India’s millennial-driven shared economy has led to a sharp surge in the growth of its coliving industry, which offers managed rental accommodations for working professionals and students.

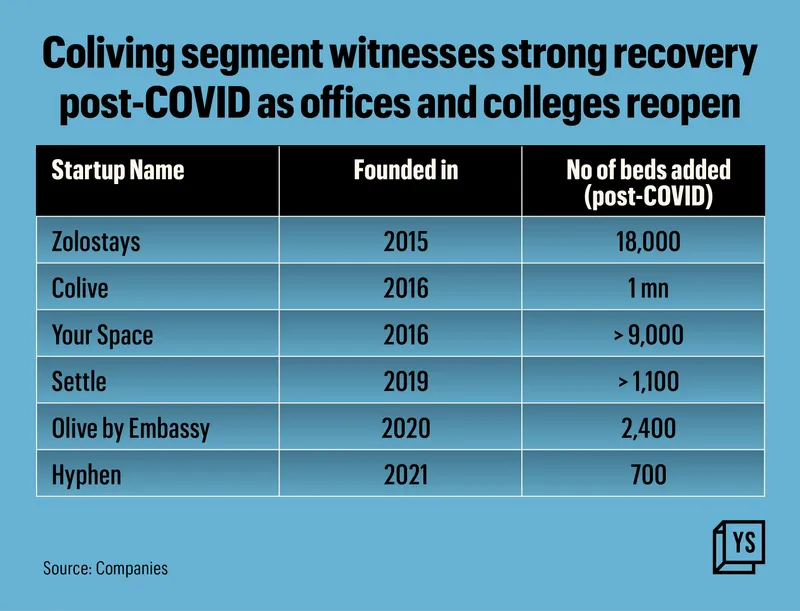

Between 2015 and 2021, the country saw the emergence of numerous coliving startups such as Zolostays, Colive, Your-Space, Isthara, Housr, Settl, and Hyphen, all offering the ideal home away from home.

However, COVID-19, the consequent lockdowns, and reverse migration from cities upended business. The sector was among the worst affected as offices and colleges went completely online for almost two years and demand dried up.

The coliving industry, which seemed to have come to a standstill in 2020, saw a slight recovery by the end of 2021. And now, the reopening of workplaces across India has breathed new life into the beleaguered sector, which seems poised to bounce back to pre-COVID-19 levels or even higher.

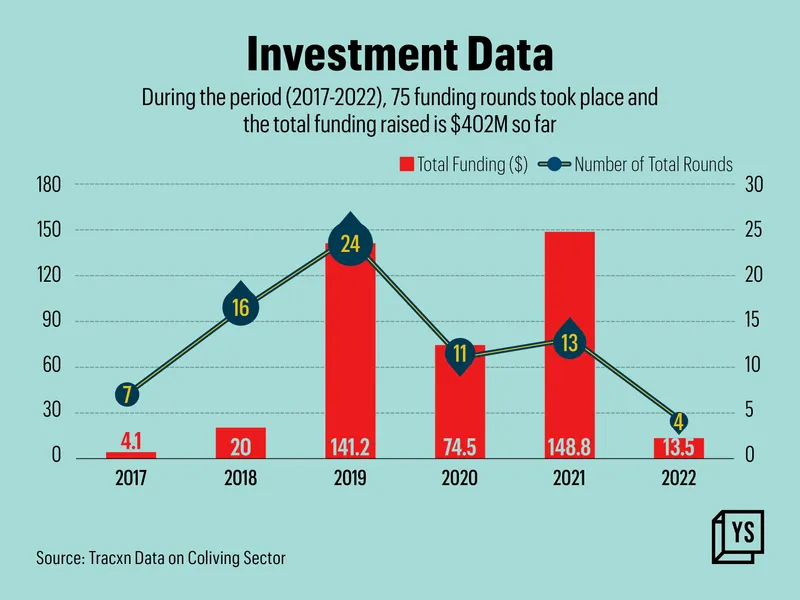

According to IBEF, India has more than 75 coliving companies, with the market expected to grow to 5.7 million by 2025 in terms of beds, from 4.19 million in 2019. The size of the sector across India’s top 30 cities is expected to grow two-fold and reach $13.92 billion from $6.67 billion at present.

