With the rise of HNIs and investable funds, we have seen a recent shift away from traditional investment avenues and toward sophisticated financial instruments

The drive for attractive risk-adjusted returns coupled with lacklustre returns from fixed income asset classes has opened the avenue of angel investing for many

Despite the post-pandemic recovery being marred by tightening interest rates, geopolitical tensions and tanking valuations, the overall sentiment is that of enthusiasm with an ever-widening pool of angel investors

A common dinner table topic amongst HNI investors is the names of the new business ventures they have invested in with the hope that their bang on the buck would be the new-age disruption. Investors have brewed the perfect coffee bean and realised that as more capital flows there will be more startups, more funding, more exits and consequently more wealth creation. With India housing the third largest number of unicorns after the US and China, the buoyancy in the Indian venture capital investment landscape is note-worthy.

The drive for attractive risk-adjusted returns with limited public market correlation coupled with lacklustre returns from fixed income asset classes has opened the avenue of angel investing to millennials, Gen Z and younger generations of traditional business families via sophisticated family offices. This has placed venture capital as a favourable alternative asset class.

SEBI Alternative Investment Funds Regulations

SEBI (Alternative Investment Funds) Regulations, 2012 (SEBI AIF Regulations) came into force with effect from 21st May 2012. As per the SEBI AIF Regulations, pooling of funds through any entity other than Alternate Investment Funds (AIF) is prohibited.

This means that if investors have to pool funds to invest collectively, it is mandatory to make such investments through AIF only. The regulations advise against pooling in funds and making investments through LLP, and Private Limited Companies, among others. It might be argued that this might be viewed as being violative of SEBI AIF Regulations.

As per SEBI data, fund managers who run AIFs raised a total of INR 6,41,359.11 Crore across categories as of June 30, 2022. In March 2021, the figure was INR 4,51,216.01 Crore. AIFs witnessed an impressive 42% jump in a year.

AIFs are classified into three broad categories, amongst which Category-I AIF is the most preferred type for investing in startups. An Angel Fund is a sub-type of Category-I AIF and has been specifically introduced and designed to encourage angel investment in startups.

The post-pandemic recovery has been marred by tightening of interest rates by global central banks, strained geopolitical relations, choppy domestic markets, and tanking pre-IPO valuations of tech and new age stocks. The overall sentiment, though, is that of enthusiasm with an ever-widening pool of angel investors and family offices.

Let’s first answer some of the frequently asked questions around investment via an AIF to better understand AIFs.

What Is An AIF?

An AIF is a privately pooled investment vehicle that pools funds from investors for investments in private equity, hedge funds, angel funds, and venture capital funds, among others.

In the interest of investors, these investments are governed by a predefined investment policy of AIF. An AIF inherently differs from age-old traditional investment avenues such as fixed deposits, stocks, and debt securities, among others.

Is Registration Of AIF Required With SEBI?

Under SEBI AIF Regulations, each AIF is mandatorily required to be registered with SEBI. This means that they are required to adhere to the regulations and guidelines issued.

Are There Any Exclusions To The Definition Of AIF Provided Under SEBI AIF Regulations?

The following categories are excluded from the definition of AIF and are not required to comply with SEBI AIF Regulations:

- Family trusts set up for the benefit of relatives

- ESOP trusts and other employee welfare trusts

- Holding companies

- Other special purpose vehicles, including securitisation trusts, regulated under a specific regulatory framework

- Any such pool of funds which is directly regulated by any other regulator in India

In Which Formats Can An AIF Be Set Up?

