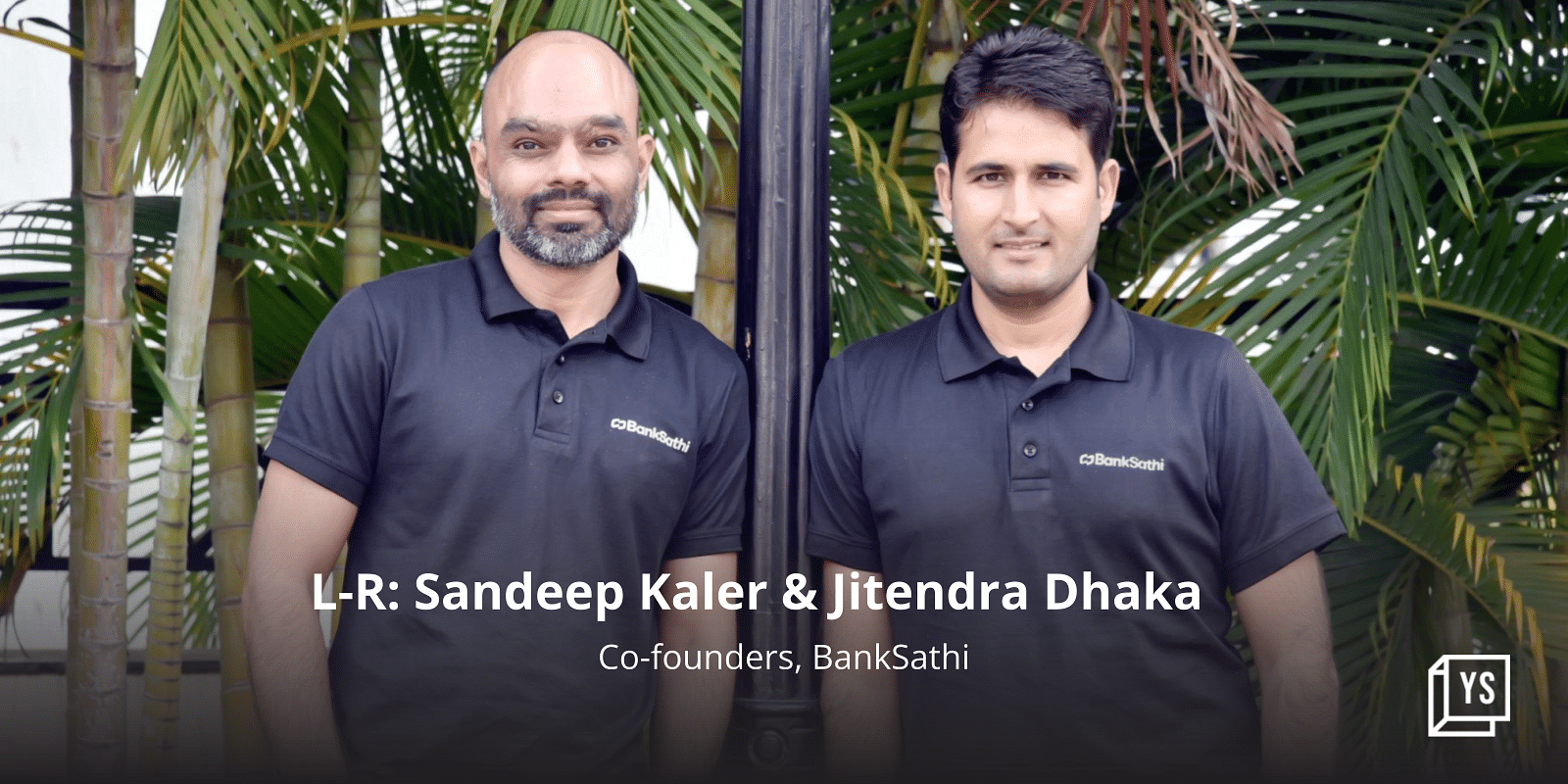

Bengaluru-based social ecommerce platform BankSathi has raised $4 million in pre-Series A funding from Kotak Securities, Lets Venture, We Founder Circle, Hem Securities, and Inflection Point Ventures.

The other investors who participated in the round include Recur Club, Liquiloans, Sunil Singhania (Abakkus), Kunal Shah (CRED), Dr Ritesh Malik (Innov8), Kailash Biyani (Asian Markets), Mukul Rastogi and Bhaswat Agarwal (ClassPlus), Varun Alagh (MamaEarth), Sameer Rastogi (India Juris), Manish Dabkara (EKI Energy), and Mukund Modi (MS Fincap).

The startup will use the funds to invest in high-calibre employees across operations and accelerate the development of new products and technology.

In addition, it will also invest resources to grow its agent network and geographic reach.

Founder and CEO Jitendra Dhaka said, “We’re keen to make a big contribution in the prime minister’s mission ‘Develop India by 2047’ by increasing financial penetration through our tech-empowered financial advisors. With this funding, we will be able to expand product, technology, and distribution network at a faster pace.”

Empowering micro-entrepreneurs

The BankSathi platform empowers consumers by providing the right financial products with access to last mile users in Tier II and Tier III cities and remote locations. The startup claims to use priority algorithms to recommend financial products to advisors, based on the customer’s profile and past transactions. According to the firm, this helps both customers and advisors receive the best recommendations.

“Today, small and mid-sized financial advisors/micro-entrepreneurs are not able to directly work with financial institutions. BankSathi is enabling these micro-entrepreneurs to sell and earn extra income by selling financial products online and making themselves financially independent and educated,” said Jaideep Hansraj, MD and CEO, Kotak Securities Limited.

As per CTO and Co-founder Sandeep Kaler, BankSathi has an endeavour to empower 10 million financial advisors and serve 50 million+ customers in the next five years.

BankSathi’ss advisor base claims to have increased by 40X and it has served a three million+ customer base across 18,000 pin codes. Its financial advisors include insurance agents, chartered accountants, product advisors, financial analysts, retired bankers, and small business entrepreneurs. In 20 months, the company made an ARR of $10 million.

BankSathi is partnered with 60+ financial institutions, including HDFC Bank, Axis Bank, IDFC First, SBI, Kotak Mahindra Bank, and Bank of Baroda.

Recently IRDAI approved an insurance licence to the company to offer a more diverse portfolio of financial products to the customers. The startup is on its way to bringing affordable insurance options for customers in Tier II and less developed regions.

![Read more about the article [Funding alert] Women-focused healthtech startup Proactive For Her raises $5.5M in Series A](https://blog.digitalsevaa.com/wp-content/uploads/2022/02/Featureimages-newdeck35-1645000663771-300x150.png)