The year 2021 has been a landmark year for venture capital funding in India. The total funding raised by Indian startups in 2021 has been at a record level of $42 Bn across 1,583 deals.

In total, the year recorded 108 deals worth more than $100 Mn. Over the year, 42 Indian startups entered the unicorn club, taking the total tally to 86, with four more additions in 2022, the India’s unicorn club now has 90 unicorns.

In 2021, seed-stage funding in India crossed $1 Bn for the first time with total funding of $1.1 Bn with an average deal size of $2.3 Mn.

Even of the IPO front, India saw the listing of 11 startups, including FSN- Ecommerce (Nykaa), Zomato, PolicyBazaar among others, among others that give high rating value exits to VCs.

This trend is very encouraging and assuring for the VC investors. It indicates that the coming year would be exciting from the point of view of venture funding for startups. The increase in VC confidence is apparent, with the launch of venture capital funds worth more than $6.2 Bn in India in 2021 alone.

All this activity augurs well for the startup ecosystem in India, and venture capital will play a very significant role in the growth of startups in India.

In this article, we will discuss venture capital as a source of funding for startups and how startups can prepare to approach a VC firm and seek funding.

What Is Venture Capital Funding?

Venture Capital is a form of funding, or capital invested in a company or a startup, at various stages of business in exchange for the company’s equity capital. The funds provided by the venture capital firms are used by the startups for expansion, scaling up, product development, etc., depending on the business’s stage.

Giant global corporations like Google, Facebook, and Apple were once startups supported by venture capital firms. In India, companies like Paytm and Ola were able to reach high scale with the support of venture capital investments.

What Are Venture Capital Firms?

Venture capital firms or VC firms are investment firms that provide financing and guidance to early-stage to late-stage businesses and startups. They raise funds from limited partners and invest in promising private companies. VC Firms typically take a stake in the company for a limited time.

The role of venture capital firms mainly comes in the second stage when the innovative idea of the startup founders needs support to grow, upscale, become commercially viable. The startups are finally sold to a big corporation or listed on a public exchange as an equity IPO.

Thus, a venture capitalist invests in an entrepreneur’s idea and nurtures it for some time. The investor then exits with the help of an investment banker, cashing in a good return, which is usually not possible from traditional investment assets.

Why Should Startups Seek Venture Capital Funding?

The structure and rules of the capital markets make it difficult for a new business to seek capital. Regulations constrain investment banks and public equity operating practices to safeguard the investor.

Banks lend money to startups to the extent of hard assets, and in today’s information-driven economy, startups do not possess hard assets. The risk in startup funding is high and the banks’ mandate; therefore, venture capital financing is a sort of refuge for startup founders.

Benefits of VC funding

The VC funds enable the business by adding fuel to the fire. Startups can utilise the funds received from a VC for helping expansion to other markets (cities, countries) and differentiation or diversification of product lines depending on the current stage of the business. While these are direct benefits, some indirect benefits that businesses accrue when they get VC funding are:

- Industry Expertise: Most venture capital firms provide funding and do a lot of hand-holding for the startups, which may prove to be very useful to the founders.

- Support: Support in complex areas like legal compliance, taxes, and human resources can prove very helpful in the early stages of the business.

- Network Expansion: The founders can benefit from the vast network of VC investors after funding.

However, the startup seeking VC funding also has to bear the weight of increased scrutiny, loss of control, and added stress. But in the long run, benefits outweigh these trivial costs, which only save the startup.

Stages of Venture Capital Funding

VC firms in India are investing from early rounds, including seed rounds. Leading firms have set up early-stage accelerators that provide seed funding to startups.

