Having worked in the investment banking industry for a long time, Ajinkya Kulkarni one day noticed there was a discernable gap between exclusive investment opportunities offered to high-net-worth individuals (HNIs), and the low-yield, traditional options offered to retail investors.

He particularly realised that a lot of the investment options that were available to the common, everyday investor carried substantial risks with them, or were at least not as proportionately risk-adjusted as options available to HNIs and UHNIs (ultra-high net worth individuals). Specifically, debt investment instruments were sorely lacking in the retail space because they needed huge capital commitments upfront.

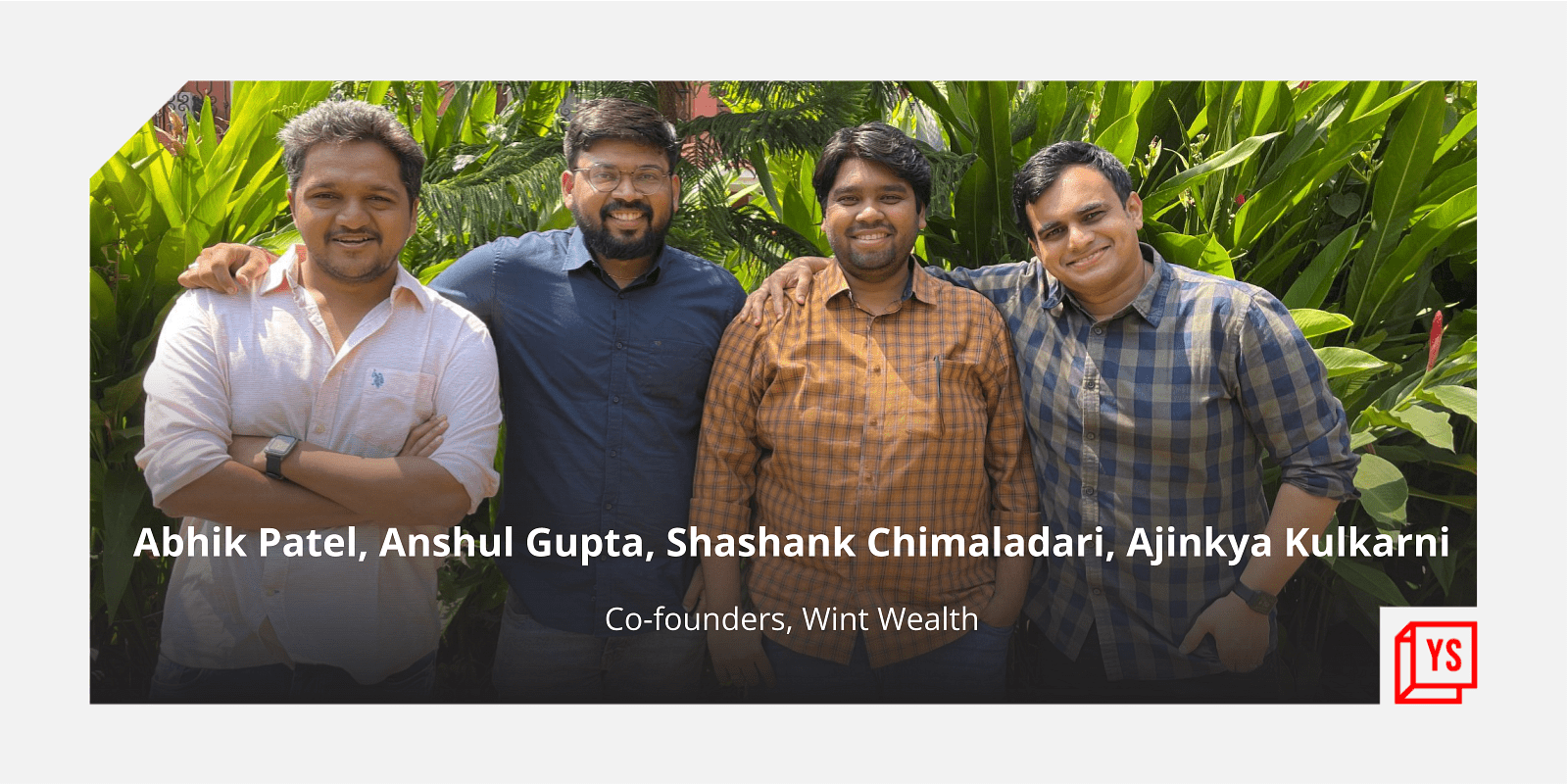

To test if regular people would invest in debt instruments if they were given the opportunity, Ajinkya and his four friends and colleagues — Abhik Patel, Shashank Chimaladari, and Anshul Gupta — all IIT graduates — started talking to people around them who they knew regularly invested in some form or the other. They even accepted cheques from them to really put their thesis through the paces, before they registered a formal business.

