Every three years since 2015, Ankiti Bose and Zilingo’s life has taken a turn and on each occasion, it was a transformative event. And incidentally, each of these times is related to a close friend or a mentor of the Zilingo CEO and cofounder.

The course set in 2015, when Zilingo was founded, twisted to search for growth in 2018 on the advice of a high-profile fellow Sequoia portfolio entrepreneur.

The idea that emerged from Bose’s discussion with this second-time entrepreneur — also an angel investor in the company and the CEO’s close friend — would change the course of Zilingo forever, according to multiple sources directly aware about this meeting. It solved the challenge with scaling up and signing up vendors and suppliers rapidly.

But it involved a series of manoeuvres and deep discounting that would eventually unravel the startup, considered one of the biggest success stories to emerge from Southeast Asia and Singapore.

And then three years later in 2021, another massive shift — this time more tectonic than tactical. It was a clash between Bose and Sequoia, the company’s earliest and most consistent institutional investor.

As one person close to the Zilingo CEO described it, “This was not a professional fallout, this time it was personal.”

The personal fallout was between Bose and Sequoia’s Shailendra Singh, over the direction of the company, the cash burn and the lack of any path to profitability, all dating back to the focus on rampant growth that began in 2018. And it happened even as tensions between Bose and the other cofounder Dhruv Kapoor escalated.

And allegations have also been raised that Kapoor and other senior employees at the company buried complaints of sexual harassment. Now, Bose is said to be exploring a lawsuit against Kapoor as well as a buyback of Sequoia’s stake in the company.

How did things get so bad? One look at the company’s past shows it was more of a house of cards, riddled with ideas and strategies that lacked operational vision or any sort of planning. The tech platform was more or less missing in the initial years, and overspending to market and promote the B2C fashion vertical meant Zilingo burnt millions. Amid all this, founders clashed over many ideas and even over alleged patterns of sexual harassment in the company.

But the charge now being levelled against Zilingo is that there was wilful fraud. At least that’s what the board is saying, but we don’t know what the fraud was, how it happened and how it evaded notice of the board and investors like Sequoia, Temasek, Burda, Beenext and other major VCs is another major mystery.

In short, the Zilingo saga has snowballed from mismanagement and millions of dollars burnt to a massive controversy that threatens to swallow the company whole. What will happen to the 500+ employees and will Zilingo become fodder for acquisition as VCs look to exit? Besides this, there are some serious questions about VCs neglecting corporate governance processes and not pushing for transparency, even as they now lay allegations against the very founders they invested millions in.

Zilingo & The Missing Tech Stack

Having begun as a company that promised to revamp B2B commerce in the fashion industry, Zilingo also made the jump into the B2C category with its own ecommerce operations. The company was balancing both verticals between 2016 and 2019 when operations were in full swing.

However, in those early years, Zilingo burnt cash to grow and the B2B platform was still being developed.

Operations in India, Indonesia and Thailand were managed largely through spreadsheets and not a SaaS platform, according to multiple former employees.

This was not exactly in line with Zilingo’s claims of connecting the supply chain through a marketplace, on the back of which Zilingo raised $308 Mn till December 2019.

The operations were in a complete mess because of a lack of a working tech platform to onboard clients during. Processes and sales reporting was manually done, just like traditional supply chain businesses.

Besides this, former employees from Delhi and Mumbai told us the sales and procurement teams were not given any direction or targets. The lack of any go-to-market strategy, quality checks, tech platform or coherent planning led to revenue leakage, including episodes of LED screens worth INR 24 Cr disappearing from warehouses, or sales personnel cracking deals regularly that involved kickbacks to themselves or large discounts.

We were told that these deals resulted in INR 35 Cr – INR 40 Cr being syphoned away by some sales executives alone.

Between 2017 and 2019, sales executives offered discounts to vendors to record their transactions on the Zilingo platform, with the SaaS platform offered as a complementary solution. The discounts — ranging between 2% and 5% — would help Zilingo boost its topline numbers, but in reality, the company was giving away the commission that it might have earned from these transactions in the form of discounts.

