While fintech services remain the foundation of digital consumerism, neobanks are emerging as the next step to bring financial access to all

After its success with the credit-lending app MoneyTap, Freo is entering the neobanking space to offer a range of products, including savings accounts, QR Code-based payments, line of credit, debit and credit cards, BNPL and more

Ankur Maheshwari, group CFO of Freo, believes that a credit-centric model is the key to building a profitable neobank

Over the years, fintech players in India have ushered in a financial renaissance for consumers and businesses alike. They have brought around robust, integrated payment gateways and the ubiquitous e-payment/mobile payment solutions to virtual cards to digital lending and insurtech. This slew of services has ensured paperless solutions to meet the emerging needs of a country moving quickly to the digital sphere.

Thanks to fast-converging technology trends and the changing demand of digitally active consumers, the banking industry has embarked on its own transformation. It is no longer business-as-usual for legacy banks as the next wave of disruption is already here in the form of digital-only neobanks. India has as many as 27 operational neobanks like Open, Niyo, YeLo, Zeta, Jupiter and more, pushing convenience and customer-centricity to the next level and also servicing the unbanked.

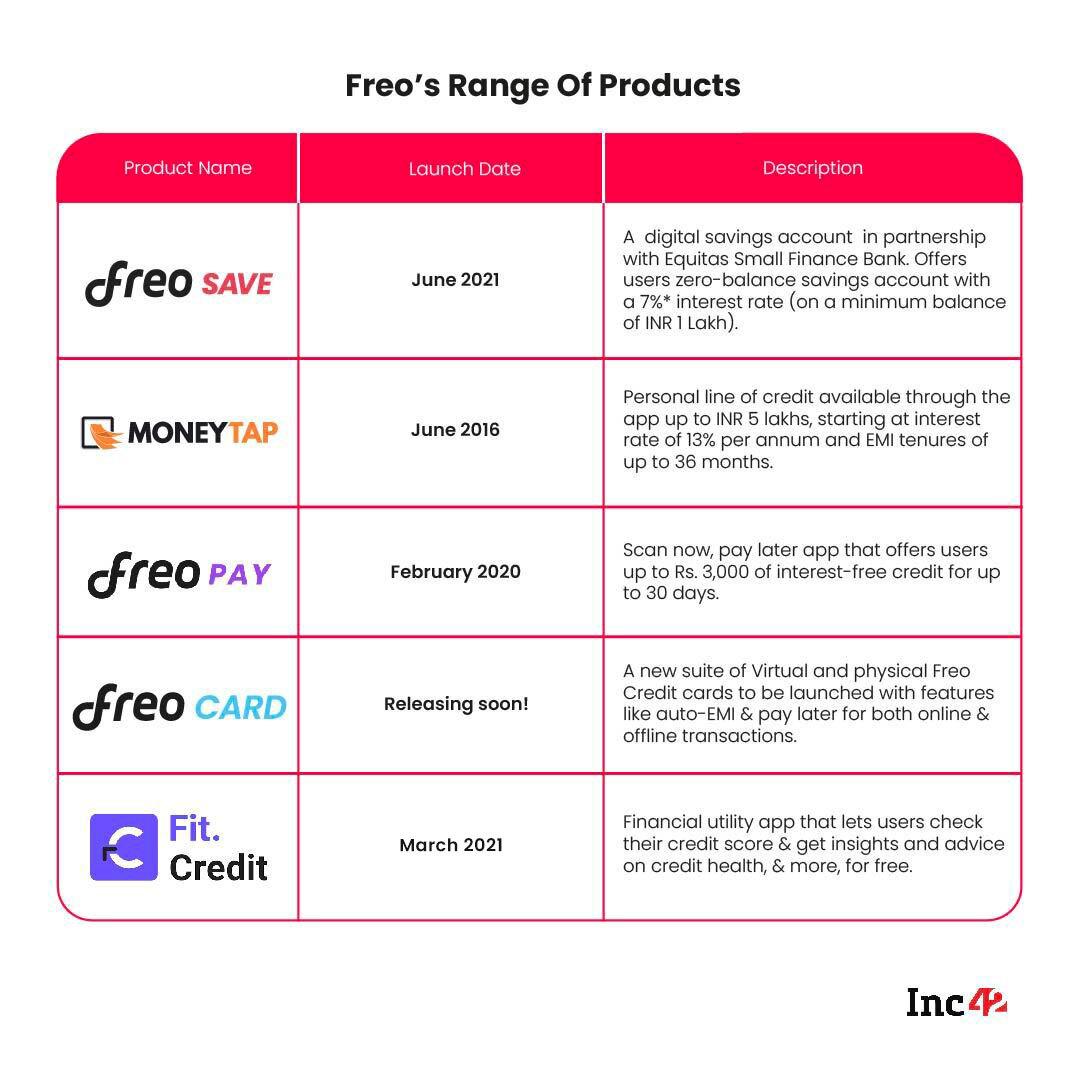

One of the latest players to join the neobank sphere is Freo, India’s first credit-led neobank. Freo started its operations in India with the launch of MoneyTap and now offers a suite of multiple financial products.

Before we explore Freo’s journey in the neobanking space, it is important to look at the context of these innovative banking experiences. Also known as digital banks or challenger banks, neobanks are completely digital in nature without any brick-and-mortar presence. They offer a wide range of financial products and services (full-fledged banking services, instant personal loans, buy now pay later, or BNPL, and more) through their apps.

In India, neobanks do not operate independently as the Reserve Bank of India is yet to acknowledge them as a new category of banking intermediaries. Hence, each of them is backed by a regulated bank that partners with them in their operations, offering core banking facilities, loan disbursement, finance management, credit health analysis and more.

Neobanks also can offer a higher rate of interest on a savings account than traditional banks by partnering up with small financing banks and similar partners. Traditional banks also benefit from this association as the digital-first nature of neobanks enables them to onboard more customers that might be outside the physical reach of these banks.

