Netflix has taken a U-turn from its anti-ad position to introduce a lower-priced ad-supported tier next year

The ad-supported model in India may help Netflix get new users for sampling, and eventually upgrading to premium category

In terms of advertising, Netflix will have an edge over its competitors when it comes to premium brands

For a long time, OTT giant Netflix’s CEO Reed Hastings continued to say that the streaming colossal would stay away from advertising as an ad-free experience was one of its core propositions for consumers.

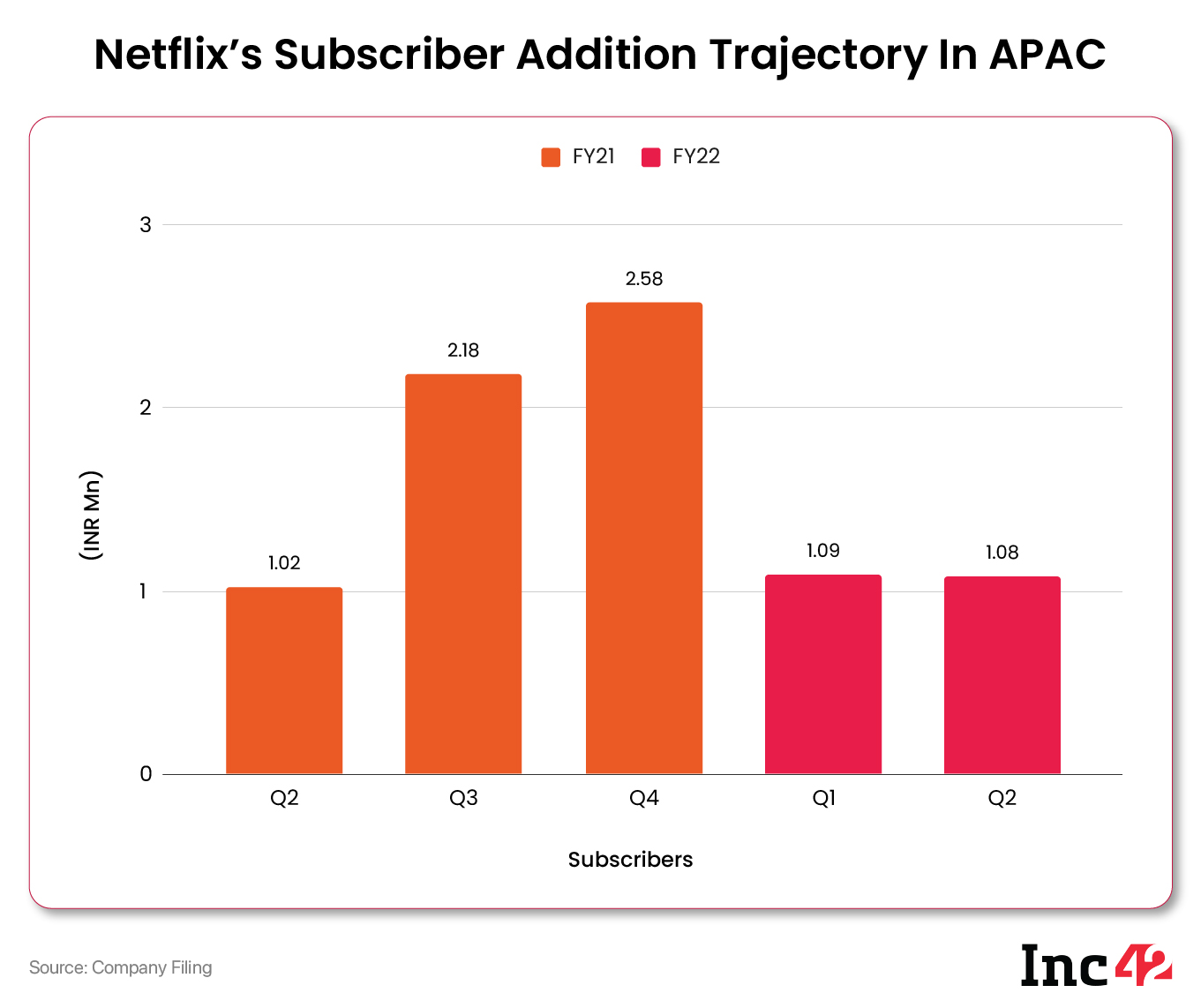

However, times have changed, and so have the market dynamics. Netflix, once a flag bearer of cord cutting and the growth of over-the-top (OTT) platforms, for the first time, lost subscribers during the last two quarters. After losing nearly 2,00,000 subscribers in the first quarter of 2022, Netflix lost nearly a million subscribers in the second quarter.

With increasing competition due to the launch of new OTT services, slowing of the pandemic-induced growth and other macroeconomic factors, Netflix has decided to take a U-turn from its earlier position and introduce a lower-priced ad-supported tier next year.

