Insurance is highly under-penetrated in India, especially in rural areas; penetration of life insurance in India stood at 3.20% 2020-21, and a mere 1% for the non-life segment

The insurtech startups see a big opportunity in this under-penetrated market and are trying to make insurance available to the rural populace with the help of their tech prowess

From embedded sales to use of tech to cut distribution costs, these startups are employing a variety of techniques to take insurance products across the country

Insurance as a risk management tool was not a popular concept in India till recently. It is still alien to most in semi-urban and rural areas. Therefore, it is no surprise that insurance penetration has traditionally been very low in India. In the non-life segment, the penetration was as low as 1% in 2021.

For many years, the insurance sector was the preserve of the public sector companies. State-owned insurers were ill-equipped to serve the vast market for obvious reasons. They lacked product innovation and were unable to embrace technology. Lack of funds was a big impediment, too.

Under-Penetrated Rural Market Beckons Insurtech

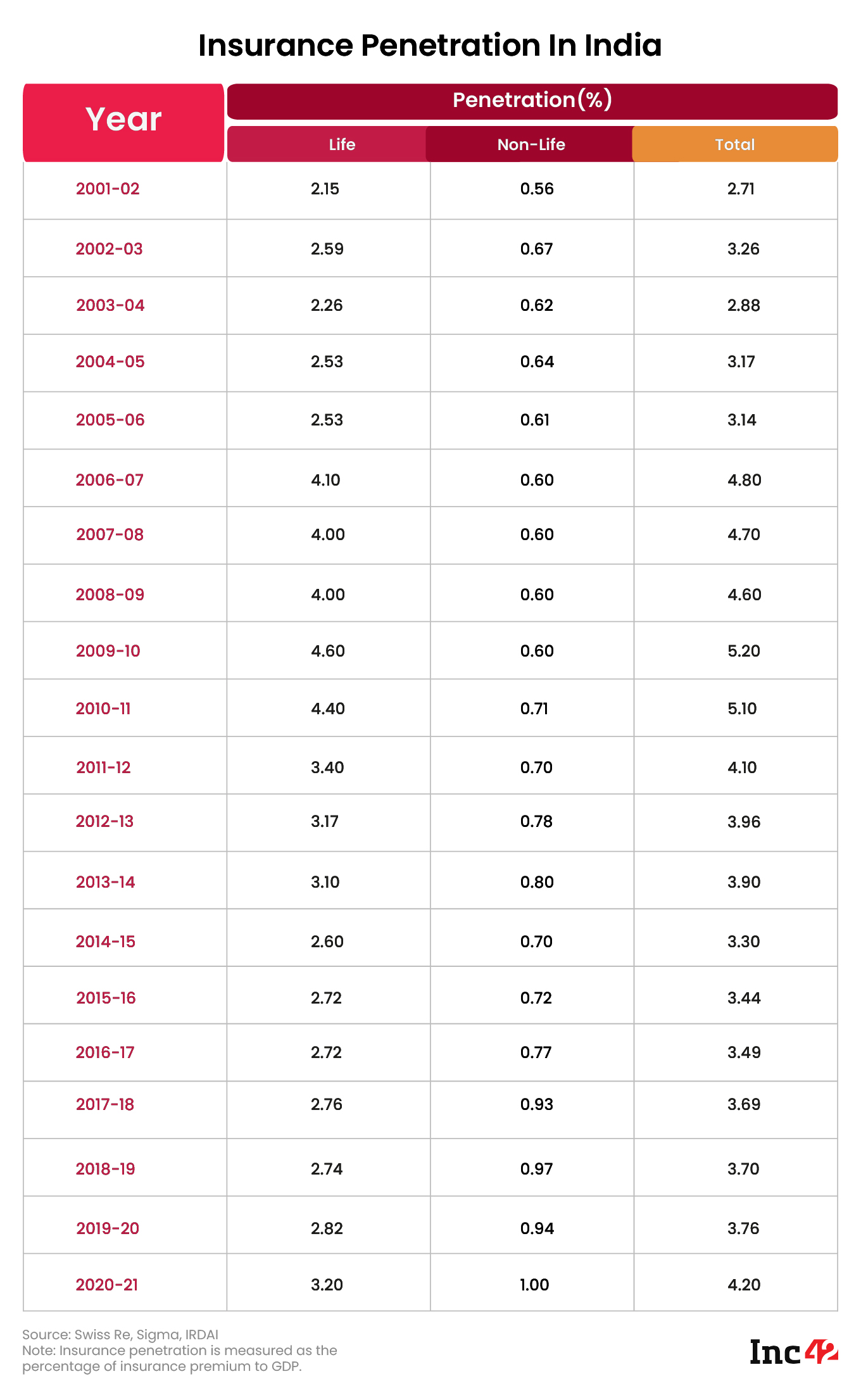

The sector underwent a welcome change with the entry of private players post liberalisation of the economy. Reforms in the sector led to consistent foreign fund inflows into insurance. Thanks to liberalised policies, the insurance penetration in the country grew to 5.20% in 2009-10 from 2.71% in 2001-02.

