, but it claims to have onboarded close to 100K borrowers. Its on-ground executives do the due diligence before loans are approved and provide credit counselling, thus minimising the risk of default. Moving forward, it will expand its portfolio of debt-based investment products to offer low-to-high risk high-return categories.

Insciple

Share On:

Why Insciple Made It To The List

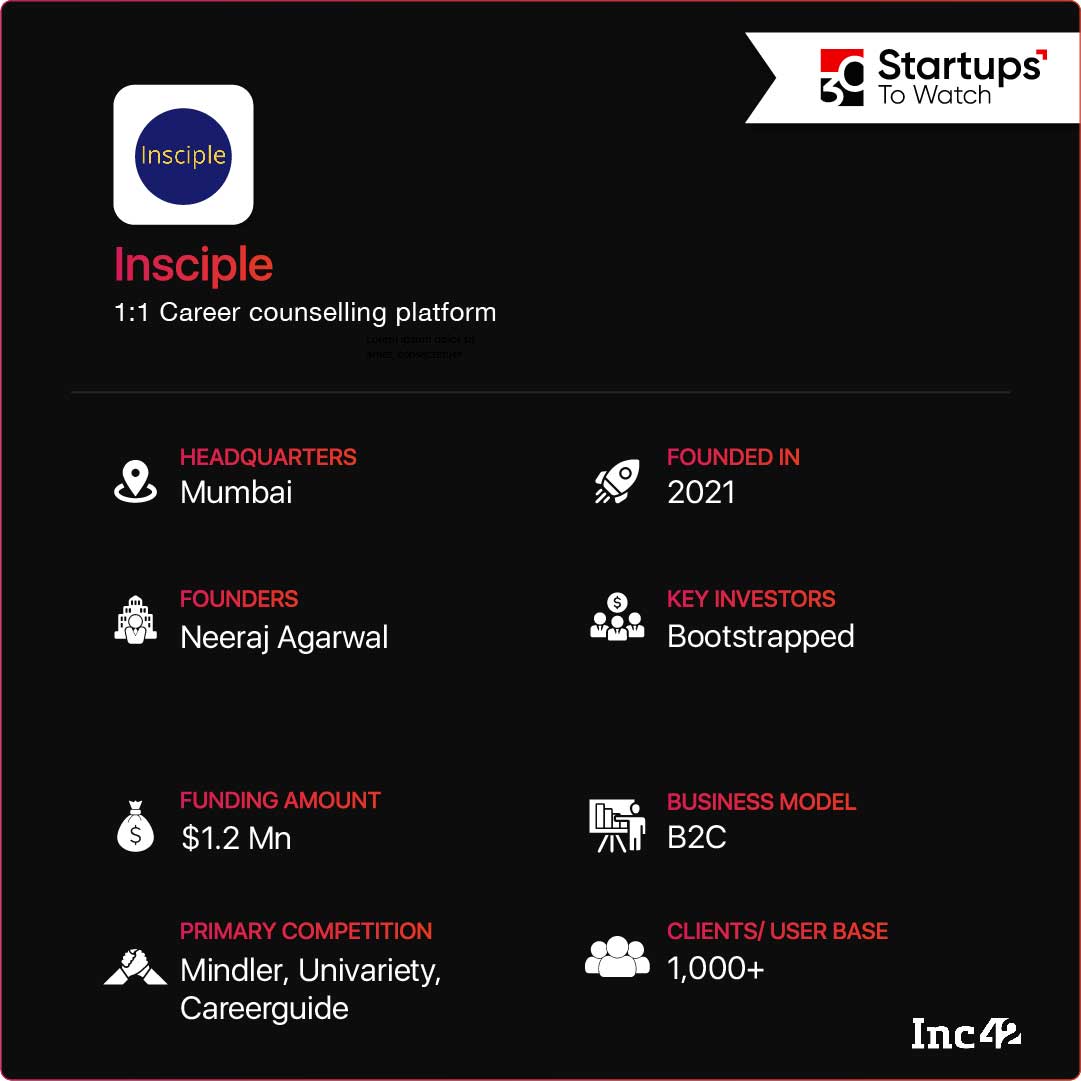

Job vacancies and their descriptions seem to flood the internet all the time. But former Yes Bank executive Neeraj Agarwal noticed that students desperately needed industry-specific career counsellors to nail suitable job opportunities. Keen to give young people a headstart in their professional life, he launched Insciple in 2021 to video-connect them with veteran industry professionals who will help chalk out sound career plans.

The Mumbai-based startup enables one-on-one career counselling by professionals from 10 countries and 40 different fields, with an average work experience of 10 years. Each advisor gets to choose the topic of discussion, sets up the consultation fee and provides a 30-minute video consultation on a range of career-related matters. Students can browse through their profiles to zero in on an advisor of choice, pay the fee and book an appointment.

Each session costs INR 2,000-4,000, based on the value the consultant brings and their popularity. Some popular names include chef Himank Bhardwaj, TikTok’s HR executive Malavika Rajagopalan and tech journalist Sugandha Malhotra. Insciple charges a commission on each consultation fee to generate revenue.

Although the platform started its career counselling services for teenagers, it is now helping working professionals keen to shift gears mid-career or move to managerial positions. It plans to add 100+ different career fields in 2022, including the less-talked topics such as getting promotion-ready and rejoining the workforce after gap years.

KareXpert

Share On:

Why KareXpert Made It To The List

India’s public healthcare system is too overburdened due to a lack of resources and inadequate application of modern technology. However, healthtech solutions like telemedicine, health record digitisation and AI for predictive analysis/diagnosis may soon improve this scenario.

Observing that legacy solutions led to inefficiencies, a dip in service quality and revenue loss, Gurugram-based KareXpert was launched in 2018 to provide timely tech support for service enhancement and business growth. It is a SaaS platform that charges a monthly subscription from hospitals for a plug-and-play cloud gateway that can remotely connect healthcare providers with medical equipment and IoT devices, manage data silos, track transactions and provide business intelligence and analytics. It also brings many healthcare modules together as a pre-integrated stack, including a health management information system, electronic medical records, laboratory information management system, telemedicine and connected ambulances.

