The Reserve Bank Of India (RBI) expects the fintech ecosystem, flushed with funds and higher user adoption to drive employment growth for the financial ecosystem

While a few traditional banking roles across underwriting, customer support and sales are likely to be lost to the fintech boom, many more are expected to be generated across product and compliance in the sector

According to Michael Page’s India Talent Trends report (2021), over 63% of companies in the Indian BFSI space expect their headcount to increase by 11% in 2021 itself

The fiscal year 2020 was a blockbuster year for the fintech ecosystem for several reasons. Not only did the pandemic encourage consumers across the board to adopt digital payment channels and financial services in a big way, but, it also drove massive funding towards the ecosystem.

At the same time, the past year also forced traditional financial institutions to face their shortcomings in the digitally enabled world with massive system failures that forced the Reserve Bank of India (RBI) to pull them up for not being technology ready. At a systemic level as well, banks have been increasingly challenged to change their traditional operating models for a post-pandemic world. These changes require technology overhauls and a change in how they work and who they work with. It is not surprising that RBI, in its annual report, stated that the next phase of job growth in the ecosystem will come from fintech.

With the fintech sector expected to drive job creation in the banking and financial services ecosystem going forward, what is the employment opportunity in this segment expected to look like?

Traditional BFSI Roles At Risk

According to a 2019 assessment by National Skills Development Corporation (NSDC), the banking and financial services and insurance (BFSI) sector in India will need an additional 1.6 Mn skilled workforce by 2022. However, more than 50% of the jobs would need reskilling due to changes in technology, 15 to 20% of the jobs would be new roles in nature.

The upcoming roles include trade finance specialists, credit and risk analysts, wealth management experts, cybersecurity analysts and blockchain experts among others. To a certain extent, this demand is driven towards automation in the industry.

On the other hand, the same digitisation solutions are expected to render several core BFSI jobs obsolete. These include manual task-driven activities like that of underwriters, tellers, data verification operators. In fact, as an increasing number of traditional banks and financial institutions seek to partner with fintech companies there will also be a massive need for reskilling traditional financial product sales and customer service executives, say fintech companies.

Alok Tiwari, cofounder and CEO of CogNext, a fintech startup that helps banks automate and digitise financial processes, says that as banks and financial institutions increasingly seek to automate several processes, there will be an impact on a certain category of jobs.

“(Fintech) adoption in different areas is seeing varied impact across the traditional financial services. Automation will significantly impact the key roles in operations, we can expect a 20% reduction in banking roles in a 5-year period,” says Tiwari.

He expects an impact across customer support solutions in the sector. According to Tiwari, conversational technologies are expected to shrink customer support roles by 25%.

Kaushik Banerjee, vice president and business head, Teamlease, an HR consultancy adds that concerns of job losses in the traditional banking ecosystem due to greater adoption of fintech solutions are not as bad as made out to be. While the roles will change over time, the demand for skilled people to fill these roles will continue to grow. That said, Teamlease sees a massive demand for fintech based roles across different categories.

What Jobs Are Fintech Cos Creating?

Fintech made up for almost 17% or 88 of all the 502 deals cracked in 2021 till May 29, 2021, representing a 60% hike from 55 deals cracked in the same time frame last year. Like last year, fintech continues to dominate the Indian startup funding scene by raising almost 22% of the capital infused this year. The sector has raised more than $2 Bn in 2021 so far, representing a 4X increase from $495 Mn raised in the first five months of 2020.

Some of the prominent deals in this segment were CRED’s $296 Mn fundraise across Series C and D round, Groww’s $83 Mn Series D round, Zeta’s $250 Mn Series C round, and BharatPe’s $108 Mn fundraise, among others.

In addition, global fintech companies like Tide, Revolut and Wise are also setting up bases in India.

RBI stated that it is important not only to have an ecosystem that promotes new entrepreneurial ventures, but also one that helps in capacity building of domestic start-ups and handholds/nudges them to scale up.

“Their operations (fintech) do not directly depend on the movement of goods and people, and they are more suited for work-from-home culture. The pandemic has also presented an opportunity to expand operations, as the general public is expected to emerge from the crisis more comfortable with using new technology,” said the RBI report.

An example of how the HR ecosystem sees fintech evolving to accommodate traditional BFSI roles is the increasing number of fintech startups that are offering marketplace-like platforms for fintech advisors in addition to robo-advisors. The existing knowledge base of insurance agents, financial advisors and salespersons in this ecosystem will continue to be relevant, only that it will be increasingly accessed online, say experts.

