Blume Ventures, the homegrown and early-stage venture capital firm has successfully closed a differentiated secondary vehicle fund at Rs 350 crore in partnership with Avendus, a leading investment banking firm.

Called the Blume Ventures Fund IX, the VC firm says it is designed to allow interested new investors, existing Blume Fund I and allied entities’ investors, to hold the top performers in Fund I for an additional four to five years.

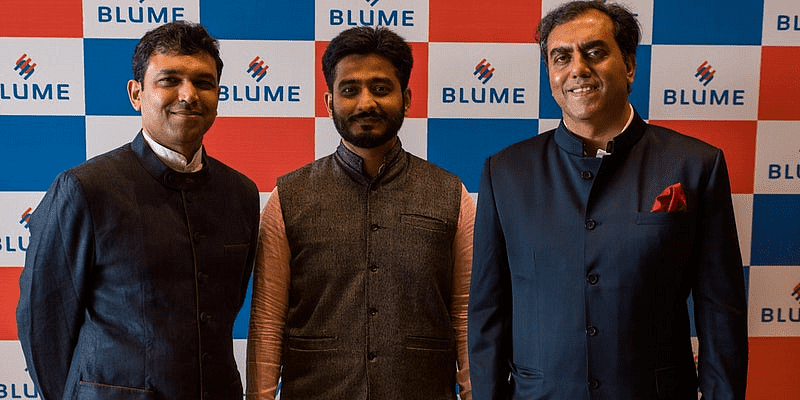

Blume Ventures Co-founders & Managing Partners Karthik Reddy (L) and Sanjay Nath

According to the VC firm, six of the Blume I portfolio companies were packaged into a portfolio and their positions are being acquired by the new fund, Fund 1X. The companies are GreyOrange, Purplle, Turtlemint, Exotel, IDfy, and WebEngage.

The target size of this fund was Rs 300 crore but it was oversubscribed to Rs 350 crore. According to Blume Ventures, secondary structures are common as fund lives reach their natural limits. It further stated that historically, buyers in such funds have been offshore institutional investors, who specialise in taking risk of this nature but the challenges of a COVID-19 year allowed for innovation onshore.

This secondary vehicle allows Blume’s Fund 1 and Fund 1A investors to see gross cash returns of over 2X while they can still expect an additional 1-2X from the residual positions that were not a part of this secondary portfolio, the VC firm stated.

Blume Ventures also noted that Avendus also saw merit in the opportunity and built an exclusive product for its wealth customers.

“There is tremendous potential in our country as wealth creators get savvy and demand solutions that are differentiated and on par with global offerings,” said Nitin Singh, MD and CEO, Avendus Wealth Management.

Ashish Fafadia, Partner, Blume Ventures, who led the effort, said, “We continue to be in further discussions for the select assets including global-first innovation businesses and those targeting the Indian consumer from the remainder of the portfolio to be part of another similar portfolio basket.”

Karthik Reddy, Founding Partner, Blume Ventures added, “We believed that the capital markets were harsh to some of our best Fund I founders (pre-2015 era) and we wanted to back them further as they begin to shoot up to their true potential.”

![Read more about the article [Funding Alert] Bengaluru-based Rapido raises $52M in its latest investment round](https://blog.digitalsevaa.com/wp-content/uploads/2021/08/Imageugwl-1602829711283-300x150.jpg)