The increase in insurance consumption was visible in metros and Tier-I cities. However, it still has a long way to go.

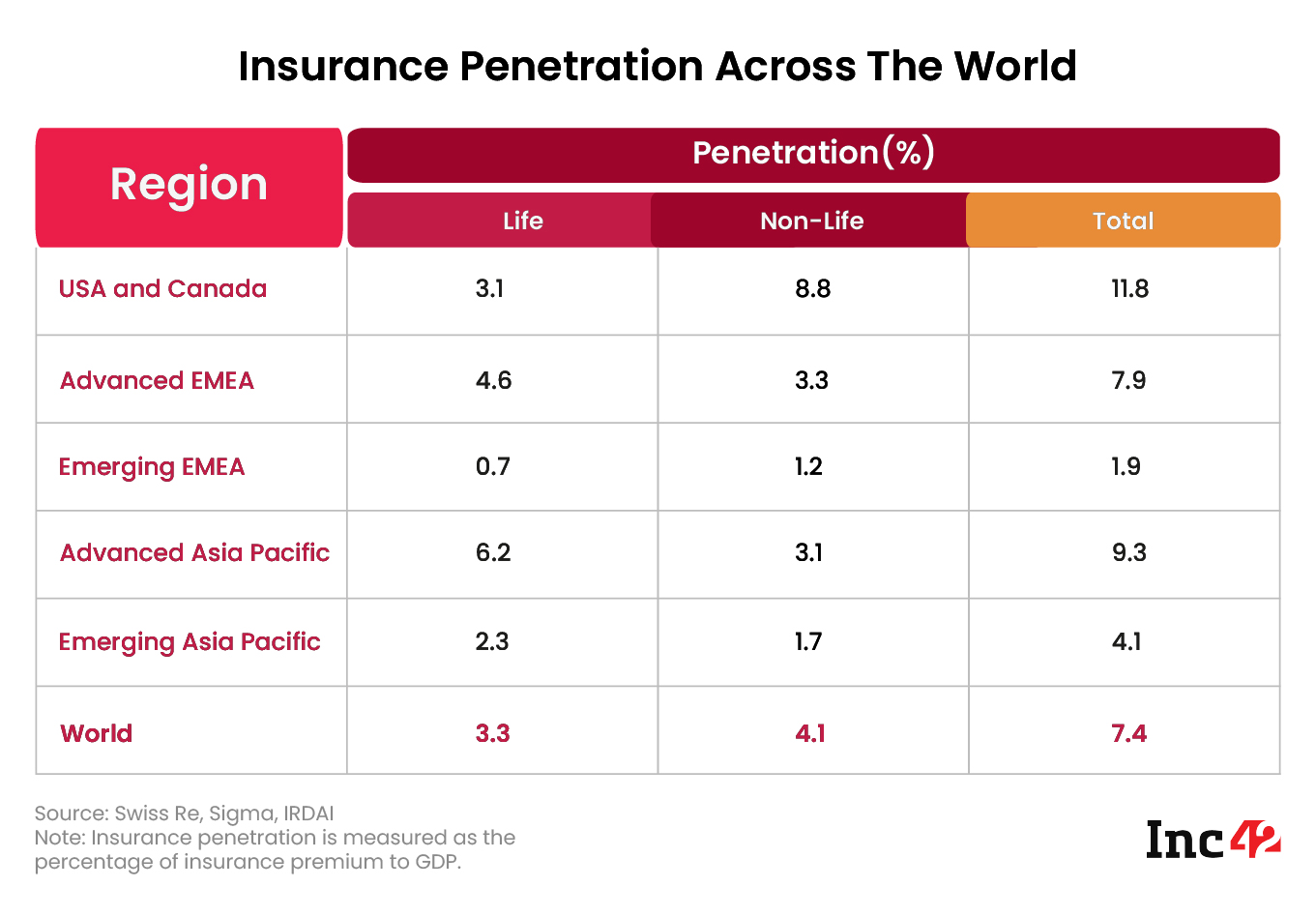

According to the Insurance Regulatory and Development Authority of India’s (IRDAI’s) annual report, insurance penetration reached 4.20% in 2020-21 (see the table). Globally, the overall insurance penetration stood at 7.40% in 2020.

While the penetration of life insurance in India stood at 3.20% 2020-21, it was a mere 1% for the non-life segment during the same period.

The under-penetrated market, particularly in rural areas, presents a huge opportunity for insurtech startups. Some reckon that the rural market in India is bigger than the entire European Union for insurers.

The insurance sector is projected to grow by leaps and bounds over the coming years. While the life insurance segment is expected to touch $150.6 Bn by 2026, the non-life sector is likely to touch $41.8 Bn by 2026 in terms of gross written premium, according to GlobalData and IRDAI annual report 2020-21.

The country’s insurtech startups have set their eyes on this huge growth opportunity.

Startups Place Big Bets On Embedded Selling

As of now, insurance is yet to reach a sizable population in rural India. Insurtech startups with their tech prowess are expected to play a crucial role in taking insurance to rural populace. The potential of the rural market remains completely unrealised, Ensuredit co-founder & COO Rohit Sadhu said.

