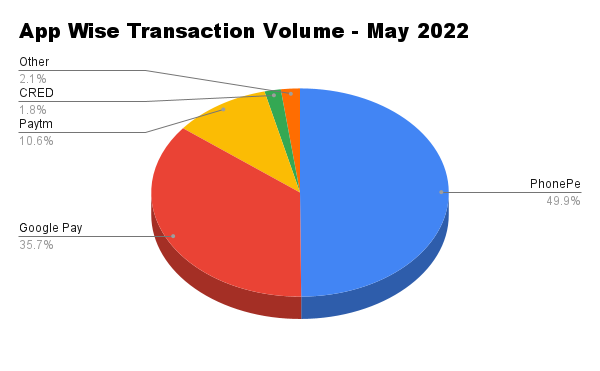

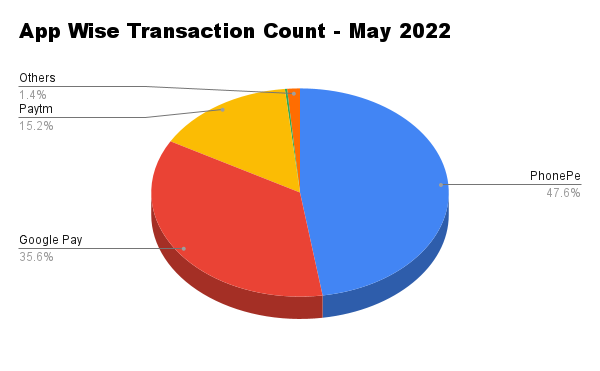

The top four UPI apps – PhonePe, Google Pay, Paytm and CRED amassed a total of 96% market share

Individually, CRED recorded 13.9 Mn transactions worth INR 18,174.61 Cr with an average ticket size of INR 13,085

RBI has recently announced that RuPay card users will be able to link their credit cards with UPI apps

Real-time payment system UPI broke another record as it crossed the INR 10 Lakh Cr mark with nearly 6 Bn transactions in May 2022 – a 6% higher than April 2022 when it registered 558 Cr transactions worth INR 9.8 Lakh Cr.

The growth might have declined to single digits in the last two months but UPI apps have already crossed almost 80% of the transaction volume of 2021 in the first five months of 2022.

For the first time, PhonePe registered transactions worth INR 5.11 Lakh Cr while Google Pay maintained its second spot with INR 3.66 Lakh Cr transactions. Next in line were Paytm (with transactions worth INR 108,276 Cr and CRED with transactions worth INR 18,174 Cr.

As opposed to our previous stories where the standard comparison was between PhonePe, Google Pay, Paytm, Amazon Pay and WhatsApp Pay, this month, Inc42 has included CRED, Tata Neu and BHIM as well.

It is to be noted that PhonePe and Google Pay amassed a market share of 49% and 35.15%, leaving 10.4% with Paytm and almost 2% with CRED. That is, the top four UPI apps amassed a total of 96.35%.

PhonePe led the UPI segment on all metrics, including count and volume of transactions, registered users and merchant coverage, growing 5% MoM. Google Pay and Paytm, on the other hand, grew a little over 6% MoM.

Individually, CRED recorded 13.9 Mn transactions worth INR 18,174.61 Cr – showcasing that the average ticket size was relatively high at an average of INR 13,085. This can be attributed to CRED allowing payment of credit card bills via UPI.

Credit Card On UPI: Ease Of Payments Boost The Credit Economy

So far, users could only pay their credit card bills using UPI, but the UPI as a payment option was not available on credit cards. For instance, users could not add their credit card details on UPI apps to enable P2P transactions.

It is a noteworthy point that among all payment mediums, credit cards have the lowest penetration rates at 5.55% in India and the volume of total credit card transactions was slightly over INR 1 Lakh Cr in March 2022.

There were a total of 7.36 Cr credit cards in the country as of March 2022 and credit card users spent almost INR 68327.73 Cr on ecommerce platforms as opposed to INR 38773.42 Cr on offline swipes on Point of Sale machines (PoS) – a difference of 76%.

As credit spending on ecommerce platforms increases, RBI has recently announced that RuPay users will be able to link their credit cards with UPI apps.

Despite the industry welcoming the move, it is not clear yet if MDR would be charged for the usage of credit cards through UPI.

The move is likely to propel UPI usage in the country where the apps are already marred with the market cap conundrum.

NPCI, the governing body of UPI, has repeatedly reminded UPI apps that they will have to adhere to the market cap and the TPAP restrictions by January 2023. But as the deadline is less than eight months away, NPCI may look to extend the timeline as an inevitability, fearing market disruption.

![Read more about the article [Funding alert] Minimalist raises Rs 110 Cr Series A round led by Sequoia Capital](https://blog.digitalsevaa.com/wp-content/uploads/2021/07/Founders-1627473560515-300x150.jpg)