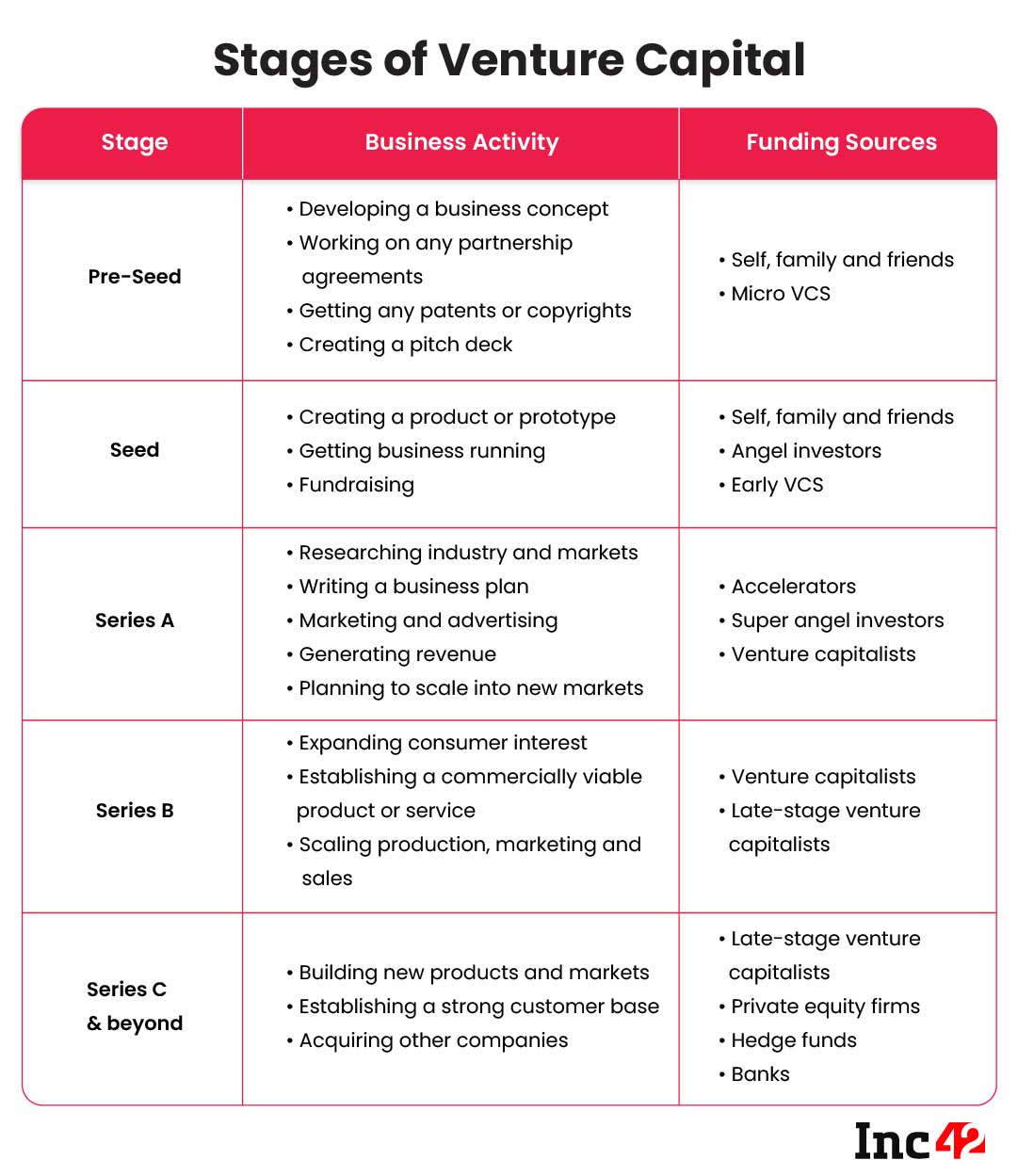

Overall, VC funding has the following stages:

- The pre-seed stage: Product or service prototype finalisation stage; VCs are generally not interested at this stage. Founders have to arrange funds from their own resources or angel investors, angel networks among others.

- The Seed Stage: The founders have to prepare a pitch deck and demonstrate to the VCs that the idea is viable for development into a profitable company.

- Series A Funding: This stage is typically the first round of venture capital financing, and it is here that venture capital investors get interested. The founders have to demonstrate the potential of their business in terms of product mix with growth strategies.

- Series B Funding: The startup is ready to scale at this stage. The venture capital funding supports the production of goods, marketing, and sales efforts. While the investors look for potential in Series A, here they are more interested in the performance.

- Series C Funding: Series C funding is when the company is on a growth path. The business model is tested and well established, and additional venture capital funding is required to develop new products and enter new markets.

After this stage, the venture capital investors look for an exit, either by sales or listing on a public equity exchange.

How To Get Venture Capital Funding In India

The guidance, mentorship, and support that come with VC funding can be very valuable for the startup founders, but raising venture capital funding in India is far from easy. As a startup founder, you need to know the working of a venture capital firm.

A venture capital firm has limited partners who provide funds:

- General partners who operate those funds,

- Associates who manage the relationship with entrepreneurs,

- And analysts who identify, analyse, and evaluate the funding opportunities.

Striking a good deal with the right VC investor requires the entrepreneur to have sound tactical knowledge, proper market study, and the right ways to attract the investor to your business potential.

The factors that an investor needs to keep in mind are:

- The right VC firm: The entrepreneur needs to shortlist a VC fund whose expertise lies in the company’s sector. To do this, the entrepreneur has to do their homework to identify the right VC firm.

