Quick commerce increases our addressable market, the potential profit pool and also makes our business more defensible: Zomato CFO

The acquisition of Blinkit will help increase Zomato’s hyperlocal delivery fleet utilisation and reduce the cost of delivery, the CFO said

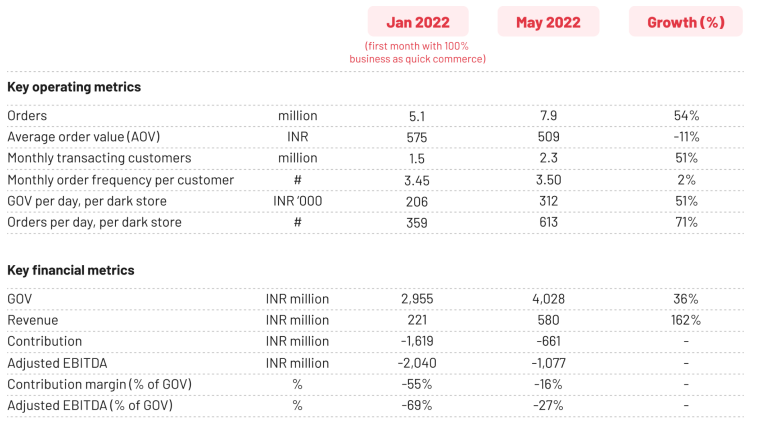

While all key business metrics of Blinkit, shared by Zomato, showed an increase during the January-May period, its average order value fell by 11% to INR 509 in May 2022

In March 2022, there were whispers of foodtech giant Zomato acquiring quick commerce startup Blinkit. Amidst this, the struggling Blinkit received an investment of $100 Mn from Zomato. In the same month, Blinkit received a loan of $150 Mn from the food delivery startup, and reports said that a merger was on the cards.

Finally on Friday (June 24), Zomato announced that it will acquire Blinkit for INR 4,447 Cr in an all-stock deal.

“Quick commerce has been our stated strategic priority since the last one year. We have seen this industry grow rapidly both in India and globally, as customers have found great value in quick delivery of groceries and other essentials. This business is also synergistic with our core food business, giving Zomato the right to win in the long-term,” Zomato founder and CEO Deepinder Goyal said.

In a blogpost, the foodtech startup’s CEO and CFO Akshant Goyal explained the reasons behind the acquisition of Blinkit, the scope of the quick commerce segment, and much more.

Why Blinkit?

The listed unicorn believes that the quick commerce segment is a natural extension of its food business. Tapping into the hyperlocal aspect of the segment, Zomato is aiming to increase the customer wallet share spent on the platform and to shore up engagement from its users.

“Quick commerce increases our addressable market, the potential profit pool and also makes our business more defensible…This will help increase our hyperlocal delivery fleet utilisation and reduce the cost of delivery,” Akshant said.

The two companies will continue to operate separately and Blinkit founder Albinder Dhindsa will continue to lead the team at Blinkit. As part of the deal, Blinkit shareholders will get a 6.9% stake in Zomato.

Meanwhile, explaining its decision to acquire Blinkit and not build another brand, Akshant said that the quick commerce startup’s proprietary tech platform, scale of business, relationships with third-party brands as well as the network of warehouses made it a compelling buy.

Besides, the talent pool of Blinkit was another reason for the acquisition.

How Is Blinkit’s Business Doing?

Blinkit pivoted from a next-day grocery delivery business model to quick commerce model in January 2022. Since then, its key metrics have shown a healthy growth, barring the average order value (AOV).

As per data shared by Zomato, Blinkit’s AOV fell by 11% to INR 509 in May 2022 from INR 575 in January 2022.

The number of orders processed by Blinkit grew 54% to 7.9 Mn during the period, while monthly transacting customers also soared 51% to 2.3 Mn in May.

On the other hand, monthly order frequency per customer grew marginally by 2% to 3.5 in May from 3.45 in January.

Gross order value also surged 36% to INR 4.02 Bn in May, while the quick-commerce startup’s revenue grew more than 162% to INR 580 Mn.

Blinkit is also doing particularly well in certain markets. Its GOV in Gurugram was equivalent to approximately 63% of Zomato’s food delivery GOV, Zomato said.

