Amid the first national lockdown in March-April last year, Policybazaar came to know from three insurers on its platform that they would increase the premium rates on their term plans. As is the norm, the web aggregator sent out notifications to its customers, asking them to take advantage of the old rates before the new prices kicked in.

In May 2021, the Insurance Regulatory and Development Authority of India (IRDAI) slapped a fine of INR 24 Lakh on Policybazaar on three counts for sending those messages. Here are the reasons.

First, the company allegedly misled customers as not every insurer had increased premiums. Second, it had used ‘POLBAZ’ in the SMS header instead of its full name. (Ironically, the Telecom Regulatory Authority of India allows only six characters in such cases.) There was a third charge, but it was dropped later.

Globally, the standard practice for regulating internet companies is not exactly stringent, at least not initially. The regulators come knocking only when a tech startup manages to disrupt a sector. But Indian policymakers tend to tighten the noose around tech companies from the word go, be it an unpopular angel tax, FDI restrictions on ecommerce or a blanket ban on crypto.

It has been no different for the insurtech sector. Nobody denies that critical operations like insurance underwriting should be constantly monitored. But web aggregators like Policybazaar have been made to struggle as regulators kept a stranglehold on their online distribution pipeline.

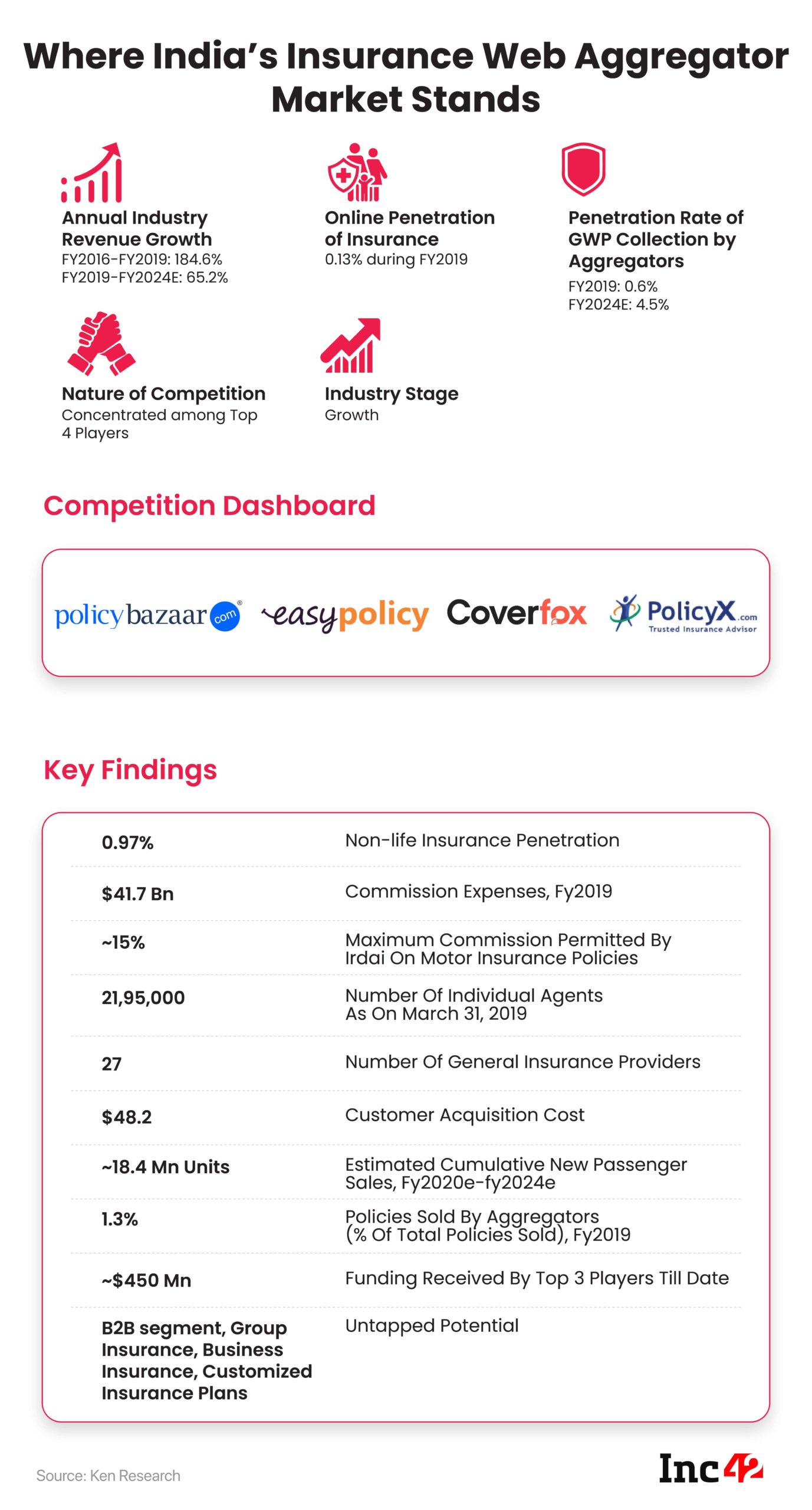

Take, for instance, how web aggregators like MyInsuranceClub, Easypolicy and Insuring India started operations during consumer tech’s revival in 2008-2011. But the regulatory onslaught stunted their growth. In 2011, IRDAI came out with a bunch of rules that determined how web aggregators should function and get paid (more on this later).

But the Policybazaar group has survived and thrived. The 13-year-old entity recently filed for an IPO to raise INR 6,000 Cr, reportedly at a $5 Bn – $6 Bn valuation.

According to Frost & Sullivan, PolicyBazaar was India’s largest digital insurance marketplace with a 93.4% market share based on the number of policies sold in FY20, when 65.3% of all digital insurance sales in India (by volume) was transacted through its platform.

Although fintech unicorns like Paytm, Acko, BharatPe, PhonePe and others entered the fray later on and started selling insurance and credit online, Policybazaar was operational when Indian policymakers and consumers did not trust online transactions.

Overcoming the trust issue was not the only hurdle, though. The influx of new players, backed by billionaire venture capitalists, compelled the business to burn a huge amount of cash and look for new avenues of growth. The group has done well in many departments to emerge as the most valuable insurtech startup in India, but it has also made some costly mistakes on the way. This is a story to take you through that journey.

