Shares of Zomato, which were on an uptrend this month, began the week with gains, but plunged on Friday, giving up the weekly gains

Shares of MapmyIndia fell for four straight sessions during the week, becoming the biggest loser among the new-age tech stocks

Nifty50 closed at 17,758.45, down 198 points, on Friday, while Sensex fell about 652 points from Thursday’s close to 59,646.15

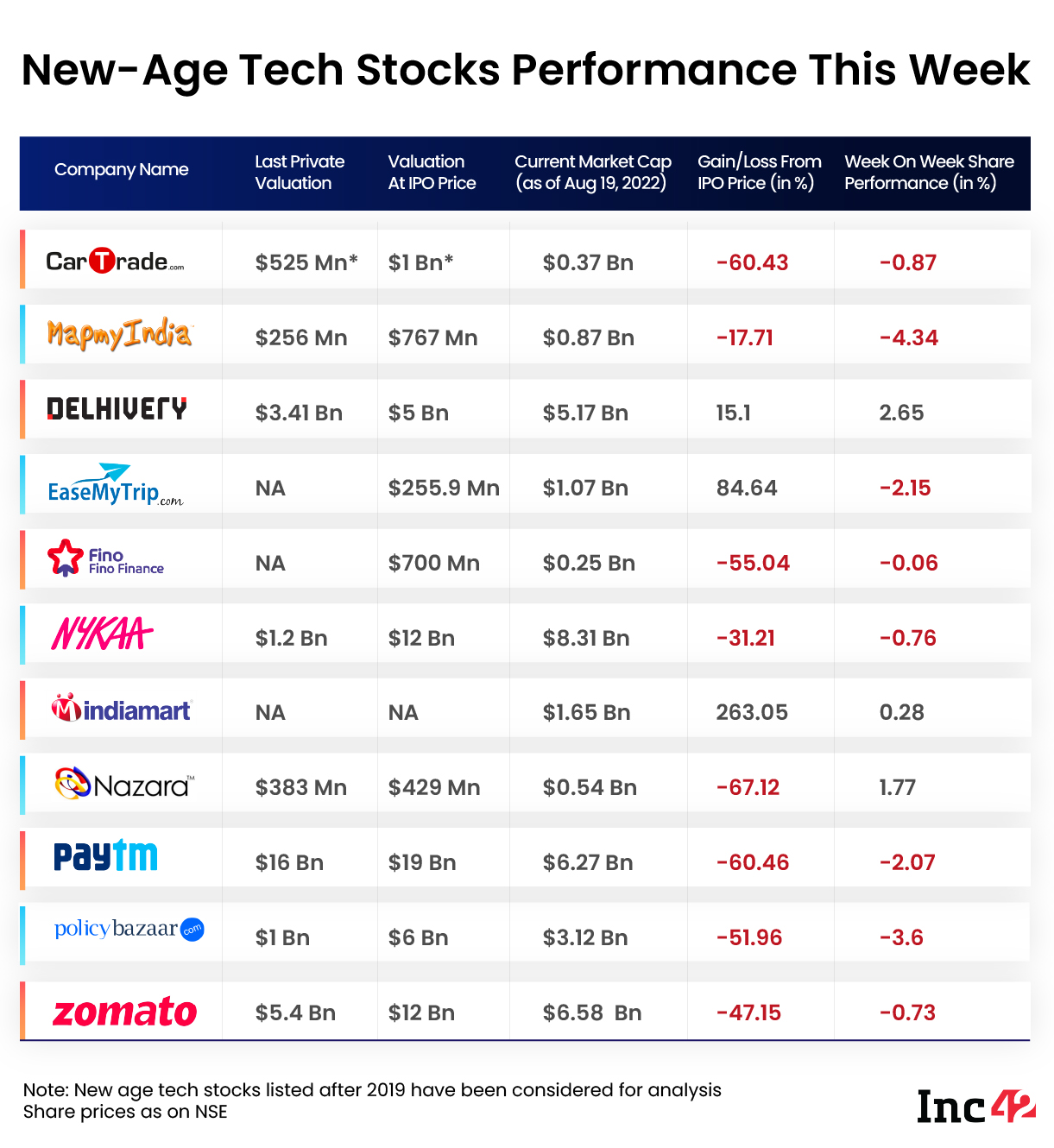

The new-age tech stocks had a weak week, with the majority of them ending lower on a week-on-week basis. Except for Delhivery, IndiaMart, and Nazara, which ended the week slightly higher, the rest of the tech stocks were under pressure.

