As the controversies within BharatPe escalate by the day, many questions are being asked about how the company was run, its culture, the lack of due diligence by investors and much more. Even as the company looks to distance itself from cofounder Ashneer Grover, the feeling is that there will be some tough months ahead for the fintech unicorn.

These issues could not have come at a worse time for BharatPe as it looks to develop on the Unity Small Finance Bank licence that it had acquired last year and build upon its merchant and individual user base through PostPe and P2P lending plays.

But currently, all the focus is on the many players in this saga and their role in the power struggle that threatens to derail the company, which is backed by some of the biggest investors in India including Sequoia Capital, Steadview, Ribbit, Coatue and others. So here’s a refresher of all the characters that are embroiled in the BharatPe saga.

Ashneer Grover

Before starting BharatPe, Grover had been the chief financial officer at Grofers (now Blinkit) besides other roles at banks and a brief stint at PC Jewellers. Incidentally, Grover has been associated with Kotak Mahindra for over 15 years. Besides this, he is a prominent angel investor with over a dozen startup investments.

An alumnus of Indian Institute of Technology-Delhi and Indian Institute of Management in Ahmedabad, Grover is one of the more outspoken personalities in the Indian startup ecosystem, and has pretty much been among the headlines for some provocative statements.

For instance, during the Paytm IPO in November 2021, he had criticised the company and its founder Vijay Shekhar Sharma over the valuation and the fact that retail investors were making losses. And earlier in April 2020, he had also claimed that the pandemic would not have a major impact on BharatPe, while announcing that the company is giving raises to its employees.

Even in his recent role as a jury and investor of Shark Tank India, which launched in December 2021, Grover was called out for being too harsh on some founders. But all those social media controversies paled in comparison to the many scandals that have hit BharatPe since then.