Staying The Course For The Long Haul

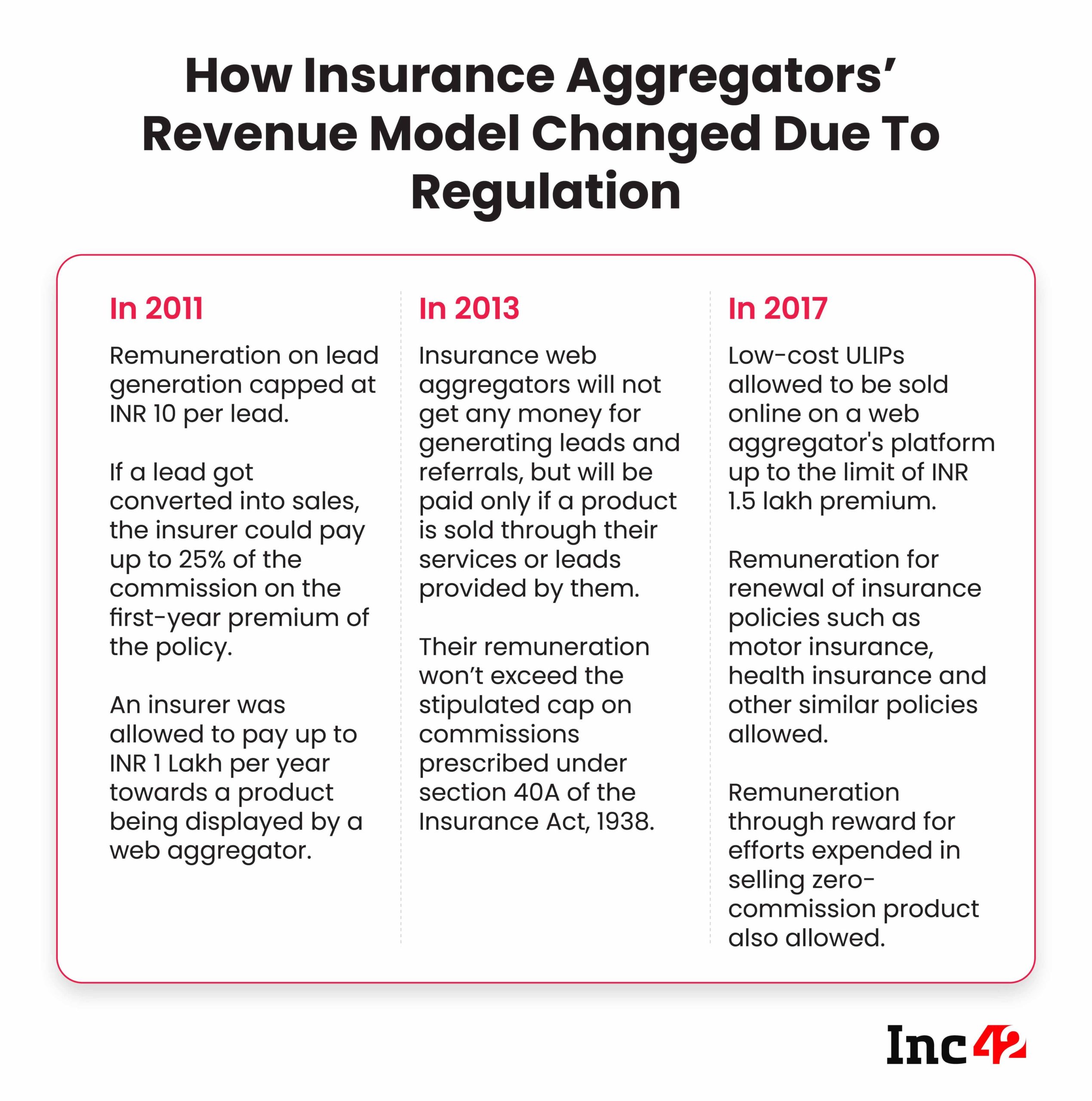

Until 2011, web aggregators in the insurance space had a simple business model. Users registered on these platforms by entering their contact details and browsed through the insurance policies listed there. This data was passed on to insurers who listed their products on the platform, and web aggregators were paid for lead generation.

But the IRDAI guidelines of April 2011 crushed this model by capping the amount a web aggregator could charge — it was INR 10 per lead. If the lead got converted into a sale, the insurer could pay up to 25% of the first year’s premium as commission to the aggregator. An insurer was also allowed to pay up to INR 1 Lakh per year for product display on a web aggregator’s platform.

These developments put paid to the lead generation model as the cost per lead amounted to INR 80-300 in 2011. The only way out for aggregators was to convert leads into sales by providing telemarketing services to the insurers.

But few had the cash or the foresight to build the sales machinery for the long haul.

A former Policybazaar executive, who does not want to be named, sums up the situation aptly. “Most of our competitors would go to an insurer and say: Give us some fantastic payouts, and we will sell for you. So, they would sell for one company but would soon go to a second company and move the customer. They intended to make as much money as possible in the short term. And customers did not come back when they realised it.”

Unlike its peers, Policybazaar was quick to change tack in sync with the regulatory change. Its revenue from lead generation was brought down to 20% by 2013, from 70% of the total revenue in 2010. Eventually, this revenue channel was shut down. At present, its major revenue streams include commissions on policy sales and earnings from post-sales activities outsourced by insurers.