Shares of Zomato, which were on an uptrend this month, began the week with gains, but slipped into red on Friday, giving up the weekly gains.

Meanwhile, Paytm parent One 97 Communications’ performance was largely flattish during the week, but the stock ended almost 2% lower on Friday at INR 771.85 on the BSE, as the uncertainty over Vijay Shekhar Sharma’s reappointment as the company CEO kept investors cautious.

On the other hand, shares of MapmyIndia parent C.E. Info Systems fell for four straight sessions during the week, becoming the biggest loser among the new-age tech stocks. The stock fell over 4% on a week-on-week basis.

The stock exchanges were closed for trading on Monday (August 15) on account of the Independence Day.

Meanwhile, EaseMyTrip, which has performed better compared to the other new-age tech stocks since its listing, continued last week’s downward trend this week. However, Delhivery, after being the biggest loser last week, ended this week up 2.6% at INR 569.60 on the BSE.

In the broader market, the benchmark indices NSE Nifty50 and BSE Sensex rallied for the first few sessions this week but ended Friday’s session in the red zone.

Nifty50 closed at 17,758.45, down 198 points, on Friday, while Sensex fell about 652 points from Thursday’s close to 59,646.15. However, the indices rose 0.3% on a weekly basis.

Let’s take a look at the weekly performance of the listed new-age tech stocks from the Indian startup ecosystem and their key trends this week:

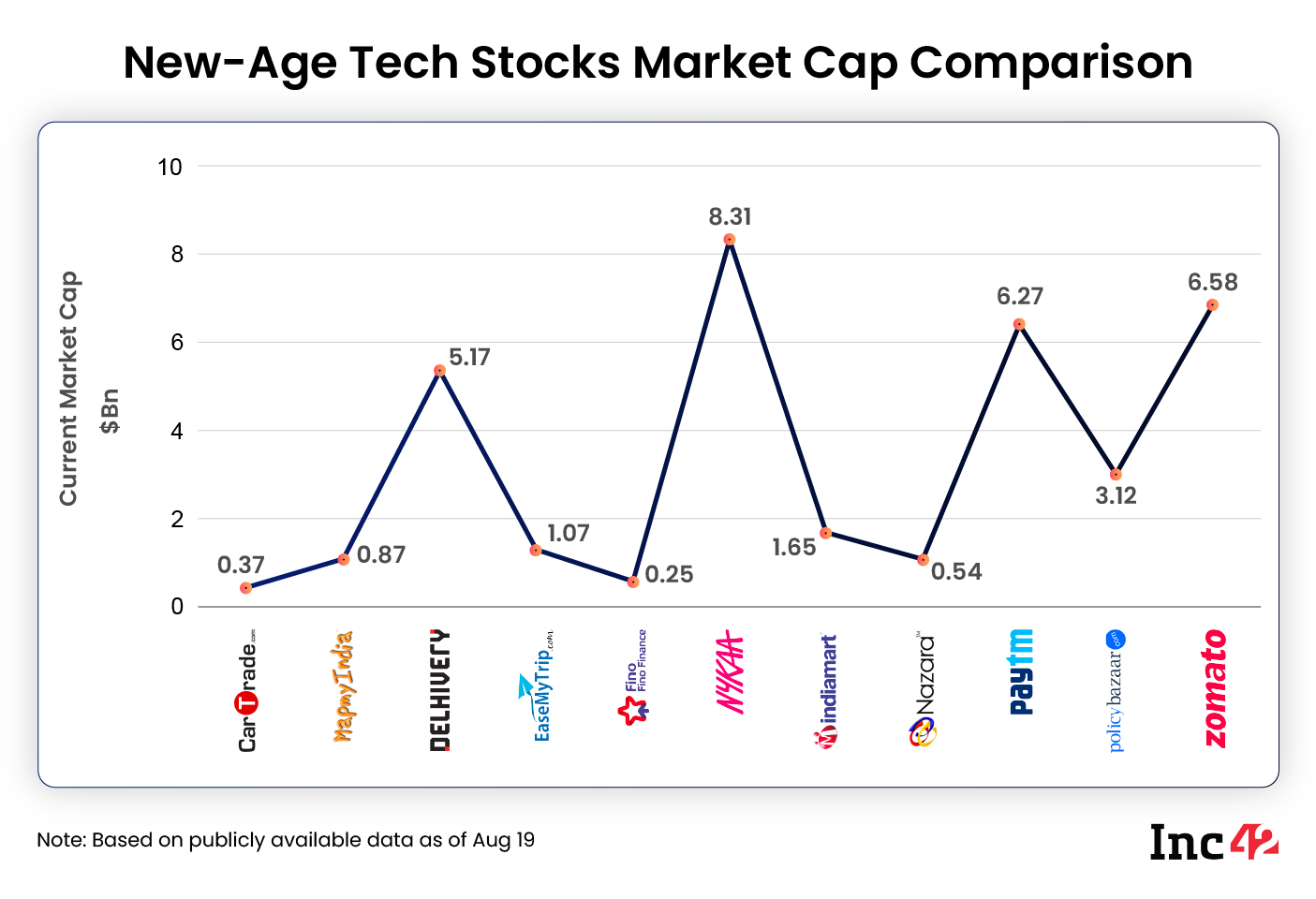

The 11 new-age tech stocks ended the week with a combined market cap of around $34.2 Bn.