For instance, Freo’s Credit arm, MoneyTap allows a user to get an instant line of credit of any amount up to INR 5 Lakh without asking a user to fill a physical form, visit a branch or provide collateral. The company assesses a user’s creditworthiness by checking all pertinent information, and one can access the line of credit upon confirmation of eligibility. Such swipe-and-go services often attract millennials and Gen Z’ers who were early adopters of digital solutions and prefer mobile-first services.

“Over the years, banks and their services have evolved to fulfil the needs of their customers. Neobanks are the logical successors of this process and come with the tech and data DNA to serve the end customer better. At Freo, we aim to bring financial access to consumers and make credit more affordable and convenient,” says Freo’s group CFO Ankur Maheshwari.

Globally, the market is booming. The market size of neobanks, an estimated $35 Bn in 2020, is expected to grow at a CAGR of 47.7% to hit $722.6 Bn by 2028, according to Hamburg-based market and consumer data analysis firm Statista. Apart from the steep growth projected for this sector, investor confidence has also remained strong as prominent players in India raised more than $500 Mn between 2019 and July 2021.

The Journey From MoneyTap To Freo

Launched in 2015 by Bala Parthasarathy (CEO), Anuj Kacker and Kunal Varma, MoneyTap was one of the early entrants in the mobile-based credit lending space. By then, India was looking for an alternative to legacy lending, and in sync with its needs, the founders wanted to usher in a customer-centric approach by keeping convenience at the forefront.

To begin its operations, this consumer fintech startup partnered with RBL bank, the first of the many banking and NBFC partners (non-banking financial company) in its portfolio. In the next few years, MoneyTap tied up with several financial institutions, including HDB Financial Services, Credit Saison, InCred, Fullerton, IDFC First Bank, and more.

Funding poured in as MoneyTap grew. It raised $70 Mn for a series B round in January 2020 that comprised debt and equity funding led by Aquiline Technology Growth, RTP Global and Sequoia India. A month later, the company made its first foray abroad and launched MoneyTap Credit Line in Vietnam where it has registered INR 7 Lakh customers so far.

Powered by its international stint and domestic operations, MoneyTap saw more than 15 Mn app downloads and has disbursed loans more than INR 4,500+ Cr in India and claims to have grown at a CAGR of more than 230% since inception. The company also launched an NBFC (called Tapstart) in 2019 with a license granted by the RBI.