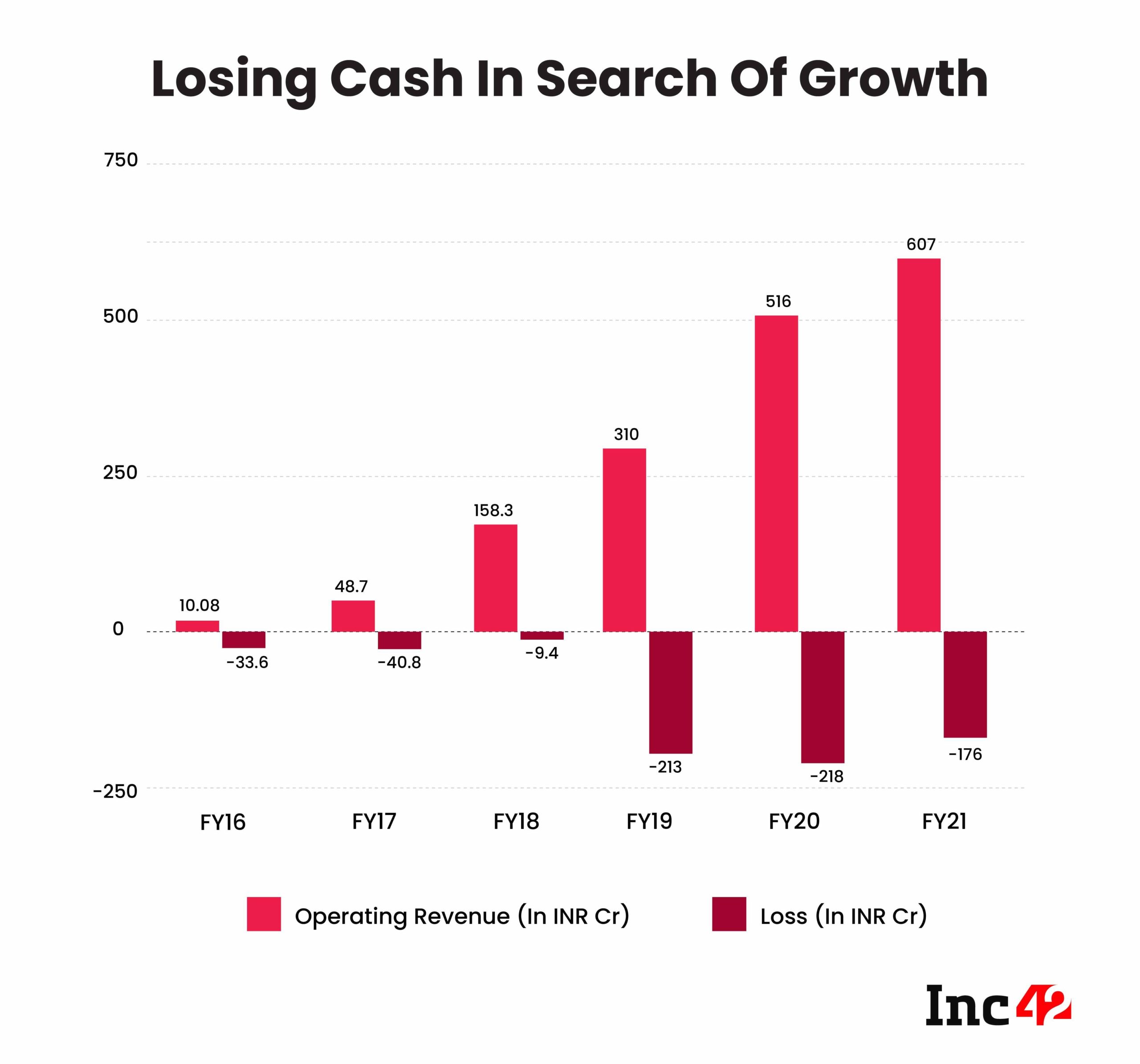

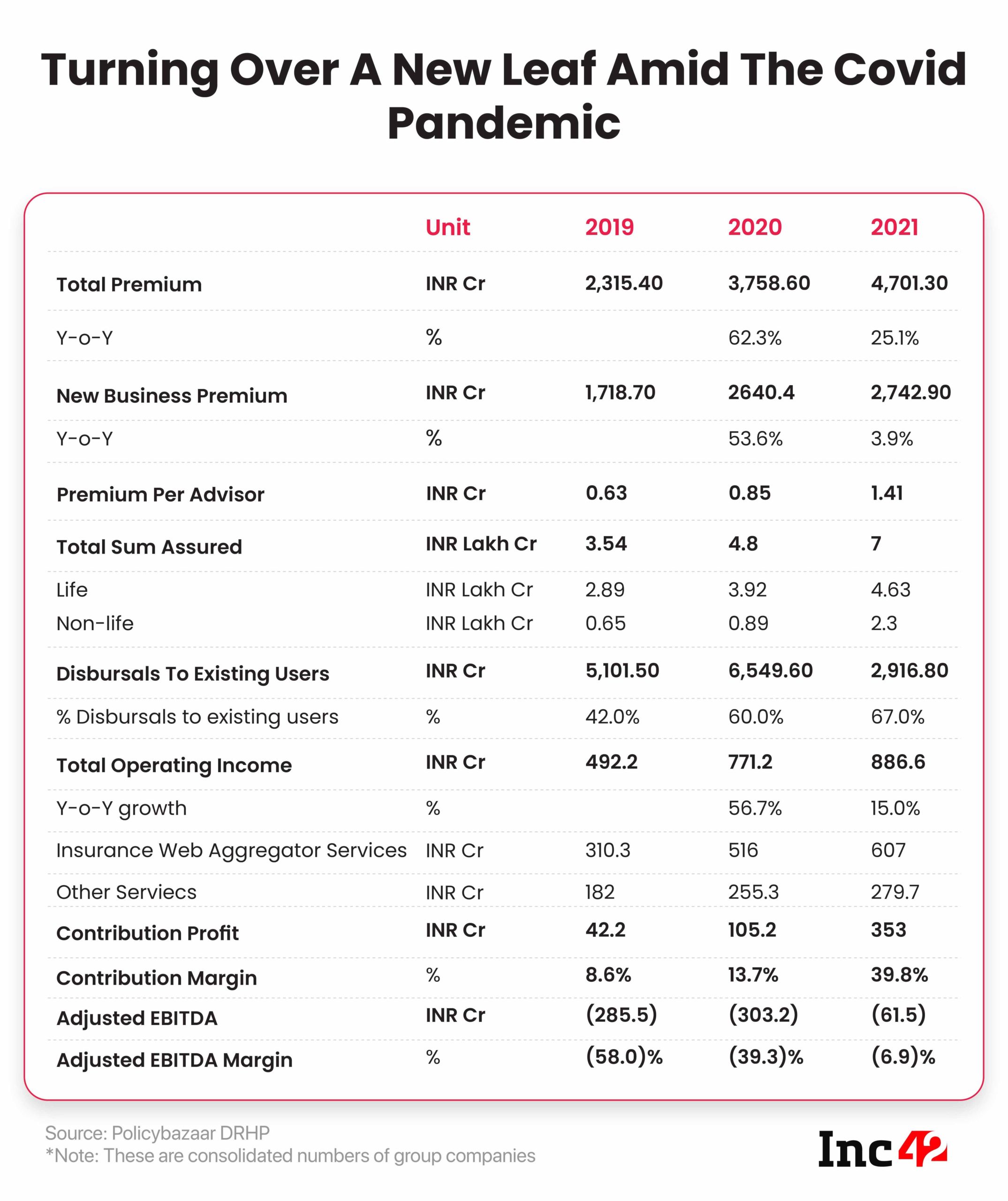

A quick look at the latest financials also validates the company’s shift in the revenue model. Out of the INR 516 Cr earned in FY20, INR 213 Cr (41.2%) came from commissions, INR 257 Cr (49.8%) from outsourcing, INR 45.7 Cr (8.8%) from rewards (incentives for achieving sales targets) and INR 8.5 Lakh from product listings.

In the pandemic-hit FY21, its revenue rose to INR 607 Cr, including INR 259 Cr in commissions, INR 299.4 Cr from outsourcing, INR 48.3 Cr from rewards and INR 2 Lakh from product listings.

“Also, most web aggregators adopted another shortsighted strategy. They partnered with private insurers and stayed away from public sector companies. Of course, it is easier to get the private players to sign on the dotted line. But around two-thirds of all insurance premiums in India still go to public sector companies. Hence, they are big revenue generators,” the former executive points out.