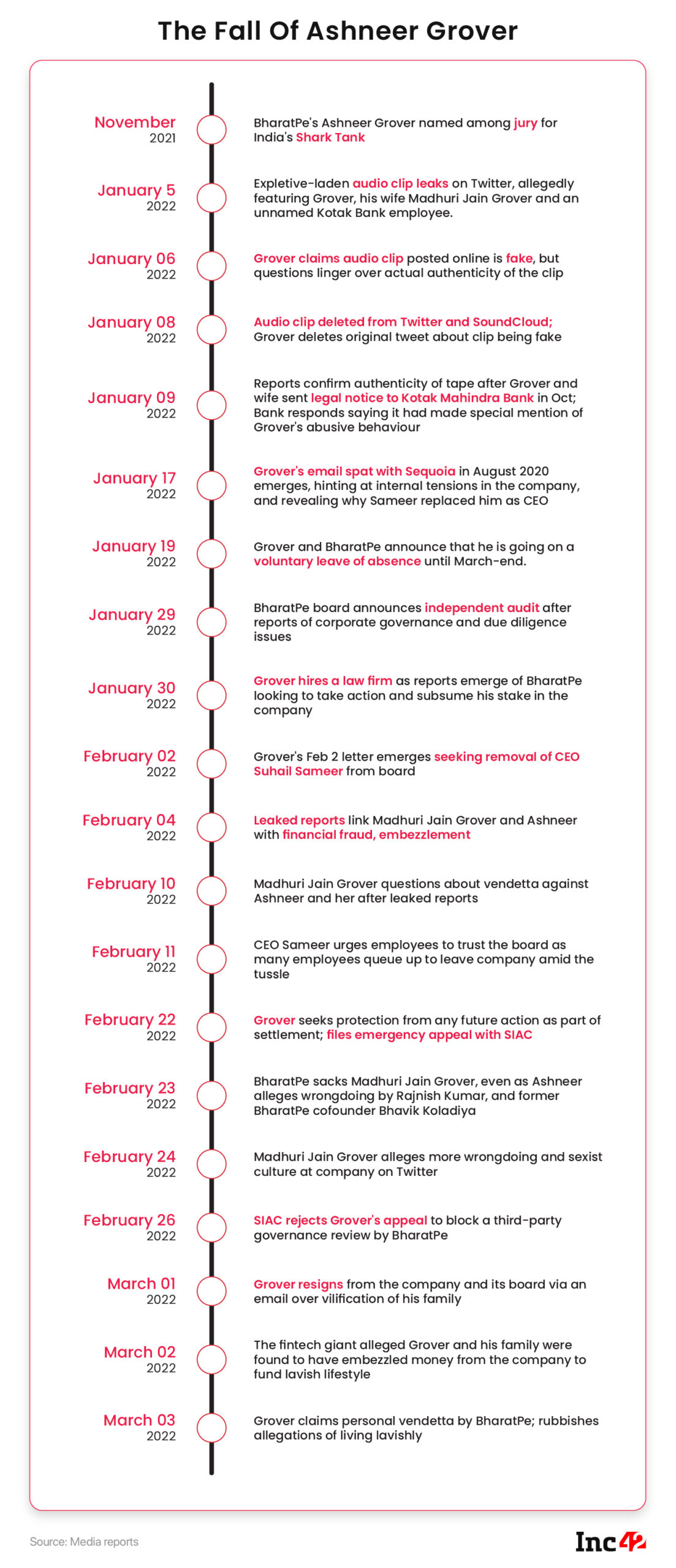

In October 2021, Ashneer and his wife Madhuri Jain Grover sent a legal notice to Kotak Mahindra Bank accusing the bank of failing to secure financing and allocation of shares in the hugely successful Nykaa IPO. This legal notice only surfaced after an audio clip was leaked on Twitter, where Grover is allegedly heard hurling abuses and threats.

Grover and his wife Madhuri Grove sought damages from Kotak Mahindra Bank, but the bank said that it had replied to the notice appropriately. It also said that it had placed on record objections to inappropriate language used by Ashneer Grover.

This called into question Grover’s claim that the audio clip was fake, and pushed the company into starting an investigation into the internal governance and Grover’s actions.

After weeks of questions and public mudslinging, Grover resigned from his position on March 01, 2022, claiming that his family has been vilified by the company and the board. He has also questioned the integrity of Rajnish Kumar and others in BharatPe, alleging that the review process has been biased.

Shashvat Nakrani

An IIT Delhi alumnus, Nakrani earned a bachelor’s degree in Textile Technology in 2018 but was always interested in starting his own venture from an early time.

Hailing from Bhavnagar in Gujarat, he came from a family of educators. In his college days, he launched a startup called BookMyHaircut as his first venture. While that did not take off, during his third year, he decided to begin the BharatPe journey and founded the company along with Koladiya in March 2018. Grover joined the duo as a cofounder in November of that year.

Currently, Nakrani owns 7.5% of BharatPe and is now the only cofounder in the company to still have that title, after Grover was dismissed earlier this week.

In the current power struggle within BharatPe, Nakrani has refrained from commenting in public, but did state that he had not requested the removal of Suhail Sameer as CEO last month, after Ashneer Grover’s demand for the same was reported.

Bhavik Koladiya

Having founded the company along with Nakrani, Bhavik Koladiya should have been one of the faces of the company, but instead, most don’t even know that he was one of the founders of the company.

In 2015, Koladiya was convicted in a credit card fraud case in the US. His conviction and subsequent sentencing as time served in the US does bar him from holding directorships in the US, and would have complicated matters for BharatPe in future fundraises from foreign investors.

