Small businesses in India face a wide spectrum of challenges, one of them being not having a unified view of their business in real-time, leading to sub-optimal management of finances and operations. Most of the small businesses struggle to overcome the survival phase of their growth journey because they do not have access to resources and know-how that bigger enterprises benefit from.

Jeevan Gopisetty, co-founder and CEO of Nemo, a neobank, says his organisation was built to bridge that gap. “Our web-based and mobile platform follows an ecosystem approach – combining payments, accounting, banking, lending, insights, and business services (operations) – leveraging a network of enablers.”

An easy and secure cloud-based neobank that unifies banking, accounting, credit, and operations for small businesses, Nemo is the brainchild of IIM Ahmedabad alumni Ashish Deswal, COO of Nemo, and Jeevan.

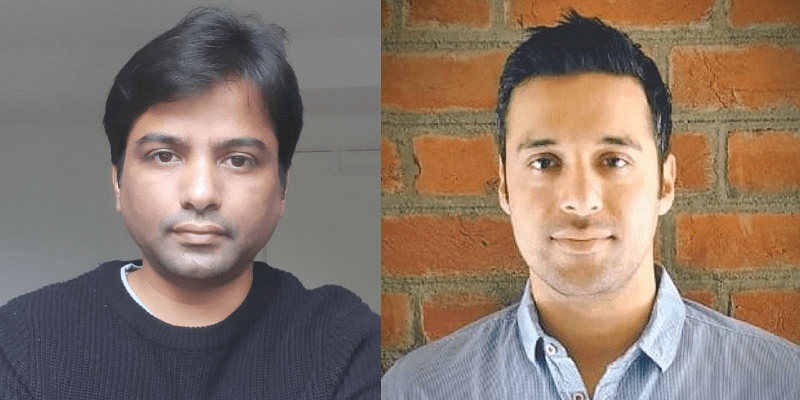

Founders (L-R): Jeevan Gopisetty and Ashish Deswal

Based out of Hyderabad, Nemo, through its banking platform, is on a mission to create a first-of-its-kind business that aims to simplify the financial aspect of business for India’s MSMEs, and empower them with the right tools, resources, and networks that large corporations have access to.

Founded in 2019, Nemo is currently piloting with a small cohort of selected customers, and plans to scale rapidly over the next 12-18 months. Its app is available for Android users currently, and the company is planning to launch on iOS shortly.

The USP

Nemo is building its business on two tenets – simplification and unification. And for this, it is crafting one central platform that covers the entire financial journey of a small business – working closely with banks, partners, fintechs, government agencies, and key stakeholders.

“Most fintechs are quite transactional, and are laser focussed on building one product/service well. We rebel against such convention, and believe that the correct approach is to create that one platform for all MSME business needs – banking, accounting, insights, products, credit, business services, community, and more!” Gopisetty adds.

The team

Nemo’s operations consist of engineering, financial analytics, customer support, partnerships and sales.

Their engineering team interfaces with Ashish, who is also leading Product function, and who acts as a liaison between engineering and customers. They analyse financial data, and sort documents to make it easy and fast for lending partners to process a loan request.

CEO Jeevan focuses on forming new partnerships and bringing in new customers, and leads the overall strategy, business development and sales management. The startup has a total team of nine employees currently including freelancers.

Currently, the management team comprises of Jeevan and Ashish, who, in their roles as CEO and COO respectively, are primarily focused on partnerships/customer-acquisition and product development.

Jeevan Gopisetty is a deep-techie in the semiconductor industry; and has worked with tech behemoths such as Qualcomm, ARM, NVIDIA, AMD, Broadcom and Infineon across the EU and India. He brings in expertise in product, corporate strategy, business development and P&L (profit and loss). He did his MBA from IIM Ahmedabad and BTech in Electronics from JNTU Hyderabad.

Ashish Deswal has over 11 years of experience spanning investment research, consulting and corporate finance. He has worked with logistics startup Delhivery, fintech startup Trefis, and Deloitte. He did his MBA from IIM Ahmedabad and BTech in electrical from IIT Bombay. The duo met during their stint at IIM Ahmedabad.

The funding and revenue

In May 2021, Mumbai Angels Network, a platform for early-stage investments, invested an undisclosed amount in Nemo. The pre-seed funds will be utilised to help Nemo accelerate its product development, hiring, and customer acquisition.

“We are also looking aggressively for extraordinary talent to join us in the core team and help us revolutionise banking,” Gopisetty tells YS.

“We do not have any revenue currently. However, in steady state, we expect to have average annual revenue per user of close to Rs 3,000, with 30 percent operating margin,” he adds.

Nemo’s revenue can be divided as follows – a) Interest rate spread on loan origination, credit watch and assisting with credit underwriting (1-2 percent), b) Commission from expert and need-based business services offered on demand via platform (5-10 percent), and c) SaaS subscription for neobank suite.

The ups and downs

According to Gopisetty, a lack of awareness and trust among target customers (small businesses) are the biggest challenges that neobanks face today.

“Customers need to be educated on the benefits of using a neobanking product, which is a big task. And trusting a third party with their financial information also seems a barrier to entry, which will improve with time,” he adds.

Traditionally, MSMEs are perceived to be hard to understand and engage with, but provided they focus on the right direction, it still leaves new players like Nemo with plenty of opportunity to leverage their passion to see small businesses succeed and grow. This is substantial considering that there are more than 60 million small businesses across India.

The future ahead

According to Gopisetty, neobanking is in its nascent stage in India.

A report by Allied Market Research revealed that the challenger and neobank industry, which was valued at $20.4 billion in 2019, is projected to grow and reach $471.0 billion by 2027, growing at a CAGR of 48.1 percent from 2020 to 2027.

“We are targeting to grow to 10,000 customers in the current fiscal year; and then scale to 500,000 customers over the next three fiscal years,” Gopisetty says.

Nemo directly competes with the likes of well-funded incumbents such as BankOPEN, RazorpayX, Chqbook, TIDE, Revolut etc. Indirectly, it is seeing competition from players such as Tally, Zoho and Vakilsearch among others.

![Read more about the article [Funding Galore] Over $309 Mn Raised By Indian Startups This Week](https://blog.digitalsevaa.com/wp-content/uploads/2022/04/Social_25-30-April-300x157.jpg)