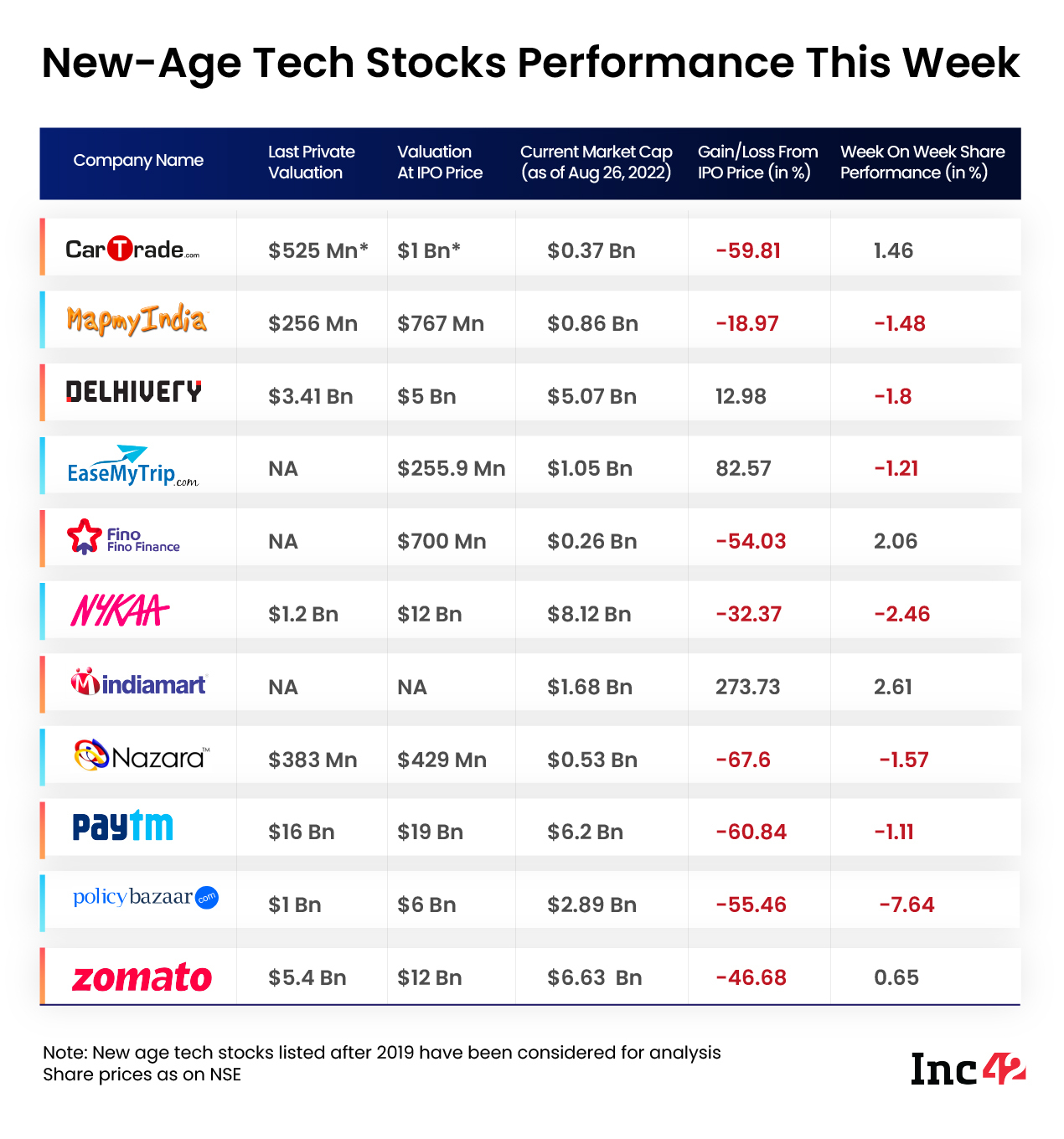

From Delhivery to Paytm, a majority of the new-age tech stocks fell between 1%-2% this week

Fino Payments, IndiaMart, CarTrade Tech, and Zomato were the only gainers

The Indian equity market remained volatile with benchmark indices NSE Nifty50 and BSE Sensex ending the week lower by 1.12% at 17,558.9 and 1.36% at 58,833.87, respectively

The Indian new-age tech stocks saw another meek week as volatility across the Indian and global equities market kept the stocks largely range-bound, the trend being on the downside.