Karkhana.io

Share On:

Why Karkhana.io Made It To The List

India is often lauded as a global manufacturing hub, but it has seen sluggish growth in components/parts manufacturing. Aiming to improve the country’s capability in this area, Mumbai-based Karkhana.io has set up a marketplace that connects spare parts manufacturers with global enterprises specialising in defence, robotics and medical equipment besides emerging sectors like electric vehicles, home automation and UAVs (drones).

Apart from bridging the demand-supply gap, the startup offers many value-added services to speed up and smoothen the entire procedure. These include identifying the suitable raw materials, ensuring IP protection, finding the right vendor, issuing quotations, project management, communications management and shipping. It has also partnered with 150+ small and medium manufacturers to provide CNC machining, 3D printing, metalworking and vacuum casting services for prototyping and mass production. Karkhana.io charges a fee from its customers, depending upon the order size.

The company rose to prominence in 2020 when it came out with tools for making personal protective equipment (PPEs) and ICU equipment such as valves, connectors and ventilator parts. In 2022, it will focus on building the ecosystem for EVs, healthtech, aerospace and defence and onboarding related MSMEs to strengthen its supply chain. It also plans to launch a portal for providing tools to suppliers for end-to-end project management.

Maximl

Share On:

Why Maximl Made It To The List

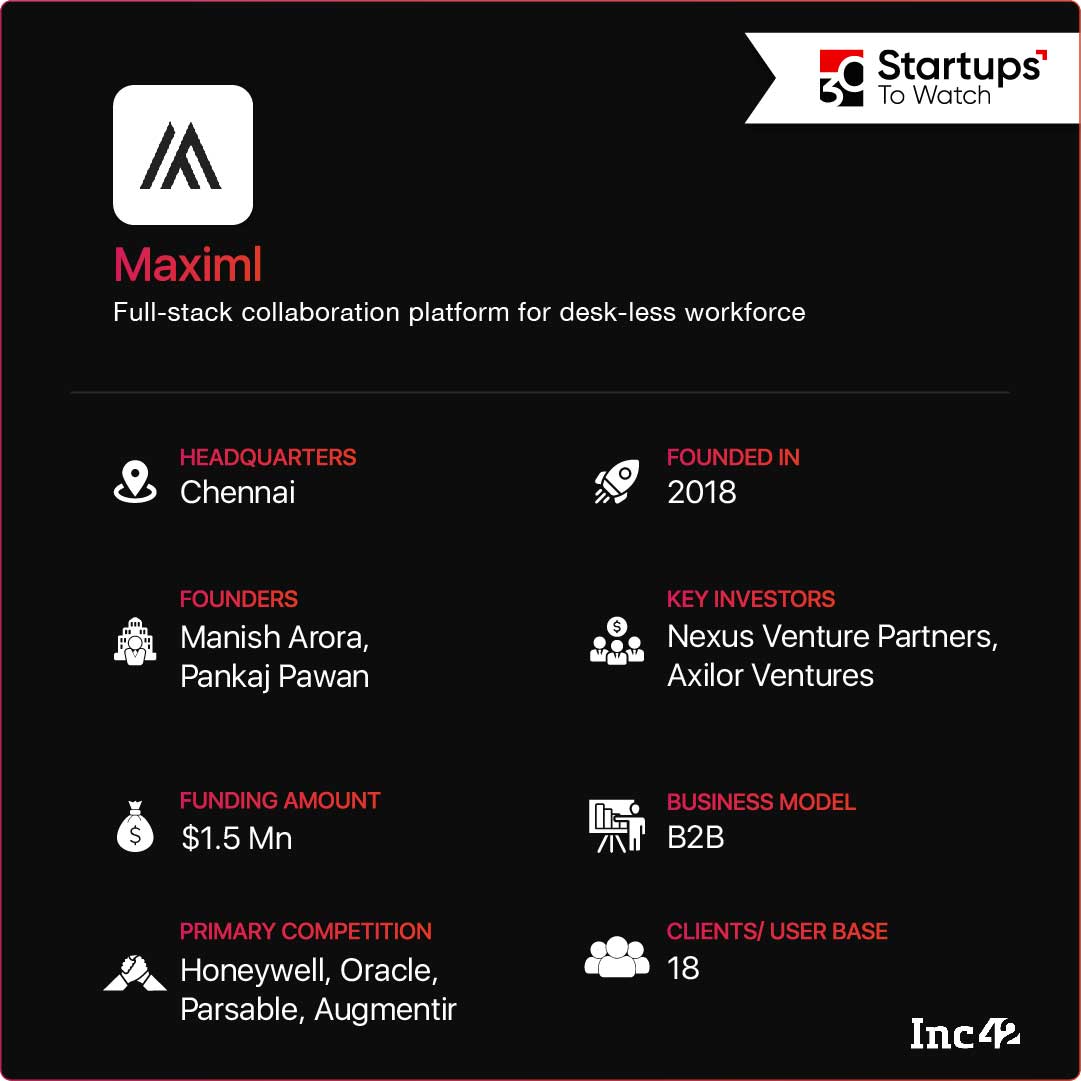

In India, a large chunk of the deskless workforce (mostly grey-collar workers) is not digitally empowered, impacting overall productivity, collaboration and growth prospects. To help employees become digitally savvy and their companies more efficient in terms of standardised shop floors and seamless communication, Maximl was conceptualised in 2017 at IIT-Madras and launched the following year.

By integrating a Maximl dashboard with the in-house system, a manufacturer can provide work instructions, on-field collaboration tools and on-the-job training to help people become more efficient and learn more about safety norms and quality standards to improve work quality. The subscription-based SaaS platform has in place a flagship cloud-based product called Connected Worker that offers real-time communications, knowledge-sharing and seamless collaboration between management and employees across tasks, including production, inspection, outage, quality audits and more. The platform can also generate workflows based on operational data and insights from workers.

