According to IBEF, the insurance industry of India has 57 players, and the overall market size of the sector in India is expected to $280 billion in 2020.

Traditionally, agents or banks sell life insurance policies to consumers. But with increased digitisation and restrictions due to the COVID-19 pandemic, it has become untenable for insurance agents to physically visit consumers.

Enter Max Life Insurance. As one of India’s largest non-bank private-sector insurers, the company has focused on creating an online channel where customers could go about buying policies without any intermediary.

But, the overall insurance penetration in India is merely 3.71 percent of the GDP. One of the sections showing a clear disconnect between agents and customers is the under-35s.

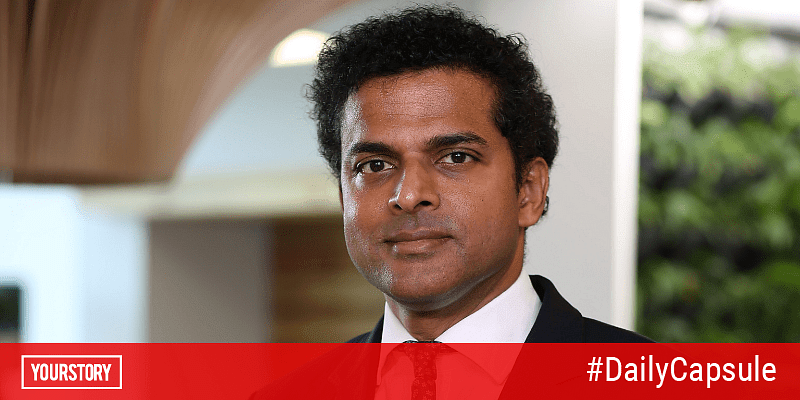

“The mission was how to make ourselves attractive to millennials or generation Z,” says V Viswanand, Deputy Managing Director, Max Life Insurance.

The company came to the conclusion that younger consumers preferred short term products, and decided to make a strong foray into digital commerce where policies are sold and bought directly through the online route.

Today, the digital commerce team has seen a 44 percent CAGR growth over the last three years.

The Interview

A typical staffing company leverages multiple software like customer relationship management, applicant tracking system, and HR tracking system. All these software create silos of data. Venkat Kolli, CEO of Oorwin, shares how the startup is adding intelligence to sales, recruitment and HR, and enabling companies to win more deals and recruit quality candidates.

Editor’s Pick: The Turning Point

Prateek Singh’s interest in the stock markets began when, at 17, his father casually asked him to start trading. Prateek started LearnApp along with Ankush Oberoi, Swati Sharma, and Sohail Alam in 2018. It is a subscription-based platform that offers courses on investing, trading, and finance via recorded and live video sessions from industry leaders. Read more.

Startup Spotlight

Carrying out digital payments using soundwaves

With over two-thirds of the population still relying on feature phones, the penetration of digital payments is still low in India. To solve this, Kumar Abhishek set up ToneTag with Vivek Singh to enable digital payments on feature phones. The duo developed a technology that used soundwaves to enable data transfer between two devices. Read more.

News & Updates

- BOB Financial — the credit card arm of Bank of Baroda — and Mastercard have jointly launched a small business-focussed, QR code-embedded credit card called ConQR that will enable the cardholders to make and receive payments.

Before you go, stay inspired with…

Max Life Insurance Deputy Managing Director V Viswanand

“As leaders, we need to accept that we don’t have all the winning ideas and solutions, and the focus needs to be on creating an ecosystem that allows winning ideas to emerge consistently.”

— V Viswanand, Dy MD, Max Life Insurance

Now get the Daily Capsule in your inbox. Subscribe to our newsletter today!

![Read more about the article [Funding alert] Fintech startup Nivesh raises $1.6M in pre-Series A round led by IAN Fund](https://blog.digitalsevaa.com/wp-content/uploads/2021/04/VCfunding-1605087354569-300x150.jpg)