Given the low penetration of general insurance in India, there is certainly enough room for Go Digit Insurance to capitalise with its digital-first approach, but how far is it from legacy players?

Digit’s business is heavily reliant on motor insurance which is seen as a more profitable vertical, but health insurance has grown rapidly in Fy22 and could pose solvency margin problems for the company going ahead

The insurtech landscape is set to change rapidly as more and more fintech players see the revenue opportunity including the likes of Paytm. Is Digit prepared to deal with this new-age competition?

With insurtech startup Digit Insurance looking to go public later this year or early 2023, it joins the fray of insurance giants in the public markets. A startup that was only founded in 2017 is looking to take on legacy companies in the general insurance space some of whom have over two decades of experience.

But given the low penetration of general insurance in India, there is certainly enough room for Go Digit Insurance to capitalise with its digital-first approach, which on paper should be more cost-effective. However, there are major regulatory shifts in the insurance landscape that could shake up the distribution and revenue models of digital insurance platforms.

Ahead of its IPO, Digit Insurance has also secured funding from HDFC Bank, which will invest between INR 49.9 Cr and INR 69.9 Cr in two tranches in the company. In return, HDFC Bank will acquire an equity stake of up to 9.944% of the paid up equity share capital of Digit Insurance.

Go Digit In India’s Insurtech Landscape

Before we delve into the competitive analysis of the various players across the key metrics and how they have grown in comparison to Digit Insurance, let’s take a look at the two ends of the general insurance spectrum — i.e insurtech startups and the legacy players.

The insurtech landscape is set to change rapidly as more and more fintech players see the revenue opportunity. RBI’s tighter regulations in segments such as lending and neobanking make insurance something of a safe haven, despite the presence of a dedicated insurance regulatory body in Insurance Regulatory and Development Authority of India (IRDA).

But as per startup founders and insurance sector experts that we have spoken to in the past week, IRDA is seen as a more progressive regulator because a large part of its mandate is to increase penetration beyond simply monitoring the activities of insurance players.

Besides Digit Insurance, fellow Bengaluru-based insurtech unicorn Acko is another digital-first new age player. Both have tried to go deeper into the primary general insurance categories of motor and health insurance as well as property and employee insurance plans.

Sachin Bansal’s Navi Technologies is another new-age fintech company that has an insurer licence and has been gaining steadily in terms of market share among insurtech players.

Fintech giant Paytm is also in the process of entering the fray, and has plans to invest up to INR 950 Cr over the next 10 years as per its filings. We’ll take a closer look at the insurtech players later in the article — the primary challenge for Digit Insurance will be the competition from long-term incumbents and bank-backed insurers.

With its upcoming listing, Digit will also be taking on the likes of ICICI Lombard General Insurance, Star Health and Allied Insurance, SBI General Insurance, Edelweiss, Bharti AXA, Bajaj Allianz and a host of other players.

Through this analysis, we will see how Digit Insurance stacks up against this competition as well as fellow insurtech players. Let’s dive in.

Digit Lacks The Scale Of Legacy Players But Is Fast Catching Up

Acko and Go Digit, the two fastest growing companies in the non-life segment in 2021-22, both challenge the industry’s historical sales template. Coincidentally, both received their insurer licences from IRDA in September 2017.

Go Digit was founded by Kamesh Goyal in 2017, and is backed by Prem Watsa’s Fairfax Capital and other major VCs such as Sequoia Capital India, A91 Partners and institutional investors such as IIFL Finance and TVC Capital.