Currently, Maximl has a strong presence in the oil and petrochemicals and metals space, and 8-10 major refineries are using its solutions. It also claims an ARR of $1 Mn for FY22. In the next financial year, it plans to foray into new sectors such as power, chemicals and industrial OEMs besides onboarding consultants to draft safety and best practices templates. It will also fortify its position in the North American, LATAM, the EU and the SEA markets.

Mykare Health

Share On:

Why Mykare Health Made It To The List

Healthcare in India has improved post-Independence, but the country is yet to cope with major issues like an inadequate health infrastructure, meagre outlay and expensive services. Moreover, the cumbersome medical process – from selecting the right hospital to making sense of the paperwork to getting insurance claims reimbursed – are always riddled with difficulties.

Senu Sam, a former executive of Apollo Hospitals, faced similar difficulties when his father had surgery at a local hospital. He soon realised that small and medium-sized healthcare facilities are underutilised and disorganised at times. This led to the concept of Mykare Health, set up in 2020 as an asset-light network of hospitals for patients undergoing specialised surgery in India and abroad.

The Kochi-based startup offers a host of solutions to fund specialised surgeries, including cost structuring, flexible payments, no-cost EMIs and an AI-enabled insurance platform. It also provides access to top surgeons and medical centres, meticulous postoperative care for quick recovery, 24×7 in-app screening and more. The company claims that its services help patients save 20-40% on surgery and post-surgery costs.

Mykare Health has already served more than 1,500 patients and facilitated 450+ surgeries directly and through 80+ associates, including pharmacists, hyperlocal medical consultants. The company also runs four Mykare medical centres in Chennai and plans further expansion across Tamil Nadu, Karnataka, Kerala, Telangana, Andhra Pradesh, West Bengal and Bangladesh. It claims an ARR of INR 5 Cr for FY22, earning via commission per package and premium subscriptions from users seeking preventive care. It plans to take the number of medical centres to 20 by CY22 and open the subscription services for all from the current 100 beta users.

Neuphony

Share On:

Why Neuphony Made It To The List

The Covid crisis has brought about unforeseen tragedies and taken a severe toll on our mental health. But there was a personal tragedy that drove Ria Rustagi and Bhavya Madan to set up their wearable healthtech startup Neuphony. The untimely death of Rustagi’s sister Pankhuri due to a rare brain condition and the grief that followed made the duo realise the need for a holistic solution to cope with mental health conditions.

In December 2018, Madan, who was then pursuing his master’s in human-computer interface, came up with the idea of a device to help patients suffering from speech complications. After conducting several surveys and interviews, they decided to work on brain health and mental fitness first. That was how Neuphony, also known as PankhTech (an ode to Pankhuri), was born.

So far, the company has developed two products. The first one is a head wearable band that uses an SDK to read brain activity to help improve memory and auditory processing, decision-making, emotional and social responses and brain training for spatial orientation. The second is a mobile app focusing on self-awareness and an ML model recommending custom meditation techniques. The mobile app and the headband can also be synced to measure the neurofeedback, based on which meditation techniques are recommended.

The wearable piece tracking brain activity will have two price points (INR 15,000 and INR 35,000), depending on the number of sensors. In addition, the plug-and-play SDK will cost INR 4,000 per licence per month. The mobile app can also be used without the headphones and can work as a meditation and mood tracker for INR 100 a month.

Neuphony’s head wearable product recently witnessed 25 early adopters and will be rolled out for home psychotherapy by the end of 2022. The company is also working on a communication device for patients with speech difficulties, with a tentative timeline of 2025.

NeuroPixel.AI

Share On:

Why NeuroPixel.AI Made It To The List

Cataloguing apparel in the best possible way is a challenging task carried out by every fashion outlet, and online fashion shops are no exception. This critical chore cannot be ignored as 60% of purchase decisions made by online shoppers depend on great images and attractive product presentations. However, most buyers remain sceptical about the real-life effect of a newly purchased outfit even though they liked the look and feel of the clothes online. Aware of these issues, former Myntra chief Arvind Nair and image processing specialist Amritendu Mukherjee decided to develop a deep neural network (DNN) for personalised try-on in the digital space using virtual mannequins.

Set up in 2020, the Bengaluru-based deeptech SaaS company offers a cloud-based, pay-as-you-go platform to make this rendering possible. Simply put, NeuroPixel’s AI-powered tool allows you to get a product photoshoot done using any mannequin. Next, its proprietary technology will render the apparel on virtual models of different sizes in different poses to help buyers make the best choice. The startup has recently launched its paid pilot for T-shirts and polo shirts.

NeuroPixel claims to be reducing cataloguing and merchandising spending by 30% and cutting down on time by 90%. Within this year, it plans to launch other outfit categories such as formal and casual shirts, kurtis and lingerie with the help of AI-powered cataloguing. It envisions personalising catalogues based on age and ethnicity in the long term.

NeuroTags

Share On:

Why NeuroTags Made It To The List

Ecommerce was the most funded sector in 2021, with startups in this space amassing $10.6 Bn in funding. Even then, a large number of people still prefer to shop offline as e-shoppers often end up buying fake products. This has become a matter of concern for new-age retailers keen to grow their online user base by addressing such problems.

Set up in 2018, Pune-based NeuroTags helps companies fight the ‘counterfeit’ threat by providing anti-counterfeiting solutions powered by AI. The company has developed a double security layer for product provenance – an ‘open’ tag or QR code on the package that can be scanned for product details and an ‘inside’ tag scanned post-purchase to get the user name tagged to that product. Next, the status of both tags gets updated on the company’s server in the cloud. These are unique tags to prevent data replication, incorporated during manufacturing and controlled by backend software.

The startup gathers consumer data via the ‘inside’ tag to offer an e-warranty service. Also, this data is used for a consumer engagement and data analytics platform. It further influences buying decisions through targeted ads and enhances customer engagement through a digitised after-sales service.

