Jitendra Gupta is one of the most recognisable names in India’s fintech ecosystem.

As the founder of Citrus Pay, and later, the MD of PayU (which acquired Citrus Pay in 2016 in what was the-then largest fintech M&A), he’s built and scaled products that revolutionised the country’s digital payments industry over the last decade.

However, despite getting a $130 million exit and minting millionaires out of Citrus Pay’s early employees, he harbours some regret.

“In hindsight, selling the company so early, maybe, was not a good decision. We could have built Citrus Pay into something bigger instead of the exit. Even if we had not done anything new, we would have been 10X of where we were in 2016,” Jitendra tells YS Founder and CEO Shradha Sharma in an exclusive interview.

“But back then, the [exit] was right for the company, for shareholders, and for team members. And the market supported us,” he adds.

After serving at Naspers-owned PayU for three years, Jitendra began his second innings as an entrepreneur in August 2019 with Jupiter, a mobile-first neobanking platform targeted at millennials.

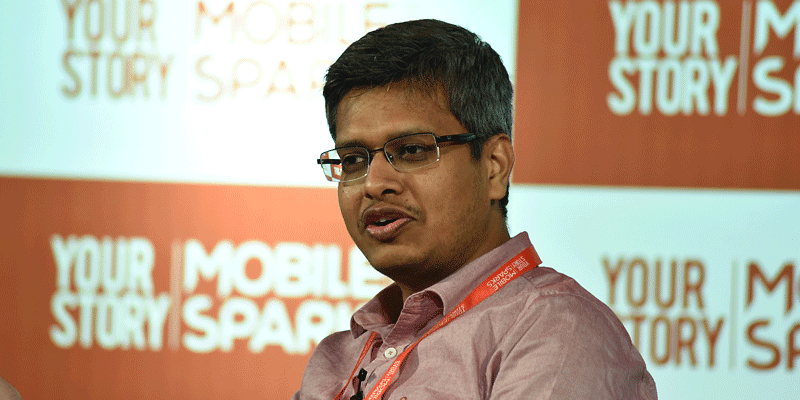

Jitendra Gupta speaking at YS’s MobileSparks 2016

By then, fintech had become the hottest segment in India’s internet economy, attracting hundreds of millions of dollars in venture capital, clocking billions of transactions annually, and benefitting from post-demonetisation tailwinds.

Jitendra says, “There was this feeling that I had not created anything large and impactful even after being in the startup ecosystem for 10 years. I felt restless.”

Armed with his knowledge of the fintech and financial services sector — he had a seven-year stint at ICICI Bank before starting Citrus Pay in 2010 — he set out to disrupt the traditional banking system in India, with a new-age fintech product.

Jupiter grabbed headlines for raising an eye-popping seed round of $24 million within three months, and while in stealth mode.

Marquee investors like Sequoia Capital India, 3one4 Capital, Matrix Partners India, and BEENEXT, along with distinguished angels, including Amrish Rau (Pine Labs), Sriharsha Majety (Swiggy), Kunal Shah (CRED), Sumer Juneja (SoftBank India), Utsav Somani (AngelList India), Ashish Hemrajani (BookMyShow), and Kunal Bahl (Snapdeal), among others backed Jitendra’s vision.

Later, in April 2020, the startup went on to raise a follow-up round of $2 million led by British venture capital firm Hummingbird Ventures and US-based Bedrock Capital, at a reported valuation of $100 million.

Why a neobank?

Jitendra was convinced that “Indian customers were fatigued with their existing banks, their processes, experiences, mindsets, and behaviour”.

So, any service that was simpler, quicker, and different would be welcomed.

“We wanted to deliver a personalised banking experience with the mindset of an internet company. Our customer service is not differentiated based on a customer’s balance, and we give them an instant resolution to their needs,” the founder says.

Also, Jitendra wanted to build a business that would go beyond a transactional relationship with customers.

