The tax department has asked for a detailed note on the income source, detailed source of earnings outside India and computation of income

Currently, the I-T department is only looking at 2019 and 2020 as the investigation period

The government is looking at the profit share, which can reach as high as 30% of a PE fund’s profit

India’s Income Tax Department has sent notices to major private equity (PE) fund managers working in India seeking details of their income and assets abroad. The move comes as the government is looking to tax PE fund managers on the profits they make on the exit of investments.

According to an ET report, the tax department has asked for a detailed note on the income source, detailed source of earnings outside India and computation of income.

The department has also sought details of any other assets held outside India, the details of investments in foreign assets for 2019-20 and details of trusts created under the law of a country outside India.

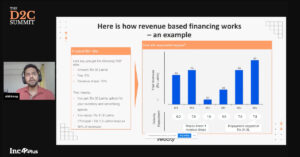

The government is looking at the profit share received by the fund managers, also called the carry fee or carry. It can reach as high as 30% of a PE fund’s profit on an exit and into hundreds of crores in the case of big funds making big exits.

It is prudent to mention here that a PE fund manager receives the carry besides the management fee and a fixed percentage of the assets under management irrespective of the fund’s performance.

The I-T department is looking at whether India-based PE fund managers working with global funds bring the money to the country and pay local taxes. The department wants the fund managers to explain how they bring the carry fee to India. Currently, the I-T department is only looking at 2019 and 2020 as the investigation period.

A professional services firm executive told ET that many PE funds create a structure so that the funds based overseas would pay the asset managers in tax-friendly jurisdictions such as Mauritius and Singapore. This ensures that carry fees are held outside India.

These structures allow for a large part of the money made by PE fund managers to be held outside India. Only a small part of the total remuneration is brought to India and taxes are levied on them by the Indian government.

The government, therefore, is looking at these structures and will dismantle them under tax laws such as the General Anti-Avoidance Rule (GAAR).

Further, there is a lack of clarity on how income tax is charged in India. For instance, the amount of tax being charged on foreign capital gains can reach as high as 40%.

The government’s move comes days after the Reserve Bank of India (RBI) announced the new overseas direct investment (ODI) rules, which will impact startup funding and merger and acquisition deals in the country.

The Centre has also been busy building taxation regimes for emerging industries, with crypto, online gaming and influencer marketing being a handful of examples of the same.