CEO Goyal also owns more than 368 Mn stock options that vest over the next six years

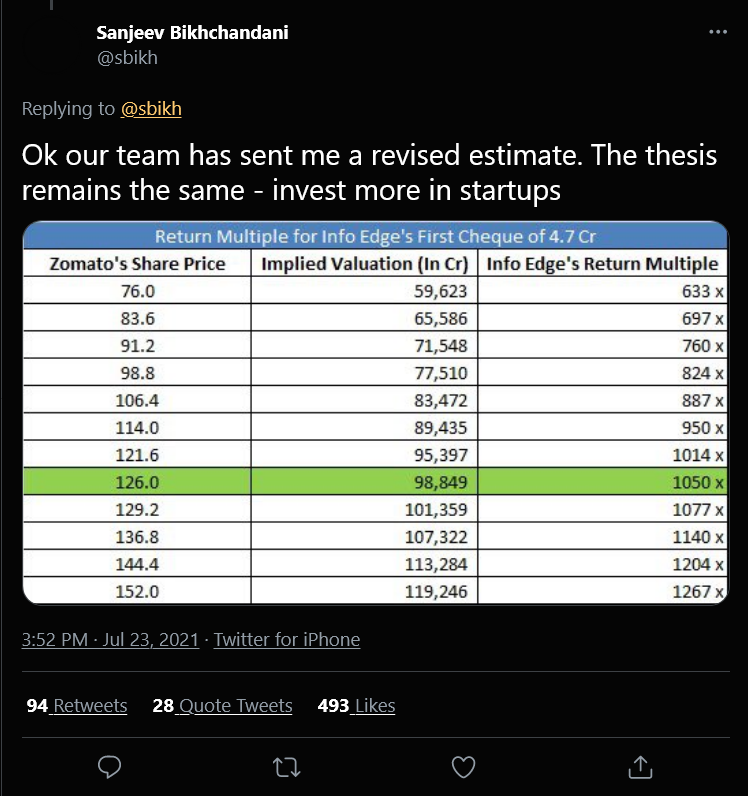

Info Edge had invested INR 4.7 Cr in the company, which has seen over 1000X returns today at the current stock price

On its first day on stock exchanges, Zomato also touched a market cap high of $13.3 Bn or INR 1 Lakh Cr

Restaurant aggregator and food delivery giant Zomato’s stellar debut on the stock exchanges brought in a 66% jump in the share price, which took cofounder and CEO Deepinder Goyal close to the vaunted billionaires’ club. Goyal’s 4.7% stake in Zomato is estimated to be worth $650 Mn, and besides this the CEO also owns more than 368 Mn stock options that vest over the next six years. These shares will double his stake in the company at the time of exercise, and taking his net worth over well over $1 Bn at the current stock price.

On its first day on stock exchanges, Zomato also touched a market cap high of $13.3 Bn or INR 1 Lakh Cr. The price premium was far ahead of the 25-30% premium that analysts were expecting.“We are going to relentlessly focus on 10 years out and beyond, and are not going to alter our course for short term profits at the cost of long term success of the company,” Goyal said in a letter to stakeholders ahead of the official listing.

“The tremendous response to our IPO gives us the confidence that the world is full of investors who appreciate the magnitude of investments we are making, and take a long term view of our business,” he added.

Among the early investors in the company, InfoEdge is also likely to see tremendous returns from its investment in the foodtech company. Info Edge had invested INR 4.7 Cr in the company, which has seen over 1000X returns today at the current stock price, as per Sanjeev Bikhchandani, InfoEdge founder. “Congratulations and very well done team Zomato and Deepinder. Great things take time to build. Thank you for making us look like smart investors,” he tweeted.

However, Professor Aswath Damodaran, a finance professor at New York University who is popularly referred to as the ‘Wall Street’s dean of valuation’ sounded a word of caution with a blog post published in lead up to the Zomato listing. According to Damodaran’s calculation, even assuming that Zomato will be the market leader in India’s food delivery sector with 40% market share, the company’s stock price should not be worth more than INR 41.

![Read more about the article [Funding Galore] From Tata 1mg To ZippMat — $225 Mn Raised By Indian Startups This Week](https://blog.digitalsevaa.com/wp-content/uploads/2022/09/Funding-Social-1-1-300x157.png)