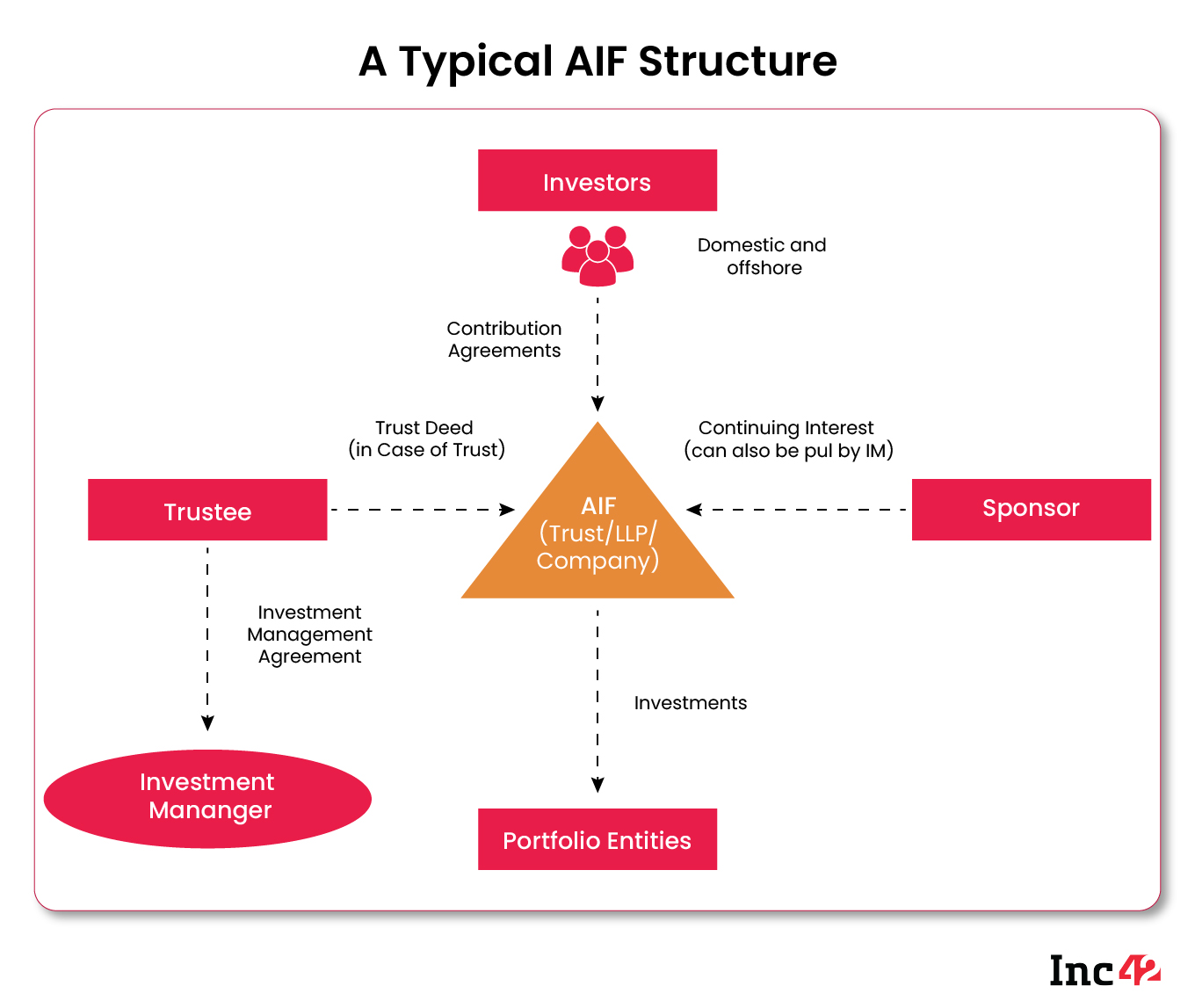

The fund can be incorporated in the form of a trust, limited liability partnership or a body corporate.

In most cases, a trust structure is preferred due to ease of management and administration. Additionally, it is easier to set up and wind up a trust.

How Are AIFs Usually Structured And Who All Are The Parties To An AIF?

The different parties to an AIF include:

The different parties to an AIF include:

- Sponsor: a person who sets up the AIF.

- Manager: a person or entity who AIF appoints to manage its investments by whatever name called and may also be a sponsor of the fund.

The key investment team of the manager is required to have adequate experience, with at least one key personnel having not less than 5 years of experience in advising or managing pools of capital.

- Trustee: In case AIF is set up as a trust, a trustee is to be appointed under the trust deed which is required to be registered.

What Are The Different Categories Of AIFs?

As per SEBI AIF Regulations, AIFs are broadly classified into the following three categories based on the type of investments they undertake:

- Category I AIF: invests in startups, early-stage ventures, social ventures, SMEs and infrastructure, among other sectors or areas that the government or regulators consider as socially or economically desirable. This shall include the following:

-

- Venture capital funds

- Infrastructure funds

- Angel funds

- SME Funds

- Social venture funds

- Category II AIF: includes all the funds that do not fall in Category I and III. It doesn’t undertake leverage or borrowing other than to meet day-to-day operational requirements.

