The telemedicine market is the maximum potential eHealth segment in India, which is expected to touch $5.4 Bn by 2025, according to Inc42 Plus

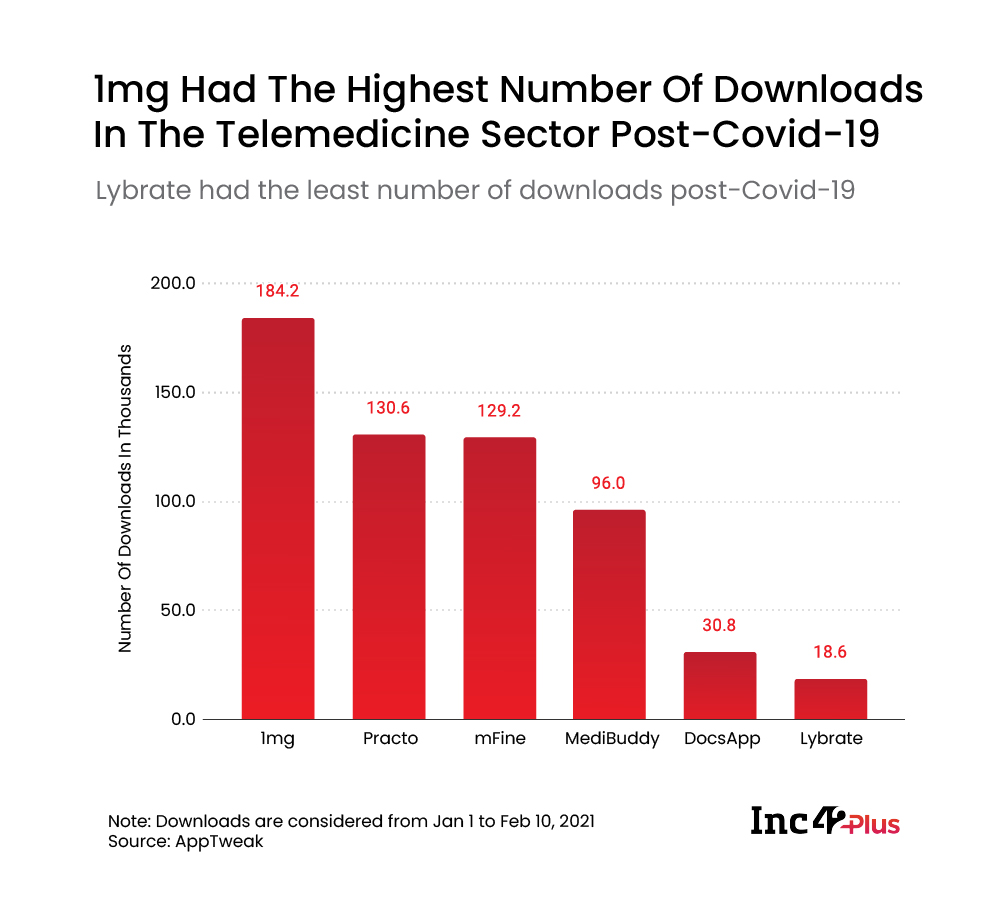

1mg had the highest number of downloads (184.2K) among telemedicine startups during Jan 1-Feb 10, 2021, as per AppTweak data

Will telemedicine be the future of digital healthcare post-Covid-19?

As the world continues to fight one of the biggest health crises, India’s healthcare sector has become the prime focus of the government post the outbreak of Covid-19. To start with, INR 2.23 Lakh Cr has been allocated for healthcare and wellness initiatives in the Union Budget 2021-22, a 137% increase over the previous year.