“The singular focus of our move into the neobanking domain was so that we could focus on innovative products that would bring ease and flexibility into the user’s life. Right from the moment they wanted to start having a financial profile, conducting their own transactions and ease that would last them for their whole life,” says Maheshwari.

The latest offering from Freo Neobank is its brand new digital savings account, offered in partnership with Equitas Small Finance Bank, called Freo Save. Along with the provision of a higher savings interest rate to its users, the company claims that account holders can also improve their credit scores through these accounts.

With MoneyTap being a leader in its chosen space for years now, the company already had an established user base of close to 15 Mn that it aims to leverage to set the foundation for its Neobank.

The other products in the company portfolio include FreoPay, a BNPL service; Freo Cards, virtual and physical cards that allow customers to convert their bills into easy EMIs; Fit.Credit, a financial utility app that can check credit scores, share insights and recommend methods to improve it and SuperSplit, an expense management Indian vernacular app that allows users to split a bill among a group.

Freo is aiming to improve credit inclusivity for a larger population through all its services.

Understanding The Freo Model Through The Financial Lens

Globally, the world of neobanks presents opportunities to take financial services from legacy institutions to mobile devices and address the big gaps in the current financial model. However, experts express concerns over the new model and its long-term sustainability as annual reports of various neobanks reveal that they are in the red.

It is not certain whether the loss-making neobanks will hit the profit track soon. Most of them earn revenues from transaction fees when customers use debit or credit cards provided by partner banks. But this is just a tiny drop in the ocean compared to their operational costs. To bridge this revenue gap, some of these fintech firms are experimenting with a freemium model where many services are free but a few topline services require a subscription fee. But this may raise the customer acquisition cost as selling subscriptions to users adds to marketing overheads and diminishes net gain.

Maheshwari, however, remains confident of the startup’s success. In a conversation with Inc42, he acknowledged the challenge in revenue generation but said that there are chances that neobanks would not be profitable by providing innovative financial solutions as these products do not generate enough revenue. If the neobanks do not have a proper financial roadmap that eventually monetises their customer base, they will always struggle to hit profitability.

This is where Freo differentiates itself because it operates with credit as its core proposition. Globally, there are three types of Neobanks: payments-led, experience-led, and credit-led. The first category makes payments faster, the second makes banking simpler and these two categories already exist in the Indian startup ecosystem. Freo is a different breed of neobank being credit-led, which means it has a powerful and proven monetization model.

“We have continuously refined our credit underwriting system in the last six years and built a robust risk management infrastructure for our MoneyTap credit line business. Because of MoneyTap, we already have a strong registered user base and deep expertise in credit understanding, which will enable us to monetise our assets through various Neo bank products and reach profitability,” said Maheshwari.

Explaining the underwriting system, Maheshwari said that their scorecard is built with more than 3K input variables, and the data is segmented into two buckets — ability to pay and intent to pay — for a holistic risk assessment of every user. The entire credit assessment process is automated and uses machine learning models at the back end.

Freo also monitors user portfolios through a feedback loop to strengthen digital fraud checks. Although neobanks in India do not undertake defaulter’s liabilities, robust underwriting is essential in both partnering with banks as well as building strong market credibility. It has claimed to achieve more than 95% current bucket collection efficiency month-on-month through its creditworthiness checks and robust collection infrastructure.

With product launch plans already set in motion for 2021, Freo intends to expand deeper into Tier 2 and Tier 3 cities and cater to a broader demographic. Currently being present in over 80 plus cities in India, it aims to be present across 120 locations in India by 2022.

Similarly, the startup wants to venture out and take the Indian Credit Line to markets in South East Asia.

“For neobanks, the critical differentiator will be leveraging customer insights through technology. It is easy to bring a customer to the neobank ecosystem but finding out what the customer really wants and providing the customised solutions accordingly for their financial needs are key drivers for a neobanks’ growth,” said Maheshwari.

![Read more about the article Funding Galore: From BharatPe To Zoomcar — $25 Mn Raised By Indian Startups [May 10-15]](https://blog.digitalsevaa.com/wp-content/uploads/2021/02/1614354848_default-social-share-image-300x158.jpg)