The startup works directly with brands and currently services several industries such as electrical and electronic appliances and accessories, jewellery, cosmetics and spirits and wines. It has a monthly subscription model in place and works with 40 big and mid-sized enterprises in India and the US, including the Raymond Group, Syska and Flo Mattress, among others. The company claims to have embedded its security solutions in 30 Cr products and engaged with more than 5 Mn consumers on behalf of its clients. It plans to scale its product reach by 10x by CY23.

OneRare

Share On:

Why OneRare Made It To The List

Born out of serial entrepreneur Gaurav Gupta and wife Supreet Raju’s love for food, travel and enthusiasm about all things blockchain, New Delhi-based OneRare is a food metaverse platform. The one-year-old startup is developing a world where users can produce NFT ingredients, sell them at a marketplace, make gamified recipes (again as NFTs) and play mini-games on the platform.

The ‘foodverse’ is being developed to help foodies engage with their favourite food creators, play immersive games and build a community around food on a blockchain-powered platform. It also allows celebrity chefs, restaurants and food brands to create virtual food experiences and signature dish NFTs and interact with a global audience.

Now in the pre-release mode, OneRare’s web platform has four parts. There is a virtual farm where farmers grow the crops used as ingredients. Next comes a farmer’s market where the produce is sold to collectors. Then there is a kitchen where users browse through recipes and combine ingredients to prepare new dishes as NFTs. Finally, there will be a playground for NFT owners who can battle it out via mini-games. The company plans to use the proceeds from the virtual games to raise awareness and funds to eliminate global hunger. Its revenue will come from tokenising celebrity chefs’ signature recipes as NFTs. It will also allow users to swap OneRare NFTs for meals and deals in real-world restaurants.

The startup will launch OneRare (ORARE) utility tokens by March 2022 to facilitate transactions in the farmer’s market and gameplay on the playground besides in-game upgrades and participation in governance on-chain and off-chain. Its public launch will take place by June this year.

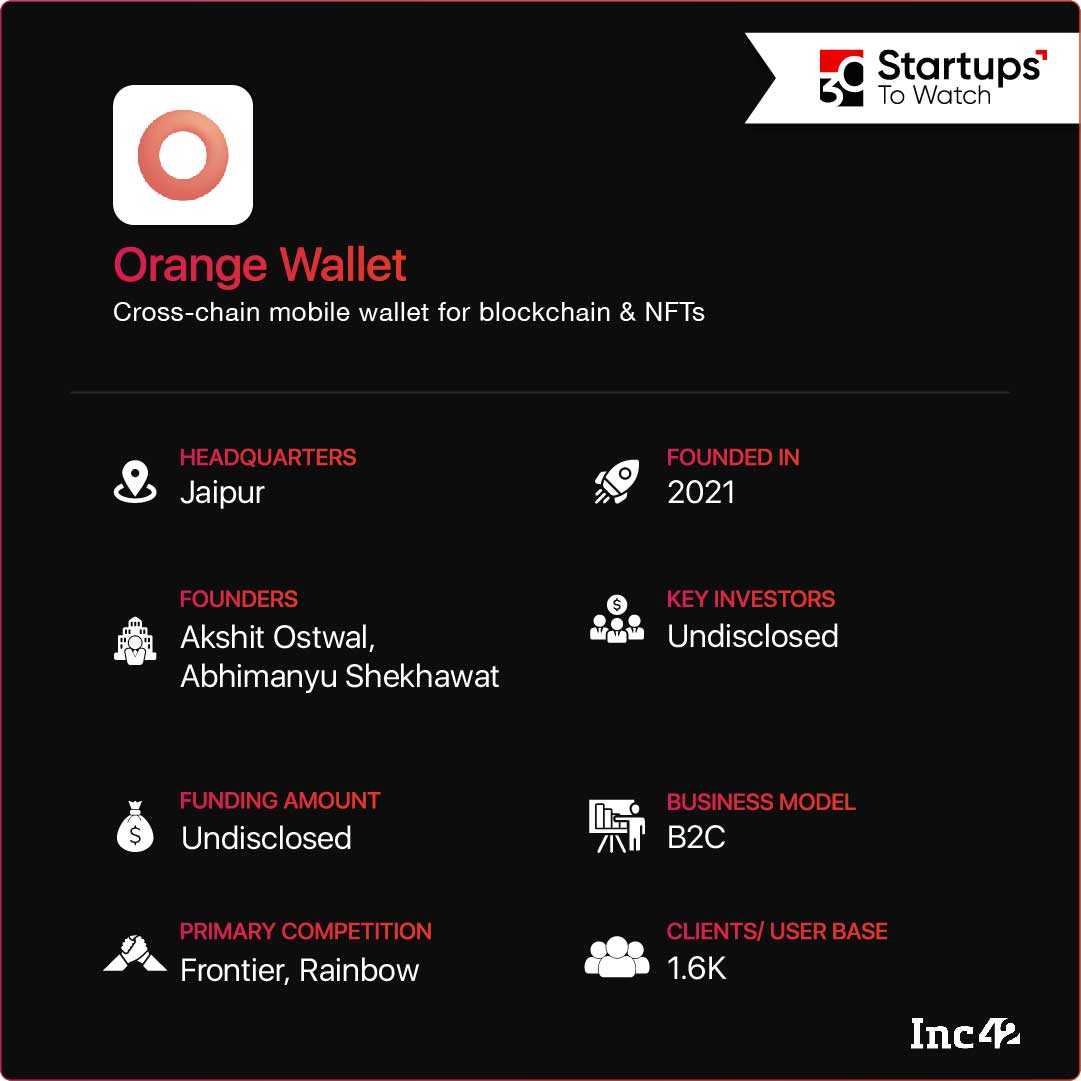

Orange Wallet

Share On:

Why Orange Wallet Made It To The List

The blockchain universe is full of jargon, and user experience is often fragmented as they need to access multiple platforms. So, Jaipur-based Orange Wallet was launched in 2021 to ensure cross-chain operability, helping users move crypto funds and NFTs from one network to another by leveraging every chain’s decentralised financing (DeFi).