While the streaming giant had already revealed its plan of bringing ads on its platform, it divulged the details of the plan in its Q2 shareholder letters.

Netflix To Focus On The Long-Game Of Advertising

“Our lower priced advertising-supported offering will complement our existing plans, which will remain ad-free. Our global ARM (average revenue per month) has grown at a 5% compound annual rate from 2013 to 2021, so it makes sense now to give consumers a choice for a lower priced option with advertisements, if they desire it,” the streaming giant said.

Initially, the company will start in a handful of markets where advertising spend is significant. It aims to create a better-than-linear-TV advertisement model that’s more seamless and relevant for consumers, and more effective for advertising partners.

Advertising is a long game and the company acknowledged that. While it will take some time to grow the user base for the ad tier and generate the associated ad revenues, it is hoping to achieve substantial incremental membership through lower prices and growth in profit on the back of ad revenues in the long-run. However, the immediate goal is to attract a broader set of consumers through a lower-consumer facing price.

Can Ad-Supported Model Help Netflix Achieve Scale In India?

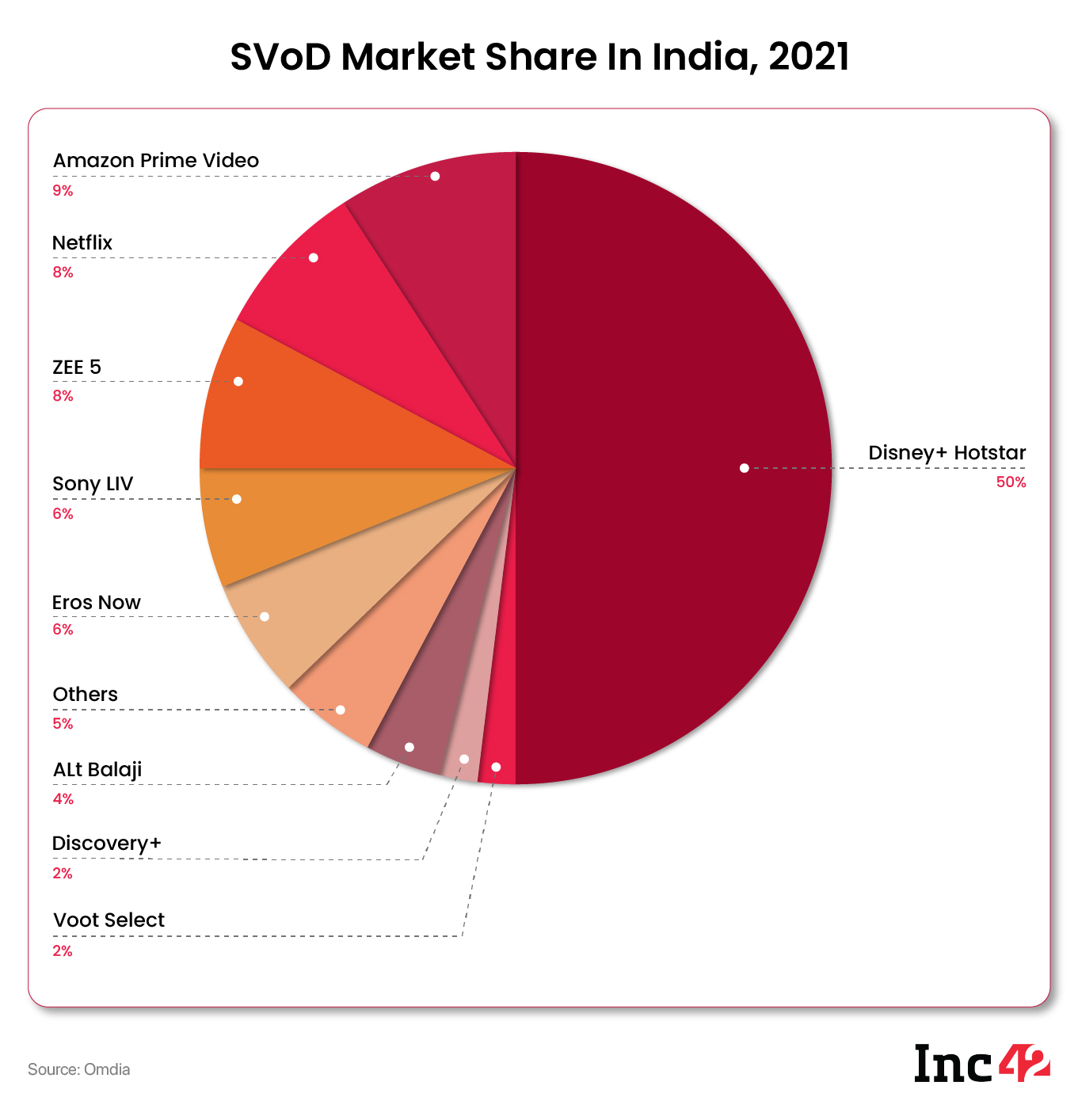

Netflix hoped to get the next 100 Mn subscribers from the Indian market but has not been able to achieve a strong market share yet. Although the propensity for paying has grown significantly among the Indian OTT audience, the advertising-based freemium model still leads the OTT market in India.