Zilingo’s Dhruv Kapoor and Ankiti Bose, Sequoia Capital India and Shailendra Singh declined to speak on the issues in the company. Inc42 spoke to at least a dozen sources that have been close to the leadership and Zilingo’s operations to emerge with a picture of the state of affairs.

Valuation Built On Fake GMV

Discounts are nothing new of course and in the context of ecommerce, Zilingo is not the only company to offer them to sign potential long-term customers. But it was accounting for the discounts among its net revenue. Plus, the intense focus on maximising GMV led to a no-holds-barred approach to sales and unscrupulous behaviour from the sales team.

A common occurrence was sales personnel striking cash-based deals with vendors, overbilling the purchases and under-invoicing the sales. In most cases, the buyer and seller were the same or related entities.

Sources told us members of the sales teams were asked to send emails from fake mail IDs to Zilingo’s auditors in Singapore containing documents that confirmed the outstanding amounts owed by certain vendors.

It remains unclear whether these outstanding dues were indeed recovered or whether they were actually outstanding. Our sources seemed to indicate that these confirmations were not accurate.

Inc42 was given access to several email addresses on Yahoo.com and AOL.com and one of these accounts show a confirmation being sent to KPMG in December 2018 about the outstanding dues from a vendor. Zilingo has not filed its financials in Singapore since FY2019.