Simply put, the Polygon-focussed cross-chain mobile wallet provides access to DeFi, NFTs, IDOs and DAOs across five EVM-compatible chains — Ethereum, Polygon, Binance Smart Chain (BSC), Arbitrium and Avalanche. It rewrites the UI of every protocol integrated with the Orange Wallet to simplify the user experience on these systems. The wallet is still in the consumer acquisition stage.

Other features include reduced transaction costs, access to all DeFi protocols at one touch, conversion to fiat money on-ramp and click-and-mint NFT services akin to an NFT social media. It also allows cross-chain swaps so that users can transfer tokens between different chains. For example, one can move it from $USDT on Polygon to $BNB on BSC or $WBNB on Avalanche to $WETH on Ethereum.

The Ethereum Layer 2 product is currently in beta. The wallet is available on iOS and Android and has clocked more than 14K downloads to date. Orange Wallet is a pre-revenue startup but intends to monetise through mediator fees on services, from DApps for featuring those on the platform, from various protocols to host their yield farms and from users for fiat conversions. It will soon provide native UI support for all prominent DeFi and DApps and further support NFT marketplaces. The company aims to launch these features by the end of 2022.

Pepper Farms

Share On:

Why Pepper Farms Made It To The List

Smallholding/shrinking farm sizes is a key reason why Indian farmers find it difficult to ensure efficiency and generate adequate incomes. Shalini Aggarwal, a chartered accountant by profession, faced the land crunch issue when she decided to take up commercial farming on a piece of land owned by her family. To address this pain point, Aggarwal and serial entrepreneur Saurabh Singla set up Pepper Farms in 2020.

The Gurugram-based startup has developed a network of farms across India to consolidate small farmlands and optimise their productivity through agritech solutions, farm inputs and efficient farm management alongside financial resources, market linkages and selling the produce as a collective. It has two business models in place – leasing and aggregation and product franchising. In the first case, the company restructures small and fragmented farmlands via leasing and aggregation and exercises complete control over operations. Otherwise, farmers can retain their ownership, and Pepper Farms only buys the produce under a franchise contract. The company has crop ownership in both models and closely monitors product quality.

Currently, the startup focusses on greenhouse farming and produces a few vegetables such as bell peppers and seedless cucumbers across 35 farms in Himachal Pradesh, Punjab, Haryana and Uttarakhand, spanning 160 acres. It supplies the aggregated produce to Otipy, Amazon India, BigBasket and APMCs and earns revenue from variable commissions on sales.

This year, Pepper Farms plans to add more varieties, including mushrooms, leafy vegetables, peas, broccoli, melons and tomatoes. It also aims to expand its network to 500 farms across 1,000 acres, beginning with Rajasthan.

Powerplay

Share On:

Why Powerplay Made It To The List

The traditional construction sector currently employs 16% of the working population in India. But very few tech companies have come out with new-age solutions to help digitise construction processes. Consequently, small and medium contractors still rely on pen and paper. (Some have graduated to WhatsApp, though, to track workers’ progress.) To help this segment deal with many operational challenges, costly delays and budget overhauls, Powerplay was launched in 2019.

This Bengaluru-based app-first company simplifies site-to-office communications by connecting multiple stakeholders and enabling them to communicate and collaborate. Project managers, workers and partners can use the one-stop platform for tracking tasks, progress, deliverables and payments and further streamline the often complex and multi-stakeholder project management process.

RetainIQ

Share On:

Why RetainIQ Made It To The List

In today’s digital-first world, digital marketing has emerged as a critical success component for any business, big or small. The measure of good marketing lies within conversion and retention rates, but many organisations fail to optimise marketing channels to ensure long-term growth. Launched in 2021, Bengaluru-based RetainIQ is a communication automation platform that helps ecommerce stores and brands to convert and retain their customers by leveraging social networking services such as email, WhatsApp, SMS and push and on-site notifications. It helps brands deliver a personalised experience across various touchpoints through an integrated digital marketing dashboard.

The SaaS-based plug-and-play platform charges $49 per month and offers two services — pre-purchase and post-purchase retention flows. Both enable in-house marketers to set up conversations based on email and other communication templates like on-site welcome messages, checkout recovery and product launch. Clients can also customise these templates in sync with their brand’s theme for websites or email, thus removing the dependence on designers and engineers.

