Digitisation has become increasingly imperative for industries, companies, and sellers big or small to keep up with the shift towards online consumption and e-payments. Businesses that don’t embrace technology to optimise their processes are businesses that get left behind.

Even when it comes to payment systems, adopting technology plays a crucial role in squashing redundancies. But a one-size-fits-all approach does not cut it for larger organisations.

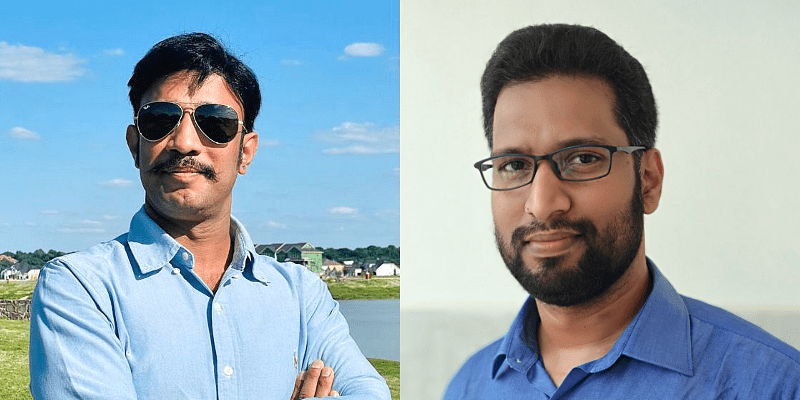

That was the hypothesis Y S Prabhu Kumar and Narendra Singh Solanki started with — creating a payments ecosystem that could fit the needs of large companies and industries by solving the specific pain points that were holding them back from digitising.

They founded , a new-age fintech startup, in 2020, under the parent company Xsilica Software Solutions, an IT solutions firm.

“We started our journey as a payments gateway that companies could use to collect money from their buyers. But we soon realised that what we really wanted to build was an innovative solution that could serve the payments needs of large enterprises and help set them on the course for their digital transformation journeys,” Prabhu tells YourStory.

“After a lot of painstaking work and research, we decided to specialise in creating products that can actually benefit large enterprises. Instead of saying ‘take this and use whatever features make sense to you,’ we said we’ll build to solve all the problems that are holding you back from growing or becoming more efficient,” he adds.

PayG’s range of products

PayG creates customised payments solutions for large companies and helps them optimise their collection channels. It not only enables huge enterprises to keep track of their cash inflows and outflows but also helps them scale when they need to, without adding any more processes.

Image Source: ShutterStock

“The simple fact is that today, companies, whether they are big or small, don’t want to invest in something they cannot use 100 percent. PayG either gives them a product that serves the industry they operate in, so they find they’re able to use all the features and then ask for more; or customises it completely for just their company and operations, which makes life a whole lot easier for them. That’s the value we bring,” Prabhu adds.

While most existing solutions offer a standardised payments collection platform and ties the enterprise up with their partner-banks, PayG gives its clients the freedom to choose whichever bank they want to collect their payments, and also the option to manually or automatically switch banks if they crash or are unable to accept payments for any reason.

Its targeted approach comes from its careful study of its client’s operations so that every feature it creates adds value to the people and departments deploying its payments solution.

So far, the startup has made more than 25 customised solutions. Its clientele includes logistics behemoth Gati, Wockhardt Foundation, AMR Sumangalee Jewellers, Shantiniketan Educational Societies, and more.

Apart from its B2B offering, PayG also has two other retail products:

- A retail payments platform that online consumer companies can use to collect payments for sales. Its value-add here is that it charges a very nominal fee, which the startup says are, on average, lower than market standards.

- A virtual POS system for rural retailers and merchants, which is an asset-light, cost-free solution that enables merchants and sellers in rural areas to collect payments. All a kirana shop owner needs to do to get started on the virtual PoS system is download the app, complete the KYC process, and then start sending payment links to their customers’ phones to collect payments.

PayG says it charges only 2 paise per transaction, but hopes that once economies of scale kick in, it will be able to generate meaningful revenue for the company.

Revenue and funding

The bootstrapped startup primarily earns its revenue from its B2B, customised solutions offering, charging companies for its expertise and the effort it takes to build software just for them. It does allow companies to pay off their due in EMIs, as they make money, and does not charge them for the initial discussions and consultations.

It also earns a very nominal amount of money from its retail and virtual PoS solution, which it hopes will become significant contributors to its top line once they become more widely used.

Over 1,000 merchants already use its standard platform and PoS system. Payments volumes across the board have risen 30 percent on a quarterly basis, with over three lakh transactions processed every month.

Its virtual PoS has seen one lakh-plus download.

Its main competitors include the likes of , , , and other digital payments platforms that enable B2B and retail transactions.

The global payment processing solutions market size is expected to hit $120.7 billion by 2025, growing at a CAGR of 10.2 percent, from $74.4 billion in 2020, a MarketsAndMarkets research study showed. Most of the growth is expected to come from APAC, namely India, China, Indonesia, and Malaysia, it added.

PayG has raised seed funding from Xsilica Software Solutions so far, and it’s currently looking to raise a Series A round by the end of the current quarter.