The small-town India is alluring for insurers of all stripes. However, it has been a difficult nut to crack for them. Effective last-mile distribution was a puzzle for legacy insurers, while high cost of operation was a deterrent too.

Insurtech startups, however, sound confident of overcoming the hurdles faced by legacy players. Vying for a big pie of the market, they have devised different sales strategies. Embedded sales seem to be the main tactic. And it is causing disruption.

“The embedded model integrates insurance with essential products and services,” said Vikul Goyal, founder of Bimaplan, a Y-Combinator-backed startup.

The model makes the distribution process simpler and more effective, he added.

How Embedded Sales Work

Microfinance is a significant channel for insurance distribution in Tier-III, IV, V towns. According to Surjendu Kuila, co-founder & CEO of Zopper, there are lots of interesting insurance products in microfinance that Zopper is bundling and cross-selling.

Series-B funded Zopper works with Chaitanya, among other microfinance institutions (MFIs). Chaitanya has operations in Bengaluru, Hyderabad, Odisha and West Bengal.

“We have first of all digitised their (Chaitanya’s) entire disbursal system. So, if I am offering a loan of INR 30,000 to someone, the point-of-sale system throws in two or three insurance products. The sales officer, who is distributing the loan, picks up one of those products, plugs it as part of the bundle and sells it to the customer,” he said.

But what types of insurance products are bundled and cross sold? It can be hospicash, personal accident cover, a group mediclaim or a combination of all these. “In Odisha and Bengal, you can sell a Dengue cover during the monsoon season because mosquito-related problems are there. They also offer airborne cover, vector-borne disease cover, etc,” said Surjendu.

MFIs and NBFCs also mandatorily bundle a credit life product, which covers their risk in case of defaults.

Leveraging Tech For Seamless Distribution

Insurtech focuses on making insurance accessible and affordable to the rural populace. The collaboration between financial institutions and insurtech platforms makes product accessibility seamless.

These startups leverage AI, IoT, data analytics and open APIs. Application programming interfaces or APIs help personalise products. But distribution in small towns demands a high trust model.

“The deployment of the right PoSPs (agents) for physical assistance is necessary to build trust among the rural population,” said Goyal.

Adoption of a hybrid model — a combination of physical and digital selling modes — can boost insurance distribution, he added.

How Insurtech Reduces Cost Of Legacy Insurers

Small-town India segment was not a focus area for legacy insurers. There are different reasons for this. First, they needed to create the kind of products suited for this segment. Second, operating costs were so high that the unit economics of operating was not viable.

“Insurtech startups help distribute at lower cost and curate the right kind of products for masses,” said Sadhu of Ensuredit. Insurtech also provides access to products from a broader set of insurers.

Distribution cost is high for insurers, but digital distribution reduces the fixed-cost investments like setting up offices, sales force management, business management, among others.

According to Surjendu of Zopper, insurtech’s job is to distribute products in an economically viable way to the last mile. It costs a lot for a Bajaj or an ICICI Lombard to sell in a Tier-V city because they need to set up offices and other required infrastructure. Often, the output of the branch office will not justify the cost.

On the other hand, in metros and Tier-I cities, purchasing power parity is better and people have disposable income. Naturally, the focus of the insurer turns there.

Surjendu said you cannot look at distribution from a traditional business model. “That will never increase your penetration. Technology has to play a very important role.”

Citing the above-mentioned MFI loan as an example, Surjendu said. “Why should I not empower the microfinance institution to offer an insurance product? If I do that I’m not adding cost to anyone because the microfinance guy is already entrenched into that village. The insurance company does not have to open up a branch there.”

Zopper is taking the contextual product, enabling a MFI or an NBFC or an NGO to distribute that insurance product in an economically viable way to the last mile, he said.

Reduced cost makes better economics. It also gives pricing opportunities for the entire insurance value chain, expanding operations to the rural market, said Sadhu.

The embedded model integrates insurance with existing customers’ lifecycle. This integration enables distribution channels like MFIs and NBFCs to provide an instant policy. As a result, the processing time is significantly reduced, bringing down the operational costs, said Goyal of Bimaplan.

Embedded Sales Not The Only Route

A full-stack financial services platform for small towns, WeRize has a different approach to insurance distribution. Customers in small towns need guidance and support to buy financial products, said Vishal Chopra, co-founder and CEO, WeRize.

WeRize enables freelancers who are literate in finance matters to sell curated micro-insurance products.

“We have built a social distribution tech platform called ‘Finance ki Dukan’,” he said. Thousands of freelancers across cities are able to acquire and service customers through this app, he added.

“We have curated micro health and life insurance products that fit the unique needs of small-town customers,” Chopra said.

![Read more about the article [DesignUp 2021] How creative design strategies help sustainability and inclusion – Payal Arora, author, ‘The Next Billon Users’](https://blog.digitalsevaa.com/wp-content/uploads/2021/06/Payal5-1622657676484-300x150.png)