The RBI’s notification for non-bank PPI issuers has sent the entire fintech ecosystem into a tizzy, raising questions about the business models of many companies

The fintech startups are at crossroads and are seeking clarity to know if they fall under the ambit of the new guidelines and have sought an extension for the latest directives issued by the central bank

Many people have raised questions and suggested that the regulator should leave sufficient room for new-age financial services companies to provide innovative products and services to end consumers and deliver value.

On June 20, 2022, the Reserve Bank of India (RBI) issued a notification saying that “PPI-MD does not permit loading of PPI from credit line”. The notification was addressed to all authorised non-bank pre-paid instrument (PPI) issuers and was effective immediately. The fintech startups are now seeking an extension and more clarity from RBI as per a discussion held in a Thursday (June 23) meeting, arranged by the Digital Lenders Association of India (DLAI).

According to an industry source, who was aware of the DLAI meeting, the biggest fear of the RBI is the possibility of people falling into a credit trap and the issuance of credit to a “less deserving population” as per the current credit guidelines of the regulator.

“All digital lenders are seeking funds from RBI authorised entities and RBI has a clear trail to identify the transactions. However, with the involvement of prepaid instruments as a credit option, keeping everything under RBI purview has become difficult, hence the decision,” the industry source added.

In an official statement, shared with Inc42, DLAI said, “DLAI and all its members are committed to being in full compliance with both the letter and the spirit of all regulations. We hope to be able to work with the RBI to implement any changes that might be required in a manner that safeguards the needs of all existing customers.”

It added that the association will continue to proactively monitor the innovations in digital lending through its network of members and engage with all regulators to ensure that its members meet the goals of financial inclusion and efficient intermediation of credit while strictly complying with all regulations.

When Inc42 last reported about the development, multiple startups reached out to clarify that they are not a “non-bank” PPI, hence they will not be impacted by these guidelines. Many also said that they were seeking more clarity from the RBI on this directive.

However, by definition, PPI is a prepaid instrument that can be loaded/reloaded by cash, debit to a bank account, and credit and debit cards before purchasing goods and services, or enabling remittance facilities.

A prepaid instrument, if issued by a non-bank PPI, whether it is a smart card, magnetic stripe card, internet account, internet wallet, mobile account, mobile wallet, paper voucher, or anything else, can in no manner be used to derive a credit line that is being used for future purchases by a PPI holder. RBI has not clarified whether a bank PPI can do it or not.

“However, with so much ambiguity around, under the light of the new guidelines, now entire bank PPI and non-bank PPI ecosystem need to be relooked to identify the flaws and share more clarity,” said one of the industry sources, who has more than 17 years of experience in the Indian and global banking industry and is currently working with a leading digital lending platform.

Is RBI Killing Fintech Growth Momentum?

Fintech market in India is estimated to reach $1.3 Tn by 2025, growing at a CAGR of 31%. Riding on the wave of new-age technology integrations and backing from local and global investor ecosystems, India today has 21 fintech unicorns and more than 4.2K+ active fintech startups in the country. However, for the majority of its existence, the RBI has remained risk-averse by only trusting traditional banks and has seen fintech as a support ecosystem.

Whether it’s PPI, payments bank, digital lending, credit cards, or crypto, the RBI has been putting the fintech ecosystem at crossroads with regular updates and new mandates in the guidelines.

For instance, with the rollout of the Unified Payments Interface (UPI) and the imposition of strict obligations to ensure KYC compliance in 2017, the PPIs witnessed a loss of appeal in providing wallet services. In the next three years, 22 digital wallet providers became inactive as their licences were rendered infructuous.

Intense regulatory scrutiny in digital lending, prepaid payments instruments and buy now pay later (BNPL) have raised concerns and have impacted the entry of international players. Earlier, international companies such as BNPL provider Sezzle.. Applying a 30% tax on income from crypto and 1% TDS on crypto asset transactions was another blow to the industry.

Many people have raised questions and suggested that the regulator should leave sufficient room for new-age financial services companies to provide innovative products and services to end consumers and deliver value.

For instance, in the case of the recent non-bank PPI vs RBI conundrum, it’s essential for the RBI to clarify to whom the circular applies, the mitigating steps, and give sufficient time to fintech startups to ensure adherence. As the fabric of the fintech startup ecosystem in India matures, it’s paramount for all the stakeholders to identify a potential problem early on and work towards collectively implementing robust solutions.

“Such sudden decisions can have a negative impact on investor sentiments and the innovative spirit of the fintech players,” said Mayank Goyal, CEO, and founder of cross-border neo-bank moneyHOP.

