According to Juniper Research, the number of digital wallet users across the globe reached 2.6 billion in 2020 and, by 2025 the number is expected to go up to 4.4 billion. In India, the push toward cashless payments gained pace in 2019 and it has only grown since the onset of the COVID-19 pandemic.

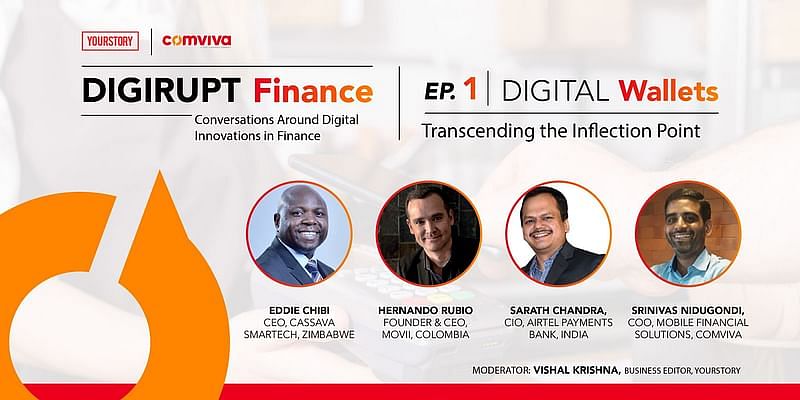

To discuss the role of digital wallets and their role in boosting a digital economy, Comviva, in association with YS, hosted the first episode of ‘Digirupt Finance: Conversations around Digital Innovations in FinTech’ on April 6, 2021. The episode brought together global FinTech leaders like Eddie Chibi, CEO, Cassava Smartech, Zimbabwe; Hernando Rubio, Founder and CEO, Movii, Colombia; Sarath Chandra, CIO, Airtel Payments Bank, India and Srinivas Nidugondi, COO, Digital Financial Solutions, Mahindra Comviva, India.

Democratising access to digital wallets

Talking about the growth of digital wallet users in Latin America, Hernando from Movii said that since the last few years, the number of Latin Americans with access to financial services has grown exponentially. “The business model we have right now is not right and there’s a huge opportunity for entrepreneurs to change that. We also have a big percentage of inequality, one of the reasons being the lack of financial services. With the penetration of internet services and smartphones, even the poor have shifted to digital platforms for communication, so why not payments? We can use technology to democratise that,” he said.

In Zimbabwe, 90 percent of the adult population uses EcoCash — a mobile phone-based money transfer, financing and microfinancing service. Speaking about how they managed to achieve this growth, Eddie said that the penetration of mobile phones, which was below 50 percent back then, is what encouraged them to easily adopt such financial services.

“To create a digital ecosystem, you can either compete or collaborate with ecosystem partners,” he said.

EcoCash integrated with banks, remittance partners and payroll processing companies to digitise financial services in the economy. To encourage people to use wallets more often, it also added mom-and-pop stores to the ecosystem. “People want an easy life. Therefore, demystify technology, make it user-friendly and deepen its usage in communities. Today, 90 percent of Zimbabwe is on digital wallets, with EcoCash as the primary solution,” he added.

In India, given its large population, the scale is different. According to Sarath, the RBI has done a brilliant job with the JAM (Jan Dhan-Aadhaar-Mobile) initiative, which is a stepping stone to reach every nook and corner of the country. “In India, digital wallets are all about reach, safety and ease of use. The question is whether we can create a system for financial transactions that is as easy as consuming video content. And to do that, you need to think as a platform and not as a product,” he said.

Watch the full conversation here:

Focusing on the overall financial lifecycle of consumers

In March 2021, Unified Payments Interface (UPI) topped the Rs 5 trillion mark in terms of value of transactions, which is double the amount from last year. Srinivas said that while the COVID-19 pandemic may have accelerated it, on a whole, cash transactions have come down significantly. “We need to think how we can make transactions seamless for merchants, customers and businesses alike. For this, super apps have been an easier way to facilitate payments through mobile.”

Digital wallets can also explore other areas like loans, insurance, wealth creation and so on. “We have to believe and think like a platform and start open APIs to work with everyone. We are the ones putting user experience in the hands of people, but we also need partners to try new and different ways to generate loans, insurance and so on. Users will benefit from the competition. After all, you run as fast as the dog that chases you,” said Hernando.

The challenge lies in changing consumer habits, but the panelists agreed that the right strategy backed by technology can help change that. Like how WhatsApp and Facebook transformed the way we socialise or communicate, it’s possible with payments too.

Overcoming barriers beyond geographies

Hurdles like infrastructure and traditional habits remain barriers to greater digital payments adoption, but the primary focus for entrepreneurs is to face challenges head-on and work on the problem they are solving. “Today, smartphone manufacturers are creating affordable phones. Entrepreneurs need to grab the opportunity, be innovative and make sure that transactions go above and beyond to become global payment systems,” said Eddie.

In India, there is no one solution to solve for a large audience. For the bottom of the pyramid, it’s about reach but for Millenials, it’s about a simple and safe experience. In deep rural areas, ‘phygital’ systems are the way forward, where local merchants who provide telecom services enable digital payments for villagers. “The treatment they get at the bank is not optimal, but at a kirana store, there is a trust because of their previous engagements. Phygital will be a stepping stone to get first-time digital customers to trust the process,” said Sarath.

Possibilities of a cardless future

On whether physical cards will be replaced by virtual cards in the future, the panelists said that while the latter is a convenient option for consumers, it will take time to get there. While cash transactions have reduced in India, when it comes to the digitisation of cards, the adoption curve is slow. On the other hand, in Zimbabwe, when they started the mobile money business, they started with virtual cards, so mom-and-pop shops have reacted well to it.

Security is key for a high-volume business

Agreeing on how strong security measures were crucial for the success of digital-based payment systems, the panellists also talked about their myriad aspects and challenges. In India, the RBI is focused on customer trust and security. “We spend a lot of time ensuring that our products are safe. There are several machine learning algorithms that we use to ensure that we don’t become a part of conduit fraud. We even launched Airtel Safeway for this purpose,” said Sarath.

Authentication is also a huge challenge for consumers while opening accounts due to the need of fulfilling KYC compliance norms. “You need it because today’s bank robbers are out to steal from digital wallets. But if you increase risk solutions, you end up decreasing your funnel of conversions. We need the most clever people out there working on authentication and cybersecurity solutions,” said Hernando.

At the end of the day, what’s most important is customer awareness.

“There are three pillars of security – technology, process and people, but the weakest link of the three is people,” said Srinivas.

If you’re a FinTech startup, banking professional or FinTech enthusiast looking to transform your business into a digital-first enterprise by 2025, stay tuned for the next episode of Digirupt Finance on ‘Digital Banking: Navigating the Digital Course’ on May 19, 2021.

![Read more about the article [App Friday] This recipe and meal planner app has made it to Google Play’s best apps this year](https://blog.digitalsevaa.com/wp-content/uploads/2021/12/Imagexmw5-1639657213808-300x150.jpg)

![Read more about the article [YS Learn] It is life after each setback and not the failure that defines you, says upGrad co-founder Ronnie S](https://blog.digitalsevaa.com/wp-content/uploads/2021/03/Image38w7-1614693547403-300x150.jpg)