Patient Capital Has Powered Growth Trajectory

In hindsight, it may seem that Policybazaar took all the right decisions while players like MyInsuranceClub (angel investor-backed at the time, acquired by the Express Group in 2020), PolicyX (bootstrapped) and Unilazer Ventures-backed Easypolicy failed to keep up with its growth drive due to wrong choices. But the reason why Policybazaar could experiment with different business models for timely resets lay in the long rope and patient capital provided by the likes of InfoEdge, SoftBank and Tiger Global.

That is why the group was able to spend big consistently over the years to grow its insurance business and also ventured into new areas such as loan aggregation and OPD (outpatient department) services through Paisabazaar (launched in 2011) and DocPrime (2018), respectively.

In spite of these initiatives, the outcomes are sobering. The insurance vertical recorded standalone losses of INR 175.8 Cr in FY21, INR 218 Cr in FY20 and INR 213 Cr in FY19. The group saw consolidated losses of INR 150 Cr in FY21, INR 304 Cr in FY20 and INR 347 Cr in FY19.

Interestingly, the group had not always been a huge cash-burning machine. The combined losses of Policybazaar and Paisabazaar used to be in the range of INR 40-60 Cr annually before the Masayoshi Son-led SoftBank Vision Fund I stepped in with a $200 Mn (around INR 1,400 Cr at the time) cheque in 2018.

As the story goes, Policybazaar founder Yashish Dahiya had been courting the Japanese venture capital firm for some years. But he was told on an earlier occasion that his startup was “not crazy enough” for SoftBank to invest in. (In Silicon Valley parlance, ‘crazy’ is the quality of burning capital at a fast pace.)

He ultimately convinced the investor to back Policybazaar as it would be wiser to have SoftBank’s gunpowder on his side rather than with a competitor.

However, everything might not have been hunky-dory in this case. In an interview with FT last year, Dahiya said that the huge expansion pushed by investors, including SoftBank, was a “mistake” that led the company to operate at a loss.

To win more customers, Policybazaar sunk money into advertising and promotion. But users failed to materialise, and the company racked up huge losses.

To put things in perspective, Policybazaar targeted 10 Mn transacting customers by 2020 when it raised the SoftBank funding in 2018. The group believed that the target could be reached if its insurance business would grow at a compound annual growth rate (CAGR) of 80%. (This indicates it had around 3 Mn transacting users at the time.) However, the platform fell short of hitting the 10 Mn mark by August 2021 when it filed the draft red herring prospectus (DRHP). In the IPO prospectus, the company said that the platform had 9.6 Mn transacting customers.

“There was no… rational thinking behind things. We had a lot of capital, a lot of capital, and there was a lot of push from our investors,” Dahiya told FT last year.

Covid Helps Crack The Unit Economics Puzzle

The central pillar of Policybazaar’s unit economics is based on an apparently simple premise: Make more money out of a policy sale than what is spent on it. Although it sounds simple, it is anything but that.

For instance, even though the IRDAI guidelines say that a web aggregator can get a payout of up to 25% of the first year’s premium, a look at the financials shows that Policybazaar’s average take rate is much lower. While the commission earned by the web aggregator as a percentage of new business premium stood at 9.4% in FY21, it was just above 8% in FY20.

It means apart from negotiating better contracts with insurers, the only other strategy will have to be lowering costs on policy sales.

But this may not be feasible, as pointed out by a partner at a top management consultancy that closely works with the sector. Requesting anonymity, the person cites an example. “Take, for instance, the two-wheeler insurance business where the average ticket size of a transaction is INR 1,000, and a web aggregator’s cut is just about INR 60. Now, consider a telesales executive who is paid INR 30,000 a month. He will have to sell 500 policies per month to make up for his cost, which is extremely difficult.”

So, the secret of success is to make more sales where users need not interact with anyone and do the transactions themselves after looking at different products on the website.