While India currently has about 102 Mn subscription video on demand (SVoD) subscribers, the number is estimated to reach 224 Mn by 2026, according to Deloitte’s 2022 TMT predictions. Despite SVoD subscriber growth, advertising-based video on demand (AVoD) is expected to continue to pull in more revenue than SVoD, increasing its market size to $2.4 Bn in 2026 from $1.1 Bn in 2021.

While India currently has about 102 Mn subscription video on demand (SVoD) subscribers, the number is estimated to reach 224 Mn by 2026, according to Deloitte’s 2022 TMT predictions. Despite SVoD subscriber growth, advertising-based video on demand (AVoD) is expected to continue to pull in more revenue than SVoD, increasing its market size to $2.4 Bn in 2026 from $1.1 Bn in 2021.

On the contrary, the SVoD market is expected to grow to $2.1 Bn from $0.8 Bn currently over the same period.

The Deloitte report also added that the overall OTT space in India is expected to grow at a CAGR of more than 20% to reach $13 Bn − $15 Bn over the next decade. Pricing innovation will be one of the key factors that will drive the growth, the report added.

According to Uday Sodhi, former SonyLIV head, the OTT platforms in India need to go freemium to get scale. “Undoubtedly, Netflix has one of the best content libraries in the market today and if an ad-based service is available, it will probably help bring in lots of new users for sampling and upgrading to premium,” Sodhi said.

He also cited the example of Netflix’s rivals, such as Disney+Hotstar, SonyLIV, Voot, Zee5, which run on the freemium model and are able to get considerable viewership. In India, paid TV is also partly ad-supported, he said.

India is a price-sensitive market and customers here are looking for a value proposition, said Karan Taurani, senior vice president of Elara Capital. From that perspective, there is a willingness of customers to watch ads in case they are asked to pay less.

Cracking The Highly Competitive Video Advertising Market

However, it will not be easy for Netflix to grab market share in the advertising market. Currently, India’s video advertising market is dominated by YouTube and MX Player which are aggregators and offer a wide variety of content, Taurani noted. The competitive intensity is very high in the market, it’s a winner takes it all market, he added.

The three leading players – MX Player, YouTube and Disney+Hotstar – together have a 65% share in the Indian video advertising market due to two factors – aggregation, and sports. There are broadcaster-based OTT apps as well, which have a market share of 3-4% because of their catch-up content (the content that is shown on OTT after it has been aired on TV channels).

These players have not been able to grab a larger market share as their original content has not done well so far, Taurani said.

Although Netflix does not have the benefit of content aggregation or sports, it has a library of high-quality original content which may place it between the two genres – aggregators and broadcaster-led OTTs.

“Initially Netflix will also have a small share, but Netflix has the potential to reach the market share of broadcaster-based OTTs and move beyond that,” Taurani said.

However, Sodhi said that the introduction of Netflix’s ad-supported tier will have very limited impact on other players. Consumers will get more content choices, he added.

Netflix To Attract Premium Brands

India’s advertising market is expected to surpass the global average as it is expected to grow 16% in 2022 as against 8.7% globally, as per ‘Global Ad Spend Forecasts’ report by Dentsu.

While the market is expected to have a size of $11.1 Bn in 2022, primarily led by digital advertising which will grow 31.6%, the report forecasted significant growth in the OTT segment.

With a premium, metro-centric consumer, Netflix has an advantage in terms of onboarding premium brands as its audience base has a strong appeal for luxury brands, Taurani said.

It must be noted that in the past, Netflix has globally collaborated with various premium brands such as H&M, Nike, and Levi’s, albeit for promotional activities and not in-app advertising.

It must be noted that in the past, Netflix has globally collaborated with various premium brands such as H&M, Nike, and Levi’s, albeit for promotional activities and not in-app advertising.

To gain a competitive advantage in the Indian OTT market, Netflix already slashed prices in India and introduced mobile-only plans. Despite all the innovation, it is way behind Disney+Hotstar in terms of SVoD market share. While Disney+Hotstar leads the market with 50% share, Netflix has just 8% share, as per a report from OMDIA.

In terms of app downloads, Netflix is not even in the top five OTT apps in the Indian market, according to a report from EY-FICCI. Hence, it remains to be seen if the ad-supported model will help Netflix get more users in the country or it will need to bring change in its content strategy as well.