From Delhivery to Paytm, a majority of the stocks fell between about 1%-2% this week, with Fino Payments, IndiaMart, CarTrade Tech, and Zomato being the only gainers among the new-age tech stocks.

CarTrade Tech witnessed a slight recovery in stock performance this week, closing Friday’s session at INR 643.55, up about 1.6% on the BSE on a week-on-week basis.

PB Fintech, the parent entity of Policybazaar, was the biggest loser among the new-age tech stocks this week, falling over 7% to close at INR 512.1 on the BSE on Friday. It was also among the top 10 losers on the Nifty 500 index this week.

Shares of Policybazaar have been under pressure for over a month now driven by various factors such as regulatory changes in the insurtech segment, a data breach at the startup, and more.

Meanwhile, some of the well-performing stocks such as CE Info Systems, the parent of MapmyIndia, and Easy Trip Planners, which were on an uptrend recently, also witnessed bearish sentiment this week.

Overall, the Indian equity market remained volatile for the week with the benchmark indices NSE Nifty50 and BSE Sensex ended the week lower by 1.12% at 17,558.9 and 1.36% at 58,833.87, respectively.

“The inflation numbers and expectations regarding the response of the global central banks to tame it continues to be the major factor influencing volatility,” said Dr. Joseph Thomas, head of research at Emkay Wealth Management. “The market will take immediate cues from the Jackson Hole symposium with regards to gauging the pace of the future rate hikes.”

Speaking to Inc42, Kunal Shah, senior technical analyst at LKP Securities, said that historical data since 2019 has shown that there is an average movement of 5% on either side in September every year. “So, starting with the September series, we are expecting at least 5% move on either upside or downside. Hence, volatility is definitely going to be there,” he added.

Now, let’s dig deeper into analysing the weekly performance of the listed new-age tech stocks from the Indian startup ecosystem.

