With the massive amount of data footprint that people are creating online, the Account Aggregator (AA) framework will give users more control on their data

He envisions use cases across mutual funds, healthcare, pension, securities and even employment, using the AA architecture

In addition to accessing financial data through bank accounts linked to the AA platforms, telecom data could also soon be incorporated in the AA consent framework, according to Nilekani

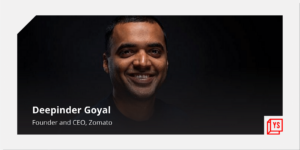

After the Indian government’s much-awaited account aggregator framework to facilitate smoother and safer access to financial data went live with four Indian banks, Infosys chairman Nandan Nilekani has said that the technology has the potential to be used across multiple use cases much like the unified payments interface (UPI) has been used so far.

Speaking at the event, Nilekani, who has worked closely with the India stack suite of products, said that with the massive amount of data footprint that people are creating online, the AA will give users more control on their data.

The Reserve Bank of India had approved a new class of NBFCs in 2016 to act as account aggregators following the Financial Stability Development Council’s decision to explore this use case in 2014.

“We saw that with UPI, it took several years to reach maturity. Today, it is doing more than 3 Bn transactions every month. Currently, we are seeing the applications of this AA framework for banks; however, the same framework can be applied for other financial actors like insurance, pension and securities in the future,” said Nilekani.

In the past, Nilekani has been the Chairman of the UIDAI and has led RBI’s Committee for Deepening of Digital Payments.

The main responsibilities of the account aggregator are to provide services based on the explicit consent of individual customers or clients. The RBI has strictly asked account aggregators to not collect any financial information of the customer shared by the financial information providers.

“ Every time we do digital transactions, we leave digital footprints. We should recognise that this data can be leveraged by consumers and small businesses for their benefit. Our MSMEs have had a lot of setbacks during Covid and need working capital to get back on track. If a business has a digital footprint of its payments and purchases, taxes and invoices, such information can be used by lenders to make credit decisions effectively even if they cannot assess the business on-ground,” he elaborated.

The Reserve Bank Information Technology Private Limited (ReBIT) has released application programming interface (APIs) and technical standards that the AA service providers will have to adhere to in order to ensure security and authenticity of data.

The AA value chain financial information providers (FIP) who are banks, asset management companies, pension funds among others and financial information users (FIU) which are companies that will leverage this data to provide services.

A regulated and licensed account aggregator will then facilitate this encrypted consent layer between FIPs and FIUs. Currently, four account aggregator entities have gone live which includes CAMSfinserv, Finvu, NADL and Onemoney.

Future Use Cases For AA

In addition to accessing financial data through bank accounts linked to the AA platforms, telecom data could also soon be incorporated in the AA consent framework, said Nilekani.

“Talks are on to get telecom data on this network too. Meaning, tomorrow somebody who has a great track record of making their prepaid mobile phone bill payments on time can use that data to get a loan using the AA system. The AA system transcends financial use cases and can be applied to any sector. There is also a discussion to apply it to health care as well,” he added.

People can use data for a better deal on credit, health care and jobs among other use cases. This approach is now getting global recognition.

“Many countries that are seeking to solve their own data issues are taking lessons from India,” Nilekani said.