Foodtech rivals Bengaluru-based Swiggy and Deepinder Goyal-founded Zomato, despite their distinct investment strategies, share one name in their investment portfolios: UrbanPiper.

The Bengaluru startup offers a business-to-business (B2B) restaurant management platform for restaurants to manage their offline and online orders in one place.

In April 2022, the two food delivery companies, along with Sequoia Capital India and Tiger Global, invested $24 million in UrbanPiper’s Series B funding round. In 2019, UrbanPiper had raised $7.5 million in a Series A round from existing investors Tiger Global and Sequoia Capital India.

UrbanPiper was founded in 2015 when online food delivery startups had only started gaining investors’ attention, with Swiggy, Zomato, and FoodPanda raising early rounds. It has, since, been a witness to the evolution of the Indian food delivery industry.

Witnessing a change

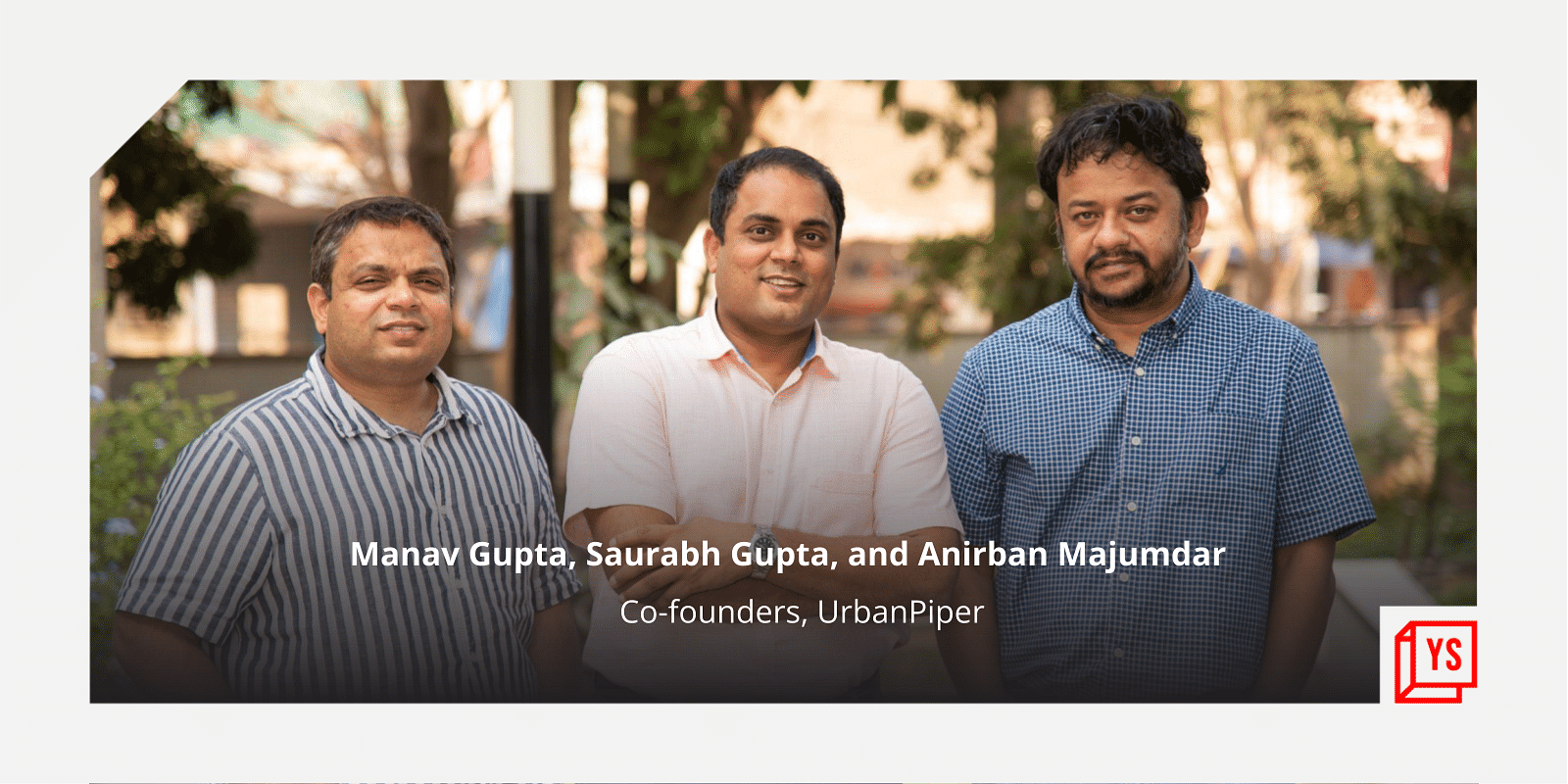

Co-founders Saurabh Gupta, Anirban Majumdar, and Manav Gupta wanted to start UrbanPiper as a ‘Shopify for restaurants’. The Canada-based ecommerce company helps merchants create an omnichannel experience.