The Future of Co-living in India, a white paper by professional services and investment management company Colliers, states that the coliving segment is expected to have 450,000 beds, mainly driven by organised players by 2024, as opposed to 210,000 beds by the end of 2021.

It estimates the current number of beds available across India at 6.9 million but says the demand is way more, especially if the burgeoning student population is considered, which is growing at a CAGR of 9.2% with more than 9.5 million students pursuing higher studies and requiring housing options.

Only 18-20% of students are provided accommodation by the university, which means the opportunity is large.

Across India, coliving startups are already reporting that the tide has turned.

Krishna Kumar, Co-founder and CEO of Coimbatore-based Isthara Parks, which offers coliving facilities for working professionals and students in Hyderabad, Bengaluru, Delhi-NCR, and Chennai, says Isthara entered the COVID-19 phase with 6,000 beds and today has over 24,000 beds, representing a 400% growth rate.

He says, “Single occupancy rooms are in high demand as the demand and preference for more personal space and privacy have increased after COVID-19.”

The coliving and food court operator, which is eyeing 10X revenue growth in the next three years, recently raised $10 million from Eagle Investments, a Dubai-based private investment company.

Elias Kawar, Managing Director of Eagle Investments, says, “Since the pandemic, we have witnessed significant growth in interest for the coliving sector. Rental housing solutions like coliving, combined with hospitality benchmarked brand hallmarks, can create a strong market opportunity in a growing market like India.”

Delhi-based student housing startup Your-Space also claims to have doubled capacity post-COVID-19, with 85%+ occupancy across markets.

“User behaviour has seen a strong online shift post-COVID-19. We introduced online bookings and have seen strong growth over the last academic session,” says Venayak Saran Gupta, Chief Revenue Officer, Your-Space.

Bengaluru-based coliving space provider Colive says it has expanded beyond coliving spaces post-pandemic to become the largest rental marketplace in India, connecting owners and tenants on a transactional platform for long-term rentals.

The millennial mindset that prefers ‘sharing’ to ‘owning’ has accelerated adoption, but the flexibility and savings coliving offers have popularised it among varied groups like corporates, entrepreneurs, working professionals, and students.

Rishi Sreedharan, Co-founder and CEO of coliving operator Hyphen (formerly Dwellingo), says demand has been resurgent post-pandemic. “We see this playing out across major Tier I markets in Q4. We are currently growing 250% month-on-month,” he says.

The new business model

Coliving players across the country were significantly affected by the pandemic, with many changing their business model during this time.

Isthara’s Krishna says, “Our new business model focused on more efficiently cost-structured contracts, revenue-sharing, and enhanced tech integration. We believe we are stronger than we were before COVID-19.”

Delhi-based Stanza Living, one of the first to tap the student accommodation market, diversified into rental accommodation for working professionals.

MD and Co-founder Anindya Dutta said the pandemic led to a recalibration in processes and frameworks.

Tech-driven managed accommodation platform Settl claims to have seen a faster and stronger bounce-back post-COVID-19 because of the “bundled offering” it provides, ranging from community experience, coworking/work-from-home setup, premium living infrastructure, housekeeping, and more.

“As markets open up, we have been able to achieve an average of 60% growth in quarter-on-quarter revenue post-pandemic,” says Abhishek Tripathi, Co-founder, Settl.

Post-COVID-19 growth numbers

Most coliving startups agree that demand has shot up post-COVID-19, with many saying it has risen higher than pre-pandemic levels.

Coliving provider Olive by Embassy was not very active during the pandemic, operating only three buildings then.

“Our growth skyrocketed post-COVID-19. We went from four to five buildings to signing up 25 buildings (with 2,400 beds) in Bengaluru. We started expanding to Goa and are now eyeing Hyderabad and Mumbai,” says Kahraman Yigit, Co-founder and CEO, adding that the majority of Olive’s properties have over 90% occupancy.

Your-Space has also seen a boost as students return to college.