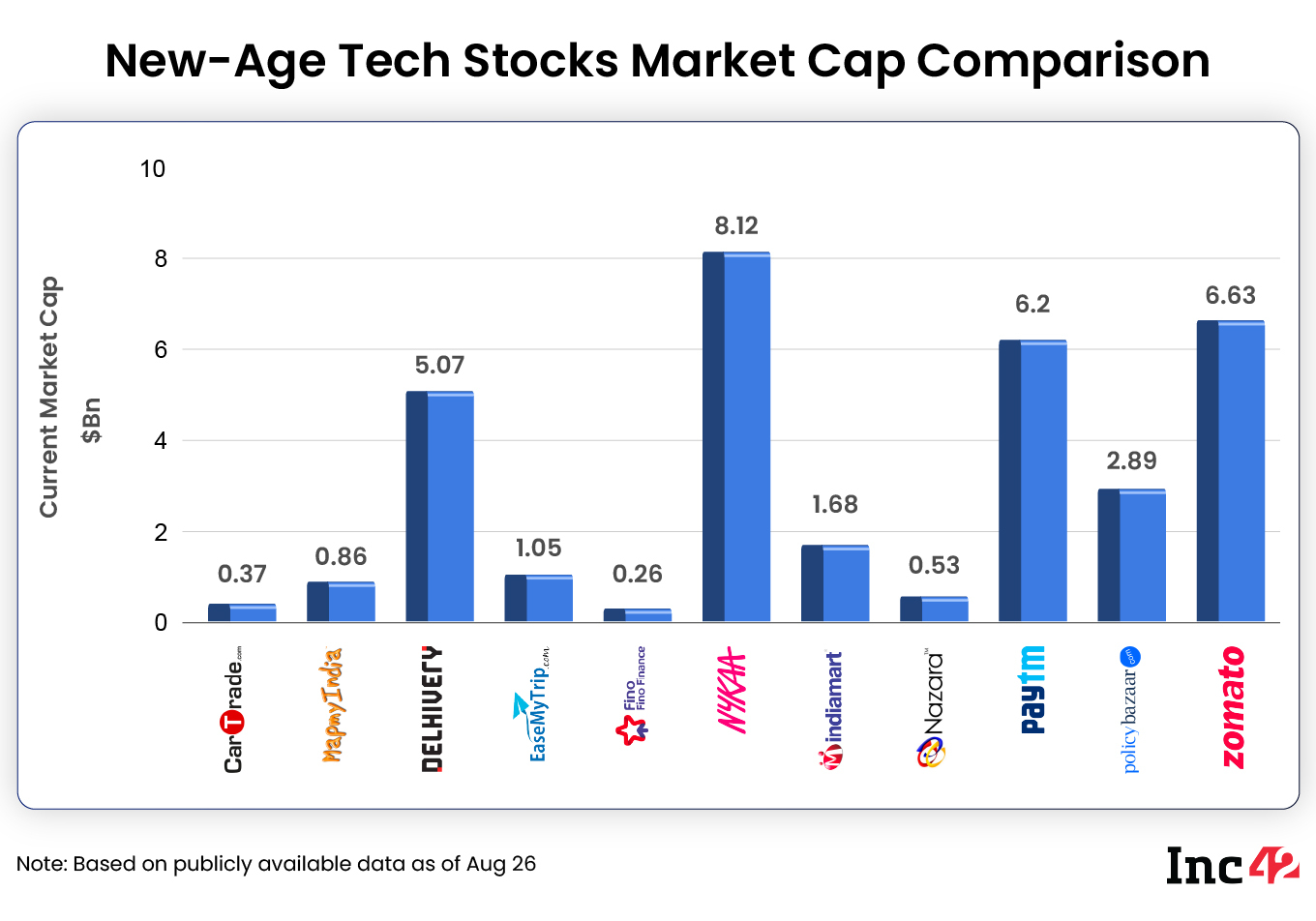

The 11 new-age tech stocks ended the week with a combined market cap of around $33.6 Bn versus $34.2 Bn last week

The 11 new-age tech stocks ended the week with a combined market cap of around $33.6 Bn versus $34.2 Bn last week

Zomato One Of The Top Gainers In Nifty 500 This Month

After witnessing a downtrend for a long time, Zomato shares revived in August and ranked among one of the top 10 gainers on the Nifty 500 index this month, with shares up over 30%.

However, like a majority of its peers in the broader consumer internet segment, the stock remained range-bound this week. After gaining in the first two sessions of the week, it lost some of the gains in next three sessions, ending Friday’s session at INR 61.9.

Despite the overall pressure in the larger equity market and some significant Zomato stakeholders continuing to sell their stake in the foodtech startup, its shares have almost regained the June-levels prior to its Blinkit acquisition announcement.

Zomato saw some good buying at the lower levels earlier this month, but the stock has remained sideways after it, with INR 70 being the resistance on the higher end and INR 55 a strong support on the lower end, LKP Securities’ Shah said.

“The next upside on Zomato will be open once it crosses the level of 70 on the upside. Once that is taken out, expect a rally towards the level of 80-85 on the upside,” Shah said.

In The News For:

- Investors continue to offload Zomato shares, with Sequoia being the latest to sell 171.9 Mn shares or about 2.01% of its total equity shares of the startup in the open market.

- Zomato has started a pilot experiment on intercity food delivery, while it has shut its earlier subscription model of Zomato Pro Plus.

