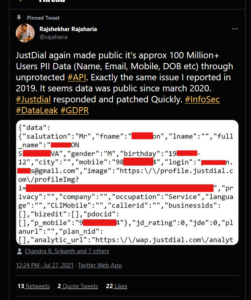

Image credit: Sentinels

Dublin-based Fenergo, a provider of digital solutions for Know your Customer (KYC) and client lifecycle management (CLM), announced on Monday that it has acquired Amsterdam’s Sentinels, an anti-money laundering (AML) transaction monitoring new market entrant with AI-based technology. The value of the acquisition has not been disclosed.

Fenergo now looks to strengthen its ability to deliver end-to-end Software as a Service (SaaS) based-CLM with smart transaction monitoring to financial institutions.

Has the Dutch workforce mastered all digital skills? Find out

An AI-powered transaction monitoring startup

Founded in 2019 by Joost van Houten, Sentinels spun off from Slimmer AI, a Groningen-based B2B AI venture studio. Using AI and machine learning, Sentinels helps fast-growing fintechs, payment service providers, remittance companies, and (challenger) banks manage risk and fulfil their compliance obligations.

The platform monitors transactions, builds rich behavioural profiles, detects a wide range of suspicious activity, and automatically generates recommended next steps, saving time and effort for compliance teams.

Joost van Houten says, “Never has there been a more critical time for businesses to bolster their transaction monitoring systems. We predict an increased demand for AI-driven risk management services as digital payments rapidly increase and regulators intensify their focus on preventing financial crime.”

The company is ISO 27001 certified and was designed and developed to meet the strictest regulatory requirements in Europe. It counts Mollie, Terrapay, Online Payment Platform, Ginger Payments, and ManoBank among its roster of clients.

Aim of this acquisition

The deal comes as the industry continues to be challenged by rising financial crime, evolving regulations, operational inefficiencies, and pressure to deliver a better customer experience. According to a research by Celent, 63 per cent of financial institutions expect budgets to increase for financial crime and fraud, with 17 per cent anticipating an increase by more than 5 per cent. Overall spending for AML and KYC technology has increased by 13 per cent since 2020 to $10.7B.

Fenergo enables financial institutions to adhere to KYC and AML regulations while onboarding clients safely and efficiently, accelerating readiness to do business. Sentinels’ transaction monitoring solutions are purpose-designed to detect and eliminate criminal transactions fast and at scale.

As a result of the deal, Fenergo’s clients and financial institutions will now be able to combine rich KYC profiles with client behavioural data for continuous and granular KYC monitoring. This will make sure that appropriate due diligence is exercised. Besides, the acquisition will also enable Sentinels to scale rapidly, increase its global footprint, and strengthen its ability to serve the needs of larger financial institutions.

Marc Murphy, CEO of Fenergo, says, “Our shared goal of aiming to solve the increasing compliance and operational challenges facing financial institutions made Sentinels an ideal fit. By adding transaction compliance to our existing client onboarding and product origination solutions, financial institutions can monitor and review client behaviour and identify risks on an ongoing basis. This blended approach to financial crime makes us perfectly placed to address the rising compliance challenges faced by financial institutions more efficiently.”

Joost van Houten adds, “With compliance costs surging to unsustainable levels, being blindsided by increasingly sophisticated criminal activity is simply not an option. It is therefore imperative for financial institutions to break through data siloes and start assessing client risk holistically across KYC and transaction monitoring. The combined force of Fenergo and Sentinels will ensure leading financial institutions and the fintech disrupters are best equipped to navigate the complex regulatory environment and fight financial crime.”

About Fenergo

Founded in 2009 by Marc Murphy, Fenergo is a provider of digital solutions for financial institutions, including corporate and institutional banking, commercial and retail banking, asset management, and private banking and wealth management.

Counting 70 global financial institutions as clients, the company’s software digitally transforms and streamlines end-to-end CLM processes – from regulatory onboarding, data integration, client and counterparty data management, client lifecycle reviews and remediation, all the way to client offboarding.

In May, 2021, the Irish fintech sold a majority of its shares for $600M (then, approx €500M), valuing the company at $1.165B (then, approx €966M) and achieving the unicorn status. London-based Bridgepoint, along with French private equity group Astorg, jointly bought the stakes from Insight Venture Partners and DXC. Insight had a 55 per cent stake in Fenergo, whereas DXC possessed a 10 per cent share.

Headquartered in Dublin, Ireland, Fenergo has offices in North America, the UK, Poland, Spain, South Africa, Asia Pacific, and the UAE.

Fintech Files Powered by AWS

In the new section Fintech Files, in collaboration with AWS, we are keeping tabs (pun intended) on the thriving fintech industry in the Benelux. Want to learn more about the benefits of the cloud, or talk to one of their experts? Visit AWS Startup Loft to register for the latest events, get free 1:1 support from AWS experts and discover more resources. Build and scale your (fintech) startup with $1,000 in AWS Activate credits, free tools, technical support and training to quickly get started with AWS. Learn more about AWS Startup Loft.

Catch our interview with Paul Down, Head of Sales at Intigriti.