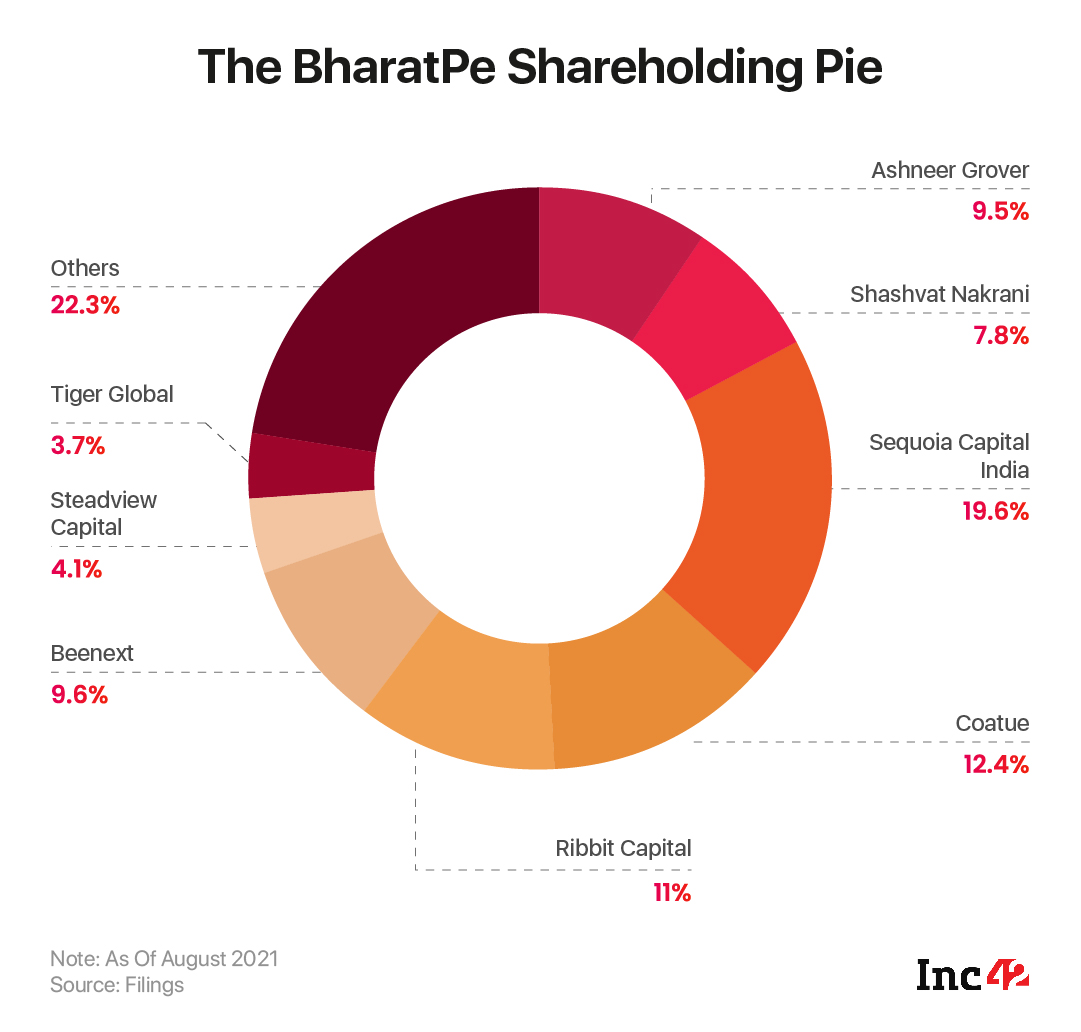

Till 2018, Koladiya held over a 30% stake in the company, but this was diluted in the many funding rounds for the company as more and more VCs backed the company. The company’s majority stakeholders include Sequoia Capital with a 19.6% stake, Coatue (12.4%), Ribbit Capital (11%), Beenext (9.6%), among others.

While he’s no longer counted as a founder in the company, Koladiya is said to be the group head of product and technology. However, the company told Inc42, “Bhavik Koladiya is an Independent Consultant and does not have any direct management role in the company. He acts as a mentor for the Technology and Product teams.”

Over its past four funding rounds, the equity held by VC funds in BharatPe has grown from 16.7% to 66.1%. A bulk of the Koladiya’s shares were sold to VC investors in these rounds, while Grover’s own holding fell from 22.7% to 9.5%.

As the technology and product lead at BharatPe, the former cofounder does have significant control on the operations of a financial services company, which might be another red flag from a due diligence point of view. Koladiya’s LinkedIn profile has been edited in recent weeks after the slew of controversy. While earlier he called himself a cofounder in the company leading product and engineering, his profile now simply states BharatPe with no official designation. Sources told us he continues to be on the payroll of the company.

