India’s direct-to-consumer (D2C) startup ecosystem has experienced an incredible boom in recent years. Last year, 77 D2C brands emerged in the country, and with $493 million, funding in the sector has more than doubled as compared to the previous years. A report by PGA Labs and Knowledge Capital mentioned that investors had put in $1.4 billion into D2C companies between 2014 and 2020. As more and more startups enter the space along with more customers, this number is bound to keep growing.

The growth of the D2C market and the subsequent funding it sees can be credited to the enablers. Speaking at the unveiling of the second set of 100 brands at YourStory’s ‘500 Challenger Brands’ initiative, Abhiroop Medhekar, Co-founder and CEO, Velocity, specified that ecosystem enablers such as shipping services providers, payment gateways, etc are making business operations independent in marketplaces and propelling the sector to success. Besides, he revealed that a relationship with customers has suddenly become key. Unlike the first wave of e-commerce in India on platforms like Amazon, Myntra, etc, brands are now realising that customers need to understand their values and know them personally.

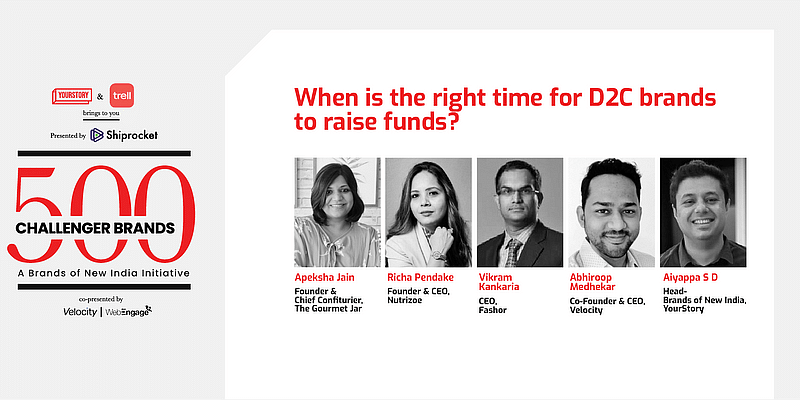

The panel discussion ‘When is the right time for D2C brands to raise funds?’ deep-dove further into the current D2C space and gave viewers an insight into the funding stories of some interesting startups in the space. Along with Abhiroop, the panel featured Apeksha Jain, Founder and Chief Confiturier, The Gourmet Jar; Richa Pendake, Founder and CEO, Nutrizoe; and Vikram Kankaria, CEO, Fashor.

The funding journey

The COVID-19 pandemic has opened new avenues for businesses and enabled them to forge relationships with customers online. Founded in 2020, India’s first women nourishment company Nutrizoe quickly scaled up during the pandemic. For brands like The Gourmet Jar, a premium condiments brand, the pandemic made them realise the importance of strengthening their online presence to counter competition.

“The brands that will get created in the next 10 years will be very different compared to the traditional brands that were created earlier,” said Abhiroop. A major factor for this change are the customers of today – ones who spend a significant amount of time online, get influenced by the people they follow on social media, and prefer buying things online. “That’s the clear shift that has happened,” he revealed.

Noticing the popularity of condiments during the pandemic, Apeksha decided to raise funds to counter the competition and strengthen their D2C model. “While raising funds, we realised that we are weak in the D2C space. We have a good offline presence, but we didn’t have access to our customers’ data as we were selling through offline channels. We were not aware of our consumer behaviour,” she revealed.

An investment banker turned entrepreneur, Vikram advised brands to secure funding for the next 12 months. “When you have short funds, it is like running with your hands tied,” said the CEO of Chennai-based online women’s apparel brand Fashor, adding that Fashor used their funding primarily in brand building and working capital. Brands need to raise money even when they don’t require it, feels Vikram, as it helps them do things they would otherwise not have done such as recruiting good talent. “Some people who are not comfortable about diluting capital need to remember that the value of the business is going to be much much higher if you’ve got higher capital,” he added.

While Fashor remained profitable during the pandemic, Nutrizoe saw strong client engagement and consistent growth during the period. Getting regular customer feedback encouraged Nutrizoe to work on new products for which they needed to raise capital.

For Richa, the tricky question was when to start the process of fundraising. She boxed them into two categories – when the brand is burning capital for market expansion and when you are seeking organic growth and profitability. “For us, funds were deployed in brand creation, operational setup, working processes, etc,” she said, adding, “We wanted to work on our physical presence and get strategic members on board.”

Finding the right investor fit

Recognising the kind of funding a brand needs and finding the right investor are important factors, the panel pointed out. Abhiroop explained that in case a brand needs capital for predictable spends like inventory, marketing, etc, which are low risk, diluting equity becomes an expensive proposition. This is where revenue-based financing can be helpful.

Revenue-based financing is based purely on the revenues they project and make. “What we have been seeing throughout our portfolio is that people have been taking a blended approach based upon the use case they have. In case they need capital for marketing and if they have established some history of their business, revenue-based financing could be a good source. In case they are just getting started, their own funds or angel funds would be a good idea. In case they are making long-term investments, which are more risky, equity investments are a good source,” he shared.

Abhiroop also added that entrepreneurs need to look at equity investors as long-term partners. Just like how a fund evaluates a brand, brands need to evaluate the fund too. New-age entrepreneurs must develop a point of view on which deals have worked out for the investors, and ones which haven’t. A reference check is essential in today’s date as these are long-term relationships and difficult to get out of.

Making a conscious decision to get the right strategic partner on board, Nutizoe’s Richa believes that brands need to treat their partnership with investors as a marriage, where both parties should be equally involved. “You need to check the synergy and compatibility,” she insisted. The investors brought in a lot of expertise in innovation, strategy, marketing benefits, etc for Nutrizoe which helped them crack some good cost-effective deals.

While Vikram feels that investors need to add value, Apeksha always looks for the same vision. The team met various investors to finally zero in on the one who shared her vision. “Ours is a small team and our investors became a sounding board for us. They also helped us with networking and connected us with an agency for marketing,” she revealed.

D2C brands will continue to experience new highs, said Abhiroop, but brands should not depend on capital investment and simply use it as an option. “If you are building a good business that is making money, you can get working capital from revenue-based financing firms like Velocity,” he signs off.