As direct-to-consumer (D2C) brands continue to flourish amid new surges of Covid-19, a new set of startups are quietly making a foray into the digital space. Traditionally speaking, fashion jewellery has mostly remained a part of local store marketing. Almost everyone has a favourite vendor or store where she finds just the right kind of costume jewellery to meet her style needs. Then there are markets like Sarojini Nagar (Delhi), Gariahat (Kolkata) and Colaba (Mumbai), which are already famous for their superb quality but affordable merchandise.

However, one rarely finds such varieties online, although ecommerce giants like Myntra, Ajio, Amazon and Flipkart flourish when it comes to stylish apparel. One reason could be the lack of pan-India brands in this space, leading to a lack of consumer trust. But with the rise of D2C brands over the past few years, fashion jewellers like Pipa Bella, Sukkhi and Voylla have started gaining a loyal following. Better still, online commerce has brought them closer home in terms of convenience and options.

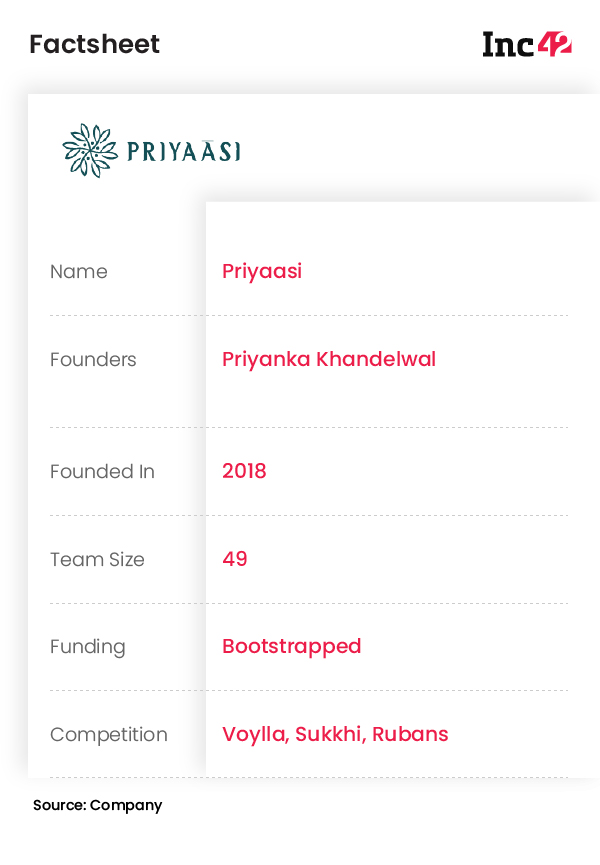

One such brand is Gurugram-based Priyaasi that went from selling a few hundred fashion jewellery pieces in 2015 to more than 90,000 a month in 2020, thanks to the spike in online demand. The bootstrapped company further witnessed more than INR 35 Cr worth of turnover in the same year.

The Jaipur-based D2C brand is currently operating across online marketplaces with a minimum social media presence. One would think social is a big part of building a D2C brand, but for Priyaasi, its product range alone has driven the company’s growth. But how has it been achieved at a time when brands all over the world have struggled to survive the economic fallout of the Covid-19 pandemic?

Priyanka Khandelwal, the founder of Priyaasi, comes from an entrepreneurial family traditionally involved in the precious jewellery trade. However, she started her career as a software professional and had a stint as an entrepreneur during her stay in the US. Once back in India in 2014, she wanted to set up a new business and deep-dived into ecommerce. Khandelwal spent an entire year trying to figure out the categories that work best in online commerce.

“I had already seen the D2C fashion boom take off in the US. And when I returned home, I saw the country warming up to online fashion. I knew I wanted to start a business in this segment. So, I took the time to do my market research,” she says.

Although jewellery design and managing product cycles came naturally to her, Khandelwal’s in-depth research also elicited the immense potential for online jewellery sales. At the time, only a few niche platforms like Voylla were specialising in fashion jewellery, and the demand far outweighed the supply.

Khandelwal started her business with just 10 products and dedicated only a few hours a day as she worked from home while taking care of her school going kids. By 2017, she set up a brick-and-mortar office in Gurugram and worked with a team to handle manufacturing and sales.

Rebranding her generic fashion jewellery business into what is now known as Priyaasi and launching the brand on Myntra in 2018 were the major turning points for the company. Today, the brand has a ubiquitous presence across all major fashion platforms such as Nykaa, Amazon and Flipkart.