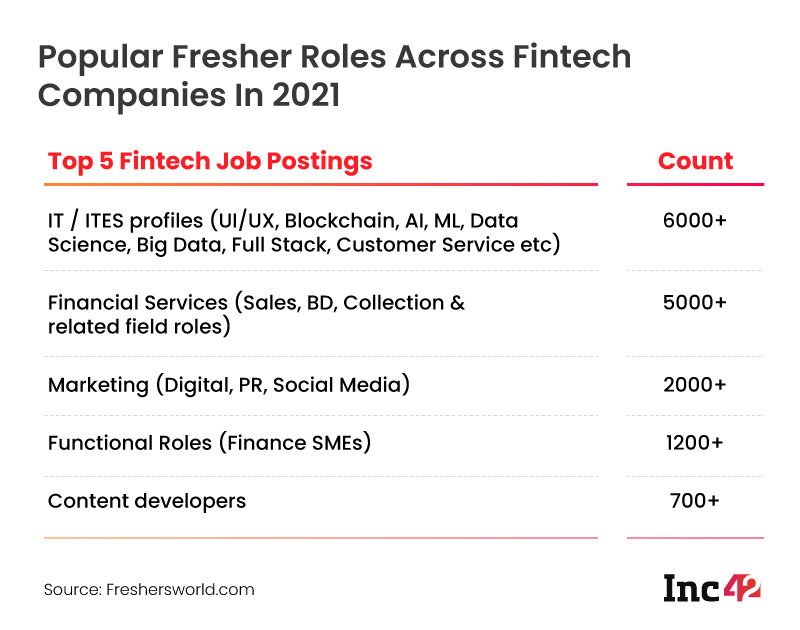

Who are the fintech cos hiring though? Technology background is a major requirement for fintech roles although it is not the only skill requirement. Banerjee adds that out of 300,000 new job postings that Teamlease is handling across technology roles, at least 50,000 are for fintech requirements. Almost 70% of these roles seek freshers.

“Clearly, the influx of fintech unicorns and global fintech companies to India has created a huge demand which will continue to grow. We expect a 300% increase in the available number of fintech jobs in the market over the next 5 years,” says Banerjee.

Banerjee adds that at the current growth rate, Teamlease expects around 30-40 top companies in the Indian fintech space to employ over 3,000 people (per company) over the next few years as this sector grows. Last week when fintech unicorn Zeta founders spoke to Inc42, co-founder Ramki Gaddipati said that their recent funding will be channelled towards hiring in India much like the other fintech companies have been doing to scale up their operations.

Nitin John Abraham, director of BFS and real estate at Michael Page, a global CXO recruitment firm says that beyond core technology roles across digital marketing for building online business and partnerships, product experts who understand user interface, technology and functions will be in demand across the traditional BFSI space as well and fintech companies. People across these roles have skill sets that match with another major startup segment- ecommerce and to some extent FMCG. The firm has already been addressing cross-functional hiring requirements for people from ecommerce to fintech. In a way, fintech is opening up the talent requirement in the BFSI ecosystem compared to traditional financial services.

“One of the traditional requirements that will stay in demand is for people in financial services who can understand and address risk analysis, compliance and data analysis. However, while fintech companies are also hiring people who understand compliance from a traditional banking perspective, that requirement will stagnate over the next couple of years,” says Abraham.

Another major area that will drive hiring within fintech is the rise of neo banks. Neo banking solutions are being introduced across the board by fintech startups, traditional banks and even telecom operators. Neo banks are also targeted towards specific customer bases like SMEs, students, white-collar and blue-collar professionals among many others. Each of these will increasingly hire for techno-functional roles, adds Abraham.

Will Fintech Address Only Highly Skilled Roles?

According to Michael Page’s India Talent Trends report (2021), over 63% of companies in the Indian BFSI space expect their headcount to increase by 11% in 2021 itself. But we need to remember that even fintech companies are not infallible. In the immediate weeks following the 2020 lockdown, the sector witnessed its share of layoffs. However, industry experts also believe that the subsequent change in demand environment will prevent layoff massive 2020 layoffs in the near future.

While there is generally a positive sentiment regarding fintech employment from well-funded startups, RBI added that preferential policies may help in the growth of sub-sectors that have the potential for low and semi-skilled job creation as well. For instance, as metro and top tier markets are saturated, fintech companies will increasingly build solutions for Tier 3 and beyond as well as rural markets especially across insurance, micro-insurance products and non-banking financial companies (NBFC).

In the 2020s, the fintech jobs will increasingly become the aspirational jobs in the market much like IT sector jobs of the past two decades. As long as the traditional financial services continue to upskill with the times, India can offer a globally relevant talent base for this ecosystem.