“This is something Policybazaar has cracked in the two-wheeler insurance space as most of these policies are bought unassisted. If a prospective policy buyer calls the company’s customer care, the agent on the other side refers him back to the website and its online chat. In fact, automation has helped increase the premium collected per telemarketer working for the company. From the numbers I have seen, even the unassisted purchase of car insurance has increased to one-third of all buys,” the management consultant adds.

The numbers validate the consultant’s observation. The metric of premium collected per telemarketer stood at INR 63 Lakh in FY19 and INR 85 Lakh in FY20. This metric shot up by 66% to INR 1.41 Cr in FY21. As a result, the web aggregator saw its unit economics improve rapidly. And the contribution margin rose from 8.6% in FY19 and 13.7% in FY20 to 39.8% in FY21.

The contribution margin tells us about the health of a company’s unit economics. It is the profit margin earned on selling a policy minus customer acquisition and operating costs.

The automation part also underscores the typical outcome of the Covid times when digital adoption was all the rage across the tech startup ecosystem, and customers embraced it eagerly for the sake of safety and convenience.

It further shows that Dahiya has walked the talk after conceding last year that burning marketing dollars was not accelerating the business growth. Interestingly, the group’s consolidated promotional expenses came down drastically, from INR 445 Cr in FY20 to INR 368 Cr in FY21. In fact, the insurance vertical ramped up its marketing spend amid the pandemic. It did not hit the unit economics, though, as it got a bigger bang for the buck, with the revenue from the segment rising 20%.

But why did the company indulge in wasteful promotional expenditure until recently?

This question should have been addressed by Policybazaar’s IPO prospectus, or DRHP. But the company chose to reveal only its consolidated financials in the document. So, we had to head back to the financials of the individual group companies — namely, the two entities that run Policybazaar (the insurance aggregator) and Paisabazaar (the loan marketplace) — to understand what is happening.

We found that the large promotional and advertising spending cut mentioned above involved Paisabazaar, and the expenditure on this account came down from INR 159 Cr in FY20 to INR 48 Cr in FY21.

And this raises a key question: Why is it stepping off the gas in the online credit market?

Forks Appear In The Road Ahead

Talking about the loan marketplace, the IPO prospectus says: Paisabazaar was India’s largest digital consumer credit marketplace with a 51.4% market share, based on disbursals in fiscal 2020. Paisabazaar is also widely used to access credit scores, with approximately 21.5 Mn consumers cumulatively having accessed their credit score through our platform as of March 31, 2021.