Zomato Shares Give Up Gains On Friday

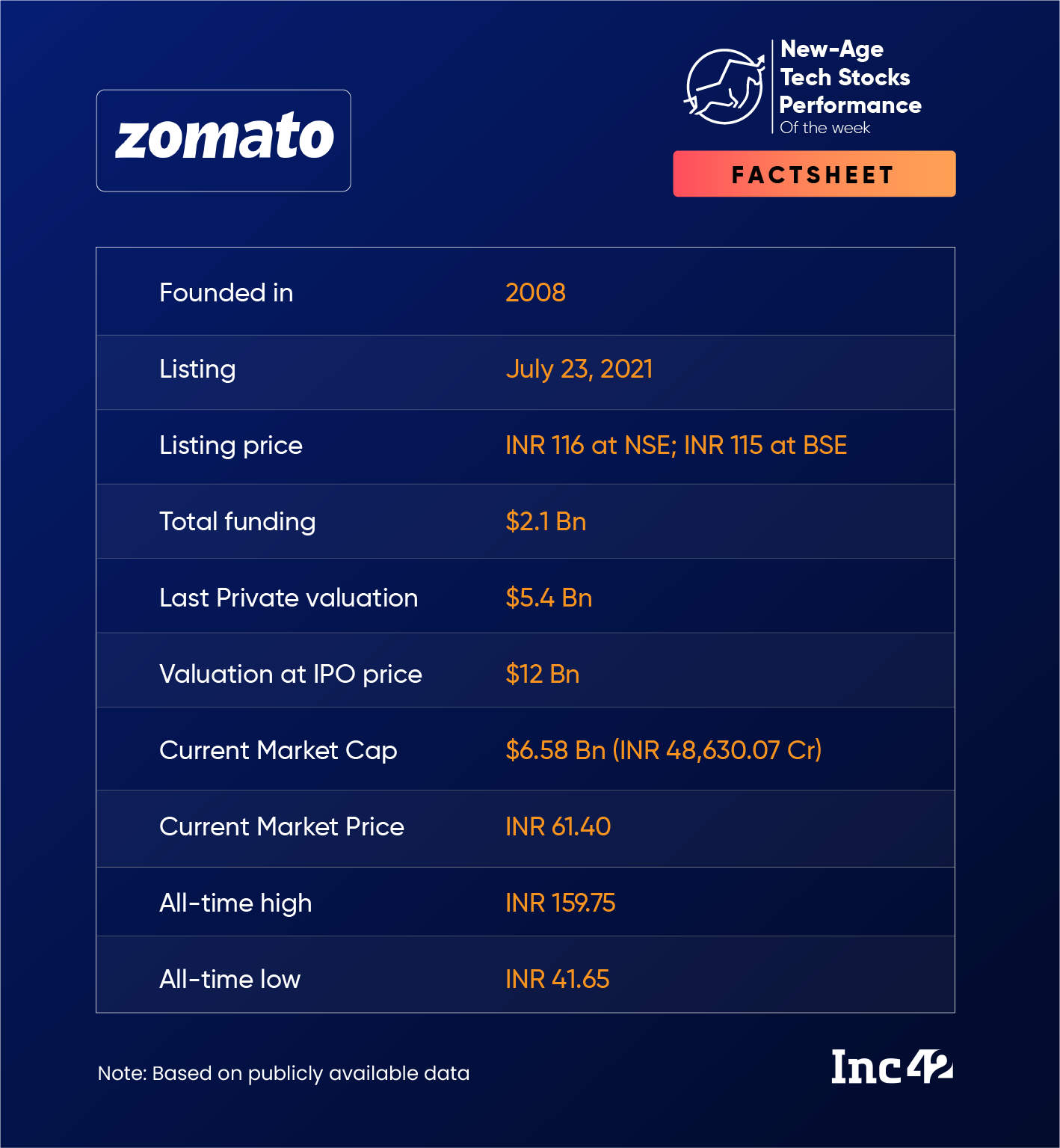

After a losing streak of more than a month, Zomato shares started their northward journey in August after the food tech startup published its Q1 FY23 results and issued a clarification on concerns around its Blinkit acquisition.

However, after gaining for seven straight sessions since last week, Zomato shares slumped as much as 8.4% to INR 61.4 on the BSE on Friday. On a weekly basis, shares fell marginally this week.

While profit booking was seen as the reason behind the slump in share prices on Friday, the slump came at a time when the startup is again experimenting with new features for its food delivery app.

Zomato has introduced intercity food delivery under the branding of Intercity Legends. A Zomato spokesperson told Inc42 that the service is still in the early stages of testing. Zomato hasn’t yet revealed the cost structure of the service or about its logistics strategy.

There is a possibility of the shares falling to around INR 55 level, said Mehul Kothari, AVP of technical research at Anand Rathi. However, he said that any such fall would be a buying opportunity as the stock is likely to reverse from there.

“However, the supports are a bit weak for the stock, that is below 50 odd levels, and if that holds for a few months or so, then the support is at 40,” he added.

Zomato listed in July last year at INR 115 and INR 116 per share on the BSE and the NSE, respectively. The food delivery startup’s shares are currently trading about 46.6% lower from their debut price on the BSE.

MapmyIndia The Biggest Loser

Shares of MapmyIndia parent C.E. Info Systems slumped during the week, making it the biggest loser among the listed new-age tech stocks. MapmyIndia ended the week over 4% lower at INR 1,300.05 on Friday.

However, as per analysts, there are no fundamental drivers for the loss. “Fundamentally, MapmyIndia has a strong and long-term order book, which is going to stay,” said Srishti Jain, research analyst at Monarch Networth Capital.

While there could be volatility in weekly trading, the stock is likely to rise further in a year’s time, she added.

Meanwhile, Anand Rathi’s Kothari said that the current price of the stock is near to the support of INR 1,280. The price action is indicating weakness, and the possibility of a breakdown below INR 1,280 is quite high.

“The stock is looking weak and below 1,280 it can further weaken,” said Kothari.

MapmyIndia shares are currently trading 17.7% lower than their debut price of INR 1,581 on the BSE. Its current market cap stands at INR 6,975.45 Cr.

Nykaa’s Struggle Continues

Nykaa was one of the favourite new-age tech stocks of investors since its stellar debut on the exchanges in November last year. However, sentiment around the beauty ecommerce platform seems to have weakened in recent days.

After a major correction in share price in May, the stock has remained range-bound. After gaining marginally last week, Nykaa shares fell again this week.

On Friday, shares close 1% lower from Thursday’s close at INR 1399.75. On a weekly basis, they fell marginally.

The stock is bereft of any momentum on the technical charts and is likely to trade sideways in the coming weeks.

“If we break 1,360, which is its Friday’s low, then we could see some downside in the stock. But as of now, it is completely sideways, no momentum at all,” Kothari said.

He added that since the shares are trading at the lower end of the range, this could be a buying opportunity, but not for any immediate major upside.

Last year, Nykaa shares listed at INR 2,018 on the NSE, at a premium of 80% over the issue price. On the BSE, the shares listed at INR 2,001 apiece. Currently, Nykaa shares are trading over 30% lower from their debut price on the BSE.