In 2015, most restaurants were new to the digital world, and many people did not order food online. Instead, they relied on Gurugram-headquartered Zomato to discover new restaurants and check their ratings.

However, a few mid-sized restaurant chains, including Chai Point, Chili’s, etc., were open to adopting data solutions. This was when UrbanPiper decided to enter the market.

“We were trying to build a technology platform to help a restaurant go online on its own,” Saurabh says.

In February 2016, UrbanPiper raised Rs 1.34 crore in a seed round from Axilor Ventures. In January 2018, it raised Rs 3 crore in a pre-Series A round, adding Kumar Vembu, Founder and CEO, GoFrugal, as its investor, and built a team of 25 employees.

At present, the startup has about 150 employees. It plans to grow to 250 next year.

Between 2017-2019, four players—Swiggy, Zomato, FoodPanda, and Uber Eats—entered the foodtech space, aggressively trying to convert restaurants to deliver food online.

However, it did not sit well with UrbanPiper, which was asking restaurants to invest in its solution, and a delivery fleet to deliver food on their own when they could run deliveries through Swiggy and Zomato.

“Almost no one [restaurants] was interested in delivering food on their own,” Saurabh says.

The pivot

While re-evaluating the startup’s strategy, the co-founders saw a bigger problem in the industry.

Apart from managing offline customers and online business, restaurant owners were also managing staff, their shifts, electricity and other maintenance bills, groceries, and inventories, among others.

Saurabh adds, “We realised these systems were not talking to each other. There was no automated way to track everything once a restaurant received an order.”

It was only when restaurants started taking online deliveries did they realise that they could manage digitally other operations, for which they earlier used 30-odd different software.

It became obvious that they had to build a different business, which needed optimisation and investment to get margins at scale.

Saurabh says, “If you’re the same restaurant guy, with the same mindset before online delivery evolved, you would not make sense because suddenly [you will be paying] about 20-25 percent of your books to these [delivery] partners.”

UrbanPiper tried to connect these systems with its full-stack restaurant management platform to help these restaurants operate and scale their business.

Along with solving online integration problems, the startup allowed restaurant owners to manage their tasks from one system. It also started integrating data from different sources to allow them to optimise more orders efficiently.

The startup offers a cloud-based system and charges customers a fixed subscription fee. Its products include: Prime POS, a point of sale (POS) system for restaurants; Meraki, an online ordering system; and Hub, a product that integrates online sales channels such as Zomato and Swiggy with the existing restaurant POS system.

Prime POS licence costs about Rs 10,000 per year for a one-year plan plus add-ons and Rs 7,500 per year for a two-year plan plus add-ons. Meraki costs Rs 4,500 per month for the website and Rs 9,000 for the website and apps. Hub pricing depends on numeroud factors, including the number of outlets and units.

The way forward

According to Grand View Research, Inc. the global restaurant management software market size is expected to reach $14.70 billion by 2030, expanding at a CAGR of 15.8 percent from 2022 to 2030.

UrbanPiper claims to have over 30,000 restaurant locations across eight countries, including India and the UAE and Saudi Arabia in the Middle East

The startup claims to have achieved 10X growth over the past two years.

After its Series B funding, UrbanPiper plans to use the capital to scale its product and engineering teams, strengthen its platform capabilities, and broaden its offerings to enable more services to restaurants.

With customers like McDonald’s, Pizza Hut, KFC, Subway, Cure Foods, Taco Bell, and Rebel Foods, UrbanPiper claims to process nearly 15 million orders per month, including 20 percent of all online orders from Swiggy and Zomato — about $750 million of estimated order value annually.

At present, it competes with the likes of PetPooja, LimeTray, and FoodEngine.

Going forward, UrbanPiper aims to become a single-window platform for restaurants to help them operate and scale their business, including managing orders, utility bills, managing, insurance, inventory, etc.

The startup plans to further expand its presence in the Middle East and Europe to get access to over 200,000 restaurant locations.

![Read more about the article [Weekly funding roundup] Dip in venture equity inflow but deal momentum remains strong](https://blog.digitalsevaa.com/wp-content/uploads/2021/05/Weeklyimage-1577460362436-300x150.png)