- Japanese brokerage Nomura initiated its coverage on Zomato this week with a ‘reduce’ rating and a price target (PT) of INR 50, while Kotak Institutional Equities raised its fair value for the stock to INR 85 from INR 80 earlier and reiterated its ‘buy’ rating.

- A recent Jefferies report said that restaurants on Zomato and Swiggy charge consumers around 10% more than the listed prices on menus for dine-in.

Competition Watch:

- Swiggy introduces moonlighting policy, allowing its delivery executives to take up other gig work besides their regular employment.

- A recent Bernstein note comparing Swiggy and Zomato noted that in India’s duopoly food delivery market structure, Zomato is gaining more market share at about 55% run rate.

At the current level, Zomato shares are down over 46% from their debut price on the BSE.

Delhivery’s Struggles Continue

Shares of Delhivery have been on a downtrend since the announcement of its financial results for June quarter, and this week was no different. The logistics startup’s shares fell 1.8% this week, closing Friday’s session at INR 559.1 on the BSE.

While several brokerages recently gave ‘neutral’ or ‘sell’ ratings for Delhivery shares, Jefferies initiated its coverage of the stock this week with a ‘buy’ rating.

With a target price of INR 775, Jefferies deemed Delhivery as “best logistics play” in the country’s fast-growing ecommerce segment.

Despite the startup reporting tripling of its net loss to INR 399 Cr in Q1 of the current fiscal year, Jefferies expressed confidence about Delhivery’s ability to reach net profitability by FY26.

“Fixed cost leverage should support the margin turnaround on 31% FY22-26 revenue CAGR as variable cost pass-through ability with market positioning should sustain,” Jefferies’ analysts added.

Meanwhile, despite the recent decline in prices, shares of Delhivery are still trading about 13% higher from their debut price of INR 493 on the BSE.

Delhivery shares are trading near the 20-day moving average level of INR 540, Shah said. “So, INR 540 is a very crucial support. If that is not held, then we can see some further selling pressure towards INR 500 level on the downside,” he added.

On the higher end, resistance is seen at INR 580, and if that is crossed, the shares can go towards the INR 620 levels, Shah said.

In The News For:

- Delhivery is increasing its headcount as part of its preparations for the upcoming festive season and will create over 75,000 seasonal jobs pan-India over the next six weeks. It will hire over 10,000 off-roll employees across its gateways, warehouses, and last-mile delivery centres.

Competition Watch:

- Shiprocket turned a unicorn last week, becoming the 106th unicorn in India.

- Amazon is looking to pick a majority stake in IPO-bound Ecom Express for around $500 Mn-$600 Mn.

- Xpressbees recently raised INR 195 Cr from Avendus Future Leaders Fund II.

- Allcargo Logistics reported a rise in consolidated profit after tax at INR 280 Cr in Q1 FY23.

Paytm Sees Sideways Trend

Last week was extremely crucial for Paytm as its shareholders were to decide on who would be at the helm of the startup. Despite several proxy firms asking shareholders to vote against Vijay Shekhar Sharma’s reappointment as the MD and CEO, he won the approval from 99.67% of Paytm stakeholders to continue in the position for the next five years.

Despite the development, Paytm parent One 97 Communications’ shares continued to trade sideways without any significant move on either side.

While the stock gained slightly in the first session of the week after the announcement of Sharma’s reappointment on Sunday, it shed the gains in the next few sessions, ending the week over 1% lower at INR 761.85 on the BSE.

Shah said that the trend for the stock is positive as long as the price remains above the level of INR 710.

“The upside momentum will resume once it crosses the level of INR 775. Once INR 775 is taken out, we expect it to move towards the level of INR 850-900,” he added.

With a market cap of INR 49,434.61 Cr, Paytm shares are currently trading 61% lower from their debut price on the BSE.

In The News For:

- Vijay Shekhar Sharma gets shareholders’ approval for reappointment as the company MD and CEO.

- Paytm Payment Services partners with Shopify to streamline payment for merchants on the platform.