In April 2022, 558 Cr UPI transactions worth INR 9.8 Lakh Cr were recorded

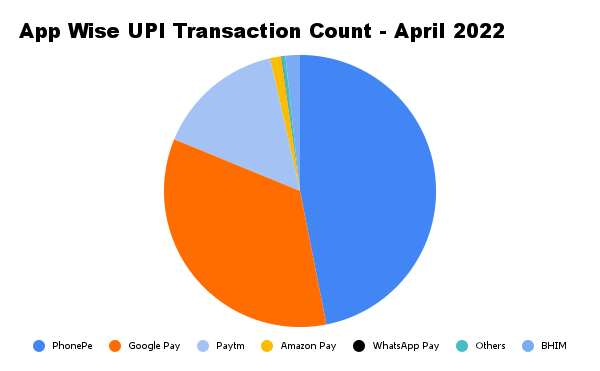

With a 49% market share, PhonePe carried out 26,162 Cr transactions worth INR 4.86 Lakh Cr in April 2022, emerging as the market leader

For the first time, Paytm crossed INR 1 Lakh Cr in transaction volume, and still held only 10% of the UPI market

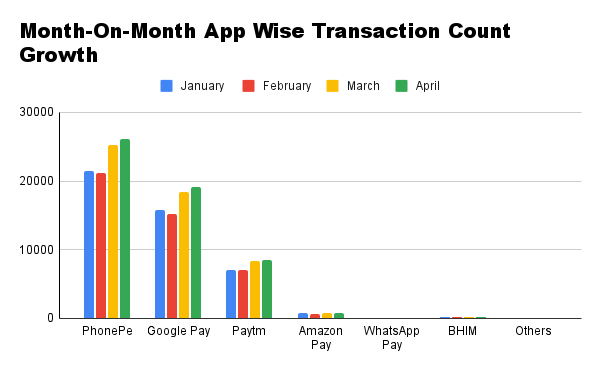

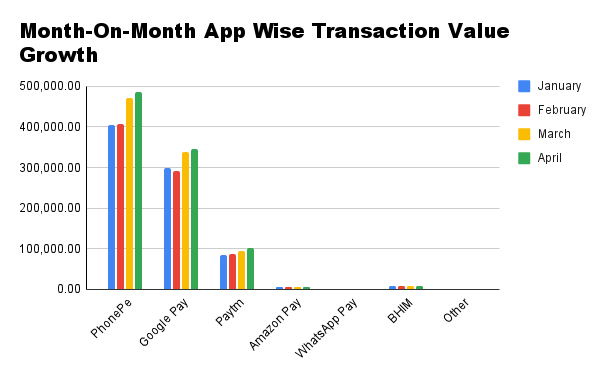

Real-time payment system UPI recorded an unprecedented 558 Cr transactions worth INR 9.8 Lakh Cr in April 2022, 3% higher than March’s 540 Cr transactions worth INR 9.60 Lakh Cr. The beginning of the financial year 2022-2023 also marked the entry of Tata Digital’s super app Tata Neu’s digital payments solution.

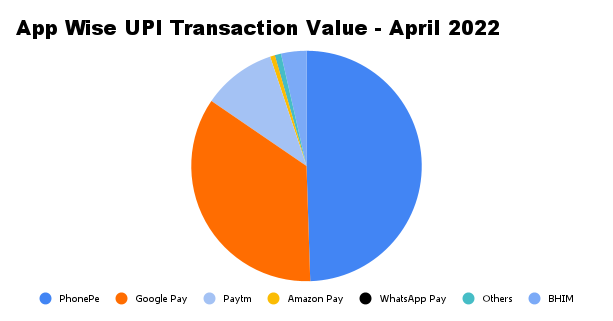

Once again, PhonePe led the UPI numbers with transactions worth INR 4.86 Lakh Cr. Google Pay maintained its second spot with INR 3.39 Lakh Cr transactions. Next in line were Paytm (with transactions worth INR 101,650 Cr); Amazon Pay (with transactions worth INR 6,699 Cr) and WhatsApp Pay (with transactions worth INR 242 Cr). All five apps recorded their highest ever transaction values in April 2022.

Starting last month, with the introduction of UPI123Pay, we at Inc42 have also included BHIM in our UPI payments list. BHIM recorded 2.57 Cr transactions worth INR 8,352 Cr in April, a month-on-month (MoM) increase of 10%. Showcasing that users were accepting BHIM on feature phones, over 37,000 users joined UPI123Pay and 21,833 successful transactions took place since its launch on March 8, 2022 (as of March 28, 2022), the government informed the Parliament earlier.

PhonePe was the leader in the UPI segment on all metrics, including count and volume of transactions, registered users and merchant coverage. The startup held over 49% market share in the volume of transactions processed in April 2022.

Google Pay was second in line, commanding a little over 35% of the total market share in April 2022 with transactions worth INR 3.45 Lakh Cr. While Google Pay’s UPI transaction count grew 10.17% MoM, its total share based on the number of transactions remained the same as in the last three months – 34%.

Both PhonePe and Google Pay are looking to reduce their market size owing to the TPAP guidelines. The guidelines intend to discourage monopoly (or in UPI’s case duopoly), by limiting the market cap to 30% per payment app by December 2023.

Both PhonePe and Google Pay will have to reduce their market cap by about 20% and 5%, respectively, while the National Payments Corporation of India (NPCI), which owns UPI, has already restricted the use of UPI on WhatsApp to regulate competition.

WhatsApp had 487 Mn registered users in 2021 in India alone, with 390 Mn active users, growing 16% year-on-year. Thus, to restrain WhatsApp from undermining the competition and creating a monopoly, its initial rollout was limited to 20 Mn users.

In a relief to the Meta-owned WhatsApp Pay, NPCI allowed it to double the number of users on its payment platform in India to 40 Mn people. Later in April 2022, WhatsApp was given a nod to expand its userbase to 100 Mn users. Yet, in April 2022, WhatsApp only recorded 25 Lakh transactions worth INR 242.4 Cr, a mere 1.09% MoM increase.

Further, Tata’s super app named TataNeu was launched in April 2022 and recorded 3.5 Lakh transactions worth INR 32.82 Cr.