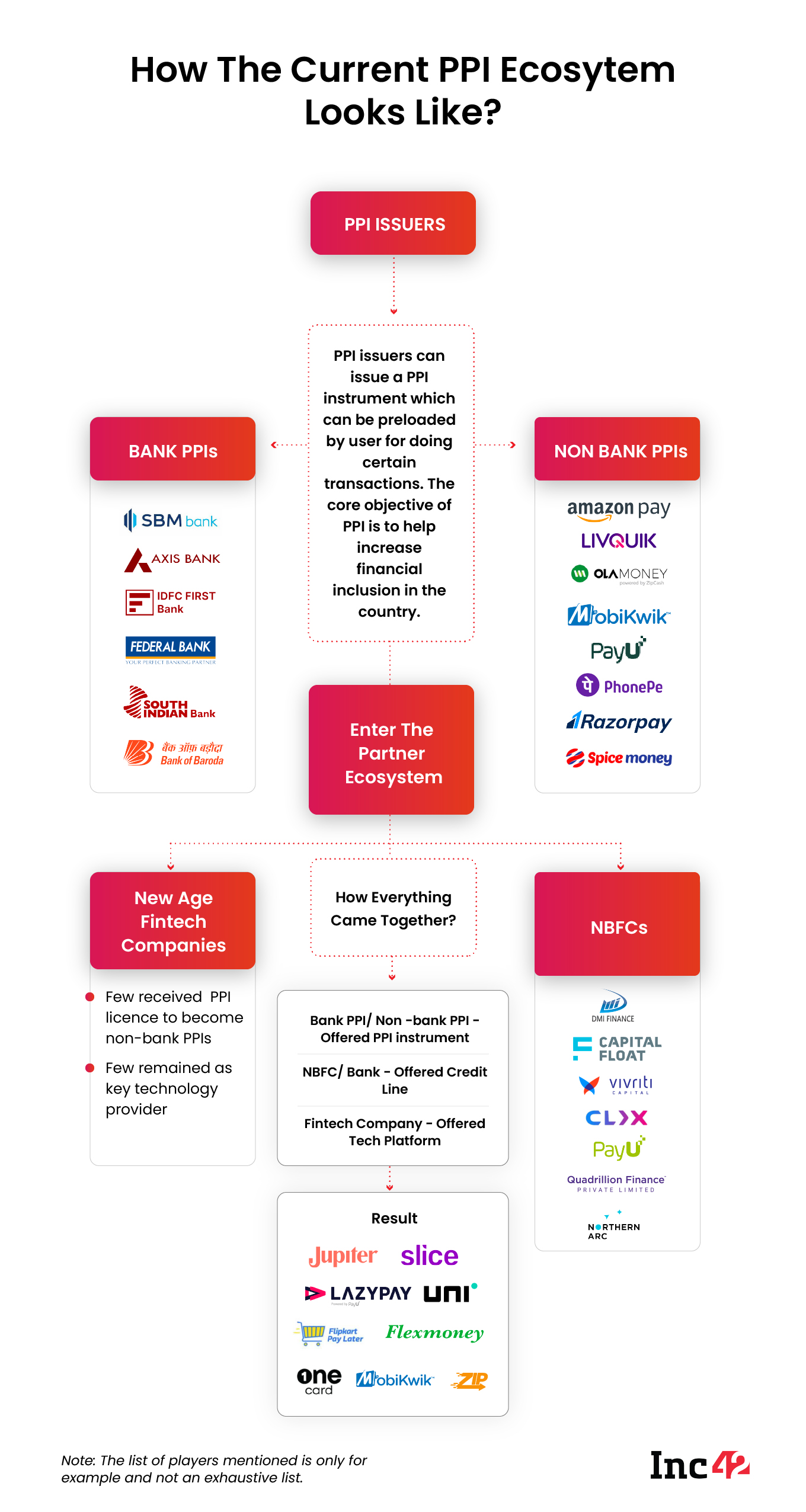

Delving Deeper Into PPI Ecosystem

Coming back to the original problem of RBI’s new notification, there is a lot of confusion regarding bank PPIs vs non-bank PPIs and how the different entities whether banks, NBFCs or fintech companies are linked to each other. Let’s understand that

Currently, there are 57 bank PPIs and 36 RBI-authorised non-bank PPI issuers in India. Non-bank PPIs are essentially companies registered under the Companies Act, 1956 / 2013.