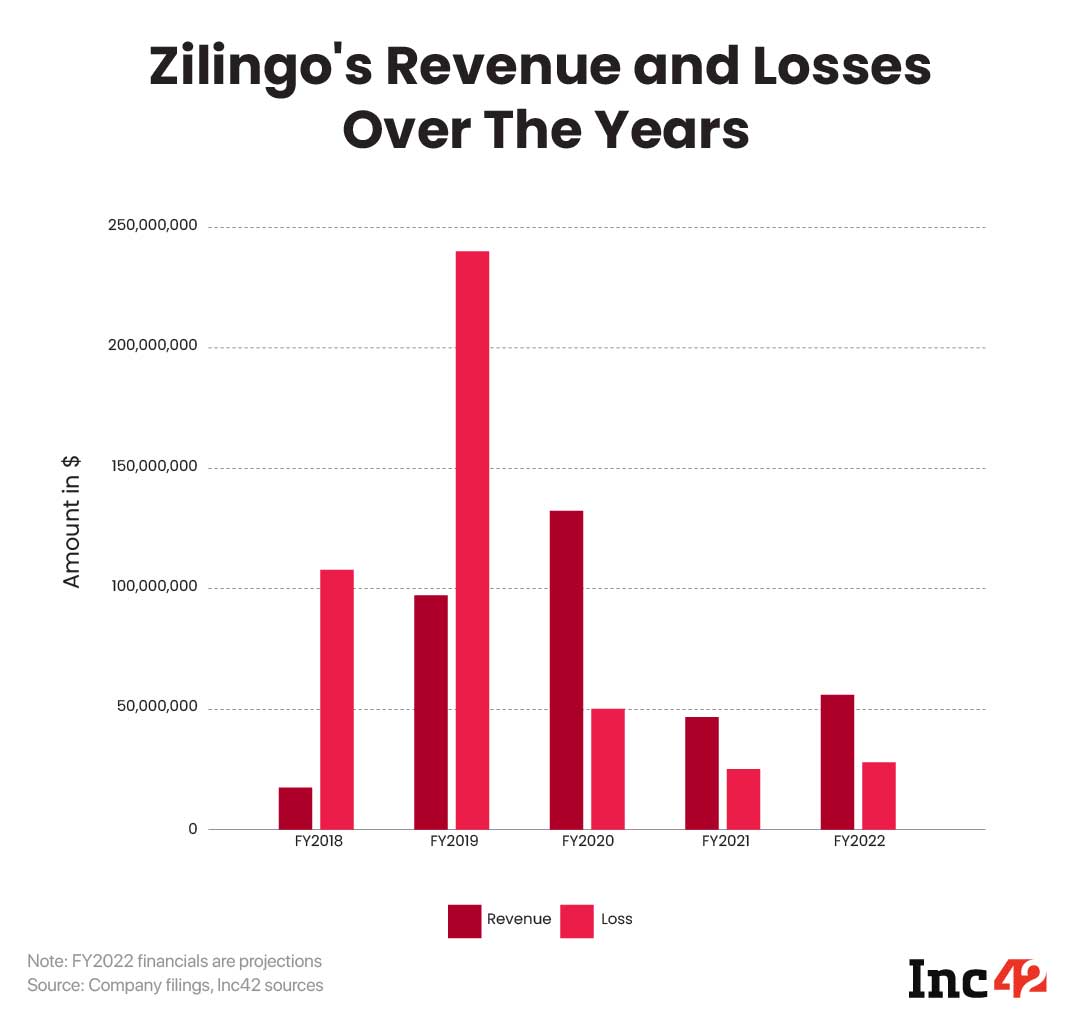

Its latest audited financial performance shows losses of $236.5 Mn in FY2019. Net cash flow from operating activities was a negative $95 Mn, with a high debt-to-equity ratio of -1.60.

This indicated that the company was not earning enough revenue to cover the interest on loans it had taken in its lifetime till 2019. However, according to unaudited financial reports, a copy of which Inc42 has seen, Zilingo has completely shut its B2C operations — it only contributed 0.5% to the net revenue in FY2021, and is not accounted for in FY2022 projections.

Over the past three financial years (2019-2021), the cumulative loss for the company was over $430 Mn, while the total net income over these years is just $285 Mn. However, the company is claiming positive contribution margins in FY2021 of $4.1 Mn.

It would seem that by January 2022, the cash burn had been cut significantly, so how exactly did the situation become this bad?

How Did Zilingo Mismanaged Its Millions

Even as the B2C vertical was guzzling cash, the company did not stop its expansion spree, that too with little to no planning.

For instance, in 2019, Zilingo entered the financial services market looking to extend working capital and other loans to its SMB partners and other vendors on its platform.

According to one source, the company issued $14 Mn in loans from books to suppliers in India and Indonesia. However, no risk assessment was conducted for these loans and the entire amount was written off as bad debt.

Further, Zilingo acquired Sri Lanka-based tech startup nCinga in December 2019 for $15.5 Mn in a cash and stock deal. Sources told us discussions with nCinga had begun in May with a valuation of roughly $5 Mn – $7 Mn, which was considered a great price by Zilingo’s management.

At the time, Kapoor had been of the belief that Zilingo could build the nCinga’s solution in-house instead of acquiring the company. But, eventually Zilingo paid more than 2X just seven months later after Bose showed desperation, a source added.