Of course, the entire transformation took time, effort and skills. Leveraging the family’s knowledge of sourcing the best raw materials and workforce, Khandelwal develops traditional and chic jewellery lines through exclusive manufacturing partnerships across the country. Everything else in the product cycle, from designing to packaging and warehousing, is managed in-house, with the logistics outsourced to other firms. The current team size includes 49 employees, mostly working across procurement, quality control, warehousing and ecommerce distribution.

“All these (online) platforms follow stringent quality and brand control protocols. The products have to meet quality standards as well as the expectations of their customer base. We got rejected several times when we initially applied to feature on those platforms. But we persisted and improved the design and presentation of the products,” says Khandelwal.

Reworking the designs paid off in 2020 when Priyaasi was awarded the best jewellery brand on Myntra. In fact, the design curation, packaging and presentation of products based on the feedback from various ecommerce platforms have played a critical role in the company’s growth, says the founder. In an industry where design requirements change much like what happens in fast fashion, staying up to date with market demand and making sure that the products are manufactured and presented online way ahead of the competition have been a major focus of the fashion label.

The outcome was in sync. According to Khandelwal, Priyaasi’s revenue grew more than 100%, from INR 16 Cr in FY2019-20 to INR 35 Cr in FY21 (ended on March 31, 2021). At present, around 15% of its online sales come from the company’s website that was launched in 2020. Khandelwal has set her sights on taking this share to 40% by the end of this calendar year, while the remaining will come from ecommerce marketplaces.

“Depending on the season, we sell anywhere between 60,000-100,000 products every month,” she adds.

Until now, Priyaasi has seen significant traction from customers visiting ecommerce marketplaces. Most buyers set out looking for fashion jewellery and often become repeat customers if they are satisfied with product lines. Priyaasi is also working on developing better customer engagements to increase brand awareness.

Incidentally, the brand also launched its social media presence along with its website. Khandelwal currently handles the customer engagement part, but Priyaasi is actively hiring to bring brand experts on board.

“Within the next five years, we want to reach a revenue of INR 500 Cr, which is possible because India’s fashion jewellery market has immense potential. We have taken a bootstrapped company this far, but the next growth stage will need funding. This funding will be required to build a strong marketing channel and brand value,” says Khandelwal.

The founder says that she did not feel the need for funding until 2020, but following the pandemic, the company has assessed its growth plans. Much like other ecommerce brands, Priyaasi briefly pivoted to manufacturing masks last year to keep the business afloat. But the rising demand for fashion jewellery has convinced the company to plan a bigger and long-term funding strategy.

Priyaasi competes with funded jewellery brands like Melorra, Bluestone, Voylla (raised $15.5 Mn), Sukkhi (raised more than INR 51 Cr), Rubans (part of Myntra’s accelerator programme) and more, but many of these are in the traditional gem and jewellery business instead of fashion jewellery. Then there are several offline-to-online brands like Zaveri Pearls, Shreehari and SriKrishna Pearls that have region- and market-specific recognition. Given the rising competition, can Priyaasi build a profitable omnichannel presence?

“We had to abandon some plans for offline marketing last year, but we have plans to assess the opportunity again once the Covid-19 situation stabilises. As of now, everyone is selling online, and we are in a good place,” says Khandelwal.

As of now, Priyaasi’s profit is in the single-digit range, but the company is solely focussing on growing its user base and building customer engagement. As fashion jewellery is quite affordable compared to precious jewellery, it has become a fast-growing market, with old and new players seeking to provide unique value offerings in this space. Understandably, this segment is highly competitive. But there is also scope for higher margins if companies can differentiate themselves in terms of quality and style statements, say retail experts. In fact, many companies have raised substantial funding in recent times, and witnessed mergers and acquisitions based on their brand value.

In April this year, beauty platform Nykaa announced its acquisition of fashion jewellery brand Pipa Bella. This is not surprising as Nykaa Fashion aims to expand its jewellery line and offer fashion jewellery and accessories. In January, Indian conglomerate Aditya Birla Fashion and Retail bought a 51% stake in Sabyasachi Couture, a luxury brand that offers apparel, jewellery and accessories. In 2019, the business group announced the acquisition of Jaypore, another D2C brand that sells handcrafted apparel, jewellery, home textiles and home decor items, among others.

Does Priyaasi see itself diversifying to other products to build a stronger brand in the future?

“Once we reach INR 100 Cr revenue, we want to start our custom line of silver jewellery and accessories such as watches and bags. But these are capital-intensive initiatives, and we will look at concrete funding opportunities before we do it,” says Khandelwal.