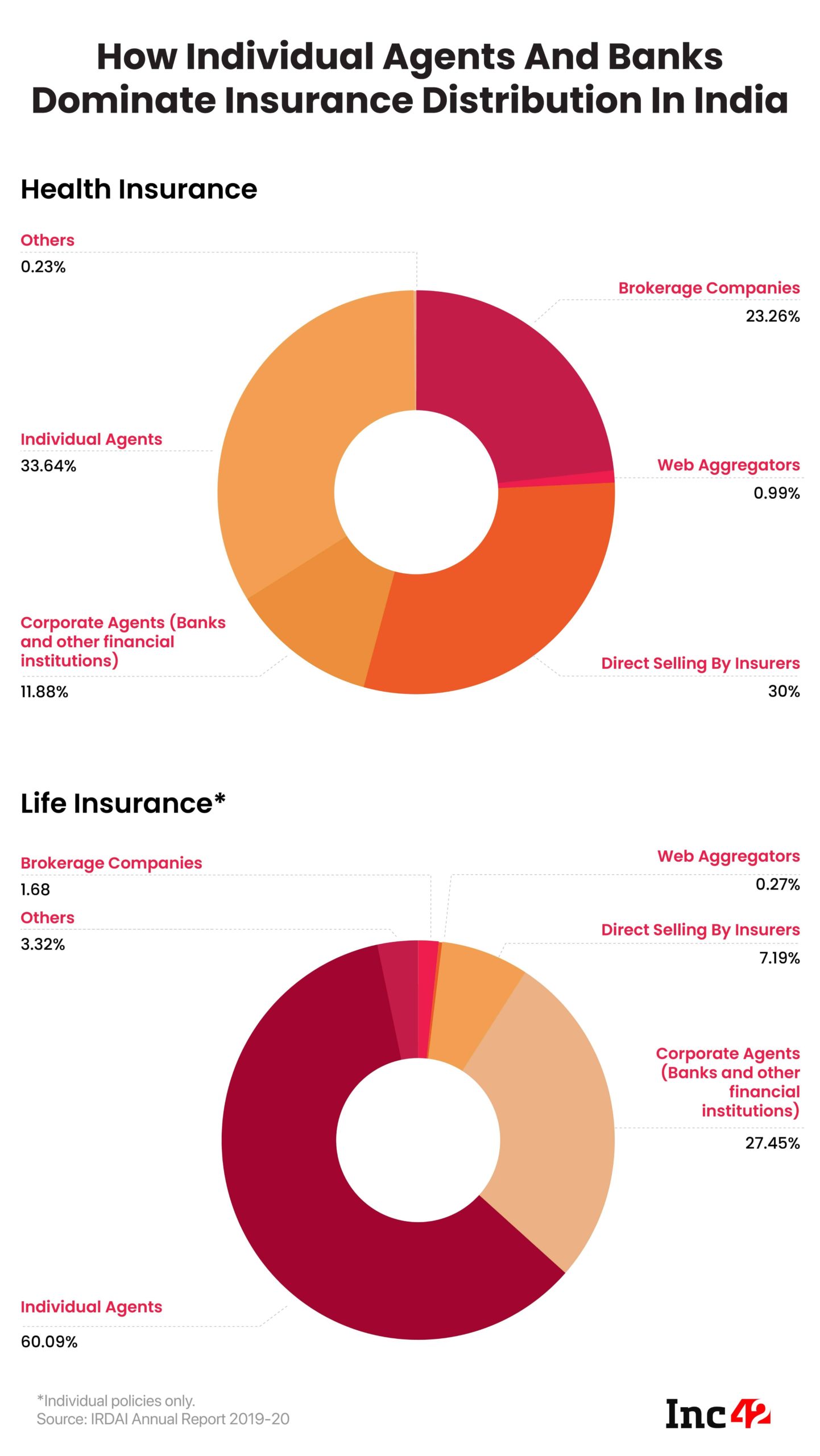

But holding on to the market share is becoming very expensive, with almost every fintech company getting into some form of lending. It is true that both insurance and formal lending are yet to reach a large mass of the underserviced Indian population. But there is a critical difference between the two sectors.

“The quick rise of payday lenders in India, often with dubious track records and collection practices, shows that people will take loans from anyone willing to lend. But that does not hold true for insurance buying. A consumer will only go to an insurer or a seller he trusts. For this reason, building a moat in the lending business is more difficult than insurance,” says a financial services industry veteran who does not want to be named.

According to him, the choice made by Policybazaar is quite simple: Control cash burn in the lending market where fintech startups are getting funded left, right and centre. Instead, focus on going deeper into the insurance market.

This explains why the group is now planning an omnichannel strategy and doubling down on expanding its insurance business overseas. It intends to utilise INR 375 Cr from its IPO to expand the consumer base, including offline presence; INR 600 Cr for strategic acquisitions and investments and INR 375 Cr for expanding its presence outside India besides using a portion of the IPO money for general corporate purposes.

After receiving an insurance broking licence in April this year, which will allow it to put agents on the ground and expand revenue streams, Policybazaar set up 15 physical offices by July. And it plans to develop up to 200 physical retail outlets by the end of FY24.

Will these physical touchpoints translate into a higher growth trajectory? A former web aggregator founder, who does not want to be named, is not convinced. “If you look at the tech companies going for IPOs, almost everyone is giving a physical tint to their businesses. I have seen this movie playing out for two decades now. Remember the MakeMyTrip points of sale that seemed to have come up in every nook and corner around its listing? Somehow, I have not spotted those for a long time,” he quips.

Of course, it will not be possible to win in the insurance market through physical touchpoints alone. However, one cannot ignore that segments like health and life insurance are hugely underpenetrated markets, and their distribution has remained the preserve of individual agents and banks. It will be interesting to see if a new-age fintech company can break through their moat.