Private equity funds or debt funds for which no specific incentives or concessions are given by the government or any other regulator can be included. Category II AIF includes the following:

-

- Real estate funds

- Private equity funds

- Funds for distressed assets, etc.

- Category III AIF: employs diverse or complex trading strategies and may employ leverage including through investment in listed or unlisted derivatives. Category III AIF shall include the following:

-

- Hedge funds

- PIPE funds

What Are The Benefits Of Investing Through An AIF?

- Regulatory Compliance: With SEBI AIF Regulations coming into force, it is mandatory that if investors have to pool funds to invest collectively, they do it through AIF only.

- Higher Returns: AIFs generally have strong potential in improving the overall financial performance and achieving long-term capital appreciation. The substantial size of the funds enables fund managers to tap into a broader investment universe. Through AIFs, investors can be exposed to alternate securities providing higher returns as compared to traditional investment instruments.

- Low Volatility: The portfolio investments of AIF are not directly related to the stock market. Therefore, investments privately held by AIFs are less reactive to market ups and downs. So they are accordingly less volatile as compared to traditional equity investments.

- Diversification: Given the flexibility under AIFs, managers can adopt different market strategies and investment styles. Accordingly, AIFs offer greater diversification of portfolios.

- Better Negotiating Powers: Under the AIF structure, pooled funds are invested in sizable amounts which provide better negotiating powers to the investors. Whereas, in the case of direct investment in a company, investors may only get nominal ownership.

- Single Captable Entity On The Startup’s Captable: Since there is meaningful ongoing back-office work that needs to be done for every shareholder a company has, minimising captable entries is a great time and money saver for the startup.

Let us now turn our attention to angel funds. What exactly are angel funds? Who invests in an angel fund? Let’s go over some fundamentals of an angel fund.

What Is An Angel Fund?

Angel funds are a sub-category of venture capital funds under Category I AIF that raise funds from angel investors for investment in startups in their early stages of development. Angel funds intend to strengthen the startup ecosystem by providing access to early-stage funding, management mentoring, and guiding a startup through its journey.

An angel fund makes investments in companies where the investment team believes it can help drive the company’s transformation. This includes contributing to and participating in the development of such companies’ growth strategies.

Who Can Invest In An Angel Fund?

According to the SEBI AIF Regulations, angel investors can be individuals or companies who meet the following criteria:

- Individual Investor: Someone who has at least INR 2 crores in net tangible assets, excluding the value of their principal residence, and:

- Someone who has early-stage investment experience (prior experience investing in an emerging or early-stage venture) or

- Someone with experience as a serial entrepreneur (a person who has promoted or co-promoted more than one startup venture) or

- A senior management professional with at least ten years of experience

- Body Corporate: With a net worth of at least INR 10 Crores

- AIF or Venture Capital Fund registered with SEBI

What Is The Minimum Investment For An Angel Fund?

Recently, SEBI has provided certain relaxations for angel funds. According to the amendments, each angel investor must make a minimum investment of INR 25 Lakhs in the angel fund.

Furthermore, an angel fund must maintain a minimum corpus (the total amount of funds committed to the angel fund by investors) of INR 5 Crores at the fund level.

Can Units Of Angel Funds Be Listed On A Recognised Stock Exchange?

No, angel fund units are not permitted to be listed on recognised stock exchanges.

What Is The Regulatory Process For An Angel Fund To Make An Investment?

The angel fund is required to launch schemes for each investment. This is subject to the filing of term sheets with SEBI. The term sheet includes information such as the name of the scheme, the name of the investee company(ies), the number of investors, the total capital committed by investors, and the capital drawn by the fund, among others.

Can Investors Participate In Individual Angel Fund Schemes?

According to SEBI AIF Regulations, the manager of an angel fund must get the angel investors’ approval before investing the sum of that investor in any undertaking. Therefore, as far as investing in the angel fund is concerned, the investors are free to choose which of the angel fund’s schemes they wish to participate in.

Furthermore, each angel fund scheme is an independent scheme with its own set of investors. As a result, the investor would be protected from other investment schemes of the angel fund for which they have not given approval.

How Does the Fund Arrangement Reflect the Parties’ Commercial Understanding?

Commercial arrangements mutually agreed upon by the various stakeholders, such as carried interest, hurdle rate, fund management fees, and any other right/interest to the investor identifying investment leads are catered to by the issuance of different classes of angel fund units.

The aforementioned classes of units include a distribution waterfall mechanism that specifies how proceeds are distributed.

