| Image Credit: DepositPhotos

Amsterdam Delta was recently crowned as the top startup ecosystem in the European Union by Startup Genome. Now, Dealroom has released its own analysis that further proves the strides made by the Dutch capital to become the second major startup ecosystem in Europe. The analysis of Amsterdam as a startup ecosystem for the first half of 2022 by Dealroom reveals how the tech sector has evolved.

The rise of Amsterdam to become the second largest startup ecosystem in Europe, second only to London, can be owed to a lot of factors. Some of these factors are an open and enthusiastic tech community, a vibrant investor ecosystem, including local investors and family based trusts, brilliant accelerators, and tech entrepreneurs. Here is a look at some of the key takeaways from Dealroom’s analysis of Amsterdam’s startup ecosystem.

Has the Dutch workforce mastered all digital skills? Find out

Amsterdam sees second highest funding in first half of 2022

The research by Dealroom shows that Amsterdam-based startups raised €698M in 2022 YTD. This funding comes after a record year in 2021 but is a 75 per cent decline year on year. Despite year on year decline, the first half of 2022 is the second highest H1 for Amsterdam VC investment.

In comparison to H1 2021, VC investment in Amsterdam was mostly restricted to startups raising between €100m and €250M. The research shows that 40 per cent of the total raised in 2022 so far have come via early and mid stage rounds. This is 2.8x higher than in the first half of 2021.

VCs were also interested in startups raising €15M to €40M as part of Series B and those raising Series A with a ticket size between €4M to €15M. This is in stark contrast to previous years when VC investment in Amsterdam based startups saw rounds with a ticket size bigger than €250M.

Dealroom says Leyden Labs, Backbase, Pyramid, Move, Dott, and ParkBee saw the top funding rounds in Amsterdam during the first half of 2022. Dott is valued at €386M while ParkBee is valued between €20M and €30M.

Amsterdam-based VCs have raised record funding

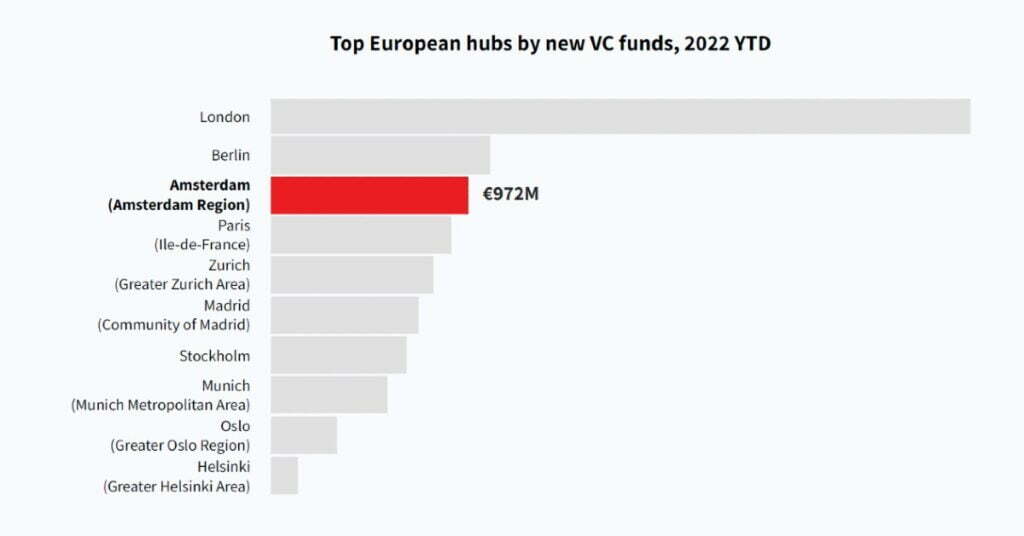

Among European hubs for VC investment, Amsterdam lags behind the likes of Paris, Helsinki, and Zurich but it finds silver lining in the form of Amsterdam-based VCs. The local investors have raised a record €972M in new funds in 2022 already. This funding surpasses the previous record set by local VCs in 2016.

Among local investors, Dealroom notes that Endeit Capital has raised €303M followed by Anterra Capital with €236M. Connected Capital and Shift have raised €154M and €110M, respectively.