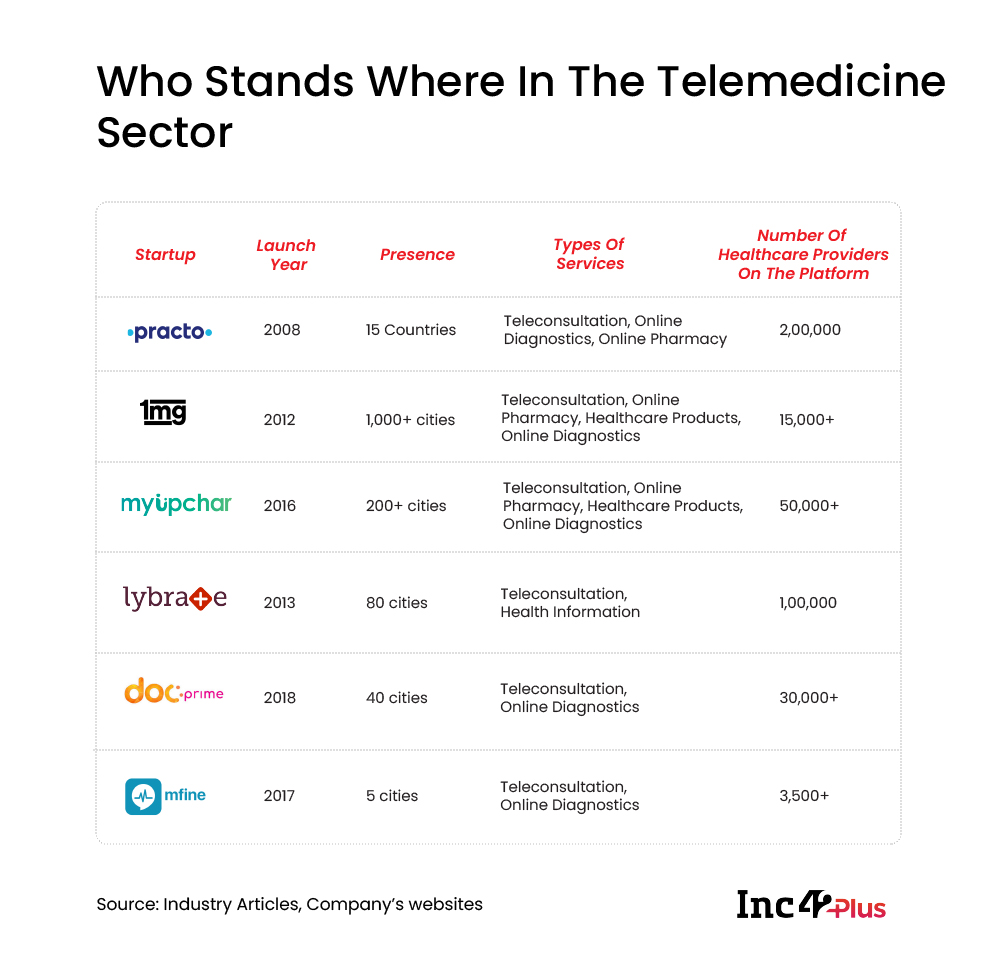

With the government releasing Telemedicine Practice Guidelines in March 2020, virtual consultation became the preferred channel for seeking quality healthcare just days after a strict lockdown was enforced to contain the pandemic’s spread. The guideline also brought some much-needed clarity around telemedicine and digital healthcare, resulting in a spurt of telemedicine platforms with startups leading the way.

The telemedicine market has the maximum potential in eHealth segment in India. It is expected to touch $5.4 Bn by 2025, growing at a compound annual growth rate (CAGR) of 31%, according to a recent Inc42 Plus report titled India’s eHealth Market Opportunity Report, 2021.

The sector got a much-required push after the outbreak of Covid-19 as remote consultation worked exceedingly well during nationwide lockdowns. It reduced all contagion risks to zero, provided quick access to medical care and cut down the time, effort and cost of travelling required for in-person consultations. For instance, Practo, a Bengaluru-based telemedicine platform where a general physician typically ‘advised’ 25-30 patients a day, witnessed up to 4x jump in the number of patients. Another Delhi based startup, myUpchaar, also saw a 3x jump in consultation requests during Covid times.