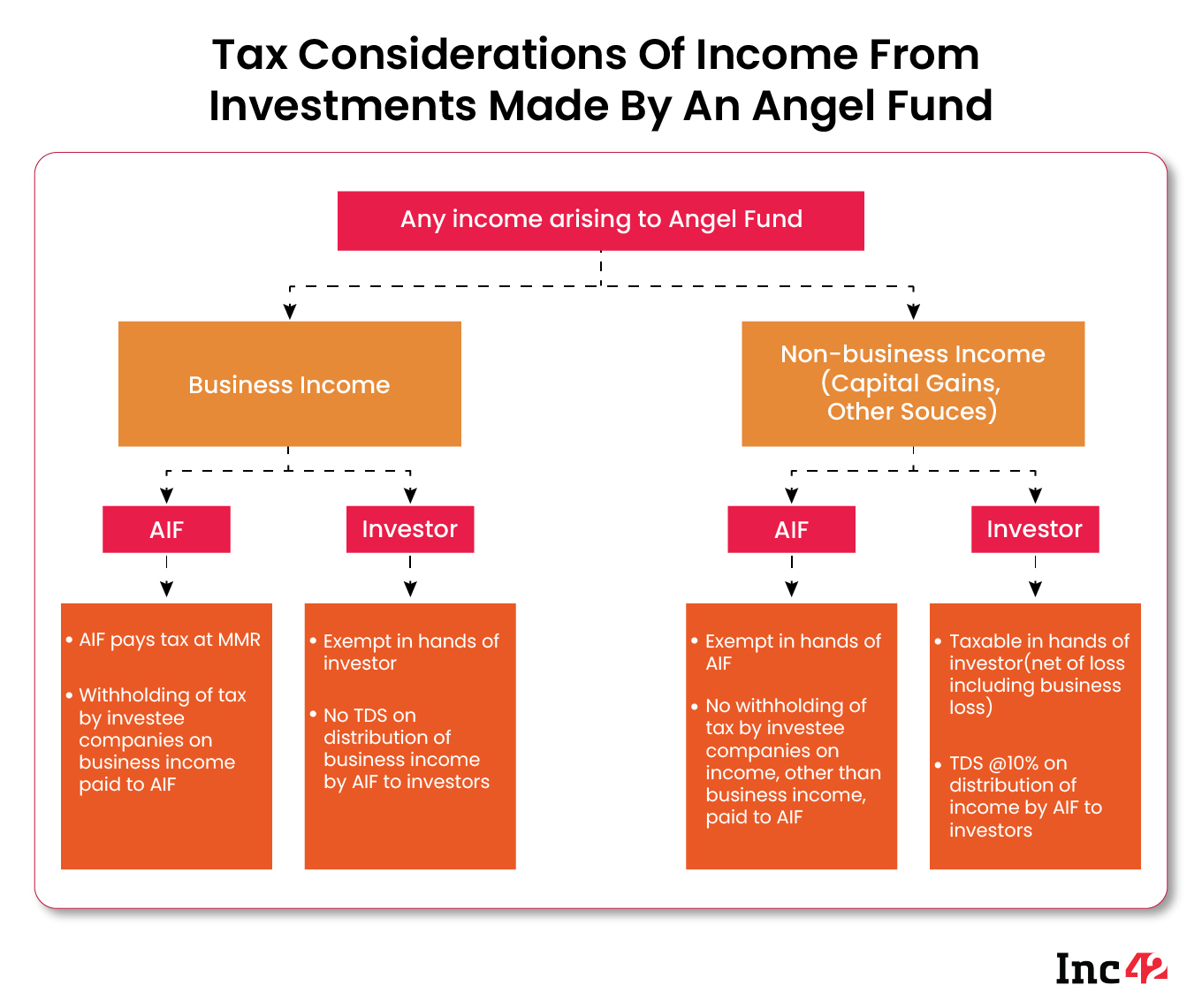

What Are the Tax Implications of Income From Angel Fund Investments?

With the rise of HNIs and investable funds, we have seen a recent shift away from traditional investment avenues and toward sophisticated financial instruments, which has resulted in the introduction of AIFs in India. It is critical that you keep in mind the features and types of AIF before investing in one.

![Read more about the article [Funding alert] Xpressbees turns unicorn with $300M Series F round](https://blog.digitalsevaa.com/wp-content/uploads/2022/02/logistics-2022-1642578960996-300x150.png)