- Making the right first impression: To secure funding, the founder needs to convince the Venture Capitalist about the business’s potential, with a sound business plan detailing the idea, potential, and strategy.

- Timing of Approach: With the pitch ready, the next step is to approach the analysts and associates of the venture capital firm and present their business plans and projections to secure funding.

- Practicing Healthy Caution: While explaining the business idea to VC investors, the founder needs to exercise caution. If the deal does not materialize, the idea may get leaked, which may be harmful to the company’s initial growth.

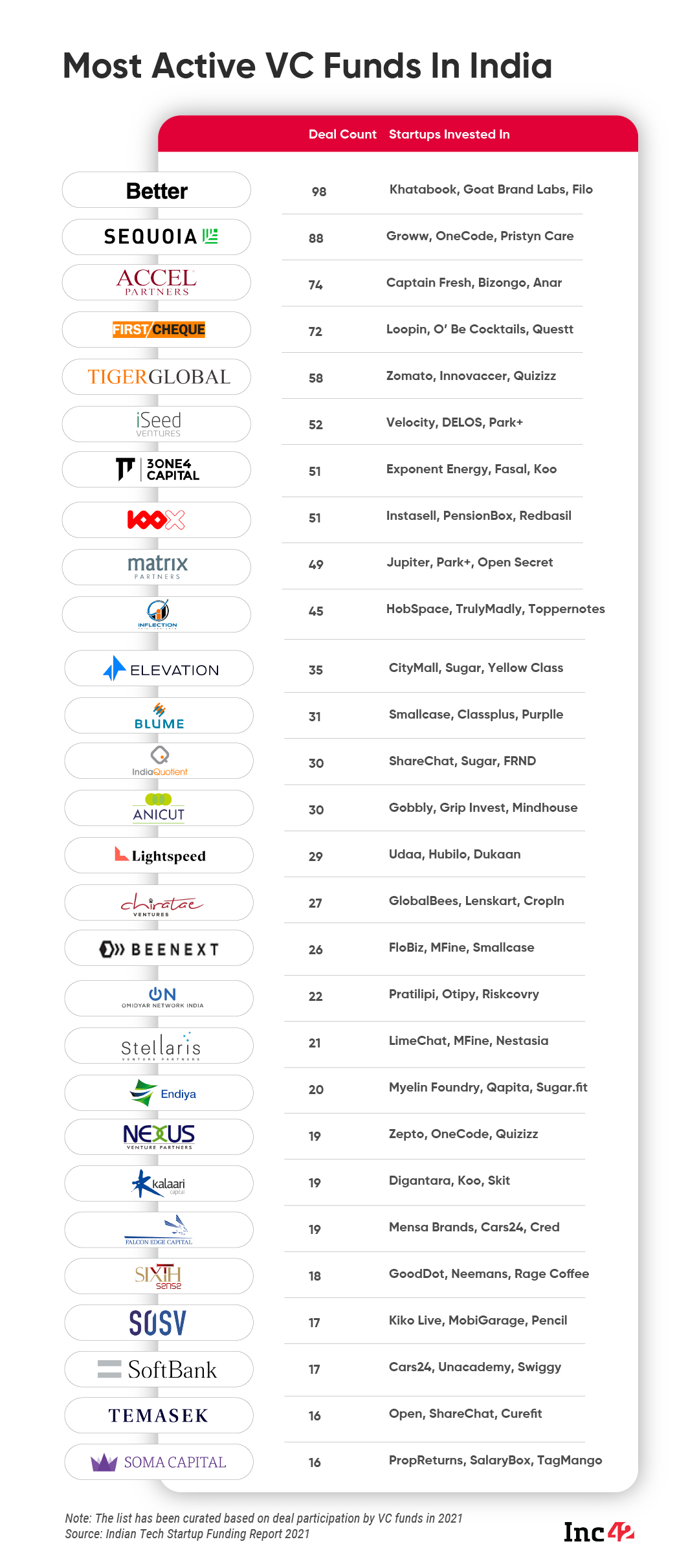

The List Of Most Active Venture Capital Funds In India

In India, there are hundreds of active venture capital firms that back startups. Besides native firms, there are several global venture capital firms that have been backing the Indian startup growth story. Here are the top 5 most active VC Funds in India –

- Better Capital

- Sequoia Capital

- Accel Partners

- FirstCheque

- Tiger Global

Primarily, there are two types of venture capital which we have presented in the tables below.

The post Decoding Venture Capital Funding For Indian Startups appeared first on Inc42 Media.