According to a new report by fintech startup PhonePe and the Boston Consultancy Group (BCG), India’s digital payments market is set to triple in the next half decade. The study states that the country saw $3 trillion in digital payments processed in 2021, and that number is set to hit $10 trillion by 2026.

According to the study, 40 percent of all payments in India were made digitally in 2021. However, this does not include payments made for financial services, corporate business payments, or government payments.

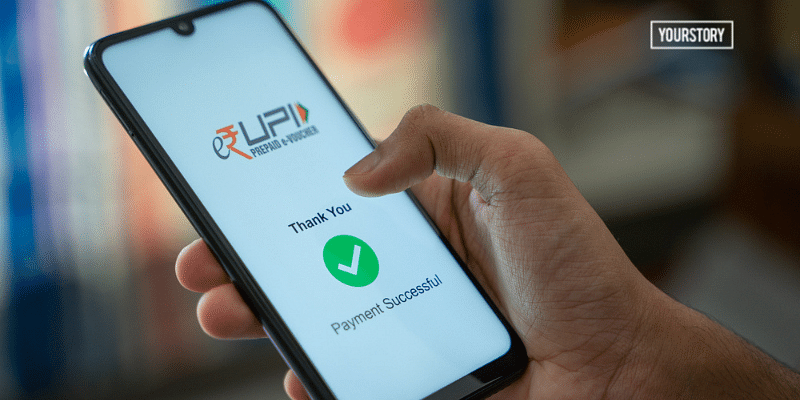

The study states that India’s united payments interface (UPI) technology has supercharged the industry, especially when it comes to peer-to-peer (P2P) and low amount peer-to-merchant (P2M) transactions.

“UPI saw about a nine-fold transaction volume increase in the past three years, from five billion transactions in FY19 to about 46 billion in FY22, accounting for more than 60 percent of non-cash transaction volumes in FY22,” the report said.

Quick response (QR) codes are responsible for the merchant growth, with the study stating that the number of merchants who have a QR code payments system has increased from 2.5 million five years ago to 30 million today. As such, P2M transactions on UPI have grown from 12 percent in 2018 to 45 percent in 2021.

The report stated that the biggest challenge to the continued growth of digital payments in India are the extensive know-your-customer (KYC) norms needed to onboard new users and merchants.

![Read more about the article [Weekly funding roundup Sept 9-15] Venture capital inflow continues to rise](https://blog.digitalsevaa.com/wp-content/uploads/2023/08/funding-roundup-LEAD-1667575602969-300x150.png)