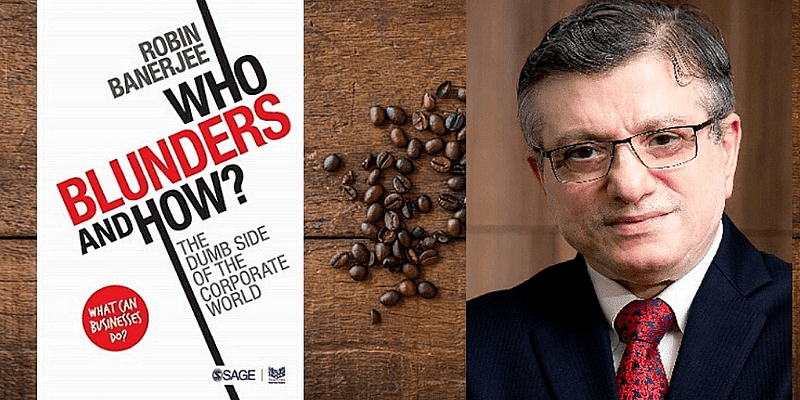

Robin Banerjee is the author of Who Blunders and How: The Dumb Side of the Corporate World (see my book review here). He is the MD of Caprihans India, and his 35 years of experience spans companies like Hindustan Unilever, Arcelor-Mittal, Thomas Cook, Essar Steel, and Suzlon India.

Much can be learned from best practices and process improvement – but leaders and employees must also be open to acknowledge, discuss and learn from mistakes, failures, lapses, and even malpractice, the author explains.

Robin is speaking on these topics at CII’s annual Global Knowledge Summit being held online on April 8-9 this year. The theme of the 16th summit is Transforming Knowledge Management for Hybrid Learning and Hybrid Workplaces.

As media partner for the Global Knowledge Summit, see YourStory’s coverage of the editions from 2021, 2020 and 2019, and sessions takeaways from the Bangalore K-Community meetups.

See also our profiles of MIKE (Most Admired Knowledge Enterprise) award winners EY, Tata Steel, Cognizant Technology Solutions, Afcons Infrastructure, Petroleum Development Oman, BINUS University, and Mobarakeh Steel Company.

In this chat with YourStory, Robin Banerjee talks about the importance of learning from failure, the role of storytelling, the impact of digital transformation, and pandemic resilience.

Edited excerpts of the interview:

YourStory [YS]: What are some key learnings we can take away from some recent business failure stories you have come across?

Robin Banerjee [RB]: There are two primary reasons why businesses become sick and sometimes irretrievable from their miseries. First, too much of debt, and second, poor governance, including unethical practices.

Borrowings that cannot be serviced through business cash flows may ultimately lead to short-term actions like selling valuable assets or doctoring balance sheets to project a holier-than-thou image.

Unethical practices are short-term measures that either (i) negate value to customers, say by compromising quality (eg. Volkswagen lying on its diesel-auto emissions), or (ii) involve very poor governance, like siphoning off borrowed funds for purposes other than the intended use.

Most business failures of recent times could be attributed to the above two causes. Contrary to popular belief, poor market conditions normally do not lead to businesses going belly-up.

YS: What are some outstanding examples you have come across of business storytelling in action?

RB: Stories tell it all. It’s all about citing examples as to how it has worked elsewhere, leading managers to understand the reality of the game.

Many times, I have come across my purchasing colleagues attempting to procure raw material ahead of time and requirement – say, the next three-four months’ requirements. These purchase plans are usually backed by the belief that the price is likely to go up, and hence it’s good to buy in advance.

Let me cite a story. Ruchi Soya (maker of the famous Nutrela soya foods) bet on castor seeds by buying them in large quantities, forecasting that the price will rise. The reverse happened – price crashed 40 percent after the new crop arrived. The company could never recover from the losses.

Another classic mistake many do is not to carry out meaningful innovation while good times prevail. Stories are in plenty of not keeping pace with time.

Nokia and Blackberry fell into the trap of overconfidence and lack of managerial foresight. The famous Ambassador car in India is another instance. Its makers, Hindustan Motors, refused to upgrade even when the fuel-efficient Maruti gave them enough notice.

One reason why many family enterprises do not last beyond the second generation is their inability to think about a successful succession. Planning for the future and passing the baton to the best-fit person in the next generation is the cornerstone on which businesses flow from one generation to the other. No wonder only 30 percent of family businesses survive the second generation, with only one percent left for the fifth.

Stories about succession planning faux pas are plenty. When famed Dhirubhai Ambani died and did not leave a will for handing over his empire, the two siblings – Mukesh and Ambani – fought among themselves only to divide the business kingdom. The results are there for all to see, with half of his erstwhile domain collapsing.