While Koladiya does not have any shares in the company directly, sources told Inc42 earlier this year that Grover and Nakrani are holding his equity for him, and that Sequoia Capital is aware of this.

It is not yet clear whether Koladiya has a say in how the company is run. Ashneer Grover has claimed recently that Koladiya has been trying to orchestrate meetings between the company and Grover. In a recent social media post, Ashneer’s wife Madhuri Jain Grover posted an audio clip allegedly featuring Koladiya abusing Ashneer over a failed attempt to set up a meeting.

Madhuri Jain Grover

Ashneer’s wife Madhuri Jain Grover joined BharatPe at the same time that the entrepreneur came on board as cofounder of the company in 2018, as per her LinkedIn profile. She earned an undergraduate degree from the National Institute Of Fashion Technology in Delhi and prior to BharatPe, she is said to have worked with several fashion labels such as Satya Paul.

As head of controls for BharatPe, Jain Grover was in charge of many of the compliance processes within the company. It was alleged that she had an outsized influence on the operations due to her relationship with Ashneer.

In fact, leaks from BharatPe’s internal review process alleged her involvement in a recruitment commission scam as well as payments to non-existing vendors. She then wrote to independent consultant Alavarez & Marsal questioning these leaks.

As per these leaks, several invoices to fake vendors were allegedly created by her brother Shwetank Jain, who is founder of tobacco brand Hash, which counts Ashneer Grover, and BharatPe CEO Sameer among its investors.

Shwetank Jain

As mentioned above, Madhuri’s brother Shwetank is the founder of Hash, which is incorporated under the name Tapisserie Lifestyle Private Limited. The siblings are both directors in the company which was registered on December 18, 2019.

Previously, Shwetank has been associated with BNS Fabrics LLP as a designated partner along with Kabir Rajan Sehgal, Rajan Omprakash Sehgal and Karan Sehgal. The company operated Beekalene Fabrics, and is part of a group of family-run textiles businesses.

In August last year, Shwetank’s D2C startup Hash raised close INR 25 Cr from Amrac Investment Trust and angel investors including Ashneer Grover and BharatPe CEO Suhail Sameer.

Suhail Sameer

In August 2021, BharatPe appointed Suhail Sameer as the CEO, promoting him from the group president position at which he joined the company one year before that. In fact, Grover was replaced as CEO by Suhail Sameer at the same time as the Series E announcement.

Grover’s quote in the press release says: “At BharatPe, we have a high performing team attracted to our focussed execution, growth potential and culture of meritocracy. I am happy to appoint Suhail Sameer as the CEO in recognition of stupendous business growth he has delivered during the last 1 year and his ability to lead from the front. I am also honoured to invite him to the Board of Directors.”

But now the two are clearly on opposite sides of the power struggle.

An IIM Lucknow alumnus, Sameer was the first group president at the company, having come on board at a time when it was rapidly expanding into many verticals. Before BharatPe, he had worked with the RP-Sanjiv Goenka Group and its consumer VC fund RPSG Ventures, as well as McKinsey’s power and cleantech divisions.

Like Grover, Sameer has made plenty of angel investments, including backing Shwetank Jain’s Hash, as mentioned above. He has also invested in Locofast, UpScalio, Goldsetu, OTO Capital, AdmitKard, G.O.A.T Brand Labs, FableStreet, Breathe Well-being, dezerv among other startups.

Rajnish Kumar

A veteran in the Indian banking industry, Rajnish Kumar was once the chairman of the State Bank of India, one of the largest banks in the world. He served SBI from 1980 and was appointed as MD of the bank in November 2015, before retiring in 2020. He has also served as a senior advisor for Baring Private Equity Asia and Kotak Investment Advisors.

In October 2021, Kumar joined the board of BharatPe as its chairman and his experience across India’s financial sectors and familiarity with compliance processes was thought to be a key consideration behind his appointment. Kumar was brought on board to mentor the BharatPe team as it looked to build the Unity SFB.

At a time when there were a lot of questions about how BharatPe would deal with the tightly-regulated banking market, Kumar’s appointment was seen as a major coup for the startup, but as it turns out he landed in the company at a time when everything was going haywire.

