Gulf Islamic Investments, a UAE-based financial services firm, stole the spotlight when its $20 million investment in Dubai-based ecommerce platform Mumzworld over two rounds not only helped catapult the company to new heights and expand geographically but also created a blueprint for what investors who are really “invested” in a venture should do.

Mumzworld was an up and coming company in Dubai when Gulf Islamic Investments (GII) decided to back it. Ecommerce, inherently, is a capital intensive sector that requires ongoing funding and cash flow — and GII remained at the forefront of leading investments in the company.

But beyond just cutting expensive cheques for the startup founded in 2011 by Mona Ataya, GII advised it at every critical juncture, provided counsel when needed, and even extended its in-house team for operations from investment banking and marketing to talent sourcing. It created an ecosystem for Mumzworld where it could thrive — and the fact that the startup grew from selling only in Dubai to shipping to 20 countries in the Middle East/North Africa region is an ideal example of what a fruitful startup-VC relationship looks like.

Closer home, Gulf Islamic Investments, which manages around $2 billion in assets across venture capital, private equity, and real estate, among others, has picked up stakes in two Indian healthcare companies — a chain of hospitals, and a diagnostics venture.

The firm has outlined plans for a second India Growth Portfolio to invest around $50 million in Indian startups, particularly in the healthcare, technology, and consumer sectors, which it finds personally very interesting.

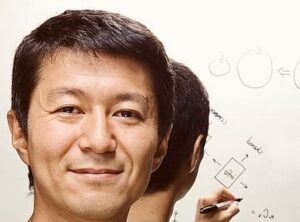

Co-founders of GII, Pankaj Gupta and Mohammed Al-Hassan with Co-founders of Mumzworld, Mona Ataya (R) and Leena Khalil (L).

In an interview with YS, Pankaj Gupta and Mohammed Al-Hassan, founding partners and co-CEOs, talk about lessons from the investment in Mumzworld, what excites them about the India story, what GII brings to the table when it invests in companies, and more.

YS [YS]: Let’s begin with your most successful investment to date — Mumzworld. What are some important lessons from your journey with them?

Pankaj Gupta [PG] Our experience as a strategic investor yielded several insights.

First, the importance of being in the company of like-minded investors as this ensures the company’s ability to face challenges successfully and build a strong business.

Second, establish a qualified and collaborative board of directors. If a company is looking to grow exponentially, creating a Board with solid expertise isn’t enough. You need to create a Board of Directors with fundamental parameters, code of conduct and collaborative culture in place.

Third, I cannot emphasise enough the importance of a capable and conscientious team with both the right set of hard and soft skills. A high-performing senior employee who looks good on paper but isn’t a team player will only negatively impact productivity and outcomes…which is why other skills and qualities are just as important such as professionalism, integrity, and a solutions-oriented mindset.

Finally, I would say the investment is a long term association, and can only prove fruitful to all stakeholders if there is strong teamwork coupled with a sense of fairness.

YS: Let’s move to your strategy in India — what excites you about the Indian startup ecosystem, and what’s your strategy for investments here?

PG: As one of the world’s most populous and fastest-growing economies, India represents an incredibly attractive investment destination for GII. Across the board, several sectors in India remain underserved, buoyed by strong growth prospects and favourable demographic shifts.

In the last decade alone, the ecosystem has seen several startups achieve unicorn status. The Indian economy showed exceptional resilience despite the economic challenges in the wake of the COVID-19 pandemic.

Startups that have survived and thrived during this black swan event will be far more agile and innovative, and consequently, make for very attractive investment opportunities.

Given the tremendous growth opportunities in the country, India will continue to play a prominent role in GII’s future investment plans. We are currently evaluating several deals, primarily in the healthcare and consumer technology sectors.

YS: Is there a common theme that runs across the startups GII has its eye on currently in India?

Mohammed Al-Hassan [MAH]: GII’s investment approach in India is focused on certain sectors as long as the opportunity is Sharia-compliant. We seek scalable companies led by exceptional management teams that demonstrate solid business fundamentals, proven traction, revenue growth, and a clear path to an exit.

YS: Which sectors in India do you think have room for growth?

PG: We are especially interested in consumer-tech and healthcare but truth be told, India is a massive economy and virtually every sector is underserved. Demand is almost always outpacing supply.

For example, GII invested in healthcare via our India Growth Portfolio I last year, with a significant minority stake in an award-winning multispecialty hospital chain in western India. The hospital chain’s primary market is significantly underserved — with a doctor to patient ratio of 1:10,000 — which stands much below the World Health Organisation’s minimum prescribed ratio of 1:1,000.

When you consider the robust demand drivers and tremendous growth opportunity in this one market alone, the investment case for India remains incredibly compelling.

YS: How do you think the pandemic has changed the trajectory of the Indian startup ecosystem?

MAH: I believe the pandemic has brought the principle of scarcity into play. Companies that thrive amidst scarcity prove to be more innovative, resourceful and leaner, learning to achieve outcomes with less capital and fewer people amidst the heightened uncertainty that comes with doing business during a pandemic.

YS: What value does GII add to startups when it invests in them? How do you support startups beyond just cutting the cheque?

PG: As an investor, the hallmark of GII’s approach in working with portfolio companies is not just the breadth of expertise we bring to the table but also a macro-understanding of specific sectors.

More often than not, the CEO and their senior team will be in the trenches, focused on a specific set of priorities that can sometimes result in a limited range of vision. This is where we bring in our eagle-eye viewpoint and diversity of perspectives since we see several business propositions daily, and have a big-picture view of possible headwinds or tailwinds.

For example, our Silicon Valley-based portfolio company — an edtech startup called zSpace — often seeks our advisory during critical times to guide specific strategic approaches or hiring specialized talent.

Just as important, we also enable the creation and implementation of an exit strategy, even getting down to brass tacks by offering our legal experts to guide the drafting and negotiating of certain clauses.

YS: What is the Indian startup ecosystem lacking currently, according to GII? How can that be remedied?

PG: In my view, the Indian startup ecosystem is still too fragile; there is often far too much sensitivity and fall-out around a company’s failure. Failures are part and parcel of growing beyond our periphery and we need to embrace and learn from them instead. Very often, the failures of predecessors serve as a foundation for future success.

There is also the risk of overinflated valuations — companies that make for strong investment opportunities often price themselves very high.

Lastly, we need to increase opportunities for more individuals with disposable incomes, even if they are not venture capitalists or seasoned investors, to participate in the ecosystem. The more capital we inject into the ecosystem, the more investment opportunities we create and the more startups we see get funded.