“Revenue has grown 5X from pre-COVID-19 levels, owing to strong demand and increased capacity. Your-Space is on track to hit over Rs 150 crore ARR in the current academic session,” says Venayak.

The company has also seen nationwide expansion, growing from 3,000 beds to more than 12,000, and launching in two new markets.

Colive claims to have added nearly 18,000 properties and close to one million beds post pandemic.

Hyphen, which added close to 70% of its 1,000-bed portfolio after the pandemic, with the majority in Bengaluru, is set to launch another 20% in Hyderabad soon. It is also exploring multiple partnerships and expanding its partnership with edtech company Scaler Academy.

After the second wave, Settl added 21 properties (totalling up to 1,104 new beds)—14 in Bengaluru, five in Gurgaon, and three in Hyderabad.

Housr has also seen demand go up to pre-COVID-19 levels, with a greater demand for single-room occupancy. The startup has over 55 properties with 5,000 beds. It recently added Bengaluru as a location, following the acquisition of StayAbode, and aims to expand to 100+ properties and 12,000+ beds pan India by March 2023.

“The occupancy rate currently is the highest in the industry—95% of Housr rooms are booked. We expanded 6X in adding new accommodations during the COVID-19 period,” says Founder and CEO Deepak Anand.

The way ahead

Your-Space has joined hands with universities and colleges across India, and views them as critical stakeholders. The company plans to invest Rs 50-80 crore to expand in existing markets and launch in two new markets next year, doubling its bed count to 25,000 in the 2023-24 academic year.

Isthara has tied up with 30 colleges, including IIT Hyderabad, National Institute of Fashion Technology, Malla Reddy Institutions, PSNA College of Engineering and Technology, and JB Institute of Engineering and Technology. It is looking for more tie-ups to fuel its expansion. The startup also aims to expand to Noida, Pune, and Mumbai, and Tier II and III cities such as Kota and Jaipur.

“We plan to double the bed capacity to around 50,000 beds by 2025. We aim to achieve 10X revenue growth in the next three years,” Krishna says.

Colive has drafted a massive expansion plan to disrupt the rental residential market. Founder-CEO Suresh Rangarajan says, “Colive is set to expand to 10 metros in the coming year. We are also evaluating lucrative rental markets in the US.”

The startup is also launching Vanaprastha, a rental service for senior citizens in partnership with healthtech company Portea.

Meanwhile, Settl plans to add 2,000 beds in Hyderabad and Gurgaon this fiscal while expanding to Noida, Pune, and Chennai.

Housr aims to onboard around 12,000 more beds by FY23. It expects to generate 70% revenue from the coliving segment, and the rest from Housr Homes.

“We plan to expand to cities such as Chennai, Noida, Ahmedabad, Chandigarh, and Jaipur. We are also looking to raise anything between $20 million and $30 million in another round of funding in the next few months. The funding will help us to grow 6-7X by March 2024,” says Founder-CEO Deepak.

Rents are rising

As per Your-Space, rents have gone up after COVID-19, with its average price between Rs 15,000 and Rs 16,000, and varies across metro and non-metro cities.

Colive’s Suresh says rents have gone up by an average of 20-25%, compared to pre-COVID-19 levels. The demand for private rooms/larger studio apartments has gone up by 80%, with people wanting more space.

Sneha Choudhry, Co-founder and CBO of Zolostays, agrees that customer expectations and demand have soared. “We have 65% working professionals and 35% of students as of now, and have seen a 10% increase in rent post-COVID-19,” she says.

According to Settl, the average price is Rs 12,000-17,000 per bed per person post-COVID-19, 20% above pre-pandemic pricing.

Housr, meanwhile, claims to have increased its prices by 25% in the last six months. “There has been a 10% surge in demand. Several A+ and A-grade colleges have approached us to set up facilities near their campus,” Deepak says.

![Read more about the article [Funding alert] Ex-Ather Energy led Exponent Energy raises $5M in pre-Series A round](https://blog.digitalsevaa.com/wp-content/uploads/2021/12/FramesforImages5-1638949604669-300x150.jpg)