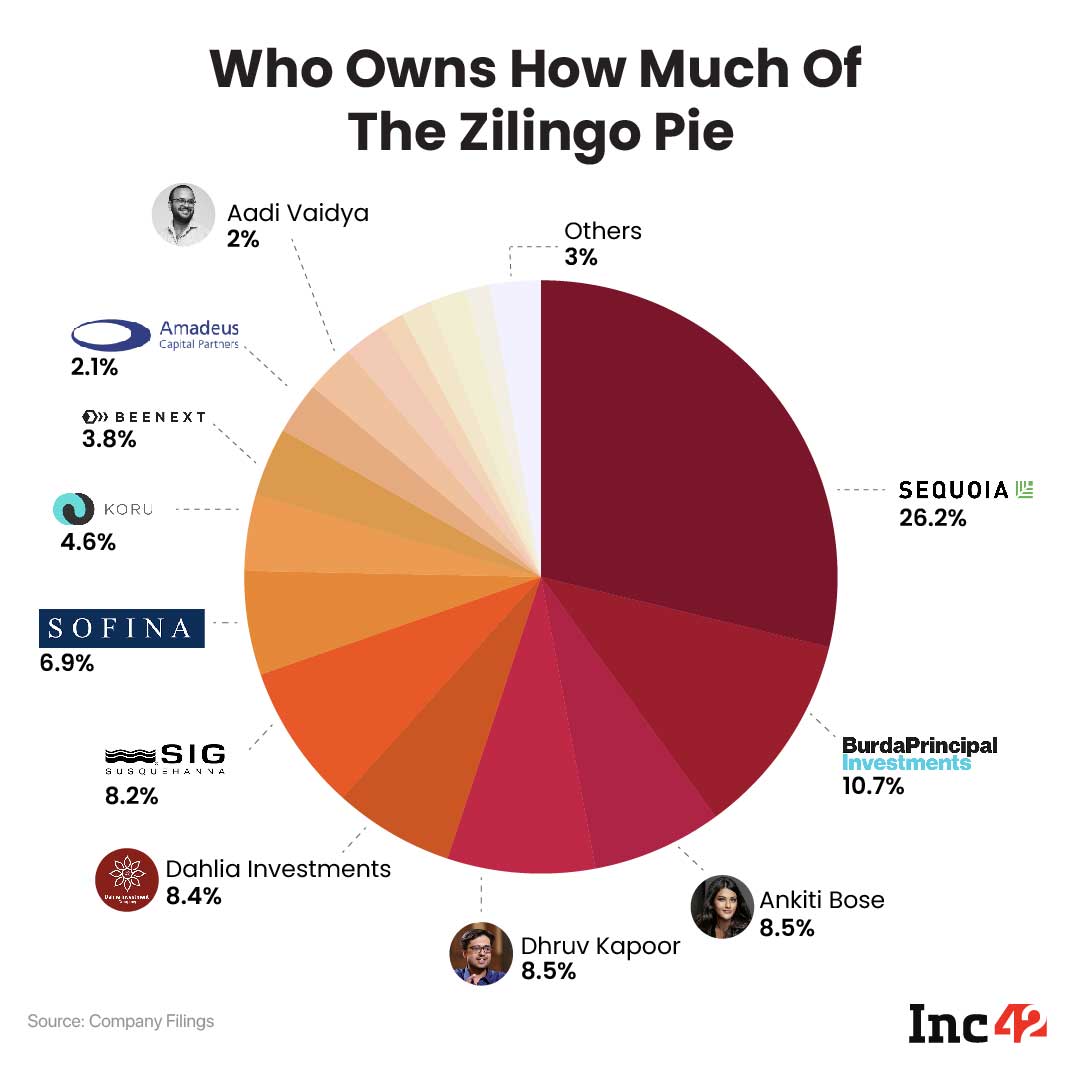

Interestingly, Rajan Anandan-backed BOV Capital was one of the investors in nCinga who exited the company in this transaction. Anandan has been a managing director at Sequoia India since August 2019, and one of the VC firm’s key leaders in India. Sequoia holds over 26% stake in Zilingo and has invested in every funding round for the company since its seed round in 2015.

Further, sources alleged that Bose overspent when it came to marketing and promoting the B2C operations in the US, signing up big contracts with talent management and branding agencies in the US.

Zilingo is said to have spent $20 Mn in setting up mini brands in the US, but given that the B2C operations have fizzled out, this spending was in vain.

A similar scene played out in Australia, where a team was brought in for B2C operations in January 2019, but by March 2019, Zilingo decided to shift its focus in Australia to B2B, and the team was left clueless.

We were also told that Bose expensed personal spending to the company’s accounts, though Inc42 was not able to independently verify these claims.

Among these expenses were allegedly payments for first-class flight tickets for her family to Singapore between 2017 and 2019, as well expenses for purchases of luxury items for personal use. Besides this, Bose is alleged to have signed a retainer contract with US-based Creative Artists Agency (CAA) for branding of Zilingo and herself, as well as managing any potential contracts for entertainment IPs based on her journey.

However, other sources at Sequoia told Inc42 that the current situation and the suspension of Bose is not about cashburn or GMV boosting (which the company had been doing), but about wilful misconduct and fraud, the nature of which is still unknown.

Ankiti Bose Vs Dhruv Kapoor: Disagreements Turn Bitter

Even as Zilingo was trying every trick in the book to grow its topline and brand through 2018 till 2020, CTO and cofounder Kapoor is said to have been at odds with Bose on a number of matters.

Sources reiterated that Kapoor had already been burnt by the nCinga acquisition episode, where certain promises made by Bose were not kept. And then there was more tension in 2020.

