The ability to tell a story has taken precedence over strategy and execution during a valuation.

New age businesses pursue mergers and acquisitions with scant regard for integration and multiplying shareholder value.

Frugal and judicious use of capital has given way for spending liberally.

When I went to B School and passed out in the early nineties, majoring in Finance, we were taught certain cardinal principles (First principles thinking, if you like) on how one should perceive businesses, evaluate business models & business health and value corporations. I found that the principles were time-invariant, and I could apply the same to any business (of course with some nuance) and come to an assessment of the business and its intrinsic value.

Things were going well until Venture Capital happened in my career. During my past 7 years in this field, I found that the principles, which I was taught and implemented for more than two decades of my professional life, turning on their head. This phenomenon has gotten more pronounced in the past 18-24 months. Coming to terms with the new reality is imperative if VC’s must play in this space.

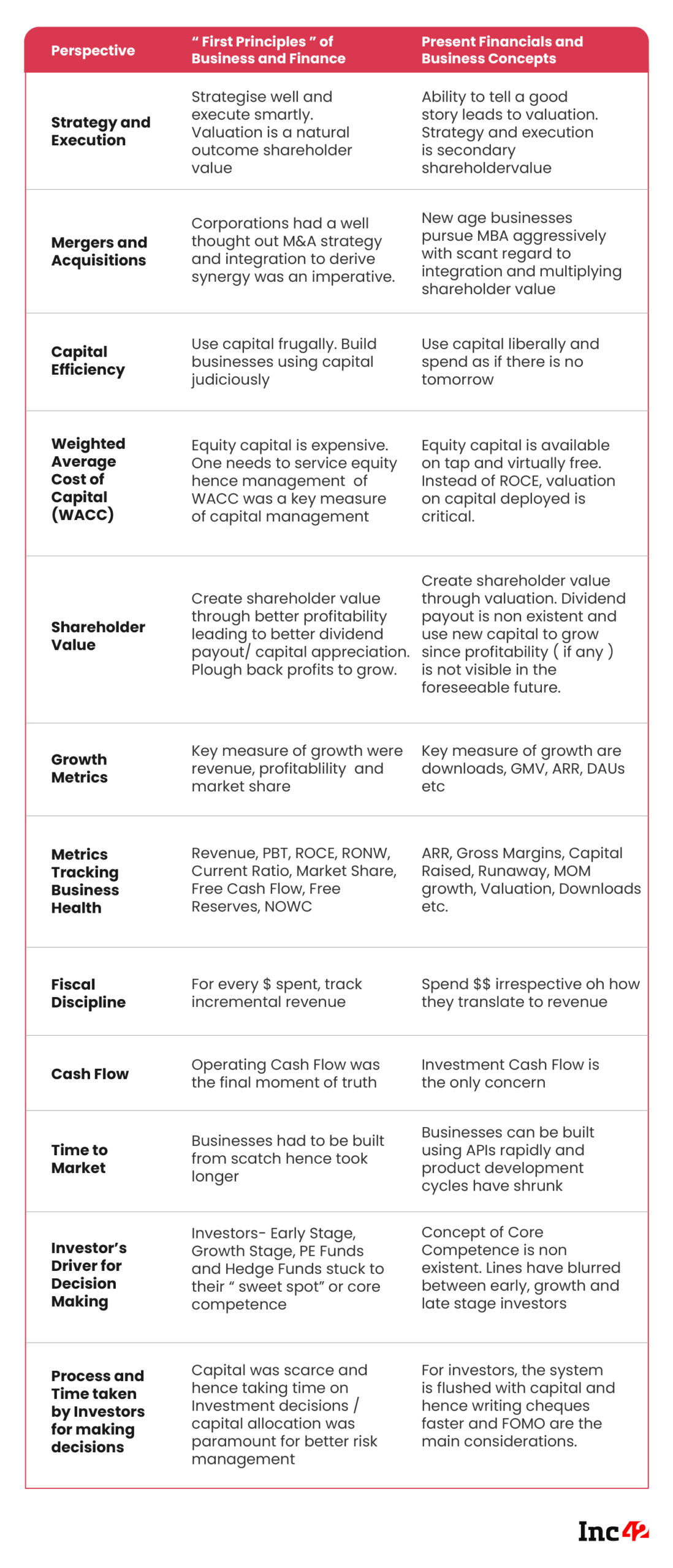

Here is a small table that I wanted to share which will make my point abundantly clear.

It is abundantly clear from the above that there is a completely different way in which technology businesses are assessed, measured, and valued. Whether this is an outcome of the increased risk appetite, availability of capital, the transformative nature of these businesses or something else, is a matter of conjecture. The crucial question is whether these “new age” methodologies will sustain and stand the test of time. The jury is still out on the same.

![Read more about the article [YourStory Exclusive] NCLT admits petition for insolvency proceedings against OYO subsidiary; OYO challenges o](https://blog.digitalsevaa.com/wp-content/uploads/2021/04/Image1es3-1607490933033-300x150.jpg)