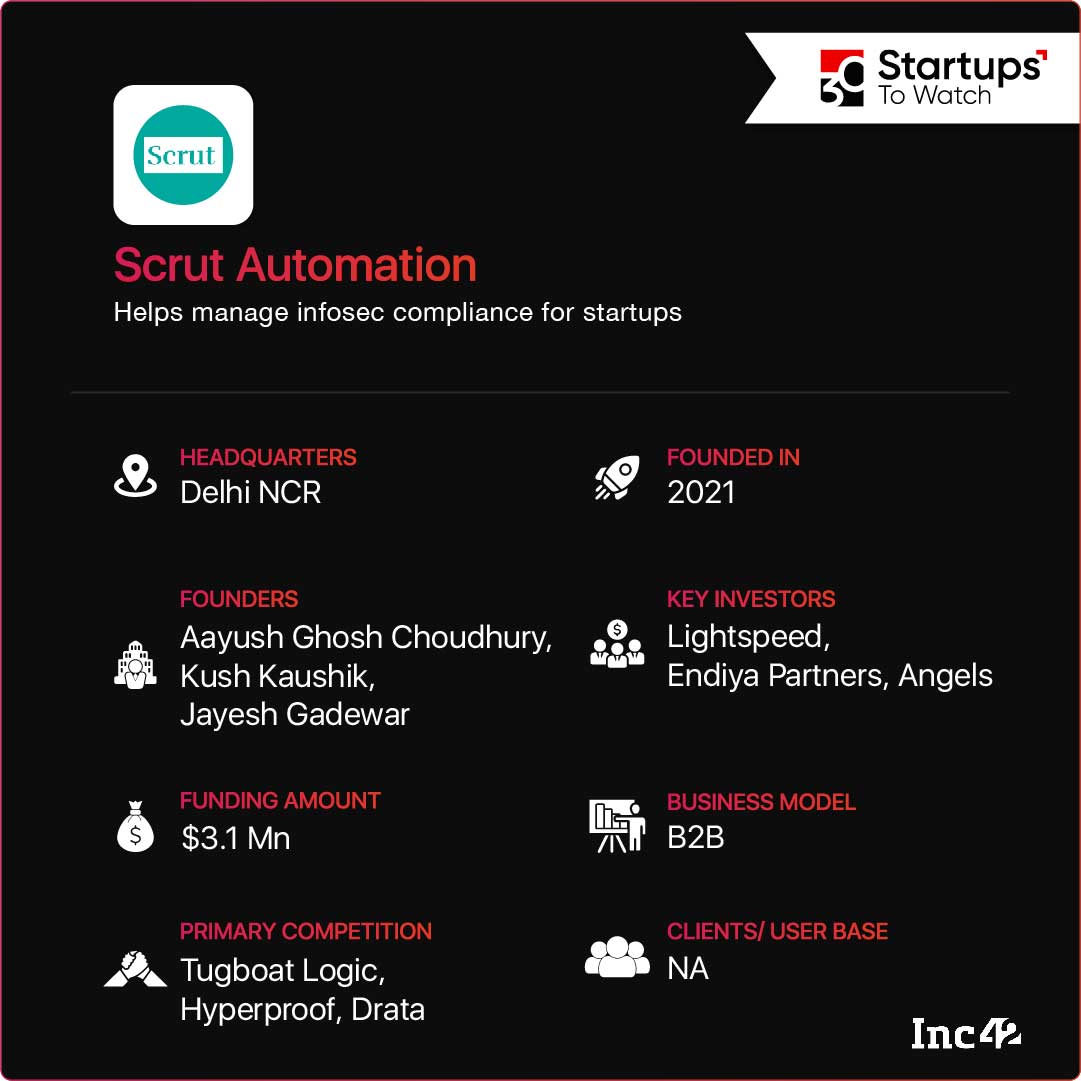

Scrut Automation

Share On:

Why Scrut Automation Made It To The List

While working on a startup idea, cofounders Aayush Choudhury, Kush Kaushik and Jayesh Gadewar faced a major challenge as they went through the compliance procedures of five different information security standards. The issue: When evidence artefacts and cloud controls were manually tracked, the exercise gobbled up the team’s bandwidth. So, Gadewar built internal tools to monitor the cloud environment and track potential loopholes. Eventually, the trio discontinued the earlier concept, but their security tools took centre stage, and Scrut Automation was born in 2021.

The New Delhi firm automates labour-intensive compliance tasks using SaaS tools and cloud integrations and auto-collects hundreds of evidence artefacts within hours. Otherwise, this process could have taken weeks, the company claims. Scrut’s flagship product is a governance, risk and compliance (GRC) tool that can be integrated with any cloud service provider and other commonly used tools to collect evidence and flag any deviation across 150+ controls.

The startup charges a licence fee for its enterprise tech solution that brings all infosec compliance standards and internal SOPs on a single platform and advises against factors that may lead to slips and loopholes. It is also building a marketplace for infosec resources, including auditors, subject matter experts and penetration testers, and plans to open a US office by the end of 2022.

Soptle

Share On:

Why Soptle Made It To The List

The rise and rise of ecommerce over the past few years impacted offline intermediaries (read savvy suppliers) who connected manufacturers and sellers. Nevertheless, buyers in small-town India still rely on local shops, while these retailers are heavily dependent on the middlemen for access to the latest products. This traditional approach often leads to rising costs and shrinking profits due to supply chain inefficiencies. That is why Gurugram-based Soptle has created a manufacturer-only marketplace for Indian SMEs, connecting rural and small-town retailers with regional brands.

Set up in 2021, the platform has developed an Android app to help retailers browse through all products and deals available from manufacturers and place orders directly. In fact, an army of Soptle development partners (SDPs) work with retailers to drive the adoption of the retailer app. It also provides a web dashboard for manufacturers to upload catalogues with the latest prices and trade schemes. Revenue comes from commissions on transactions and logistics services provided by the company.

Soptle acquired 10K retailers and onboarded more than 50 manufacturers within two months of the launch. By 2022, it plans to onboard 80K+ retailers, 3K+ manufacturers, 2K+ SDPs and hit INR 750 Cr in revenue. It aims to take the number of retailers to 500K by 2025.