Going after Kumar amid this controversy, Grover has alleged that the former SBI chairman has not been unbiased in his assessments of the company, and the cofounder had also claimed that he was working on behalf of CEO Sameer to squeeze out the Grovers from BharatPe.

Harshjit Sethi

As one of the key leaders within Sequoia Capital, Harshjit Sethi naturally has seen his share of founders that have scaled up rapidly and turned unicorn in a matter of months.

Sethi, who has been with Sequoia Capital India since 2015, was promoted to as a managing director in the venture team in July last year. Besides BharatPe, Sethi has been a key figure in Sequoia’s investments in unicorns such as Apna, Darwinbox as well as Nasdaq-listed Freshworks.

From reports that emerged in the past couple of weeks, it’s clear that Sethi’s relationship with BharatPe’s Ashneer Grover has been strained to say the least, since mid-2020. Grover had gotten into a heated argument with Sethi in August 2020 over delays from Sequoia Capital in committing to BharatPe’s Series B round, which already had commitments from other investors.

This had caused a lot of back and forth between Grover and Sethi. At one point, Grover suggested that Sequoia should exit the cap table due to its commitment-shy ways.

Interestingly Sequoia did not invest in Series B or Series C rounds for BharatPe, which took place between August 2020 and February 2021. But then it made a comeback as an investor in BharatPe’s mega $108 Mn Series D in February and $370 Mn Series E funding rounds in August 2021, which took the company’s valuation to nearly $3 Bn.

Were any issues between Grover and Sequoia ironed out? Not according to sources close to the company who told Inc42 that, at the time, Sequoia’s investment in BharatPe came with the condition that Grover stepped aside from the CEO role, which was indeed what happened.

Amid the controversies in the past two months, Grover has lashed out at investors including Sequoia, claiming that they are all out to just get his share of the company and enforcing the shareholder agreement without due process.

Of course, investors in BharatPe also have to answer for the years of investment and the lack of thorough due diligence, which could have brought to light many of these problems well before they escalated.

Alvarez & Marsal (A&M)

A noted global advisory and management consultancy, Alvarez & Marsal (A&M) has built its reputation around turnaround management and performance improvement with the likes of Lehman Brothers during the 2008 global economic crisis, Arthur Andersen, Target among others featuring as its customers.

The company was founded in 1983 and its India business is led by Manish Saigal and Vikram Utamsingh, both of whom hold the managing director position. On its website, A&M claims it assists corporates, banks and private equity clients with debt advisory, guidance on corporate finance and market entry and expansion.

The risk advisory firm was roped in to conduct an independent audit of the startup’s internal processes and systems shortly after cofounder Grover took a leave of absence.

“The Board of BharatPe is committed to the highest standard of corporate governance at the company and is doing an independent audit of the company’s internal processes and systems,” the company had said in early February, but soon after details of the investigation were leaked, alleging embezzlement by Madhuri Jain Grover and Ashneer Grover, and payments to fake vendors by BharatPe.

Screenshots of A&M’s reviews were leaked on social media which showed inconsistencies in dealings with vendors and payments to non-existent vendors to the tune of INR 53.25 Cr. The company incurred a total loss of INR 10.97 Cr in these dealings due to the write-offs and the fines it had to pay, as per the leaks.

These allegations were only confirmed by BharatPe this past week.

PricewaterhouseCoopers (PwC)

After A&M, BharatPe also brought on board a Big Four accounting firm PricewaterhouseCoopers (PwC) to look into the company’s transactions. Interestingly, PwC’s involvement is being linked to clauses in BharatPe’s memorandum of association, which calls for using a Big 4 audit firm to initiate dismissal action against any of the cofounders.

It is unclear whether it was the reports by PwC or A&M that prompted BharatPe’s statements this week that claimed the Grovers syphoned off money from the company to fund their lavish lifestyle, which Grover has vehemently denied.

Of course, we expect the BharatPe saga to have more twists and turns as more developments unfold. If nothing else, Grover is likely to go into a legal tussle with the company over his stake and its worth, if not for more.