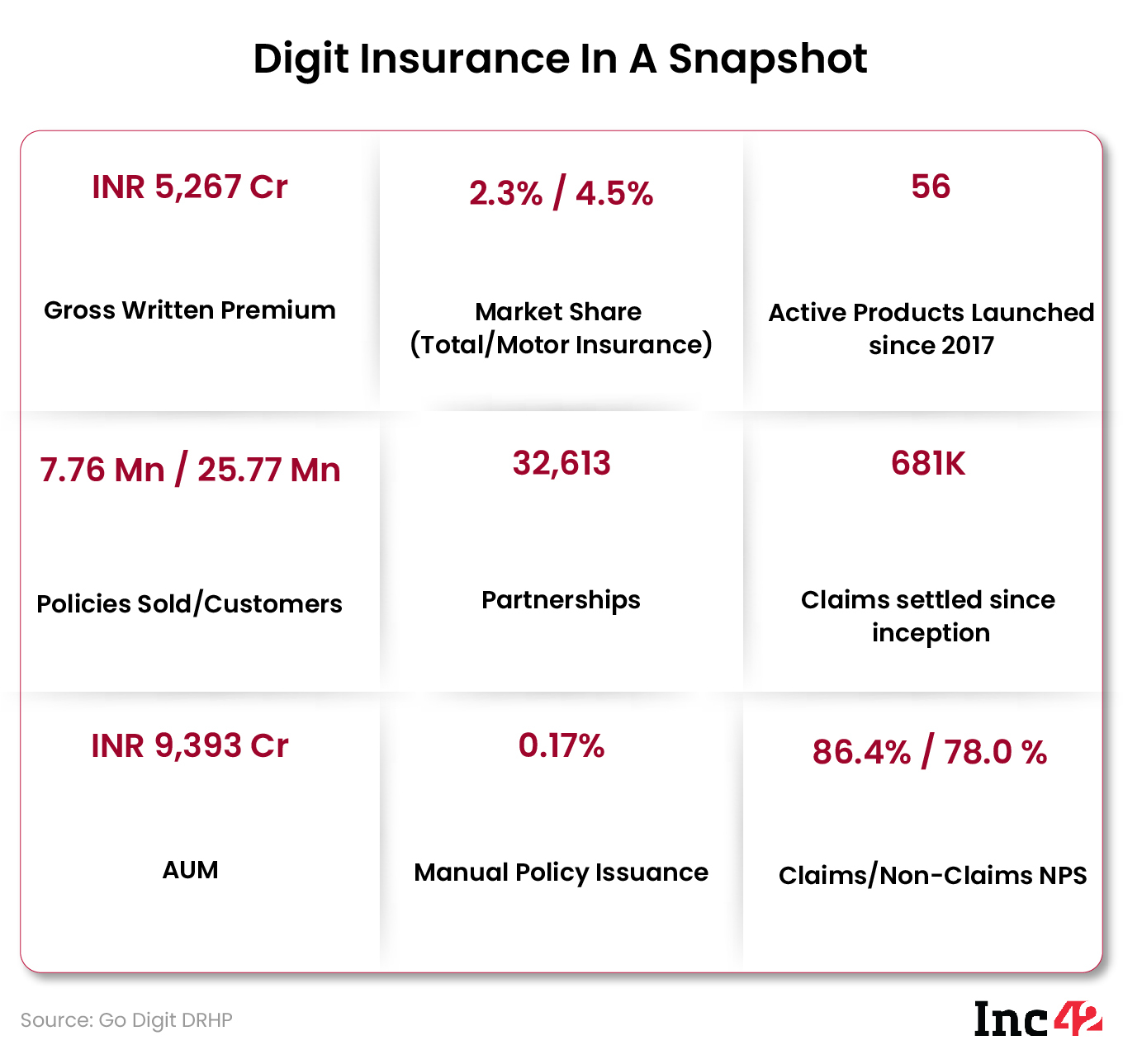

While Acko’s latest growth in gross premiums is on a small base, Go Digit is already ranked 13th among the 25 full-stack non-life insurers, which includes Future Generali India, Universal Sompo and Royal Sundaram, companies that once had a higher market share than Digit. Digit sold over 77.6 lakh policies, an increase of 40% across all products, in FY222, compared to the year ended March 2021.

The fiscal year saw record growth for Go Digit with gross written premium (GWP) increasing by 93%. In fact, in the first four months of FY 2022-23 (April-August), Digit has grown faster than all 12 insurers that have a higher market share than the insurtech startup.

Digit’s business is centred around motor insurance, from where it collects more than half of the GWP, while health insurance only contributes 11% to the total GWP, which could become a problem in the long run as we will analyse.

Can Digit Capitalise On Niche Products?

In terms of the revenue streams, Go Digit is heavily reliant on its top three segments, which together account for 86% of the GWP, which is roughly around 75% across the industry, if one considers ICICI Lombard as a barometer. One segment that Go Digit has carved a niche in is liability insurance i.e legal and professional liability covers which it offers to businesses. This segment accounts for about 23% of the GWP and Go Digit has the highest market share in this category.

