Early-stage startup fund 9Unicorns announced the fourth close of its first accelerator fund at $50 million with participation from key players and limited partners (LPs) including Haldiram’s, Indian Bank, Chona Family Office, among others. The $82-million sector-agnostic fund, from the stable of India’s leading integrated incubator Venture Catalysts (VCats), plans to invest in 150 startups over the next one year.

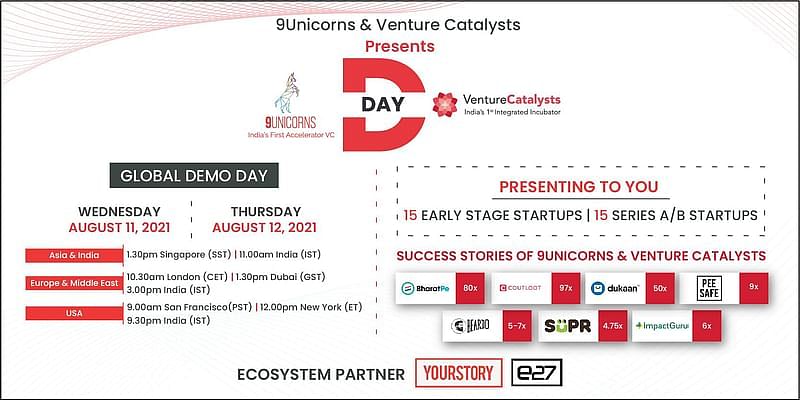

The country witnessed the birth of 15 unicorns in the last six months as compared to 11 in the whole of last year. Riding high on this success, 9Unicorns is set to organise its first-ever Global Demo Day – D Day – along with its parent firm Venture Catalysts on August 11-12, 2021. A total of its 30 portfolio startups – 15 early-stage and 15 pre-Series A startups – will represent sectors as diverse as deep tech, artificial intelligence and data analytics, B2B SaaS, fintech, insuretech, healthtech, consumer tech and edutech.

“India has truly emerged as the land of the unicorns, which puts us at the right place at the right time. We are in the best possible spot to capitalize on the momentum. India is poised to cross hundred billion-dollar companies by 2023 and hence we feel this is the right time for us to conduct our first Demo Day to showcase some of our innovative startups to global VCs to raise bigger rounds,” says Dr Apoorva Ranjan Sharma, Managing Director and Founder of 9Unicorns.

9Unicorns has so far invested in 60 unique startups whose combined valuation is pegged at $420 million. Seven of them have already raised bigger rounds of investments within a range of 1.65X– 4X valuation. Some of the startups in its portfolio include mediatech company Toch.ai, revenue-based financing firm Klub, fertility care provider Janani, marketing automation firm ExtraaEdge, audio production automation firm Deepsync, D2C lifestyle footwear brand Monrow, and edtech Qin1.

As an accelerator fund, 9Unicorns typically invests around $1,50,000 for 5-7 percent equity per startup at the idea-stage. As of May 2021, it has syndicated over $67 million investments with co-investors such as Sequoia Surge, Titan Capital, SOSV, Nexus Ventures, among others. The syndication also includes some of the country’s leading ‘super angels’, namely, Ritesh Agarwal (OYO), Pankaj Chaddah (Zomato), Anand Chadrashekharan (Facebook), Ramakant Sharma (LivSpace), Amrish Rau (Citrus Pay), to name a few.

Backed by several well-known global and domestic LPs, 9Unicorns’ USP lies in the fact that it allows startups to tap into its vast nexus of industry experts and investors in cities other than metros, enabling them to go pan-India quicker. It helps them in getting early customers, distribution partnerships, cross-portfolio synergies for startups leveraging the pre-existing network of over 4,000+ investors, founders, and executives in the VCats ecosystem.