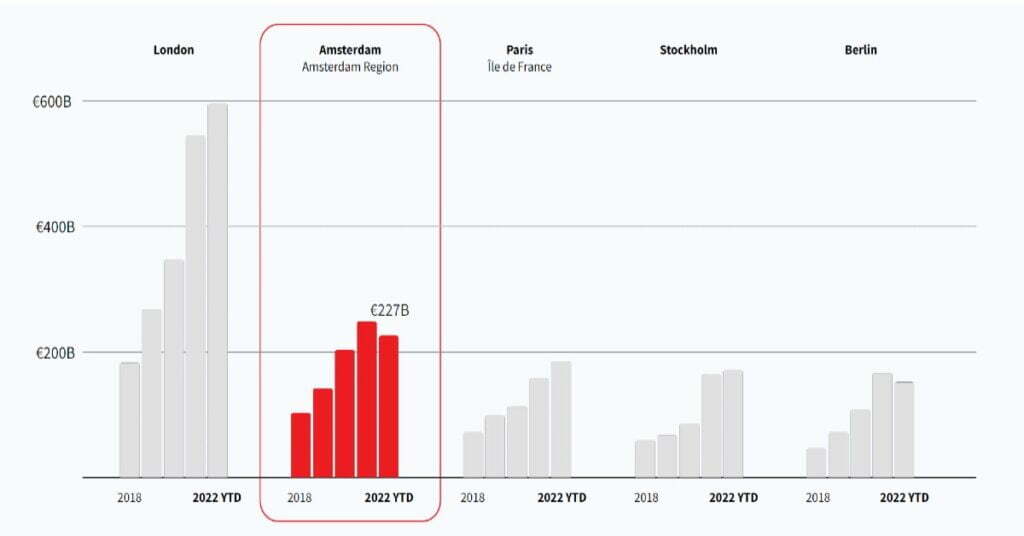

Among new VC funds raised so far in 2022, the Dutch capital follows London and Berlin as the third major city in Europe. The new funding takes the value of the Amsterdam tech ecosystem to €227B and it is second only to London in Europe but leads in the European Union.

Amsterdam startups attract international VC investment

The analysis of Amsterdam’s startup ecosystem for the first half of 2022 reveals a strong interest from international VC firms. For the first half of 2022, Amsterdam has seen a large portion of investment come from US-based venture capital firms. American VCs have surpassed domestic and European VC firms during the first half of this year.

Among international investors, Sequoia Capital and Accel Partners top the list. EQT Ventures, BioMed Partners, Eir Ventures, and Energy Impact Partners were also active among international VC firms. Dealroom says 90 per cent of Amsterdam VC investment has come from foreign investors during the first half of 2022.

Security tech and Mobility tech are growing

Among industries, fintech continues to dominate as the top sector for VC investment. The fintech industry saw €189M in funding, which is 14 per cent lower from half-year average since 2017. It was followed by health with €161M in funding and a growth of 96 per cent.

The transportation industry was the fastest growing with funding of €129M and 144 per cent growth compared to half-year average since 2017. The education, e-commerce, and food industries raised €28M, €19M, and €12M, respectively. The security industry registered 128 per cent growth and brought in €15M in funding.

Impact investment sees slowdown in Amsterdam

During the first half of 2022, the impact investment was equivalent to €79.5M, which is equivalent to 11 per cent of total investment. This is the lowest first half for impact startups since the first half of 2017.

The first half of 2022 saw impact startups raise €436M and there is room for impact startups to see further investment. The key startups in Amsterdam’s impact rounds for 2022 included Dott, ParkBee, Check, Quicargo, Packaly, and Willicroft.

Amsterdam tech ecosystem is second in value

The value of the Amsterdam tech ecosystem accounts for €227B in 2022 so far, according to Dealroom. This makes the tech ecosystem in Amsterdam second in terms of value in Europe and first in the European Union. The Amsterdam tech ecosystem lags only London in terms of value in Europe.

In 2022, Amsterdam has produced two unicorns and now has a total of 20 unicorns. Backbase, with a valuation of €2.5B, and Azerion, valued at €1.7B, joined the elite club this year. In Europe, London leads with a total of 81 unicorns, followed by Berlin with 31, Paris with 30, and Stockholm with 24 unicorns.

Amsterdam startup ecosystem in numbers:

- Ecosystem value: €227B

- Total funding in 2022 YTD: €698M

- New funds raised in 2022 YTD: €972M

- 40 per cent funding driven by early and mid-stage rounds

- Fintech startups: €189M

- Impact funding in 2022 YTD: €79.5M

- Number of unicorns in 2022 YTD: 2

- Future unicorns: 3

Catch our interview with Paul Down, Head of Sales at Intigriti.