After laying off employees in 2020, Zilingo entered the personal protective equipment (PPEs) space to supply suits and face masks. Kapoor is said to have opposed this move as it was not Zilingo’s strength. Despite Bose’s assurances to Kapoor that Zilingo would not enter the PPE business, the startup signed contracts with the governments of Germany and India and brought on suppliers.

One source told us some suppliers never even delivered the products, while others offered substandard quality leading to delays in deliveries.

For instance, the Indian government is currently locked in a legal battle with Zilingo over the failure to deliver 10 Mn KN95 masks, as per Delhi High Court filings. The value of this contract was $22.5 Mn, with Zilingo claiming that the Indian government failed to secure 30% of the total value of the invoice as a bank guarantee.

The matter is currently pending in the Delhi High Court.

Despite being founders of the company and having significant individual stake in it, Kapoor and Bose were seemingly leading different companies. From what sources tell us, Kapoor was largely buried in tech and product development, while Bose led the sales, marketing and administrative responsibilities. Such a bifurcation is common, but what is not common is one founder not knowing what the other is doing.

Sources close to Kapoor admitted that often he had no clue about what kind of money the company was burning, but this points to a serious lapse in judgement and leadership. As the only other individual with more than 8.5% stake in the company and as someone who has reaped the benefits of Zilingo’s growth and scale as a cofounder and CTO, Kapoor is equally responsible for the upholding best practices, and calling out problems or issues.

The same could be said for Bose and her knowledge of how the tech operations in Bengaluru were managed. One of the common points raised by our sources is that these were two different Zilingos, culturally and organisationally.

Disagreements between founders is common, what is not common is apathy for critical areas of the business. And this is what completely derailed Zilingo after years of burning cash became a problem.

But even as all this was happening between the two most key people, Sequoia looked to step in to solve the mess that was the business.

Sequoia’s Shailendra Singh Vs Ankiti Bose: The Final Nail?

Sources close to Ankiti Bose describe a change in the dynamics between the CEO and its key investor Sequoia Capital India, particularly Shailendra Singh, a managing director at the VC firm. The fallout began in January 2021, said multiple people aware of the development.

Singh was seen as more than a mentor to Bose, but Sequoia’s six-year-long relationship as an investor with Zilingo was under strain. So what exactly changed in early 2021? For one, the company was in the market for a new funding round, but its lead investor was not happy with the burn in the years past and wanted to hunker down on profitability.

These two objectives — profitability and fundraising — seemed diametrically opposite and the CEO was uncertain on whether this slow-burn strategy would pay off, we were told by at least two sources.

Bose believed that the company had enough runway to push for growth and raise a new round, but this line of thinking was incompatible with Sequoia’s goals.

At one point, Sequoia had even suggested former Myntra CEO Ananth Narayanan, as a successor.

Those privy to Bose’s conversations with Singh told us, “There was constant pushback from Ankiti’s side because she thought Sequoia has never pushed other founders from its portfolio in this manner. It seemed like selective targeting to her.”

Multiple sources informed us that the relationship further soured over Singh’s recommendation that Zilingo merge with another Sequoia company and fellow B2B ecommerce player Moglix. While Zilingo is focussed on the fashion vertical, Moglix offers ecommerce and supply chain solutions for various industrial and manufacturing verticals.

However, Bose disagreed with Sequoia and Singh’s view, according to multiple sources close to the CEO.

Sources told us the deal would have valued Zilingo at $200 Mn, a fifth of the $970 Mn valuation that it raised its last round at in December 2019 from Jay-Z’s venture fund Arrive.

However, sources at Sequoia told Inc42 that Moglix founder Rahul Garg had merely asked to be introduced to Bose for a conversation, and there was no acquisition-related talk in this meeting.

By mid 2021, Zilingo had gone two years without a fresh capital infusion and it was critical for the company to raise funds. Investors were more than profligate with funds throughout much of 2021, so this was the right time to raise and raise big. But Zilingo missed the bus, and it’s only when it went back to deal talks with investors that a host of issues emerged.