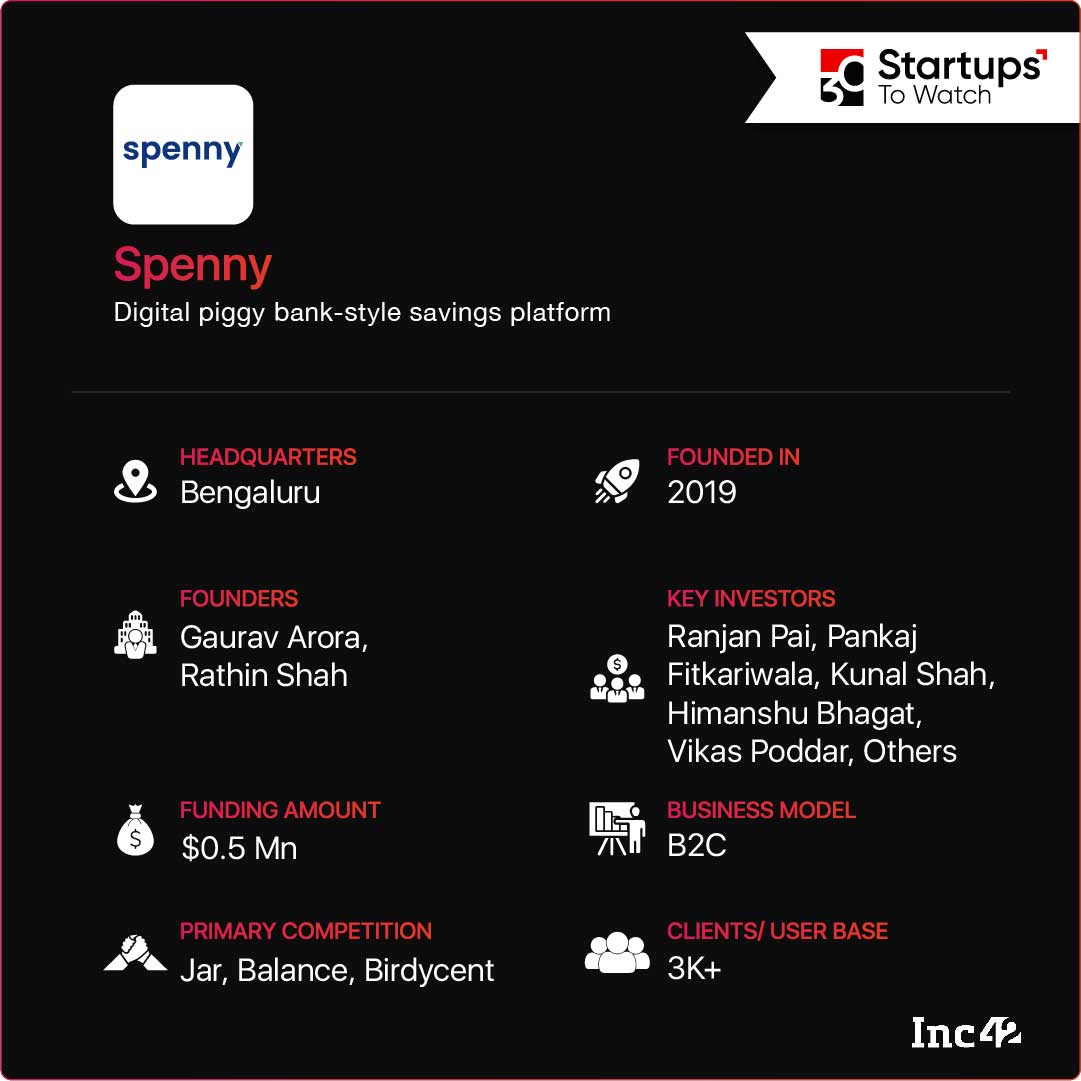

Spenny

Share On:

Why Spenny Made It To The List

The healthy saving habit of Indian kids is often attributed to the widespread use of the traditional gullak or the earthen piggy bank. Built on the same concept of saving spare changes, Bengaluru-based Spenny was launched in 2019 as a micro-savings and investment app.

The startup helps users save some spare change from their daily transactions so that a tiny portion of their money is secured without fail. For example, every time a customer makes a transaction, it gets a notification via text messages and rounds up the amount to what’s closest – INR 10, 20, 50 or 100. The money is automatically invested into digital gold or a diversified mutual fund portfolio, and Spenny earns a commission on each investment.

The fintech firm uses encryption for foolproof security and partners with insured custodians to ensure that the assets are held safely and liquified easily. It also offers a debit card for easy cash withdrawal. So far, the company has recorded micro-savings worth over INR 1.5 Cr.

Stockpe

Share On:

Why StockPe Made It To The List

Building a robust investment portfolio is essential to secure one’s financial future. But in India, people often lack the financial discipline to pursue active investment options for the long term due to a lack of basic financial knowledge and a risk-averse attitude. As a result, three out of every four demat accounts lie inactive today.

To bridge this knowledge gap, New Delhi-based StockPe was started as an online financial literacy platform in 2021. Unlike YouTube lessons or text-heavy courses, it offers a gamified platform to understand the nitty-gritty of the stock market. From mastering the basics to reading stocks and more, users can move up the learning curve by unlocking more advanced levels. The company targets students aged 18-24 in the Delhi-NCR region. Users need to open StockPe learning accounts on the platform to practise trading in a simulated market. They can also use real money to compete against peers in learning tournaments and earn monetary rewards. StockPe gets a commission from each user investing in these tournaments.

The startup’s Android app is currently limited to 500 early users, but it plans to take the number to 2,000 by April 2022. It will diversify the platform within a year by adding more financial instruments such as forex, mutual funds, and crypto. StockPe aims to achieve a positive cash flow within the next two years by scaling to 1 Mn+ users and onboarding people aged between 25 and 55.