Think of Bharti, Bajaj, BMW, Fiat, and Ford. They identified the right successor and practiced it for ages to remain successful family-run businesses. Good succession planning works wonders.

YS: What are the typical barriers for employees to share ‘bad news’ with their bosses, about mistakes and failure? How can companies go beyond sharing of only best practices?

RB: Successful businesses are those who have an open channel of communication with the employees. While many may proclaim an open door policy, most actually practice a closed one. Employee ‘bad news’ can only be heard when the boss encourages receiving them. It’s a mindset of the top.

Disasters or mistakes are bound to happen in any business. Rectification needs to take place when failures take place. But how can it be fixed, if no one discusses it or owns it, or if the boss is blissfully ignorant of the developments?

YS: As we slowly move out of the pandemic, what are some notable successes and failures we need to learn from?

RB: The ongoing pandemic has taught the business community several crisis management lessons – some good, many bad.

- Cash is the king – if not the emperor. Whoever had money power and was not over-leveraged, survived the terrible pandemic onslaught.

- Employees are the key to any business. Whichever enterprise counselled and protected employee interest, they continued to function, and not being saddled with say, migrant labourers walking out leaving the business high and dry.

- Consumers are the king. Businesses that focused on what customers want, won the battle. Stories of numerous home-chefs doubling up for restaurants are in the hundreds – a classic case of focusing on what customers want, good and safe food served at home directly.

There are also some useful learnings that perhaps have some negative implications.

- Don’t exhaust all the borrowing or financing power. There could always be some imponderables. Uncertainties are increasing. Hence, keep some unutilised financing lines or cash balances, to tide over emergencies.

- Another negative development is enhanced cybercrimes. This is a menace that is exploding. Be careful that a hacker can do irreparable harm through some terribly smart fraudulent activities.

- Always back up plans – a Plan B or Plan C if Plan A fails. There are too many imponderables in this new VUCA world.

YS: What do you see as the top three skills to succeed in a world shaped by digital transformation?

RB: Digital transformation is irreversible. The faster the business community adopts and adapts, the better off they would be. The three major skills required to succeed in the new normal could be as follows.

First, it’s about the mindset of adapting the new technology. Many successful businesses refuse to embrace the digital world early enough, and the results are for all of us to see. HMT and HMV are classic stories of this malady. So is the famous Kodak story, where the company that invented digital photography refused to accept it as its own business model, before it was too late.

Next, it is about knowledge. People working must have the know-how for digital transformation. Many times, I have found that company boards are not appreciative enough of new developments (mostly in the old economy businesses). Both top and lower levels of management need to know what the new tech world is all about. Lack of appreciation of the pluses and minuses of the new normal often leads to disastrous consequences.

Last but not the least, is protection and control against cybercrimes. The digitised world and the ongoing pandemic have forced many of us to work from home. With employees far removed from customers and the real action, cybercriminals are taking advantage and creating havoc in the marketplace.

It is very important to be several steps ahead of the cyber swindlers, set up appropriate internal control mechanisms, and take cyber insurance and effective steps to ‘know your customers’ while authorising transactions. Steps like these could help in protecting businesses from neo-fraudsters.

YS: What are your parting words of advice to business leaders on how to develop more ethical practices to prevent blunders?

RB: Every entrepreneur or manager is advised to focus on producing goods and services of appropriate quality consistently, and make them available at an appropriate price.

To make this happen, set up proper processes and systems. If you do this well, good governance will automatically emerge.

There is no magic wand to wish away the fallout of any business blunder. There is no one solution to take care of negative business outcomes and implications.

Recognise first that there is a problem and cut your losses; practice tough mindedness and resilience; think through and identify the remedy; take time to understand where you went wrong, and share the lessons learnt with colleagues. Build a defence mechanism to resolve possible adverse consequence of bloopers and gaffes.

One last word. Do not take your stakeholders for granted – be it your employees, lenders or vendors. If you treat them fairly and honestly, the long-term benefits are immeasurable.

![Read more about the article [Funding alert] Venture Catalysts and 9Unicorns invest in clean personal care brand The Switch Fix](https://blog.digitalsevaa.com/wp-content/uploads/2021/06/Untitleddesign6-1624351049683-300x150.png)

![Read more about the article [Funding roundup] Yoho, 5C Network, OptiQ.AI raise early-stage deals](https://blog.digitalsevaa.com/wp-content/uploads/2022/03/Image5wy1-1630828923435-300x150.jpg)

![Read more about the article [Funding alert] Fullife Healthcare raises $22M from Morgan Stanley Private Equity Asia](https://blog.digitalsevaa.com/wp-content/uploads/2021/12/VarunKhanna-01-1639485690121-300x150.png)