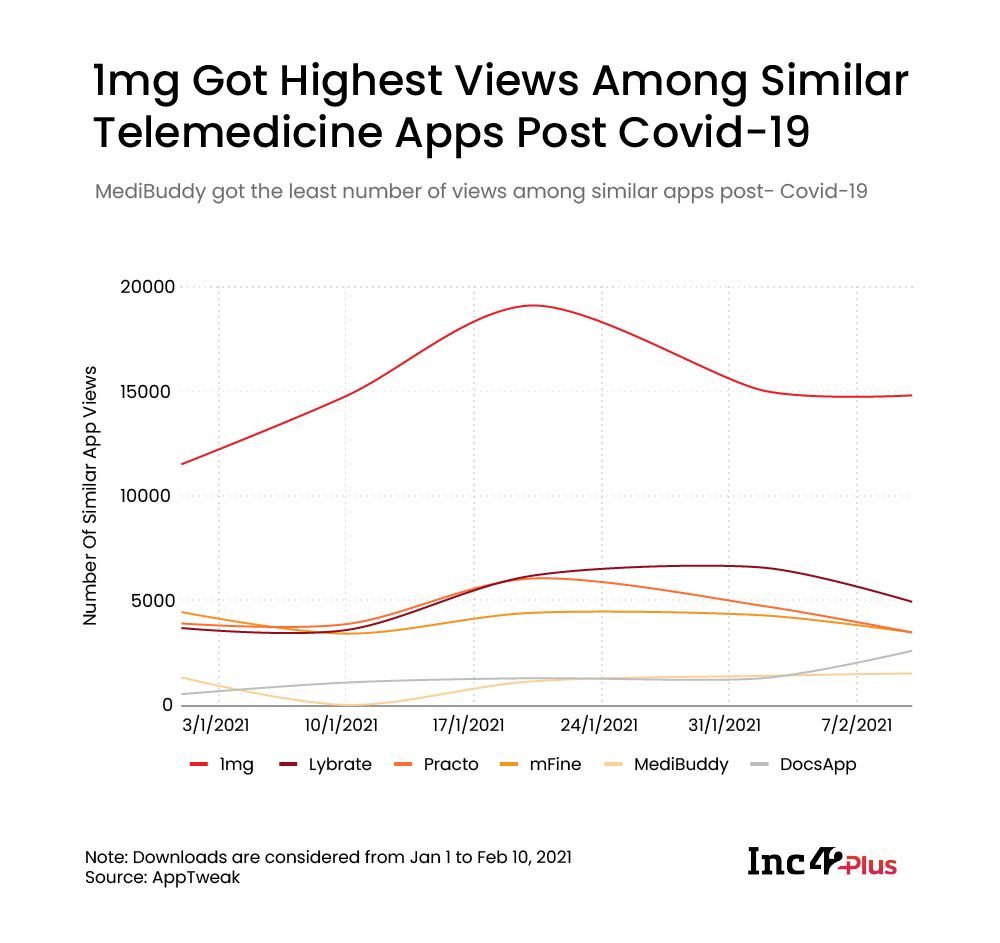

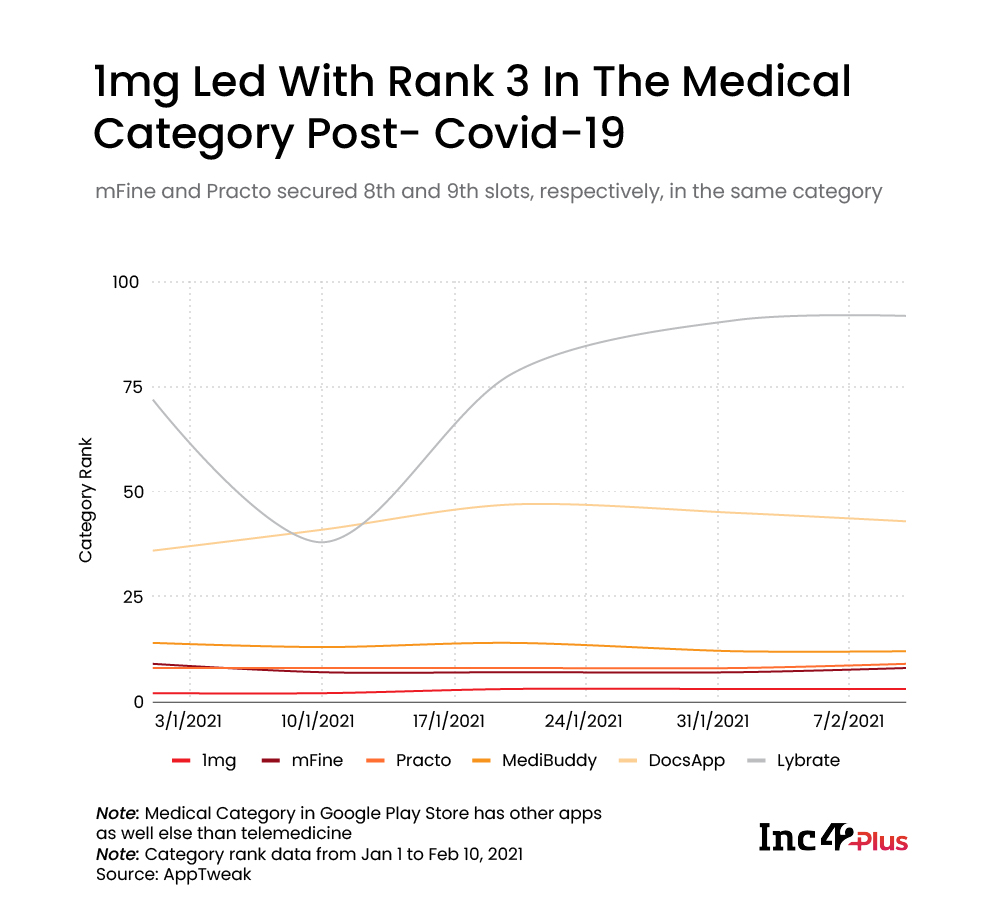

Inc42 partnered with Apptweak to analyse the performances of key apps in the telemedicine sector during the post-Covid era. The performance analysis is based on various metrics such as similar views, app power, category ranking and download estimates.

Is 1mg Becoming The Rising Star Of The Telemedicine Sector Post-Covid-19?

Delhi-based startup 1mg led the telemedicine sector with the highest number of downloads (184.2K) during Jan 1-Feb 10, 2021. With the Covid-19 vaccination pace picking up across the country, the company has invested in expanding its cold chain and training thousands of vaccinators. It is also in touch with vaccine makers for possible partnerships to participate in COVID-19 vaccination when the government allows the private sector to step in.

Besides topping the number of downloads, 1 mg got the highest number of views (75.2K) among similar apps during Jan1-Feb 10, 2021.

1mg was ahead of major telemedicine startups in the medical category and ranked 3rd as of February 10, 2021. mFine and Practo secured 8th and 9th category ranks, respectively, on the same date.

Will Telemedicine Be The Future Of Digital Healthcare In The Post-Pandemic Era?

As discussed above, telemedicine was already in the limelight during the Covid-19 outbreak for all practical purposes. Moreover, with the new guidelines in place, there is adequate policy clarity, and the sector is all set for optimal growth. The implementation of NDHM also means that the government is likely to monitor the security, privacy and quality standards of the solutions offered by startups in the telemedicine and online pharmacy sectors. Other initiatives such as the State Telemedicine Network (STN) are also on the cards, enabling telemedicine players to grow substantially in Tier 2 and Tier 3 locations and remote areas. The big challenge in this space is that consumers from far-flung places are not always tech-savvy. Hence, consumer awareness must be developed without delay for remote healthcare to succeed in India.