Once they realised they had an idea worth exploring, they set up — a fintech platform, to make it easier for retail investors to bet on debt instruments that offered better yields at lower risks.

“It’s widely the perception that retail investors cannot understand advanced assets, so it is futile to convince them to invest in new asset classes. We found this approach obnoxious, and decided to democratise assets that were previously only available to the rich class and make it available to the retail investors,” Ajinkya tells YS.

So far, the Bengaluru-based startup, founded in 2020, has seen over 80,000 registrations by retail investors, although the number of active users who have invested in something or the other on the platform is around 11,000. Wint Wealth has nearly Rs 150 crore in investments under management.

Ajinkya says the startup is currently gearing up to introduce Senior Secured Bonds on the platform, following a successful pilot and then a series of covered bonds that various NBFCs had issued to retail investors on Wint Wealth’s platform.

How the founders met

Ajinkya and Abhik had worked together on their last startup, , which they sold off. Abhik joined Shop101, a reselling app, while Ajinkya joined as its VP for vendor-lending operations.

Abhik met Shashank, Wint Wealth’s chief technology officer, at Shop101.

When the trio was discussing the lack of debt investment options for retail investors, they decided to rope in their friend, Anshul — Wint Wealth’s chief investment officer — who was working as a director at Northern Arc, an NBFC that looks at providing loans to underserved individuals and businesses in India.

“Our aim at Wint Wealth is to build something for the 50 million retail investors who want to diversify their portfolios with alternative assets and get higher returns,” Ajinkya says, adding “we have always believed in creating our own path by entering underrated segments that were previously believed to be a dead end.”

Business model

Wint Wealth basically makes it cheaper and more affordable for retail investors to invest in debt instruments like bonds, which were earlier only restricted to the UHNI layer.

Whereas the normal minimum ticket size for investments in the debt market starts at Rs 10 lakh, Wint Wealth makes them available to retail investors from Rs 10,000.

The platform currently offers investments in asset-backed securitised debt instruments (SDIs), and will start offering covered bond options soon. The investment options are made available to the startup’s users via partnerships with NBFCs that issue these bonds. After the bonds are sold to retail investors, they receive monthly interest from the NBFCs, and the full principal amount is returned at the end of the tenure.

Wint Wealth charges NBFCs that issue the bonds on its platform around 1 to 1.5 percent of the entire transaction value it processes for them on its platform.

Ajinkya says the startup is expected to cross two lakh registrations soon, as well as an AUM of Rs 400 crore in the next two months.

“There is more potential to penetrate the retail investor market deeper and introduce more options available to them that were previously hidden behind the higher ticket size curtain,” he adds.

So far, Wint Wealth has raised a pre-seed round of Rs 70 lakh from friends and family. It raised $2 million in seed funding from investors such as Zerodha’s Rainmatter Capital, CREDs’ Kunal Shah, First Cheque’s Kushal Bagia, Pravin Jadhav of Paytm Money who now runs Raise Financial, and Better Capital’s Vaibhav Domkundwar, among others.

It was rumoured that Kunal Shah was looking to acquire Wint Wealth, but the company says it was never in talks with CRED, and that the rumours were just that — rumours.

Wint Wealth’s competitors include alternative investment companies such as Pyse, , , and that allow investors to invest in non-traditional asset classes. In the debt investment space, it competes with IndiaBonds, and the likes of Paytm Money, , , and others that have been expanding the investment options they provide to their users.

Retail investors constitute 45 percent of the total stock market participants on the National Stock Exchange — a clear majority — according to data from National Stock Exchange. Nearly 14.2 million retail investors trade actively, data from National Securities Depository Ltd (NSDL) and Central Depository Services Ltd (CDSL) showed.

However, the debt markets have not seen that sort of traction yet, mostly because products that enable easy investments in these instruments are not available widely.

But users are quantifiably becoming more and more comfortable using online investment platforms, as well as seeking more diversified investment opportunities — and companies like Wint Wealth stand to gain from that precedent.