All non-bank entities seeking authorisation from the RBI under the Payment and Settlement Systems (PSS) Act need to have a minimum positive net-worth of INR 5 Cr. Thereafter, by the end of the third financial year from the date of receiving final authorisation, the entity needs to achieve a minimum positive net-worth of INR 15 Cr which is to be maintained at all times.

To get a clear understanding of the issue, let’s take a look at a few definitions.

Credit Line: A ‘line of credit’ or a ‘credit line’ is a preset borrowing limit offered by a bank or an NBFC which allows an individual or a business access to credit at any time, as per need. One can draw from the line of credit, when in need, up to the maximum amount. The interest, however, is payable only on the amount borrowed.

‘Credit line’ is essentially a virtual credit where the amount is not disbursed into one’s account immediately. It thus acts as an on-demand credit offering providing access to funds as and when needed. For example, a user can apply for a credit card from HDFC Bank where the limit is up to INR 5 Lakh/month. If the user does transactions of INR 2 Lakh in a month, s/he will be billed for the same amount. S/he is getting no prepaid cards or any amount in his bank account here, online the virtual credit line.

Loan: In the case of credit, such as a personal loan, the entire amount is disbursed directly to the bank account. These include — personal loans, home loans, education loans, among others.

Prepaid Card: Prepaid card is a stored-value card with a monetary value stored on the card itself, not in an external account maintained by a financial institution. In other words, you are spending the money you put in the prepaid card account in advance.

Thus, offering a ‘credit line’ through prepaid instruments defies the very premise of a prepaid instrument or prepaid card.

Here’s an infographic to explain this conundrum and the relationship between different entities in the PPI ecosystem.

Analysing Models Of Jupiter, Slice, Uni, OneCard, MobiKwik

As explained above, banks and non-banks can issue PPIs such as prepaid cards, gift cards, travel cards, expense cards, meal cards, among others. In essence, the PPI instrument was to be backed by funds owned by a customer. But now, it is being backed by a third party with a credit line and not directly by the customer.

“In absence of any clear guidelines, the companies were able to find a grey area. Fintechs brought in banks and NBFCs as third party credit lines. We saw three key groups emerging – fintech + banks (OneCard – credit card, Uni – prepaid card); fintech + NBFCs+ bank (Slice – prepaid card); and fintech + non-bank PPI + bank (Jupiter Edge – prepaid card),” explained one of the industry sources from a leading NBFC.

For example, RBL Bank can directly launch its credit card. However, let’s take here an example of Jupiter Edge.

