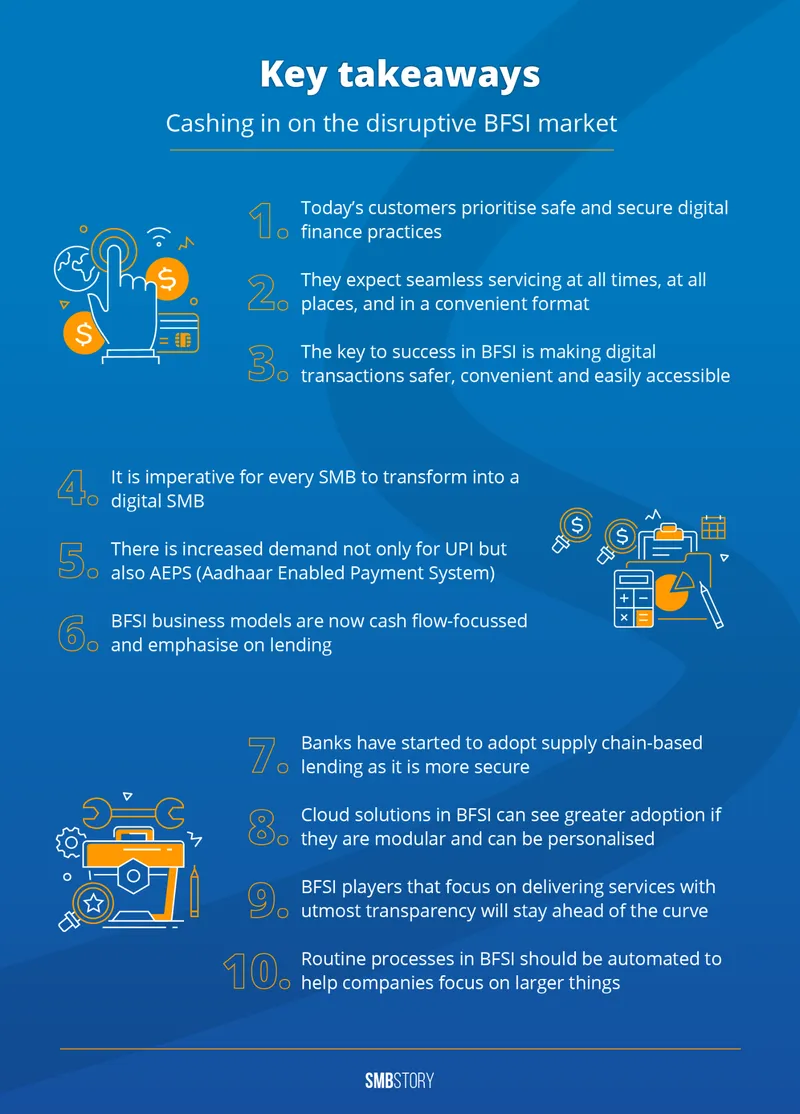

As the nation recovers from the impact of the COVID-19 pandemic and the lockdown, the time is ripe for Banking, Financial Services and Insurance (BFSI) players to reinvent themselves and introduce digitally-driven business models.

Kiranas, Small and Medium Businesses (SMBs), and larger entities alike are looking to tap into advanced technologies, such as cloud, and digitise their offerings. It is now up to players in the fintech space to supplant their legacy processes with new and optimised workflows.

To throw light on this topic, SMBStory and cloud partner Amazon Internet Services Private Limited hosted a WhatsApp chat session as part of ‘SMB week – Converse, Combat, Conquer’.

In this first session, held on March 16, industry leaders from the BFSI sector came together to discuss the disruptions and trends in the fintech market and how SMBs can leverage them to stay ahead of the curve.

Amit Nigam, Founder, BANKIT, explaining the momentum shift towards digital adoption, said, “With banks shut during the lockdown, people shifted to digital banking solutions and payments. The BFSI sector and the government have also pushed people to go digital.”

He added that fintech adoption has increased beyond the Gen Z and millennial population, and said, “Even older generations are getting more inclined towards (adopting) digital and fintech solutions. Domestic remittance is also gaining popularity among both urban and rural populations. Thus, business models for the companies in the BFSI sector moved towards digital platforms and digital securities.”

Sundeep Mohindru, Founder and Promotion Director, M1xchange, commented on how the BFSI sector has seen change in the last year. He said, “Initially, we observed a tight cash environment, and two quarters later, we saw a more relaxed cash environment. The cycle of tightness to relaxation is moving fast with government intervention, and the BFSI sector has followed suit.”

He said that business models for companies building for the BFSI market are now focusing on lending.

“Another disruption is banks adopting supply chain-based lending. This is more secure and becoming more focussed now,” he added.

Understanding the customer and collaboration is key

Bhavin Patel, Founder and CEO, LenDenClub, emphasised the importance of understanding changing customer preferences.

He said, “We will have 974 million Internet users in 2025. The question is: Can we use KYC, analytics, AI etc. efficiently to bring these users online and make them purchase financial services? Focus on customer benefit will be the king here.”

“Traditionally, people would not always place faith in finance companies. Technology can now help address this challenge. SMBs in the BFSI space should make use of all available tech solutions to deliver their services with utmost transparency,” he added.

The panelists noted that collaboration between incumbent financial institutions and new-age fintech companies has been improving. Technological breakthroughs in specialised areas by new age fintech companies are increasingly leading to strategic collaborations.

Jayatri Dasgupta, CMO, PayNearby, said, “Here, the core banking systems have been complemented with new age innovations through Open Banking APIs and BaaS. And that is the way forward. Whether it is meeting challenges of distribution, or bot-driven servicing or the proliferation of new age digital payments, the examples of close association are many.”

Mandar Agashe, MD and CEO, Sarvatra Technologies, described how his company is putting these principles into practice.

“We are creating a difference for our customers, which are mostly banks of various sizes, by giving them more tools to analyse data generated by our various platforms. This eventually helps them with better end-customer engagement and resource management. We also share product roadmaps with our customers with monthly and quarterly timelines so they know when to be ready with new features,” he said.

According to Akshat Birla, Founder and CEO, Finovate Capital, it is not always about getting ahead of the competition. “For us, getting an edge is not as important as bringing the right solution to the SMBs we cater to for working capital financing. For instance, we are focusing on becoming a one-stop-shop for anchor corporates, who we can help with in terms of vendor financing or channel financing.”

Cloud-based technology: the new normal?

The conversation then moved towards the importance of cloud technology in the BFSI space. Due to the inherent cost, manageability and scale advantages, cloud technology solutions are widely accepted as the new normal for SMBs.

They are characterised by the ability to host platforms or services from remote locations that are easily accessible via the Internet.

Akshat explained that such cloud-based technology is what powers the backend infrastructure of products that affect the lives of SMBs.

Jayatri then described why cloud technology solutions should be modular in nature. “Not all features are required by everyone. If things are modular, and can be personalised to unique requirements, together with driving cost efficiency, we will see more acceptance,” she said.

With SMBs looking to rationalise costs and conserve cash flow, cloud technology and solutions are emerging as efficient ways to keep businesses running and mitigate the extent of the financial damage caused by the pandemic.