The notice has been served to the company Zanmai Labs Pvt Ltd, legal name of WazirX and its directors Nischal Shetty and Hanuman Mhatre

Users of WazirX received incoming crypto worth INR 880 Cr from Binance accounts and transferred out cryptocurrency worth INR 1,400 Cr to Binance accounts that are not on blockchain, alleges ED

The agency has also accused the company of being involved in the ‘Chinese-owned’ illegal online betting applications

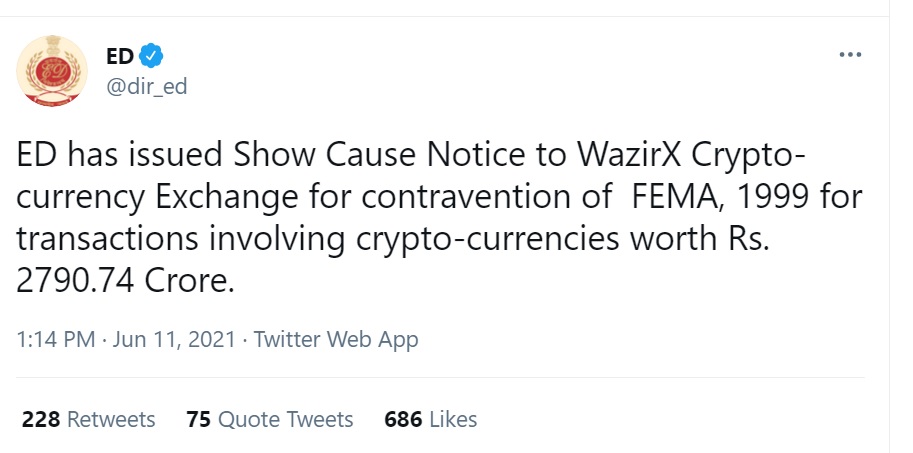

Indian crypto exchange WazirX (a Binance subsidiary), has been served a show-cause notice by the Enforcement Directorate for allegedly violating The Foreign Exchange Management Act, 1999 in transactions involving cryptocurrencies worth INR 2790.74 Cr.

After completing the investigation, the central agency has issued a statement saying “It was seen that the accused Chinese nationals had laundered proceeds of crime worth about INR 57 Cr by converting Indian Rupee (INR) deposits into cryptocurrency Tether (USDT) and then transferred it to Binance (exchange registered in the Cayman Islands) Wallets based on instructions received from abroad.”

The notice has been served to the company Zanmai Labs Pvt Ltd, the legal name of WazirX, and its directors Nischal Shetty and Hanuman Mhatre.

Responding to the allegations, founder and CEO Nischal Shetty said,

“WazirX is yet to receive any show cause notice from the Enforcement Directorate as mentioned in today’s media reports. WazirX is in compliance with all applicable laws. We go beyond our legal obligations by following Know Your Customer (KYC) and Anti Money Laundering (AML) processes and have always provided information to law enforcement authorities whenever required. We are able to trace all users on our platform with official identity information. Should we receive a formal communication or notice from the ED, we’ll fully cooperate in the investigation.”

The agency has also accused the company of being involved in the ‘Chinese-owned’ illegal online betting applications.

Founded in 2017, WazirX was acquired by global crypto exchange Binance in 2019. Since then there has been an increased synergy between the two. While Binance started offering crypto in INR, WazirX recently launched NFT based on Binance Smart Chain and is also leading the P2P arm of Binance.

ED in its statement has also alleged that since WazirX allows a wide range of transactions with cryptocurrencies, including their exchange with INR and vice-versa, exchange of cryptocurrencies, P2P transactions and even transfer/receipt of crypto currency held in its pool accounts to wallets of other exchanges, which could be held by foreigners in foreign locations.

The agency has further stated that in the period under investigation, users of WazirX via its pool account, have received incoming cryptocurrency worth INR 880 Cr from Binance accounts and transferred out cryptocurrency worth INR 1,400 Cr to Binance accounts. However, none of these transactions are available on the blockchain for any audit or investigation.

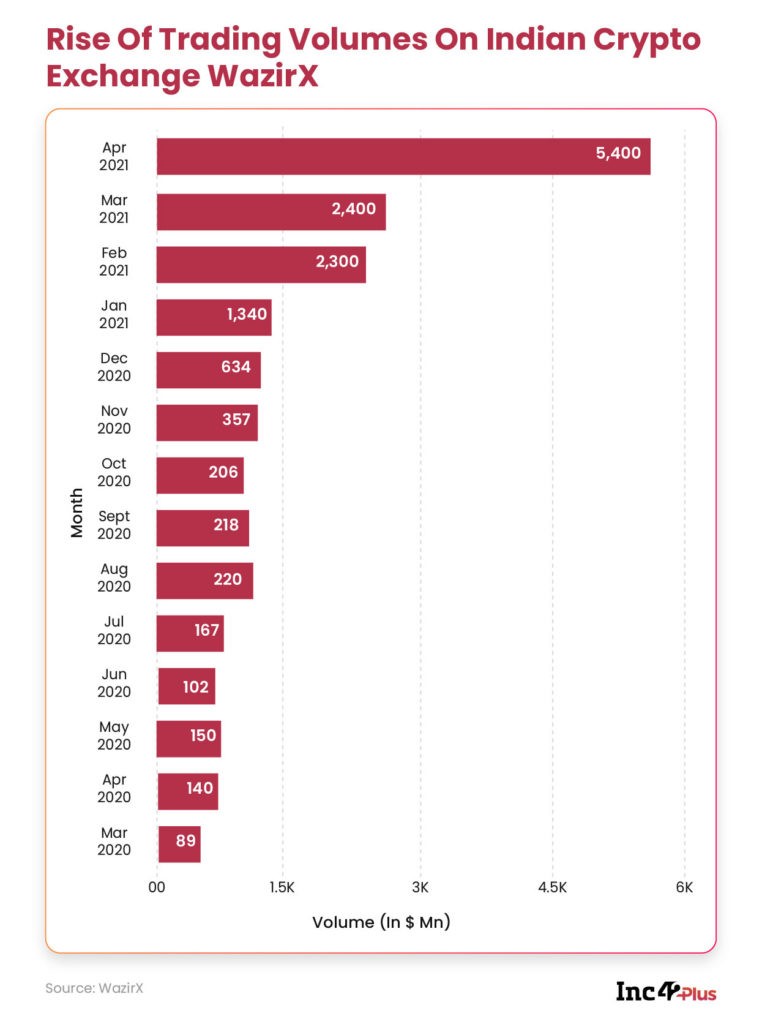

In the past few months, WazirX has seen exponential growth, along with other leading Indian exchanges including CoinSwitch Kuber, Zebpay, CoinDCX among others. In April, WazirX claimed it hit $5.4 Bn in transaction volumes, which is tenfold rise from $500 Mn in December 2020. Its user base shot up by 50% to 3 Mn in April, and in May, it saw crypto trades worth over $380 Mn on its platform on a single day.

Crypto-related crimes have been on the rise post demonetisation. Indian crypto scams such as Amit Bhardwaj of GainBitcoin case followed by Divyesh Darji of Bitconnect are regarded as some of the world’s biggest crypto scams which could vary anywhere between $3 Bn to $12.7 Bn.

![Read more about the article [Startup Bharat] From foodtech to ecommerce, these five startups from Kashmir are fostering innovation](https://blog.digitalsevaa.com/wp-content/uploads/2022/02/kashmir-1644926042551-300x150.png)