With an aim to support home-grown consumer startups, Gurugram-based Fluid Ventures has announced its first close of Rs 25 crore as investment capital.

The early-stage micro venture capital fund has a total corpus of Rs 80 crore (including Green Shoe option), slated for investment in direct-to-consumer (D2C) brands in food and beverages, beauty, personal care, lifestyle, and home products.

As lockdowns amid COVID-19 impact supply chain management and regular business activities, investors are particularly wary of investing in D2C companies. In fact, only a handful of investment institutions are actively investing in D2C startups, claims Fluid Ventres, adding that this fund will bolster confidence within such companies.

“Direct to Consumer is the next big wave in India. Right now, there are very few funding options available in the market for this sector. With this corpus from Fluid Ventures, we want to bridge that gap by facilitating investment in D2C brands,” said Amit Singal, General Partner, Fluid Ventures.

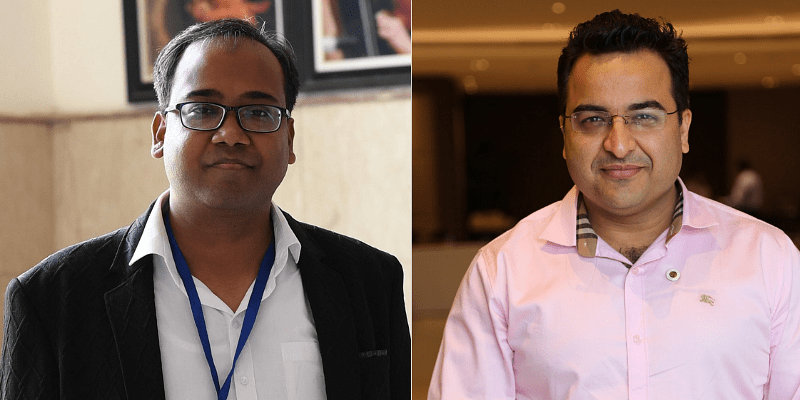

L-R: Amit Singal and Dhianu Das

“Currently, India has one D2C unicorn startup, while there are 20 such startups in the world right now. With this initiative, we hope to open the playing field for more such success stories and encourage large investors to back startups the way they do so in the equity market,” said Dhianu Das, General Partner, Fluid Ventures.

Fluid Ventures plans to use this fund to invest in 15-18 emerging brands over the next three years by participating in Seed, Pre-Series A and Series A rounds with a cheque size of up to Rs 4 crore and follow-up rounds.

The two General Partners of the fund have hands-on experience of investing in startups like PeeSafe, Junio, eBikeGo, Chqbook, Neeman Shoes, Akiva Superfoods, Power Gummies, and Vanity Wagon and has successfully exited from BurgerSingh, Carmesi, Infeedo, GoMechanic, ClearDekho to name a few.

Apart from providing financial capital, Fluid Ventures Fund claims to have a robust startup support system within the realms of recruitment, marketing, accounting, taxation, compliance mentoring, CXO coaching, fund mobilisation and legal services.