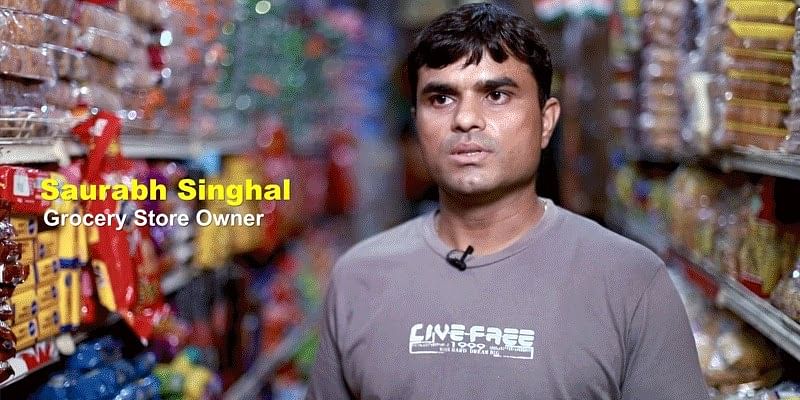

When Saurabh Singhal, an ambitious grocery store owner, decided to expand his inventory and explore new growth opportunities, he also made the decision to start accepting card payments.

“At first we thought that taking cash was good enough, but when we started accepting card payments, we realised its value,” he says. “We don’t need to carry cash [in bulk] anymore and there is no more hassle in providing change. Plus, customers prefer card payments as they can get some discounts and avail offers from their card provider. It’s a win-win for both the shopkeeper and the customer.”

Saurabh realised that when it comes to retail merchants of any size, providing varied and convenient ways to make payments is a must-have for customers, and is crucial to a merchant’s business growth. This is more so the case in the past year, when the COVID-19 pandemic saw a significant adoption of contactless digital-based payments. With a focus on safety, hygiene and convenience, there was a sudden uptake in digital and contactless payments.

In fact, according to a recent Mastercard survey, 58 percent of Indian respondents intend to increase their usage of contactless payments such as debit and credit cards, prepaid cards, and mobile wallets, which shows their comfort with the digital ecosystem. Not only that, but 81 percent of Indian respondents believe that contactless payment is a trend here to stay.

Through their flagship campaign Team Cashless India, Mastercard continues to engage with merchants and consumers to create awareness about digital payments in India.

For Saurabh, accepting card payments has also meant additional peace of mind. “In our market area, we’ve had a few cases of theft and loot. Now that we’ve stopped stocking cash, we live without fear,” he says, adding how it also helps them save time that was spent on making trips to the bank to deposit the money made from sales. The time can now be used to spend on improving core business operations.

“Earlier, four people needed to go to the bank to deposit cash every day. Now, we get the money credited to our account even before we wake up in the morning, which makes card payments a very convenient facility for us merchants.”

Watch the below video to know more about Mastercard’s Team Cashless India campaign.