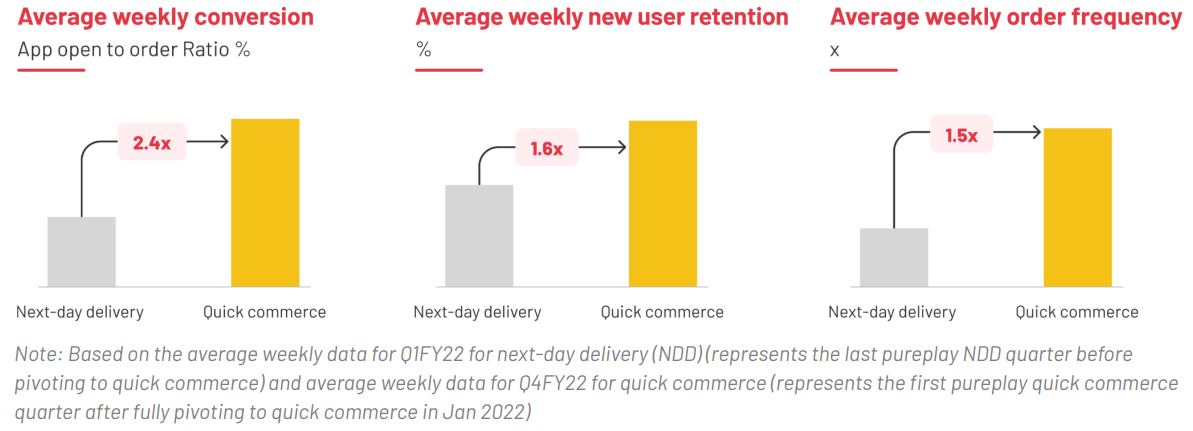

Blinkit’s average weekly new user retention rose 1.6X in Q4 FY22 in the quick-commerce segment as compared to the period when it operated the next-day delivery model. Average weekly order frequency also increased 1.5X as compared to the next-day delivery model operational.

“…all of this improvement in customer facing metrics is not driven by subsidies, as may be the perception. In fact, customers are now being offered lesser discounts by the sellers as compared to the next-day delivery model earlier. There is also a levy of delivery charge which was not necessarily the case earlier,” Goyal said while highlighting the growing demand for quick deliveries.

A Long Walk To Profitability

The foodtech company said that it has good visibility on various levers for achieving profitability in the quick commerce business.

Zomato said it has seen marked improvement in Blinkit’s unit economics in the last five months, adding that many dark-stores are inching closer to contribution break-even. Without giving a clear timeline for Blinkit’s profitability, Akshant said that “a meaningful number” of the dark stores should become contribution break-even within the next year or so.

“Overall profitability will also be a function of how aggressively we expand and open new dark stores. It is possible that this business becomes Adjusted EBITDA break-even in less than 3 years. This is an educated guess at this stage and not a guidance,” he added.

On Zomato’s profitability timeline, he said it wouldn’t be affected by the acquisition.

“In fact, we believe we will now get to profitability within the same timelines (as we thought last year) but with a much larger addressable market. We are also not envisaging any further capital raise to get to profitability in this timeframe,” Akshant said.

Blinkit will compete with deep-pocketed players like Swiggy Instamart, Zepto, and Dunzo, in the quick commerce segment.

According to a RedSeer report, India’s quick commerce segment was estimated to be a $30 Mn market in 2021 and is projected to grow up to 15X to reach $5 Bn by 2025. The number of online shoppers in the country are also expected to grow at a CAGR of 28.5% to reach 350 Mn by FY2025. These two factors are likely to drive the next level of evolution of the space as competitors fight for a big pie of the space.

![Read more about the article [Turning point] How a visit to Thailand markets helped these entrepreneurs build ecommerce unicorn Zilingo](https://blog.digitalsevaa.com/wp-content/uploads/2021/06/Zilingo1-300x150.jpg)

![Read more about the article $44 Mn Raised Across 18 Deals [May 3-8]](https://blog.digitalsevaa.com/wp-content/uploads/2021/05/FUNDING-1200x628-1-300x157.jpg)