Elevation Capital founder and managing director Ravi Adusumalli will now join Zeni as a member of the board

Zeni’s AI-powered finance concierge platform offers bookkeeping, accounting, tax and CFO services

Over the past 12 months, the company has seen 550% revenue growth year-over-year driven exclusively by referrals and organic growth

Fintech startup Zeni announced today that it has raised a $34 Mn Series B funding round led by Elevation Capital with participation from new investors Think Investments and Neeraj Arora.

Existing investors Saama Capital,Amit Singhal, Sierra Ventures,Twin Ventures, Dragon Capital and Liquid 2 Ventures also participated in the round. Additionally, Elevation Capital founder and managing director Ravi Adusumalli will join Zeni as a member of the board.

Zeni will use the capital infusion to bring its intelligent bookkeeping and accounting platform and services to more customers by investing aggressively in its team in the US and India across product, technology, marketing, sales, and finance operations.

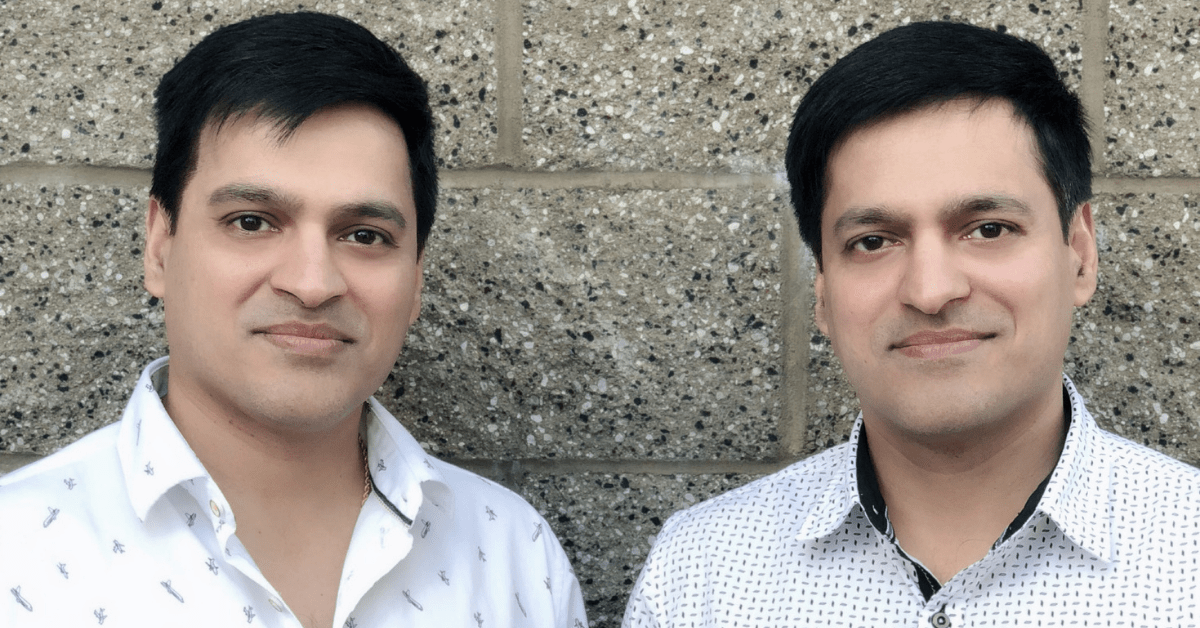

Founded in 2019 by Snehal Shinde and Swapnil Shinde, Zeni’s AI-powered financial concierge platform offers bookkeeping, accounting, tax and CFO services. Founders have real-time access to financial insights via the Zeni Dashboard, including cash in and out, operating expenses, yearly taxes and financial projections. They can also download the financial data in the “slice” that they want.

Its clients today lie in the range from from pre-revenue startups to businesses generating more than $100 Mn in annual revenue, it stated.

The company also stated that over the past 12 months, it has seen 550% revenue growth year-over-year driven exclusively by referrals and organic growth.

At the time of its $13.5 Mn Series A round in March this year, Zeni was managing more than $200 Mn in funds each month, and that has increased to more than $500 Mn currently.

Along with its rapid growth since the last couple of years, the fintech sector is slowly evolving into yet another phase i.e, the adoption of artificial intelligence (AI). More than 32% of financial service providers are already using AI technologies like predictive analytics, voice recognition among others, according to joint research conducted by the National Business Research Institute and Narrative Science.

With the adoption of AI, fintech companies are able to meet rising dependence on financial apps for transacting, determine cost-effective and personalised solutions for consumers, as well as offer enhanced customer experience through sentiment and cognitive analytics, among many other applications.

Other startups that have been using AI in their fintech business models include names such as Capital Float, Coverfox, Flexiloans, mPokket, Mswipe and PaisaDukan among others.

India’s fintech market is currently one of the fastest-growing compared to the rest of the world. Despite the first two waves of the Covid-19 pandemic that wreaked havoc across most sectors, the innovations brought about in the fintech space have helped India maintain a cutting edge. Globally, the country has the highest fintech adoption rate at 87% against a global average of 64%.