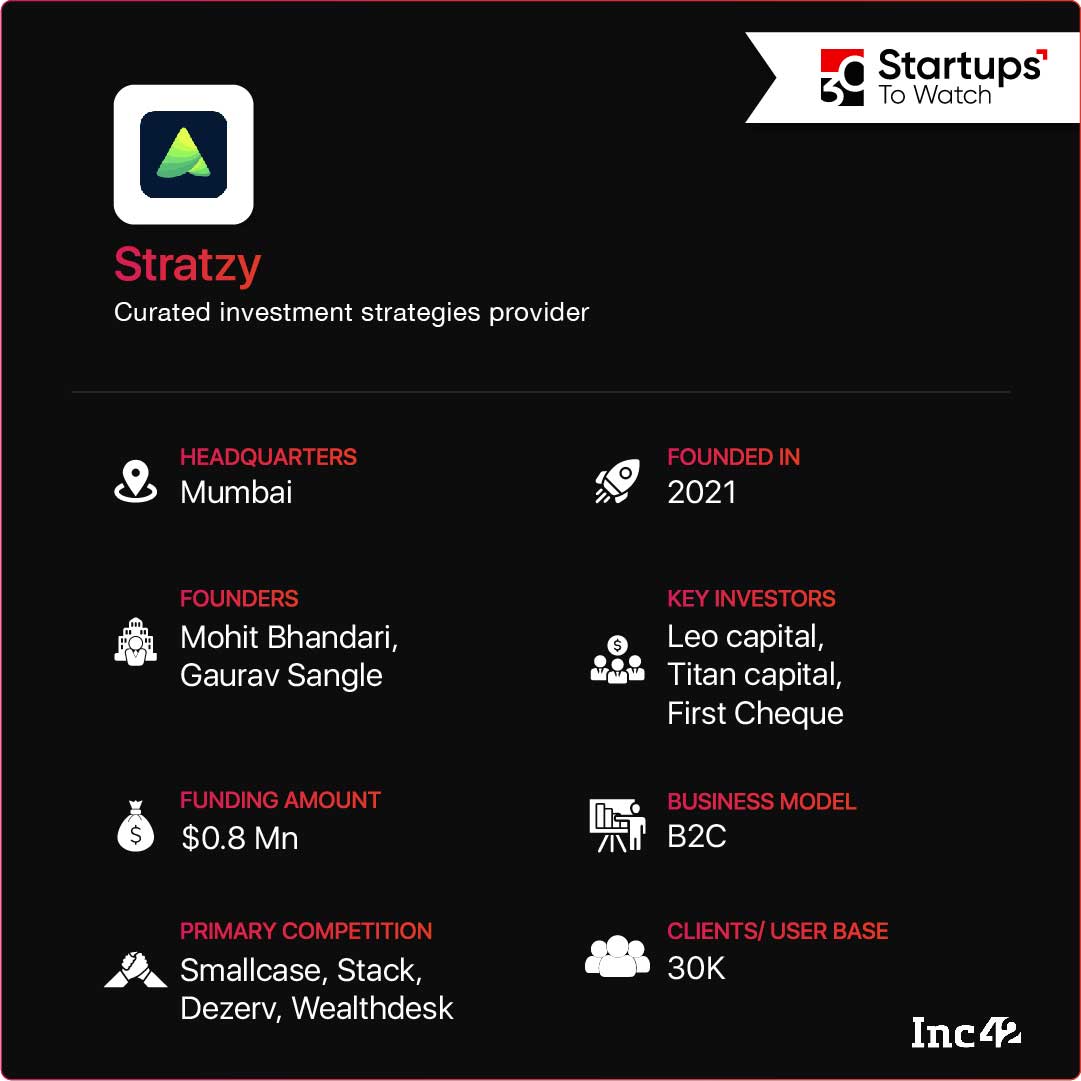

Stratzy

Share On:

Why Stratzy Made It To The List

During their college days, BITS Pilani alumni Mohit Bhandari and Gaurav Sangle joined a finance club called Wall Street and realised the need for stock market training in story formats. After helping their juniors learn about the stock market, crypto and various investment-related topics, the duo decided to launch Stratzy in 2021 and build a neobroker layer. This would provide access to expert-curated, research-driven ideas and strategies to master the investment dos and don’ts.

The Mumbai-based startup works at the intersection of fully automated, algo-driven robo advisory and active stock-picking. Powered by Stratzy’s virtual investment guide, users can pick and directly invest in the baskets, gaining stock-picking knowledge and earning hassle-free returns from investment-worthy stocks. The system also allows investors to ace their timings, buying and selling stocks at the right time for optimum returns. Besides, the company hosts the Stratzy Club, where users can engage with friends, learn from them or teach them investment strategies.

It has partnered with several digital stock-broking platforms, including Zerodha, 5paisa, Paytm Money, and more. Existing users on those platforms can avail themselves of Stratzy’s services, and vice versa. Currently, the service is free for users, but the company charges a part of the broker’s fee as commission.

Since its launch, Stratzy has enabled more than INR 1 Cr worth of investments for 30K+ users. It will onboard 1 Mn+ users by the end of the current calendar year and introduce a subscription-based premium service called Stratzy Edge+ for curated investment strategies.

SuperK

Share On:

Why SuperK Made It To The List

In India, traditional and unorganised retail across non-metro cities and small towns accounts for more than 80% of the total market, while big-box retail and retail chains are still limited to less than 2%. Of course, grocery retail has surged to a $600 Bn opportunity. But given the advent of modern trade, ecommerce and quick commerce, the time is ripe for brick-and-mortar kirana stores to pivot and grow. With that in mind, Kadapa-based SuperK was launched in 2021 to set up a franchisee network and help small retailers streamline processes and offer a better customer experience to compete with big players.

The mobile-first startup has developed an integrated software system that connects warehouses, stores and suppliers. It rebrands existing small-format stores with SuperK branding and helps them with standardised pricing, discounts, cashback and digital billing, along with a wider range of products. SuperK manages procurement and merchandising for all the physical stores through a standard operating plan. It claims a $5 Mn ARR for FY23, with earnings commission from sales margin, franchise fees and brand partnerships.

SuperK is currently operational in two districts and 10 towns in Andhra Pradesh and plans to cover six more districts by this year. It aims to expand its operations across Central and Southern India in another three years.

Truegy

Share On:

Why Truegy Made It To The List

Background checks have become a critical component of HR and legal processes, the lending industry, matrimonial sites and even dating apps. So, second-time entrepreneur Ajay Setia started Truegy in 2021 to simplify the process.

Truegy works like LinkedIn for individuals, allowing them to register their profile by uploading their documents for educational, employment-related and other requirements. For its enterprise clients, the Gurugram-based company offers a subscription-based, pay-as-you-go model to verify potential candidates’ profiles with the help of PAN, Aadhaar cards, passports, physical address proofs, bank accounts, employment history and educational institutions. The tech-driven verification process is thorough and considers 50+ API and data points.

The company claims to have more than 22K TruProfiles and counting. It is currently working on customer acquisition and aims to onboard 100+ employers in 2022 for background verification during the hiring process.

[Edited By Sanghamitra Mandal]