On the other hand, the market leader in terms of GWP, Star Health & Allied Insurance saw a 32.53% growth in premiums collected in FY22 to INR 20,880 Cr, as against INR 15,755 Cr in FY21. Star boasts a retail market share of 32% in the general insurance category.

ICICI Lombard, with a GWP of Rs 17,976 Cr, emerged as the second largest general insurer in terms of premium and a market share of 8.15%. ICICI Lombard had acquired Bharti Axa General Insurer in FY21 to capture second position in the industry. Pune-based Bajaj Allianz General Insurance, with a premium of INR 13,688 Cr in FY22 (Rs 12,569 crore in FY21) is fast catching up with PSUs such as Oriental Insurance while HDFC Ergo trailed Bajaj by a small margin, with GWP of INR 13,500 Cr.

In comparison, Digit reported INR 5,268 Cr in gross written premiums in FY22 in its fourth year of operations. Digit reported a growth of 62% in FY22 in overall GWP, while the overall industry growth stood at 10.9%. However, it incurred a loss after tax of INR 295.86 Cr in FY2022, which was more than 2X higher than the INR 122.76 Cr loss in fiscal 2021.

Despite its much larger market share, Star Health & Allied Insurance also did not manage to post a profit. It incurred a loss of INR 82.04 Cr for the quarter ended March 31, 2022, from a loss of INR 578.37 Cr for the September to December quarter of FY22.

When it comes to the net claim ratio, the other key metric that indicates sustainability of insurance companies — it is calculated as claims paid in a year as a percentage of premiums collected — Go Digit showed significantly better performance in FY22. Between April and December 2021, Go Digit’s net claims ratio was 76.4%, and it ranked 13th on this count as per IRDA data.

In contrast, public sector insurers were near or above the danger mark of 100%, which meant that they were nearly paying out the entire premium amount collected as claims. Acko, the biggest insurtech competition for Digit, fares much worse in this regard. Despite the same online model, Acko’s claims ratio was at 105% for the same period.

Insurance Stocks Prove Lukewarm Bets

When it comes to the stock market performance of the listed general insurance companies, the past year makes for grim reading. ICICI Lombard share price is down by around 16% since last August, while the General Insurance Corporation of India is down by a whopping 25% from its price one year ago.

Another general insurance major Star Health & Allied Insurance listed in December last year at a discount of 5.6% over its issue price of Rs 900. Currently, the stock is down by over 17% since its listing and is trading at INR 744 as of August 24, 2022.

Acko Beats Digit’s Growth In Motor Insurance

For both Acko and Go Digit, the segments of health and motor are the biggest mainstays of their business. While the industry average for health and motor insurance contribution to the business is 65%, Go Digit and Acko collected 74% and 92% of their total gross premium through these two segments.

HDFC Ergo, Bajaj Allianz, Tata AIG, ICICI Lombard are the large incumbents in the motor insurance segment. From its motor portfolio alone, Digit Insurance firm clocked INR 3,276 Cr in premiums with a market share of 4.7% in FY22, up from 3.7% last March.

The growth in motor insurance is explained by the mandatory vehicle insurance needed for all automobiles on the road. In July, overall wholesale figures for the automobile industry in India was 3.24 Lakh units, 15% higher on a YoY basis and 6% higher than the June tally. The advent of EVs in the two-wheeler space and commercial vehicles category has also spurred the adoption of motor insurance through digital platforms.

Acko and Digit have both spent heavily on marketing their services to prospective customers with huge spending for celebrity endorsements and ads during high-profile events.

