The size of the used car market in India was over 4.4 million units in 2020, according to Statista. Its size exceeded that of the country’s new car market for the measured time frame. The growth of India’s used car market over the past few decades could be attributed to factors like affordability, ease of resale and a growing network of dealers of used automobiles. At the same time, online sellers like Droom have helped in boosting the sales of such cars by making them more accessible to buyers.

The startup has managed to strive ahead by leveraging a robust managed marketplace business model, while proving that it is economically viable and independent of scale due to the use of technology, economy of scale, economy of scope, asset light, and network effects.

What is a managed marketplace?

A managed marketplace is an online platform that can yield a highly standardised, curated, tightly controlled, and rich user experience that’s independent of sellers by owning critical services like pricing benchmarks, vehicle inspection, vehicle history, loans, insurance, closing paperwork, and last-mile test drives and delivery in the value chain. An open marketplace does not provide any such services to the last-mile buyer.

The big picture

There’s a lot that works in the favour of managed online marketplaces. For instance, they are tech-driven, asset-light and are a ‘no-inventory risk’ business that harnesses the power of a large distribution network to offer clients a huge range to select from. Here are a few other advantages of such a business model:

- Buyers always get low prices as you try to balance trade velocity and gross margins.

- There’s economy of scope as the model does not depend on products, prices, sellers or geographies

- Economy of scale

- The business model is very scalable due to the use of technology

- Entrepreneurs do not have to maintain physical centres nor make much capital expenditure

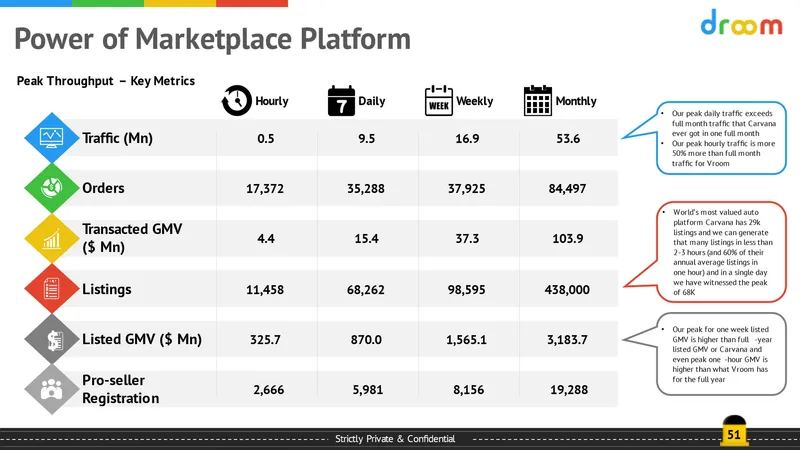

Below is the peak time analysis at Droom using various peak statistical observations of the past 7 years. One can see the power of a managed marketplace, which cannot be replicated by organised physical stores even with the deep pockets:

Offering an unparalleled customer experience

In order to provide automobile buyers an unmatched customer experience in organised retail marketplaces, traders need to regulate every component of the value chain. This requires:

- Procuring vehicles with the help of a sourcing and merchandising team

- Get ownership of vehicles before selling them

- Take risks while maintaining inventory

- Having a large blue-collar team

- Owning a warehousing or storage facility

- Make do with less operating leverage

- High capital expenditure and investing in working capital

Drawbacks of an organised retail model for automobiles

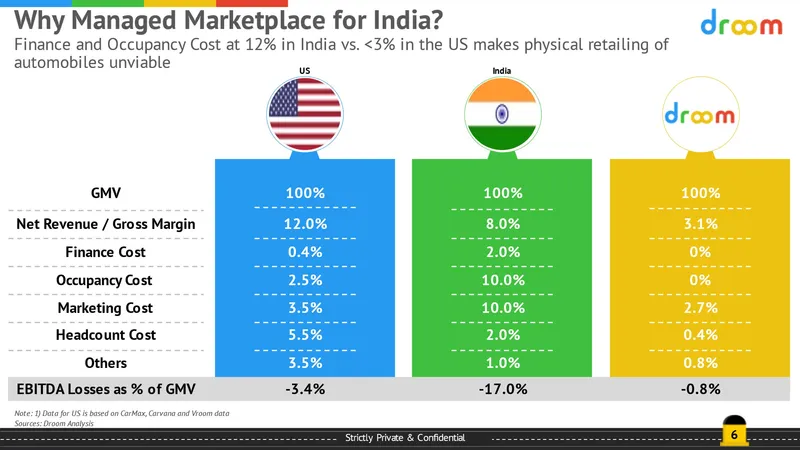

If we compare an online marketplace with an organised retail automobile market, the former option appears to be a more viable one. Here are a few reasons to support the observation:

- Ranging between 12% and 15%, the cost of capital in India is among the highest for any country. It translates into 2% of the gross merchandise value (GMV) for working capital and capital expenditure for physical stores with heavy inventory.

- Given how expensive real estate is in India, the occupancy cost for retail spaces and warehouses can be up to 10% of the GMV

- Unlike the USA, western Europe, and Japan, India is a low trust market

- The lack of regulatory support and weak law enforcement pose as challenges in scaling ahead

In the infographic below, one can see why organised automobile retail with physical stores and own inventory are not likely to make money independent of any scale.

Managed marketplace is the way to go

With a ‘managed marketplace’ model, Droom can deliver not only advantages like a huge selection to choose from and low prices, but also provide loans and insurance coverage for automobiles, while ensuring last-mile delivery for consumers. The best part is that Droom does not need to create hundreds of retail outlets, own inventory, or incur capital expenditure or deploy thousands of blue-collar workers to drive impact.

Amazon and Flipkart have already created significant value using managed marketplace models in India. Droom’s managed marketplace model controls 5 of the 10 activities in the automobile value chain. Without procuring or owning vehicles, physical centres, incurring capital expenditure, owning warehouses or hiring manual labor, Droom can still deliver a curated and controlled experience by leveraging a full tech platform and ecosystem services.

Since Droom was launched, it has sold 332,000 automobiles and 1.35million automobile ancillary services worth $3.35 billion. Since its inception, the startup has roped in 20.5k automobile dealers, more than 100,000 individual sellers, a presence in 1,100 cities and 14 million app downloads. It also owns India’s latest auto enthusiasm community on Facebook which has over 6.5 million followers. At any point of time, the company has around a million listings worth $15 billion.