Jupiter is a mobile-first neobank targeted at millennials

Jitendra explains, “Both payments and lending [what I did earlier] were transactional businesses. None of the fintechs in India have been able to create any dent in the banking industry yet. If you really want to make an impact in the consumer’s financial services life, you have to establish a trust relationship over 20-25 years.”

Mumbai-based Jupiter essentially serves as a digital bank that helps consumers meet their financial goals, maintain financial discipline, and become more solvent.

From money transfers and cash withdrawals to savings accounts and micro-loans, consumers can avail a variety of services on its app.

“The bank account is just the entry point in the customer relationship,” he says.

Jupiter lets users meet financial goals, maintain financial discipline, and grow their wealth

What building a neobank in India entails

India’s banking sector is so heavily regulated that building anything new is arduous. More so, if your long-term vision is to disrupt age-old banking systems. “It is impossible to disrupt an HDFC or an ICICI overnight. It will take ages to build that kind of trust. You have to constantly innovate to build that,” Jitendra says.

Add to that the enormous burden of compliance, which takes up most of the money and mindspace. “It is super tough, especially on the compliance front. At Citrus Pay and PayU and all my earlier stints, even after five years of maturity, we did not have this level of compliance and data security,” the founder shares.

He goes on to elucidate,

“To build a large, sustainable, and successful neobank in India, you need at least $200-300 million in the next five years. And that is solely because the initial infrastructure investment is very high. The money that goes into security compliances, liquidity ratios which you need to maintain, customer service investment, etc. is huge. Now we have learnt why banks are slow to move. So, our challenge is to maintain the fine balance between compliance and agility.”

Every swipe of Jupiter’s smart debit card helps users earn rewards

Even investors know that neobanks are a whitespace, and there is no established path. “So, they look at if your vision is audacious enough or not,” Jitendra reveals.

Even though Big Tech companies like Google, Amazon, and WhatsApp have flirted with the idea of venturing into financial services, they’ve not had any sizeable impact yet.

Jitendra reckons that is because compliance is a local and nuanced subject that varies from geography to geography.

“Also, Big Tech companies inherently do not want to be regulated. That is what creates a difference between them versus players like us who are trying to build something ground-up,” he says.

Jupiter’s present and future

Neobanking has primarily two segments: consumers and SMEs. While the likes of Open, NiYo, Razorpay X, Yono by SBI, etc. are competing for SMEs, which have historically been underserved by banks, Jupiter is laser-focused on retail customers.

Last November, it released a micro-lending (‘Buy Now Pay Later’) app Bullet, which offers consumers small-ticket loans up to Rs 10,000 that can be used for UPI-led purchases. Bullet is similar to LazyPay (a product Jitendra had launched at PayU) and has amassed over half a million downloads so far.

In May this year, Jupiter began inviting customers to join a waitlist before taking its core neobanking platform live in June. It has partnered with Visa, Federal Bank, and Axis Bank for the launch.

“We don’t want too many partnerships because we want customers to come to our proposition and not think that they are banking with the banks,” says the founder.

Jupiter’s micro lending app Bullet has clocked 500,000+ downloads

On Jupiter, consumers can create smart accounts, get a real-time breakdown of their spends and savings, get rewards on every tap of their smart debit cards or UPI transactions, grow their wealth, and gain financial literacy lessons.

Jupiter also recently acquired Y Combinator-backed Easyplan, an AI-powered financial savings app, which had over 2.5 lakh users.

“We were impressed with the customer love that Easyplan has generated, and there was a lot of overlap between our missions and philosophy to drive financial wellness for consumers,” Jitendra told the media.

Neobanking is arguably the hottest sub-segment of fintech right now. The global neobank market is estimated to be worth $394.6 billion by 2026, as per Zion Market Research. In India, of course, neobanks are at a nascent stage.

However, the buzz and investor sentiment is on the upsurge.

Jitendra, who’s spent nearly a lifetime in finance, knows what he’s building and why. “We called our product Jupiter, which is the biggest planet, because we have aspirations to become the largest financial services company in India,” he says.