Dark Side Of Unicorn Rush: Who Watches The Celebrity Founder?

Amid a slew of problems emerging in 2021 in the aftermath of the Covid year, Zilingo was under pressure to grow its revenue and show profitability. This was something Bose had never experienced before. Sources at Sequoia told Inc42 on the condition of anonymity that investors asking for profitability is nothing new, but the duo’s relationship is said to have deteriorated when Bose accused Sequoia of selectively targetting her.

In the aftermath of CEO Bose’s suspension and the stepping down of Sequoia’s Shailendra Singh from Zilingo’s board, the VC firm released a post on its blog talking about corporate governance and also about wilful fraud and misconduct by founders. The VC did not specify how it will improve its monitoring of corporate governance within its portfolio, but as per reports, the suspension comes after a whistleblower allegation against fraud in the company.

However, one big question is can investors claim ignorance for all practices at Zilingo. How has the board, which includes Sequoia and other investors, not looked into the books or financials for two years, even though the company had a full-time CFO?

And if indeed the books and financials were examined, how did the so-called ‘wilful fraud’ escape notice?

One might also wonder why the full focus is on Ankiti Bose, while cofounder, board member and CTO Dhruv Kapoor has so far not been suspended for fear of interference as in Bose’s case. Externally, it comes across as a company where one founder was running the show, and the other founder was kept away from decision making.

Bose was heralded as an inspirational founder by Sequoia and given a place of pride within its portfolio of rockstar founders, after her stint as an investment analyst at Sequoia in 2014.

She was the face of many programmes run by Sequoia over the years, but recently the VC firm has dropped her from its lineup of mentors for the Sequoia Spark Fellowship programme focussed on women entrepreneurs.

It just goes to show that celebritydom in business and entrepreneurship can be fleeting — the spotlight can be taken away from founders just as soon as it was directed to go there.

What Next For Zilingo?

It’s interesting that the action against Zilingo and Bose has come at a time when few more startups from Sequoia’s portfolio is also stressed due to several reasons, ranging from infighting and public mudslinging at BharatPe and tax and other irregularity probes at Zetwerk and Trell.

A parallel can be drawn between BharatPe and Zilingo — in both cases, one of the cofounders has been suspended for irregularities, while the focus of the public battle is on mudslinging and digging up old accusations.

One of those being harassment complaints that were allegedly buried, and now they have emerged again, as the founders take potshots at each other. A number of sources told us sexual harassment complaints were raised against a senior employee, who has been with Zilingo since 2019 and currently serves as the head of the company’s primary revenue source. These were buried by the management.

And last year, CEO Bose was also targetted by abusive emails and social media posts. Inc42 has viewed emails pertaining to the harassment allegations by Bose.

Now, Bose has sent a legal notice to Dhruv Kapoor, Zilingo COO Aadi Vaidya for burying this matter. However, sources close to Kapoor said that the employee in question was dismissed after the necessary legal formalities.

Regardless of the outcome of the Zilingo saga, ultimately it is the employees who will have to bear most of the brunt.

From 900 employees in early 2020, the company’s workforce has now been reduced to 500 after many rounds of layoffs.

Even if it raises funds in a down round or at a less than satisfactory valuation, the pressure to grow and show profits will not disappear. The alternative is a distress sale at a lower valuation, which will further impact employees, since transition of people post acquisitions is fraught with challenges. The company is also very likely to see a new CEO in the near future.

Ultimately, Zilingo’s excesses paint a picture that is emblematic of the unicorn rush in India and among Indian-origin companies. Ultra-rich valuations and vanity metrics have claimed another victim.

Bose is a huge part of the company — a brand in her own right and the face of Zilingo — but it feels like her days at Zilingo might be numbered, unless her legal steps prove fruitful. Even if there is a new leader or if Bose remains CEO, will it even matter? Can Zilingo and its founders actually climb out of the hole they have dug for themselves?

![Read more about the article [Funding alert] Convenience store retail chain AMPM raises Rs 1.6 Cr through Agility Venture Partners](https://blog.digitalsevaa.com/wp-content/uploads/2021/03/Imaged4ih-1614684807400-300x150.jpg)