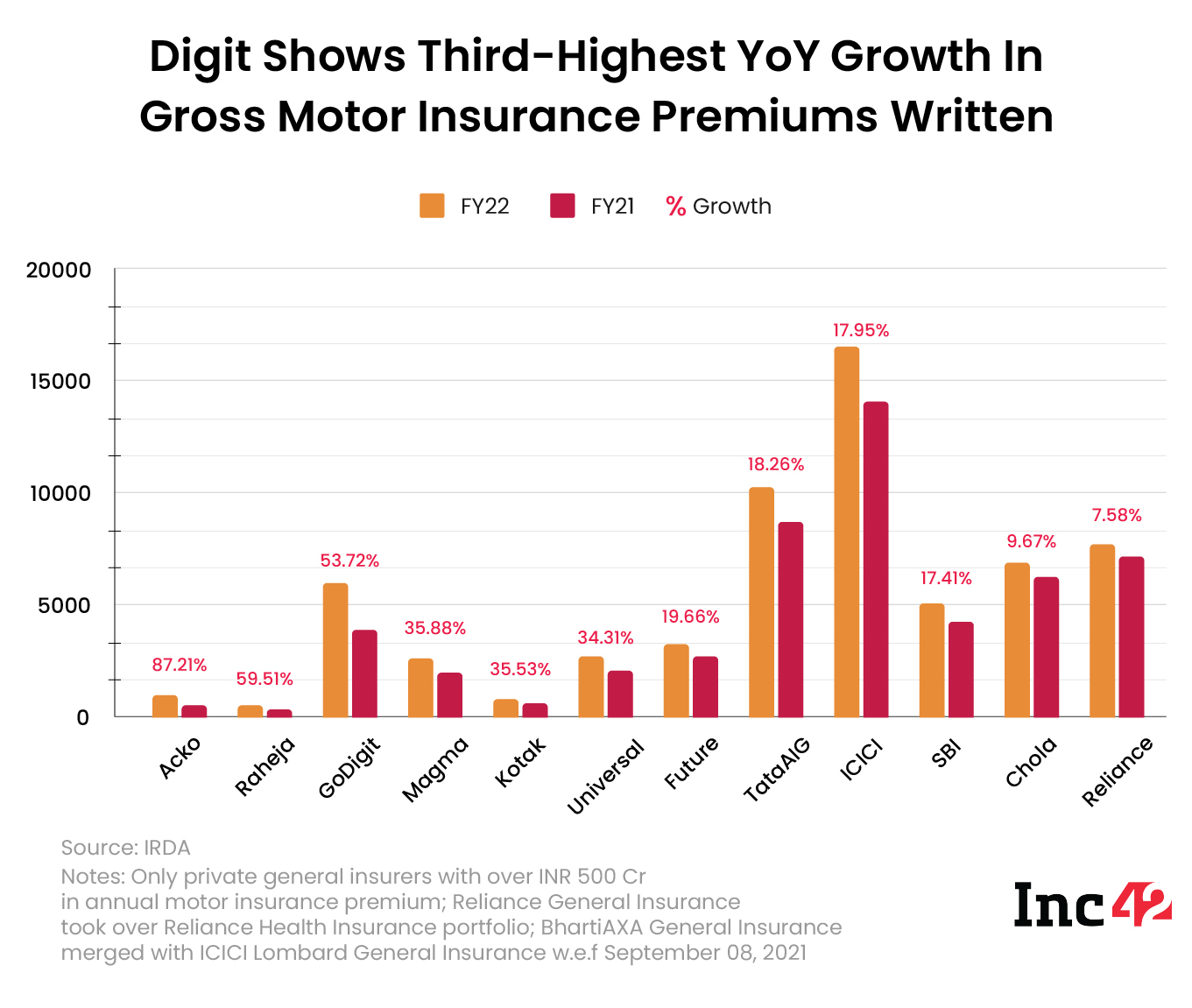

However, Acko, which has a sharper focus on the motor insurance category, has set the pace in terms of year-on-year GWP growth since FY21 with 87% higher GWP in FY22, while Digit finds itself in the third spot behind Raheja QBE.

Digit has shed its dependency on motor insurance over the past three fiscals. Motor insurance contribution to net earned premium has declined from 92.6% to 87.6% to 79.6% in FY20, FY21 and FY22. Net earned premium indicates how much of the total GWP an insurer considers to be actual revenue depending on how close a policy sold is to its end date.

Digit has a 4.5% market share in the motor segment with INR 3,276 Cr in GWP (62% of total GWP) in FY22.

The decline in overall revenue contribution has coincided with a slowdown in motor insurance growth in India. In FY22, industry-wide motor insurance premiums grew by just 4%, after showing degrowth of 2% in FY21 and 7% growth between FY19 and FY20. So in effect, the motor insurance segment is just above the pre-Covid levels.