Jupiter Edge

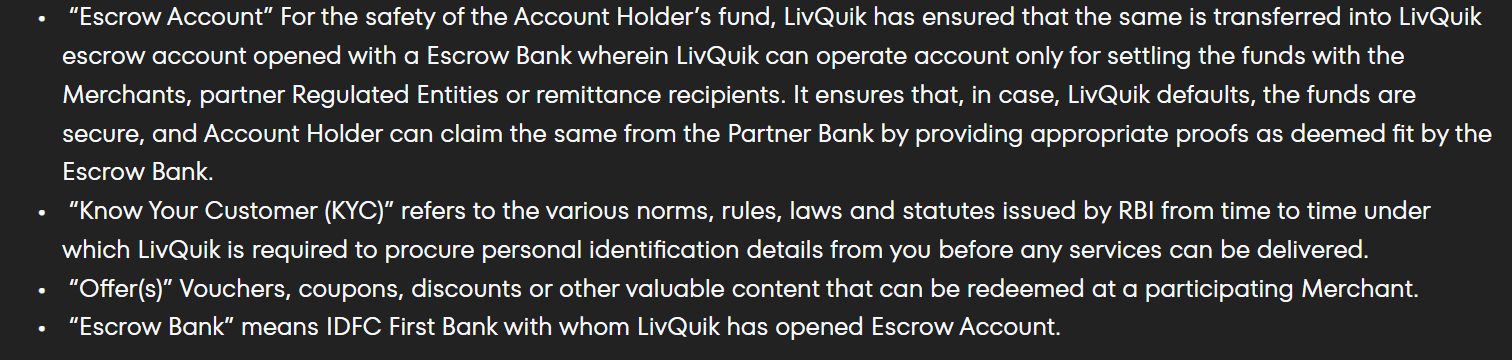

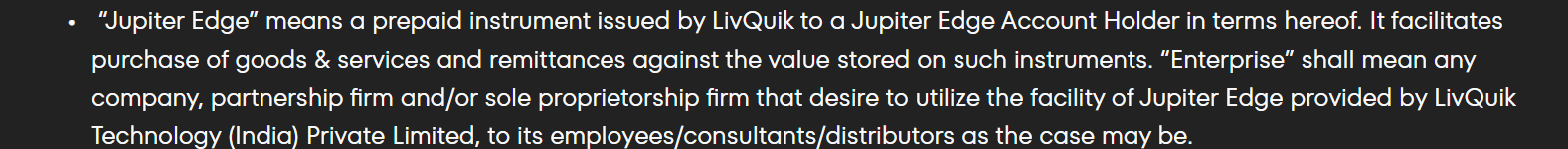

A non-bank PPI issuer like LivQuick Technologies Private Ltd cannot launch a credit line. But the company (LivQuik) is offering its PPI licence to its proprietary company Jupiter Edge, which is offering a credit limit of up to 20K with minimum KYC on its prepaid card Jupiter Edge. Also, the transactions here are routed through an escrow account with IDFC First Bank, which as per T&C implies:

“For the safety of the Account Holder’s fund, LivQuik has ensured that the same is transferred into LivQuik escrow account opened with a Escrow Bank wherein LivQuik can operate account only for settling the funds with the Merchants, partner Regulated Entities or remittance recipients. It ensures that, in case, LivQuik defaults, the funds are secure, and Account Holder can claim the same from the Partner Bank by providing appropriate proofs as deemed fit by the Escrow Bank.”

Also, as mentioned under Jupiter Edge’s T&C, “Jupiter Edge means a prepaid instrument issued by LivQuik to a Jupiter Edge Account Holder. It facilitates purchase of goods & services and remittances against the value stored on such instruments.”

This implies that it is a prepaid card.

Now, the question here is, who is offering this value stored in the Jupiter Edge prepaid card aka credit card? Also, when a user applies for a Jupiter Edge card, he gets a zero balance account with Jupiter Edge, which in turn is making transactions through LivQuik escrow account in a partner bank. By definition, Jupiter Edge is only a prepaid instrument, how can it be used as an account? Further, LivQuick is only a PPI issuer, how can it suffer a default?

“In light of the new guidelines, this appears to be a flawed model as per PPI’s inherent definition. With notification addressing only non-bank PPIs at the moment, everyone will take a hard look at the existing arrangement, making the future uncertain,” added one of the sources.

Let’s look at some other examples to understand the issue in detail.

MobiKwik

As per its website, to avail loan facility, MobiKwik Boost, one needs to just download the app, do the minimum wallet KYC to get instant approval for a loan, and then this credit will be routed to the user’s MobiKwik online wallet.

This means that the user is loading his MobiKwik wallet (non-bank PPI) through a credit line offered by MobiKwik in partnership with financial institutions, be it banks or NBFCs.

Currently, MobiKwik has partnered with one bank, IDFC First Limited, and five NBFCs – Fullerton India Credit Company, Incred Financial Services, Western Capital Advisors, Home Credit India Finance, and Growth Source Financial Technologies.

It is not clear whether the credit line is routed to the user’s wallet through the partnered bank or an NBFC with a bank partner. Also, another offering, MobiKwik ZIP Pay Later, gives users up to INR 30,000 at 0% interest in their MobiKwik wallet, a PPI instrument that cannot be loaded with credit.

UniCard

UniCard operates under Uniorbit Technologies Pvt Ltd, which is a company registered under the Companies Act and does not hold a PPI licence as per the non-bank PPIs list of the RBI. Its customers are spread across 50 Indian cities.

Uniorbit Technologies has partnered with RBL Bank and SBM Bank to issue co-branded prepaid cards. However, it has positioned itself in the market as a challenger credit card, as a customer can break the monthly spends into an EMI of 2/ 3 months with UniCard.

As per its T&Cs, “The Card can only be loaded through a NBFC/Corporate funding, the customer will not have options to add funds to this Uni RBL Co-branded card from his own account.”

Although UniCard claims it has partnered with bank PPI issuers, the PPI instrument, which is UniCard in this case, is loaded with a credit line from an NBFC. The company has not mentioned or clarified who the NBFC or corporate funding partners here are, which may pose questions and push the company to clarify a few things here.

Slice

Slice offers a Visa-powered Card which is positioned as a challenger credit card in the market. The customers are in awe of it as a credit card product, as visible from one of the tweets. Slice has a registered user base of over 5 Mn users and it claims issues over 200,000 cards each month.

However, in its T&Cs, the company has clearly said, “We are a platform who help connect our customers with our select financing partners (“Financing Partner”) for availing credit facilities.”

