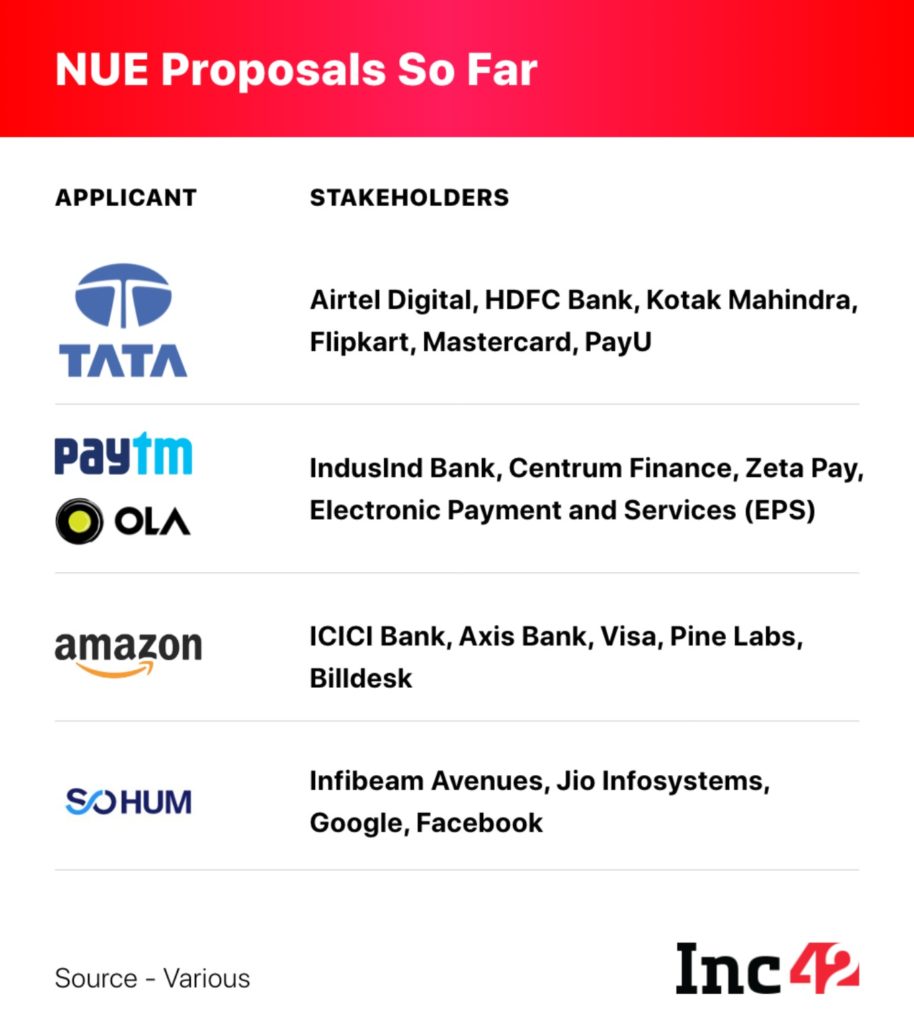

Besides the Tata Group proposal, at least three other consortiums of Indian startups, banks and MNCs have also applied to the Reserve Bank of India for an NUE license

On February 27, the central bank extended the deadline for receiving applications for a New Umbrella Entity (NUE) license to March 31, 2021

NUEs have been envisaged as entities that will further innovation in the digital and retail payments sector to complement NPCI and reduce risks of overload on the Unified Payments Interface (UPI) infrastructure

Tata Group’s planned new umbrella entity (NUE) has seemingly gained more momentum, with major participants from the financial services and tech startup sphere.

According to ET, which first reported the development, Flipkart, Mastercard, PayU and National Bank for Agriculture and Rural Development (NABARD) will together buy a 30% stake in Ferbine, the Tata subsidiary that will build the NUE as per the proposal.

Besides the Tata Group proposal, at least three other consortiums of Indian startups and MNCs have also applied to the Reserve Bank of India (RBI) for an NUE license. Below is the list of applicants at the RBI so far.

On February 27, the central bank extended the deadline for receiving applications for a New Umbrella Entity (NUE) license to March 31, 2021. The earlier deadline was February 26.

In its notification, RBI wrote that it had received requests from various stakeholders, including the Indian Banks’ Association, for extending the timeline, keeping in view the Covid-19 related disruptions.

The central bank had released the framework for the authorisation of NUEs on August 18, 2020. Since then, major players in the Indian banking and payments landscape have formed coalitions, chalked business plans, detailed the technology to be used, security features, market analysis/research, benefit/s (if any) of its payment system.

NUEs have been envisaged as entities that will further innovation in the digital and retail payments sector to complement NPCI and reduce risks of overload on the Unified Payments Interface (UPI) infrastructure. They will be able to set up, manage and operate new payments systems, especially in the retail space, comprising but not limited to regular and white-label ATMs, point-of-sale (PoS) devices and Aadhaar-based payments and remittance services.

NUEs have been imagined, not as rivals to the incumbent NPCI, but entities that will complement the state-owned body’s efforts towards enhancing access to digital payments. The central bank has stressed in its NUE framework that the new entities will need to set up systems that are interoperable with those already in place, built by NPCI. But unlike NPCI, NUEs can be for-profit entities, hence the interest shown by private players.

A detailed overview of NUEs and what to expect from them can be found in an earlier Inc42 story titled, “With Big Businesses Expected To Apply, Will NUE Make NPCI Redundant?”

![Read more about the article [Investor Summit 2021] What SaaS startup founders need to know about vanity and value metrics](https://blog.digitalsevaa.com/wp-content/uploads/2021/04/Image6ygk-1617257492912-300x150.jpg)

![Read more about the article [Funding alert] Jai Kisan raises $30M in Series A round led by Mirae Asset](https://blog.digitalsevaa.com/wp-content/uploads/2021/05/Imageb728-1622430597422-300x150.jpg)