Profitability Woes In Health Insurance

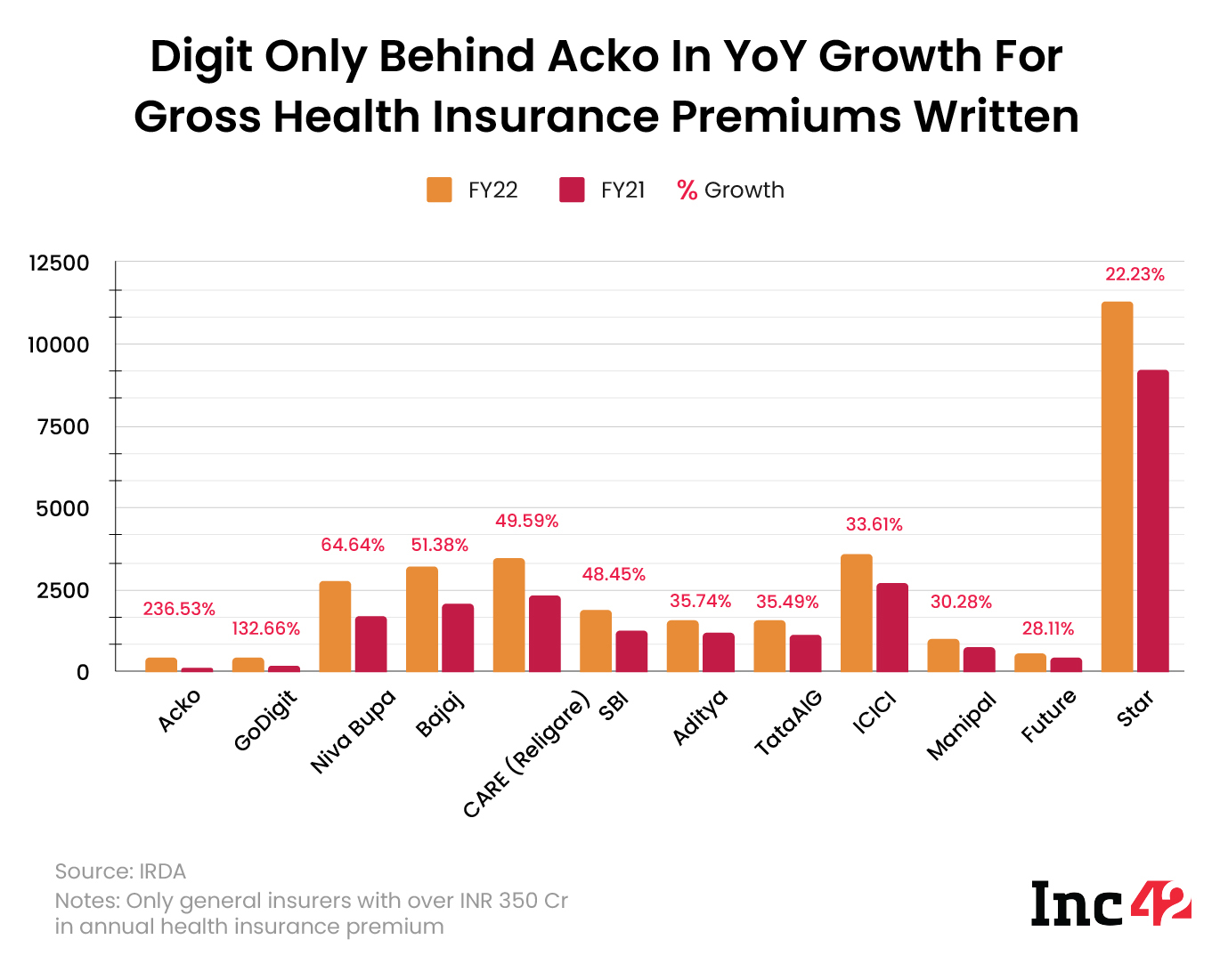

In recent years, health has overtaken motor as the leading non-life segment, which is unsurprisingly due to the pandemic and the multiple waves of infections that boosted health insurance adoption significantly.

In FY22, health insurance premiums rose to INR 73,582 Cr, becoming the main line of business for the non-life insurance sector, with a 33.33% share of business. Among the insurtech players, Acko’s GWP from health rose from INR 119 Cr in FY21 to INR 401.54 Cr in FY22, while Digit was slightly ahead in terms of GWP with INR 432.67 Cr in FY21 and INR 185.97 Cr.

However, this growth has come at the cost of a higher number of claims from the insured base due to the very same reason. Typically, a surge in health insurance premium is usually followed by years of higher claims, especially in a low-penetration market such as India.