Slice is leveraging its positioning as a credit card, but in reality, it is simply a facilitator helping customers connect with a financing partner. It is primarily a tech company, with no PPI licence or NBFC licence. Slice cards are issued in partnership with SBM Bank India, which has a PPI licence. It has also partnered with NBFCs such as Quadrillion Finance Private Limited, DMI Finance Private Limited, Northern Arc Capital Limited, and Vivriti Capital Private Limited, who are supposedly providing the credit line to the Slice Card.

Thus, although it is promoted like a credit card construct, it is essentially a prepaid card, where there is a high scope that the credit line is being filled through NBFCs, who will then have to bear the heat in case of defaults and not the SBM Bank. This poses a question on the very viability of Slice’s business model, which the company may have to justify in the future.

OneCard

OneCard is a credit card operated by FPL Technologies Private Limited, which is not a PPI licence holder. The company has partnered with five banks – IDFC First Bank, SBM Bank, Federal Bank, South Indian Bank, and BOB Financial.

As per the company’s T&Cs, ”OneCard means the co-branded credit card managed by FPL Technologies Pvt. Ltd and Bank here is an issuer of the OneCard credit card.”

Here it is necessary to highlight that in comparison to others, OneCard is not an online wallet or a prepaid card. It is a co-branded credit card product in partnership with Banks, who are also PPI licence holder.

“However, in the uncertainty around new guidelines, the company should get itself prepared to embrace the impact, as being a credit card, it will fall under the new credit guidelines issued by RBI on April 21, 2022,” said one source.

According to the new guidelines, co-branded credit/debit cards will have to explicitly indicate that the card has been issued under a co-branding arrangement. The co-branding partner cannot advertise/market the co-branded card as its own product. In all marketing/advertising material, the name of the card-issuer should be clearly shown.

Here is the card image from the company website. The issuer bank’s name is not on the front but at the back and is not clearly visible. The card is prominently promoted as OneCard’s own product, while the names of issuer banks are just mentioned at the end of the company webpage.

A good example here can be of OlaMoney credit card, launched in partnership with SBI bank. It is marketed as Ola Money SBI Credit card. Also, names of both Ola and SBI are visible on the back of the card together.

“RBI’s updated credit card guidelines are applicable from July 1. Until then this arrangement is fine, but they (OneCard) might have to tweak their strategy then,” an industry source told Inc42.

What Will Happen Next?

Similar to the above companies, there are questions about the business models of Paytm Postpaid, LazyPay Card, Flex Money and Flipkart Pay Later, among others. The fintech companies may move to bank PPIs and continue to offer their services within the purview of RBI guidelines, while non-bank PPIs can continue to serve as a PPI and not a lending instrument. However, the fintech companies will continue to be in a wait-and-watch mode until there is further clarity from the RBI on the matter.

With one directive from the RBI, the entire ecosystem of fintechs, investors, associated NBFCs, banks, and even merchant partners have landed in a soup.

The scale of these companies is massive. Together, companies including Jupiter, Uni, Slice and OneCard have raised more than $700 Mn in funding. Also, these companies are backed by marquee investors such as Tiger Global Management, Insight Partners, QED Investors, Sequoia Capital India, Global Founders Capital, Matrix Partners India, Nubank, Stride Ventures, General Catalyst, Accel, Lightspeed India Partners, among others.

However, they now find themselves at crossroads and are seeking clarity to know if they fall under the ambit of the new guidelines of the central bank. All this comes at a time when the RBI is working on its Payment Vision 2025, and fintech is becoming a global opportunity.

Under its Payments Vision 2025, the central bank aims to increase the number of digital payment transactions by more than 3X by 2025. The document also outlines the RBI’s aim of increasing point of sale (PoS) debit card transactions by 20% and to increase card acceptance infrastructure across the country to 250 Lakh touchpoints.

However, not everyone is worried about the RBI notification, and some have welcomed the RBI’s directive. Ashok Hariharan, founder and CEO of IDfy; and Bhaskar Chatterjee, VP, Product Management of EzeTap, said that fintechs are still battling a trust gap when it comes to adoption and acceptance by customers.

PPIs were a big tool for non-banking players to become a part of the lending ecosystem without actually owning an NBFC licence. However, that is in question now. On the other hand, NBFCs will have to come up with newer ways to attract customers who have adapted to the digital customer experience offered by fintechs.

A balanced and supportive regulation can help the industry by instilling trust in customers which in turn can help in increased adoption and acceptance towards fintech.