Beyond the loss-making government-owned insurers, even private players are struggling to show profits — till FY2019, the incurred claims ratio in the health segment i.e claims paid against gross premiums collected was above 90%. In the two years since then, insurers have paid around INR 25,000 Cr of Covid-related health claims in the two years of the pandemic, according to the General Insurance Council.

One needs to look no further than ICICI Lombard General Insurance for evidence. The company posted an operating loss of INR 380 Cr in the health segment in FY2022, against an operating profit of INR 186 Cr in 2020-21. Another legacy player, the New India Assurance Company Ltd, closed FY22 with a net profit of INR 164.27 crore, down nearly 90% from INR 1,604.69 Cr in FY21, largely due to 3x higher operating losses in the health insurance segment.

While these losses can be ominous for an insurer with a major dependency on health insurance, in the case of Digit, health insurance accounted for less than 10% of the FY22 GWP for the company.

On the flip side, Digit Insurance’s health portfolio has grown healthily — 132% over FY21 — led by group health or employee health insurance.

All is not doom and gloom in health insurance though as the long-term outlook for profitability is bright. Vaccine penetration and greater degree of health consciousness in the market are seen as a key tailwind to improve profitability in FY23, but one cannot rule out monkeypox cases and other Covid-related complications dampening these expectations either.

Insurtech Competition: Paytm, Navi On The Horizon

There’s plenty of unknowns for Digit when it comes to profitability in the health and motor insurance segment too due to the evolving nature of the market and multiple uncertainties around the pandemic and automobile industry growth.

Another complication is that there is new competition on the horizon which may have deeper pockets to beat Digit at the marketing game. So far, Digit has touted its lean acquisition structure — offline distribution and online conversion — as a strength, but with the imminent entry of Paytm in the insurance tech space as a licensed insurer is set to throw a major gauntlet to the rest of the market.

Paytm has so far been an insurance broker, selling policies on behalf of insurers such as Digit, but now the company has set its eyes on a larger role in the insurance ecosystem. In May, Paytm parent One97 Communications said it would invest up to INR 950 Cr in Paytm General Insurance Ltd (PGIL) over a period of 10 years.

The company is yet to commence its general insurance business, which is presently subject to IRDA clearance. This follows the fintech giant’s withdrawn bid to acquire the business of Raheja QBE General Insurance.

Paytm’s mega scale — a monthly transacting user base of 74.8 Mn — gives it an automatic advantage and could be its greatest competitive moat in the insurtech space. But it would not be as easy as walking into the arena and simply grabbing a huge piece of market share.

What will make things difficult for Paytm is that insurance will be another vertical in its huge umbrella and as such it will not get the full attention that this segment perhaps deserves. Paytm would have to rope in new leadership that can dedicate its full resources to the insurance business.

In any case, this will take some time to embed itself and in the meanwhile, insurtech players such as Digit would look to solidify new channel partners and bolster their distribution network. The number of partners for Digit has nearly tripled from 11,772 partners in FY21 to 32,976 in FY22 as per its filings. It also has 1,063 API integrations for embedded selling, and 16.57 Mn policies have been issued through these integrations since the company’s inception in 2017 to March 31, 2022.

Indeed the struggles of Sachin Bansal’s Navi Insurance to make any significant mark in the general insurance space highlights the magnitude of the task facing Paytm and indeed any other fintech competitor that might make the jump from broker to insurer — Walmart-owned PhonePe being one candidate. Navi has tried to launch sachet products such as EMI-based premium that it hopes will drive adoption after it sold a mere 390K policies in FY22, which is a fraction of the scale of Digit and Acko.

In the insurance game, digital scale is not a readymade recipe for success. Paytm has not managed to show profits in its core payments business despite the scale and the same could hold true in the insurance space as well. The fact that Digit Insurance has focussed on distribution is down to the insurance regulator and the government’s efforts to boost penetrations through various touchpoints to customers.

As we said in our analysis of the Go Digit DRHP, the government has focussed on increasing the accessibility, affordability of plans, and this makes it harder for companies to recoup the marketing and allied costs in acquiring customers.

Therefore despite the huge opportunity in India, the real challenge for Go Digit and other players will be balancing this push for affordability with the need to generate consistent profits.

![Read more about the article [Funding alert] SaaS startup Ally.io raises $50M in Series C round](https://blog.digitalsevaa.com/wp-content/uploads/2021/02/Ally-vetri-final-1613572119700-300x150.png)